As yellowcake threatens to boom, Elevate Uranium is going nuclear with 136pc jump in Koppies resource

Pic: Manuel Augusto Moreno/Moment via Getty Images

- Elevate Uranium has boosted the resource at its flagship Koppies uranium deposit by 136% to 48Mlb

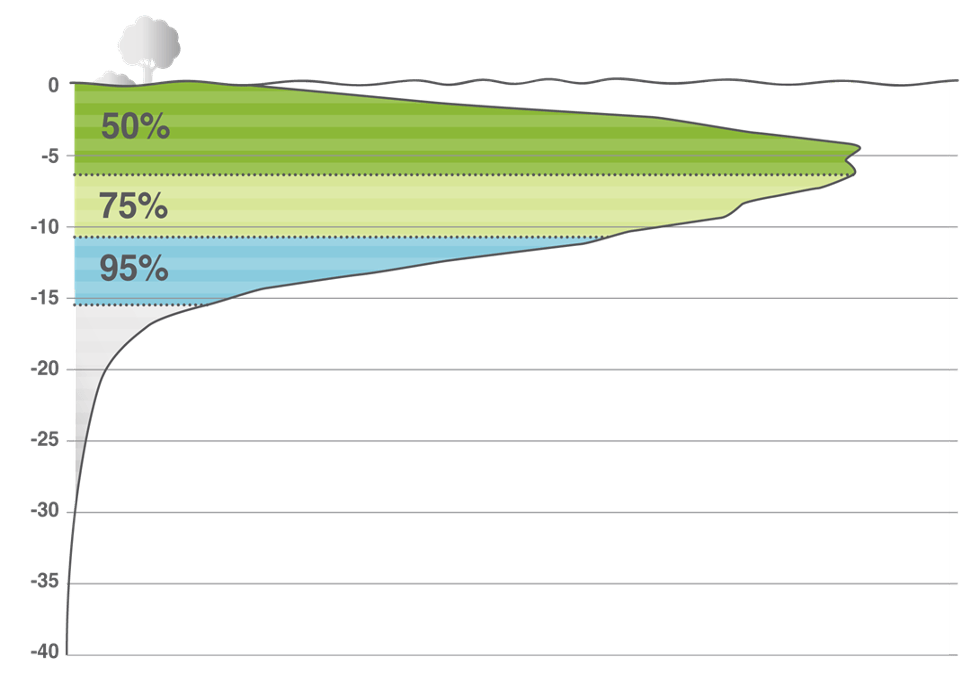

- Koppies is one of the shallowest uranium deposits globally, with 95% of those pounds within 15m of surface

- EL8 up 29% in the past six months as uranium prices hit 15-year high

Special Report: As the uranium boom that has threatened to bloom for years appears on the horizon, Elevate Uranium has put itself in the best position to capitalise by more than doubling its flagship Koppies resource in Namibia.

Now containing a significant 48Mlb of yellowcake, up 136% — that’s right, 136% — the Koppies deposit is so important because it is counted as one of the shallowest sources of uranium globally.

The shallower the mine, the lower the strip ratio (i.e. how much waste there is for every tonne of ore). The lower the strip ratio, the cheaper and more environmentally sustainable the mining is.

Koppies contains 95% of its resources within just 15m of the surface, Elevate Uranium (ASX:EL8) MD Murray Hill noted after revealing the massive resource upgrade. Half of them are within 6m.

“These parameters are important for any potential low strip ratio, low-cost mining operation at Koppies,” he said.

It means Elevate is now sitting on a substantial bounty of uranium oxide, which if you didn’t know by now is the key fuel for the born again nuclear power industry, enjoying a new dawn from the rise of the energy transition and major shortages in future utility supply.

