As gold prices ride high Codrus begins drilling to probe Bull Run gold project

Codrus is ready to burst on the scene with drilling under way at Bull Run in the USA. Pic: Getty Images

- Gold is on a bull run, climbing to US$3380/oz on Monday

- Another Bull Run is ready to liftoff, with Codrus starting drilling at the Oregon gold project

- Five targets across 2km of strike to be tested in first meaningful drilling in more than 40 years

Special Report: Fresh escalations in the Russia-Ukraine War and the threat of more tariffs from Donald Trump that tanked the US Dollar have again proven gold’s value in tough times.

Bullion moved close to 3% higher on Monday in the States, rising to ~US$3380/oz. No better time then for Codrus Minerals (ASX:CDR) to launch into its maiden drilling at the Bull Run gold project in Oregon.

Wedged between the 400,000oz historical producer Cracker Creek and the 1Moz gold, 3Moz silver Grassy Mountain deposit, Bull Run looms as a likely candidate to join the next generation of US gold developments should modern drilling live up to the promise of historical exploration results.

A diamond drill rig operated by contractor Integri-Core has been mobilised to the site, where Codrus has prioritised five targets across 2km of strike extent.

They include the Eldorado Zone, which living up to its name, has delivered high gold and copper rock chips of up to 28g/t Au and 1.5% Cu.

Grades of up to 60g/t gold and 2.5% molybdenum, suggesting a potential polymetallic system, have also been found at Lady May.

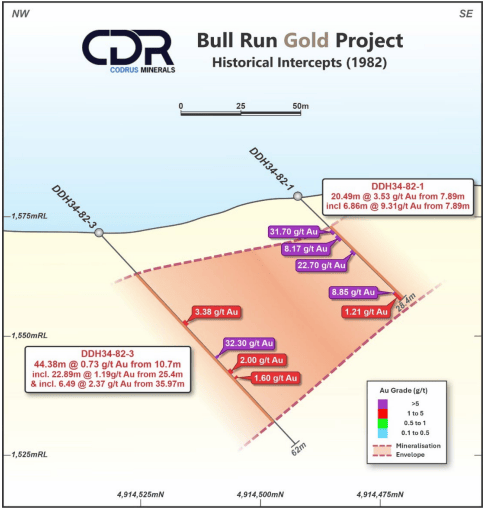

Meanwhile, historical drill results have shown the potential for high-grade discoveries at shallow depths, with hole DDH34-82-1 striking 20.5m at 3.53g/t Au from just 7.9m including a 6.9m stretch at 9.31g/t.

It all comes within a month of Codrus receiving a permit for 14,000m of drilling across the Bull Run site, which includes the Record gold mine, an intermittent producer since 1929.

“We’re excited to have operations underway so soon after our permit to drill was granted. With a number of compelling, high-grade targets to test, we’re entering a pivotal phase in our exploration strategy and doing so in an extremely buoyant gold market,” Codrus exec chair Greg Bandy said.

Golden days

Codrus raised $1.24m in mid-May to bankroll the drill drive, which will narrow in on up to five high-priority targets identified through a comprehensive program of soil and rock chip sampling.

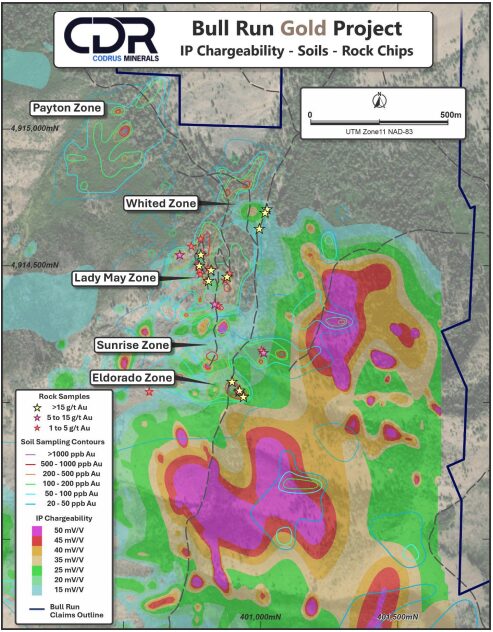

Eldorado and Sunrise are the southernmost prospects, alongside Lady May and Whited, and to the far north of a 2km strike zone Payton.

Across the targets, Codrus’ early stage exploration has picked up gold in soil anomalism up to 0.5g/t, with peak values exceeding 1g/t Au, locally extreme soil values up to 27g/t Au and rock chip samples returning values up to 1040g/t Au.

Also, a recent 3D IP Resistivity survey delineated chargeability anomalies up to 400 by 400 metres in extent. These anomalies coincide with high-priority geochemical targets, further strengthening their prospectivity.

Previous drilling conducted more than 40 years ago has never been properly followed up on, despite hitting economic gold grades down to just 60m down hole from surface.

It presents a massive opportunity for Codrus Minerals at the Baker County ground, where it holds 91 claims with an option over the 11 claims covering the Record mine.

The $8.5m capped ASX junior is returning to the ground to explore with modern techniques not just with gold prices at record highs but with President Trump’s pro-development ideology setting the foundation for new mine approvals in the USA.

This article was developed in collaboration with Codrus Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.