Argent Minerals out to increase silver count at Kempfield with new diamond hole

Drilling targets extension of high-grade silver-polymetallic zone at Kempfield. Pic: Getty Images

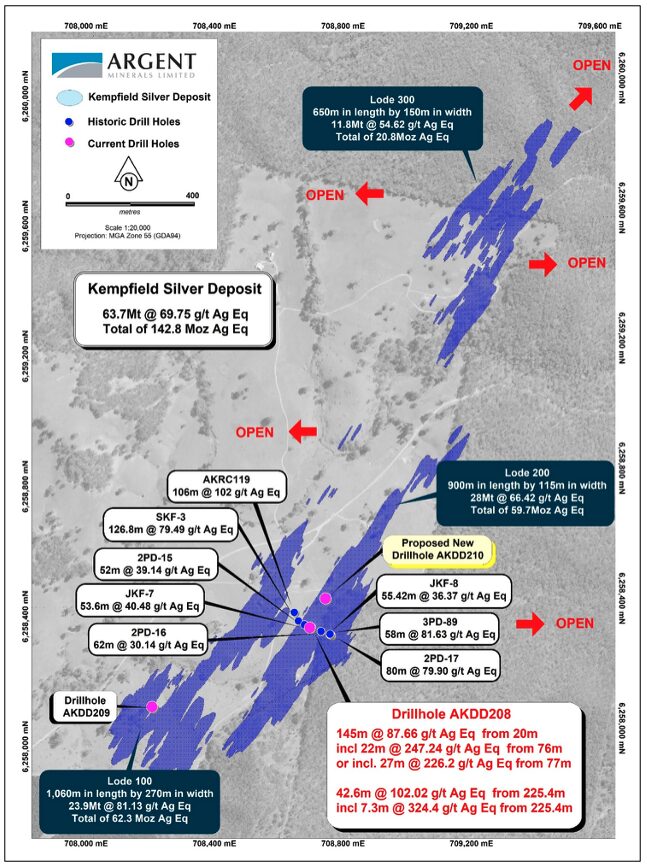

- Argent Minerals plans 330m of diamond drilling to extend high-grade silver-polymetallic zone at Kempfield

- Previous hole AKDD208 hit up to 324.4g/t silver equivalent within thick mineralised zones

- Kempfield is Australia’s second-largest undeveloped silver deposit with a resource of 142.8Moz AgEq

Special Report: Argent Minerals will carry out a further ~330m of diamond drilling to test extensions of high-grade mineralisation at Kempfield silver-polymetallic project in the famed Lachlan Fold Belt of NSW.

Chief Drilling has been awarded the contract to drill a new hole to the north and along strike from AKDD208 within the Lode 200 resource zone that intersected extensive high-grade silver-base metal mineralisation.

AKDD208 returned intervals of 145m grading 87.66g/t silver equivalent (52.7g/t Ag, 0.17% lead and 0.65% zinc) from a down-hole depth of 20m including 22m at 247.24g/t AgEq from 76m and 42.6m at 102.02g/t AgEq (48.64g/t Ag, 0.22% Pb and 1.1% Zn) from 225.4m including 7.3m at 324.4g/t AgEq from 225.4m.

Regulatory approvals have been granted with Argent Minerals (ASX:ARD) expecting drilling to start in the coming weeks.

“Following the recent high-grade results from the maiden diamond drilling at Kempfield, including mineralisation up to 324.4g/t silver equivalent, we have quickly appointed the drilling contractor from the city of Orange and securing approvals to advance our drilling program,” managing director Pedro Kastellorizos said.

“The new drill hole will be collared along strike from the most recent drilling, which confirmed both the depth continuity and strength of mineralisation.

“Importantly, several of these high-grade zones occur near surface, providing potential for early-stage mining and selective extraction.”

He added the recent drilling had confirmed the presence of thick, robust silver zones, a finding that significantly increased the potential to expand resources and support development studies at a time of record silver prices.

Watch: Argent tops the coffers with nearly $5M raising

Kempfield project

Kempfield – Australia’s second-largest undeveloped silver deposit with a contained resource of 142.8Moz silver equivalent – sits southeast of Orange and about 40km from Newmont Corporation’s (ASX:NEM) giant Cadia operations within the Lachlan Orogen.

This region – more widely defined as the Lachlan Fold Belt – is well known for its prospectivity with more than 110Moz of gold discoveries made to date around the Central Lachlan and Cobar mineralised districts.

The project currently has a resource of 63.7Mt at 32.15g/t silver, 0.66% zinc, 0.33% lead and 0.06g/t gold, or contained resources of 65.8Moz silver, 125,192oz gold, 207,402t lead and 420,373t zinc.

Early production is expected to be achieved through a heap leach starter processing oxide mineralisation to fund a carbon-in-leach/flotation hub to process the greater quantity of sulphide ore.

Its proximity to the Trunkey Creek, Mt Dudley and Pine Ridge projects offer major gold upside and the opportunity to establish a scalable, multi-deposit mine at Kempfield.

This article was developed in collaboration with Argent Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.