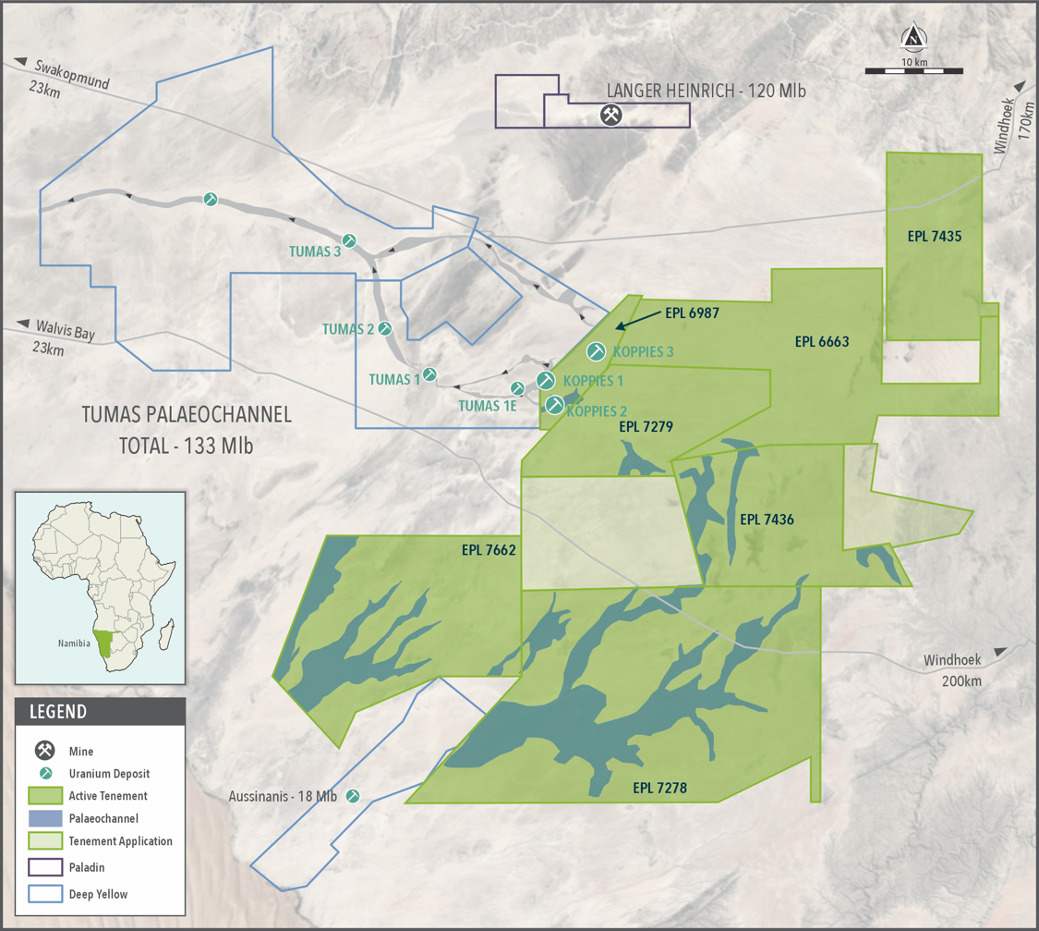

EL8’s Namibian resources have risen 42% to 94Mlb U3O8, with 142Mlb across its portfolio globally.

And with 108.3Mt at 200ppm for 48Mlb, Koppies compares well in nature to some seriously massive deposits right on Elevate’s doorstep.

Where to from here?

Is there more to come at Koppies? You betcha.

Three drill rigs are currently onsite, carrying out resource drilling at the mineralised zone to the south of Koppies 2 and at Koppies 4, which sits to the south of the whole resource estimate envelope.

“Due to the large surface area of mineralisation at Koppies, drilling activities and resource updates are split into phases,” Hill said.

“The company currently has three drill rigs operating to expand the resource reported here today. The next resource update will include the drilling in progress with the three drill rigs to the south of Koppies 2 and into Koppies 4, and is expected during the March Quarter of 2024.”

That’s a clear timeline to the next major development at Koppies, where resource growth has been well timed to meet the rise of the uranium sector.

Drilling to date has shown that mineralisation remains open, indicating potential for further expansion of the mineralised envelope as drilling activities progress. Much of the Koppies 3 resource has been found adjacent to paeleochannels (ancient river beds), in weathered basement that was previously thought to be unmineralised.

It’s opened a new frontier for discovery at Koppies. Drilling deeper into the basement rocks where previous EL8 shallow drilling came up dry is likely to add resources to EL8’s inventory, as the new geological theory delivers the goods. When we say deeper, that is just 25m below surface compared to the 16m limit of previous EL8 drilling, such is the shallow nature of the deposit.

“The success of the drilling to date at Koppies confirms this geological and mineralisation model and is being utilised in the ongoing planning of additional drilling to further test areas of open mineralisation to the south and east of Koppies,” EL8 says. On top of that, EL8 already has a metallurgical solution via its trademarked U-pgradeTM process, developed with ores from its Marenica project.

There are distinct similarities between Marenica and Koppies that lead the company to expect the process will be able to beneficiate Koppies’ ore.

A whole new world for uranium

Elevate shares are up almost 29% over the past six months, having peaked at the end of September at 55c.

While the $125 million market capped player briefly surged to a five-year high of 81c shortly after the Russian invasion of Ukraine sparked fears of a uranium supply crisis in April last year, there is little doubt Elevate is better placed now than at any time in recent memory.

Its Koppies project is incredibly well located in a part of southern Africa that has been a major source of yellowcake for 50 years. Just down the road is the 120Mlb Langer Heinrich mine, opened in 2007 and set to rejoin the ranks of the world’s major uranium producers next year under the auspices of $3 billion capped Paladin Energy (ASX:PDN).

Immediately next to Koppies is Deep Yellow’s (ASX:DYL) Tumas deposit, which boasts a resource of 114Mlb and reserve of 67Mlb, a sign of the growth potential of the adjacent Koppies.

While that surge last year came as uranium spot prices briefly hit then decade-long highs of US$63/lb, they’ve run even further this year to US$74/lb, closing on levels strong enough to incentivise new sources of supply.

And experts think the outlook is brighter than at any time in the past 15 years. The world shaken off the funk of Fukushima, and sentiment for uranium is growing, with nuclear reactor lives extended across the West and new builds flourishing in China to help meet Net Zero by 2050 and 2060 ambitions.

But actual replacement contracting from power plant owners is rising, likely to hit double the level of contract signings this year than there were last year. As the band Real Estate would say, It’s Real.

At the same time, major suppliers in Canada and Kazakhstan are struggling to ramp up production to full levels due to labour shortages, while a coup in Niger has threatened a major yellowcake source to Western Europe, making politically stable Namibia a clear growth region for a blossoming industry.

This article was developed in collaboration with Elevate Uranium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.