Ark Mines’ scoping study highlights major development upside at flagship Sandy Mitchell REE project

The company will commence a pre-feasibility study for the project next year. Pic: via Getty Images

- Ark Mines’ scoping study confirms low-cost, scalable REE development at Sandy Mitchell

- Scoping study numbers demonstrate attractive project economics based on the measured resource, which represents just 4% of the broader exploration target

- Further drilling to expand the resource, alongside ongoing metallurgical test work expected to unlock significant commercial upside in 2025

Special Report: Following the completion of Ark Mines’ Sandy Mitchell scoping study, the company’s board has determined that the project is commercial and it can proceed with development at the Queensland-based rare earth and heavy minerals operation.

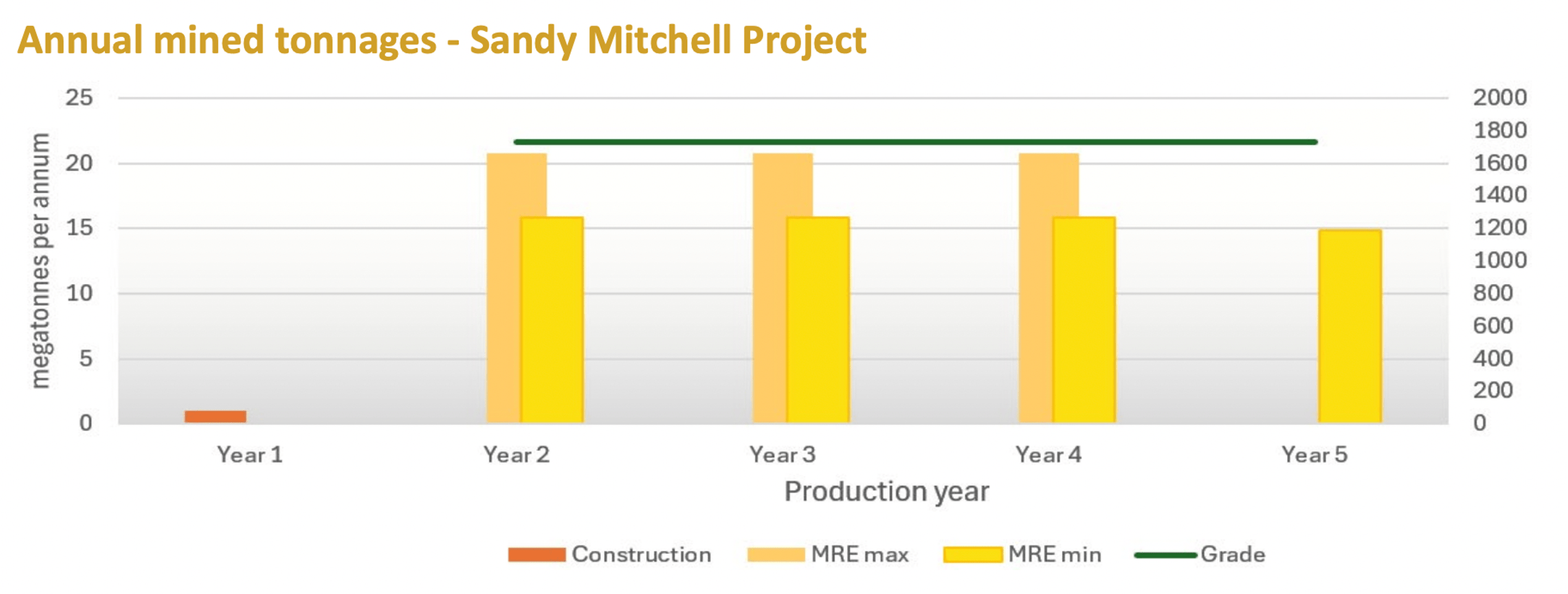

The base case considers a 20.8 megatonnes per annum (Mtpa) sand movement operating scenario and 3-4 year mine life, with annual net revenue totalling ~$120m-130m.

Calculations for scheduled mined tonnes and expected mine life are based solely on the measured mineral resource that Ark Mines (ASX:AHK) declared on October 2, 2024.

The measured mineral resource estimate (MRE) totalled 71.8 Mt at 1,732.7 ppm monazite equivalent. A follow-up exploration target update in November 2024 estimated a total of 1.3 billion tonnes to 1.5 billion tonnes at 1,286 to 1,903 ppm MzEq, building considerably on the existing measured resource.

Based on a mine plan for the measured resource assessed to-date, Ark has calculated a post-tax capital payback of ~3-4 years from first rare earth mineral concentrate (REMC) production, with total initial capex (capital expenditure) of $120m-$150m (including an estimated 10% contingency).

The company expects to generate an annual EBITDA of $45m-$53m, and annual post-tax-free cash flow totalling ~$25m-$30m.

Importantly, those numbers have the potential to increase significantly as drilling gets underway to expand the existing Measured resource, which accounts for just 4% of the broader exploration target.

The scoping study leaves Ark well-positioned with a rare earths project that’s already commercial, and has the potential to unlock significant additional commercial upside as development progresses and more of the exploration target is converted to a known resource.

The study outlines the raw mining volume estimate is 85% of the resource estimate of 71.8 Mt at 1,732.7 ppm monazite equivalent (mzeq), with the aim to mine around 60Mt-60-65Mt grading approximately 1,700 ppm MzEq containing about 1,200 ppm monazite, 660 ppm zircon, and ± accessory garnet and Ti heavy minerals.

The project also has low opex (operating expense), thanks to surface mineralisation meaning no drill and blast is required, there is minimal topsoil, no overburden, no tailings dam and waste piles – making mining much more economic.

Plus, on the processing side it’s very simple, with in-situ processing using gravity only, with no chemicals, salts or acids required.

However, there is still room for improvement with the metallurgical recovery process which could result in even better project economics than currently forecast.

Ark plans to complete further test work in early 2025 to increase the recoveries and grades of the concentrates.

Pre-feasibility study the next step

With these compelling economics, the Ark Mines board has unanimously recommended to advance the project to the next phase of development, starting with the commencement of a pre-feasibility study which is expected to kick off next year.

Along with the scoping study numbers, the PFS will incorporate additional drilling results as they are received, with ongoing exploration work planned to significantly expand the scale of the existing JORC resource.

To pay for the $120-150m capex requirements, the company is pursuing several funding channels including equity markets, off-take funding and equipment vendor finance, as well as supplier finance and debt financing.

The company is confident that future funding for development of the project will be available when required.

“The project has strong technical and economic fundamentals which provides an attractive return on capital investment and generates robust cash flows based on market rare earth element and zircon pricing,” AHK said.

“This provides a strong platform to source the debt and equity funding required.”

Offtake discussions continue, and the release of the scoping study will provide the project background to the various partners who have been seeking to advance discussions.

These partners could provide a further strong platform to source the debt and equity funding required, the company says.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.