Argent continues uncovering of Kempfield’s polymetallic goods

Argent has followed through on plans to aggressively drill its project through the early stages of 2025. Pic: Getty Images

- Argent Minerals assays continue to show the upside of its Kempfield polymetallic project

- Latest batch returns 101m of VMS mineralisation from surface

- The significant New South Wales development currently holds the second biggest undeveloped silver resource in Australia

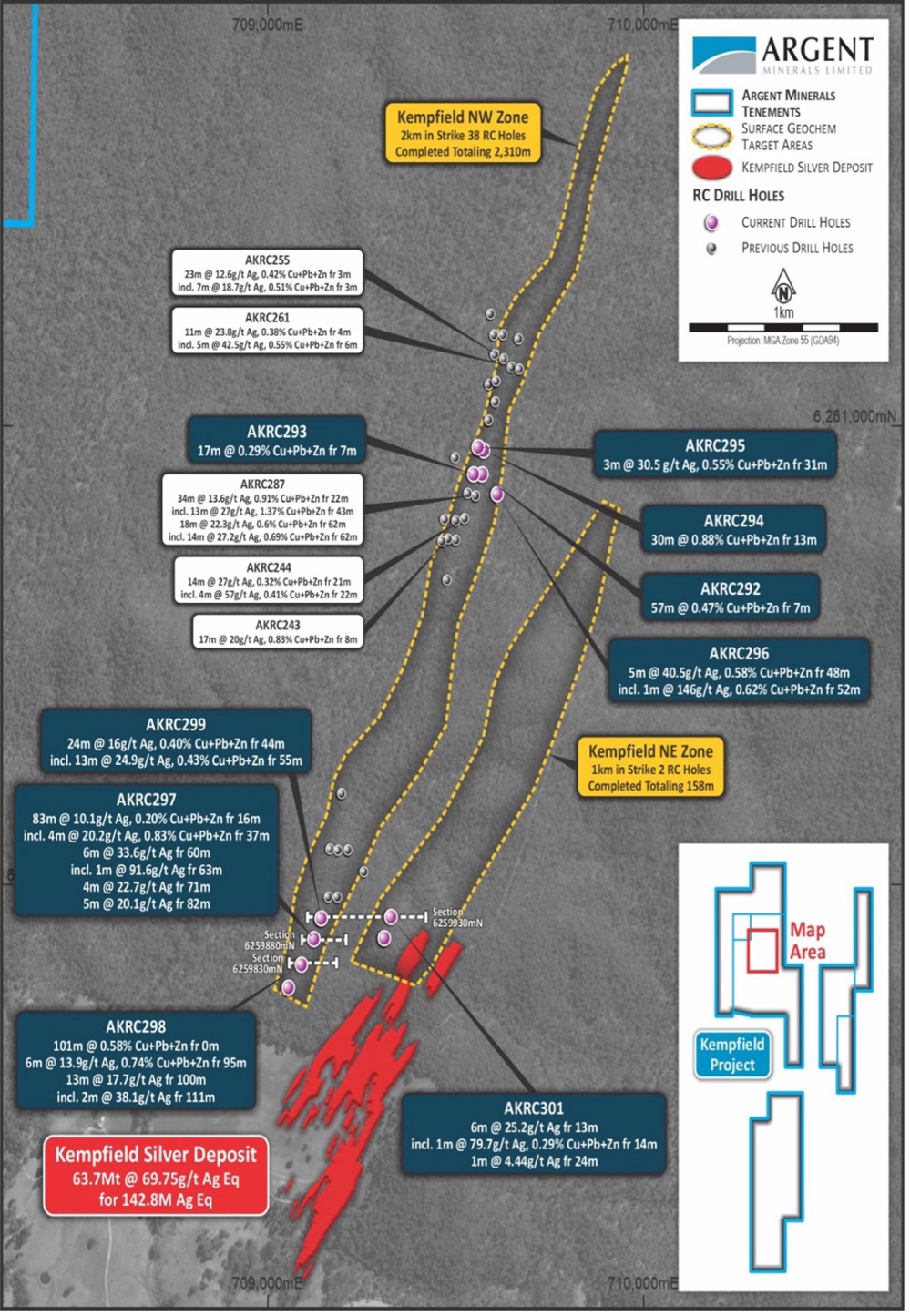

Special Report: Argent Minerals has struck thick zones of VMS mineralisation from the surface of its Kempfield project and expanded a newly discovered and open silver-lead-zinc zone lying beyond 1.1km of strike.

Argent Minerals (ASX:ARD) RC drilling over the Kempfield NW zone identified the new mineralisation by the project’s Lode 300 area and a 20.8Moz silver equivalent resource among its 142.8Moz AgEq total.

Results were headlined by a 5m at 40.5 g/t Ag & 0.58% Cu+Pb+Zn intercept from 48m downhole and a 101m at 0.34% Cu+Pb+Zn strike from surface.

Argent managing director Pedro Kastellorizos said the NW prospect zone had continued to return silver and base metal intersections beyond its main deposit.

“The delineation of mineralisation in this zone highlights the strong continuation of mineralised extensions along strike from Lode 300 Mineralised Block,” Kastellorizos said.

“These assay results, from limited drilling completed by Argent Minerals, reinforce the significant upside potential of the Kempfield Project as we continue expanding the mineralised footprint well beyond the current Kempfield Deposit.”

Last month’s results had already shown the potential to significantly swell the resources at Argent’s project, where it has made additional discoveries to the east, southeast, and this northeast area of its starring deposit.

Argentum ascension

While Argent has duly labelled its flagship deposit a polymetallic one, its namesake silver appears the real prize.

Despite traditional views which would lead to an apparent weakness in the sector, bubbling use in fast-growing and non-cyclical sectors combined with lagging supply makes Capital Economics think silver is set to outperform gold over the coming years.

Legendary investor Rick Rule saw silver stocks as a ‘coiled spring’ when the contrarian emerged as one of the backers of a ~$30 million funding deal for Argent’s fellow NSW player Silver Mines (ASX:SVL) last year.

Argent has its own support as a registered New South Wales State Significant Development and is looking to keep building what already stands as the second largest undeveloped silver resource in Australia through near continuous drilling early in 2025.

The company has yet to indicate when it will be looking at its next upgrade but believes the continued discovery of new mineralisation certainly bodes well for its next tally.

This article was developed in collaboration with Argent Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.