Assays from El Pilar oxide deposit show Antilles Gold’s JV in Cuba could well be a winner

Antilles sees potential to develop gold-copper oxide deposit at El Pilar, Cuba. Pic via Getty Images.

Copper assays from the latest two holes into the El Pilar gold-copper oxide deposit in central Cuba continue to reinforce the prospect of developing the proposed Nueva Sabana open pit mine.

The gold oxide zone is reasonably well-defined, and Antilles Gold (ASX:AAU) reckons that the underlying copper zone is increasing both laterally and vertically with continuing exploration, and will project into the underlying porphyry sulphides, giving the project massive upside potential for copper.

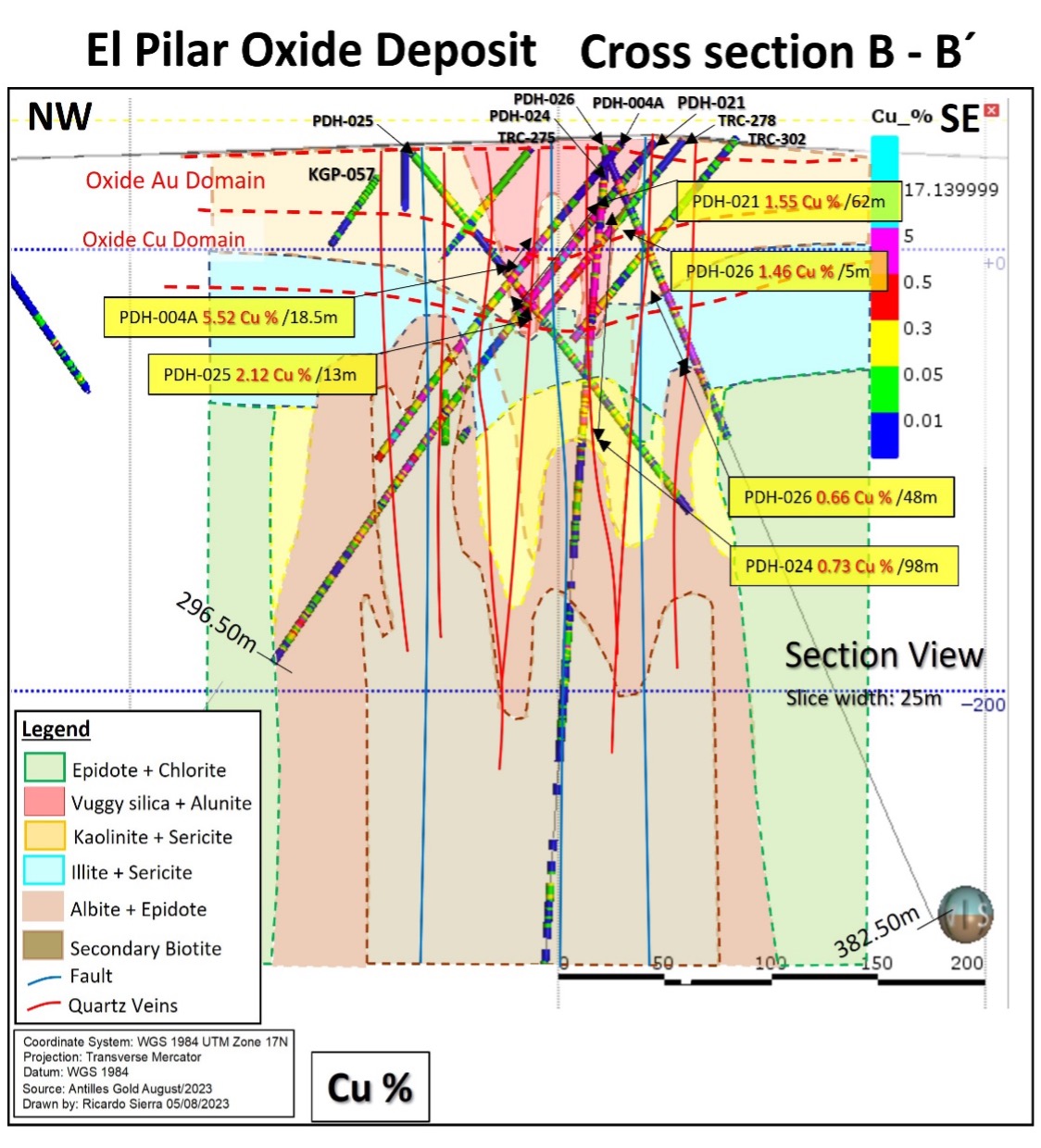

Cross Section BB shows the extent of excellent copper intercepts in the oxide copper zone.

Antilles says the El Pilar oxide deposit is not metallurgically complex, and preliminary testwork has indicated gold recoveries of 85% through a rougher first stage flotation circuit with a concentrate of 53.1g/t Au produced from an ore sample grading @ 2.11g/t.

Metallurgical test work on copper recoveries and concentrate grades is continuing.

Surplus cash flow from the Nueva Sabana mine could be as soon as early 2025 which would assist in funding an expanded copper exploration program by Antilles Gold and its Cuban partner GeoMinera.

“We are a first mover investing in Cuba because it’s mineral-rich, extensively explored, but under-developed, and our partnership with the Cuban Government’s mining company, GeoMinera, has led to numerous opportunities for copper and gold projects” Antilles Gold’s Executive Chairman Brian Johnson said.

This article was developed in collaboration with Antilles Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.