Arizona Lithium gets boost ahead of planned H1 2025 Prairie production start

The new leased lithium rights are in locations strategic for commercial development. Pic: via Getty Images.

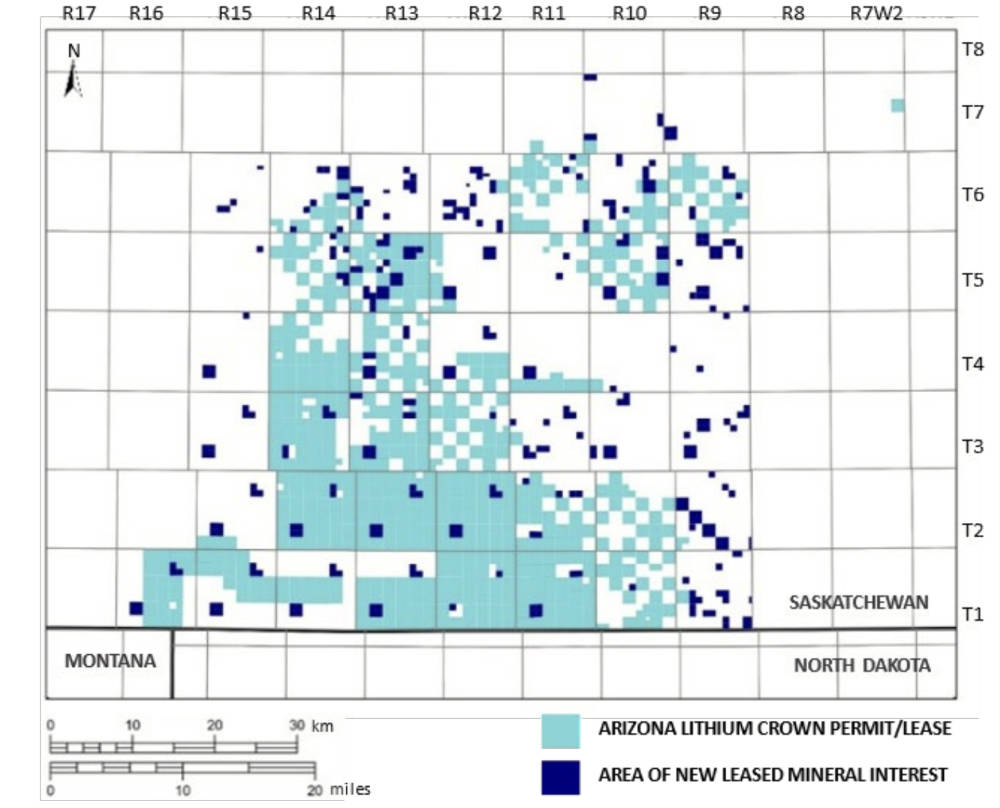

- Arizona Lithium leases lithium rights over 159km2 of ground, taking total Prairie brines project footprint to ~1,578km2

- New leased rights are contiguous to existing landholding

- Increase expected to complement and improve project economics as company aims for production start in 2025

Special Report: Growing its Prairie brine project footprint by 11% gives Arizona Lithium “greater flexibility for future exploration and production”.

There are only a handful of lithium producers in North America, including Sayona Mining (ASX:SYA) and Piedmont Lithium’s hard rock NAL project in Quebec and Albemarle’s Silver Peak brine operations in the US.

AZL, which also owns the Big Sandy project in Arizona, believes it could be one of the next producers off the rank to feed North America’s growing hunger for lithium via its 5.7Mt LCE Prairie project in Saskatchewan, Canada.

Commissioned in November, Arizona Lithium (ASX:AZL) has processed over 42,000L of raw brine resulting in the production of ~2,500L of lithium concentrate which you can see a snazzy video of here.

The first two shipments have been sent to the LRC in Tempe, Arizona, for further upgrading to high-purity lithium end products targeted to the battery market.

New leases improve economics

The new leases at Prairie cover ~159km2 and are contiguous to the company’s existing landholding in Saskatchewan, Canada, where a pilot direct lithium extraction (DLE) plant has been processing raw brine into lithium concentrate since November.

Pilot plant operations are the third and final phase of AZL’s evaluation of the promising third-party DLE technology that could drive development of its 5.7Mt lithium carbonate equivalent Prairie project.

Prairie also benefits from being in one of the world’s top mining friendly jurisdictions with easy access to key infrastructure including electricity, natural gas, fresh water, paved highways, and railroads.

AZL notes that leasing the lithium rights from a strategic freehold mineral title holder that holds land across the Prairie project area improves the economics for future production that is forecast to start in the first half of 2025.

It has started resource assessment work on the land to understand the resource size and potential.

“Increasing our acreage in these strategic locations allows us greater flexibility for future exploration and production,” managing director Paul Lloyd said.

“Our team has kicked off the resource assessment work for these new properties, and I look forward to sharing the results shortly. We have one of the best land positions in Canada and this acquisition makes it even better.

“This was an opportunistic increase in the Prairie landholding complementary to our strategy of driving towards production commencing in 2025, which would make Prairie one of the fastest to market lithium development projects.”

Speaking to Stockhead, he added that a land grab similar to the shale oil and gas boom is about to start in the North American lithium brines sector and that the company was happy to add to its very large landholding before the race for ground really starts.

This article was developed in collaboration with Arizona Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.