Arafura is poised to catch the growing wave of NdPr demand

Picture: Getty Images

It’s all about timing. While there are several juniors keen to grab a piece of the increasingly valuable rare earths pie, Arafura Resources is positioned to catch the tide at just the right time.

Rare earth elements have been in the limelight recently as attention turns towards the importance of magnet REEs such as neodymium and praseodymium (NdPr) especially for construction of high-performance magnets which are used in electric vehicle motors and wind turbines.

Such magnets improve the efficiency of the end product, making cars lighter for instance – an important consideration given that batteries can make up a third of an EV’s cost and a lighter car will require smaller batteries.

With demand for EVs and renewable energy growing, OEMs building these products increasingly need to be sure that the NdPr oxides and/or magnets they are sourcing actually come from a reliable and sustainable source to satisfy their environmental, social, and governance (ESG) criteria.

Meeting these requirements is likely to be increasingly challenging given the number of projects that seek only to produce a rare earths concentrate and trusting the processing into oxides to external parties – 90% of which are located in China.

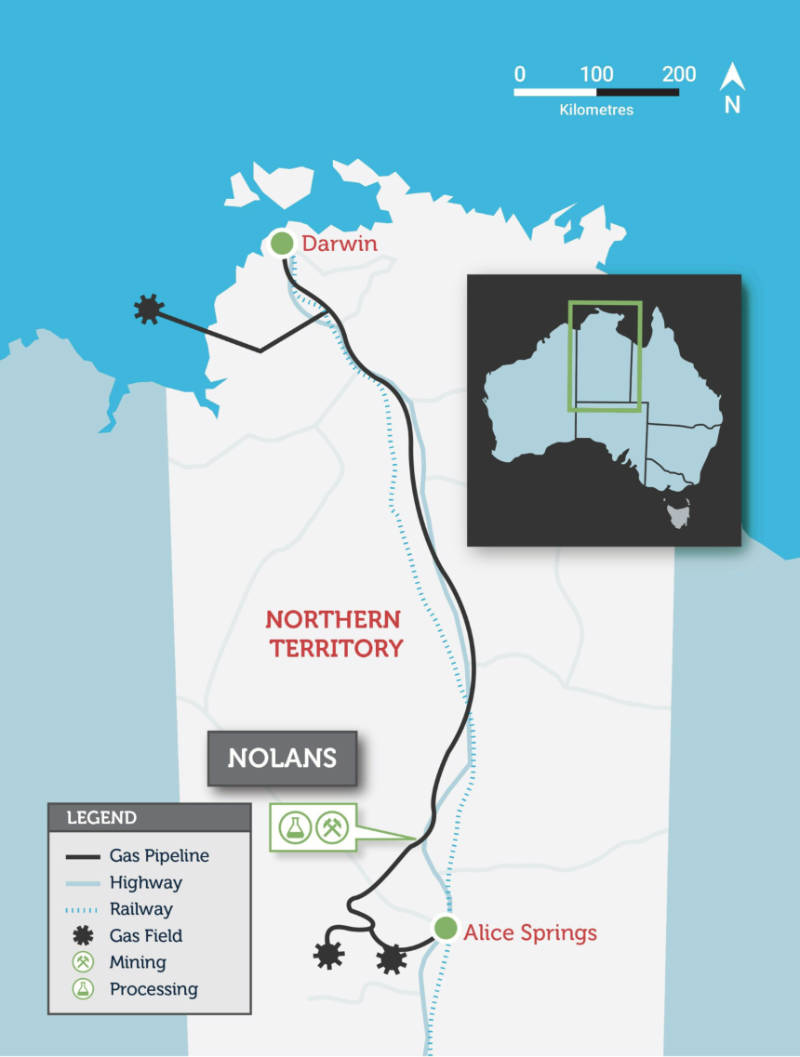

Arafura Resources (ASX:ARU) managing director Gavin Lockyer believes the company and its flagship Nolans project just 135km north of Alice Springs in the Northern Territory might just be the answer to these concerns.

Speaking to Stockhead, he noted that by advancing further downstream to produce an NdPr oxide onsite that can be fed directly to customers or customers’ preferred component maker, Arafura could ensure that its NdPr buyers had much clearer visibility around where their product is being sourced from.

The project’s location in one of the most attractive jurisdictions and stable polity also serves to provide customers with security of supply.

So just what are the other (equally important) factors that make the Nolans project attractive to NdPr buyers?

Big, rich and well located

First off the rank is the size of the Nolans resource. There isn’t any way to put it other than to say that it is pretty big.

The resource currently stands at 56 million tonnes (Mt) grading 2.6% total rare earth oxides (TREO) and 11% phosphate with more than half of this, or 29.5Mt at 2.9% TREO and 13% phosphate, already defined as an Ore Reserve that can be mined economically.

And more than a quarter of the rare earths is valuable NdPr, enough in fact to underpin production of about 4,440t of NdPr oxide along with 474t of heavy rare earths oxide and 144,393t of phosphoric acid per annum for 38 years from a single pit, which incidentally simplifies mining operations.

For some context, this production is expected to be equivalent to about 5% of global demand for NdPr. Take a little time for that to soak in.

This giant resource was made possible by Arafura drilling over 90km into the resource to define and classify the material type, which Lockyer said granted the company a clear understanding of its geology and mineralogy.

Nor is this the limit of mineralisation at the project.

“This resource is only defined from a depth of 220m and we have drilled holes as deep as 440m which are still in mineralisation similar to the material above it,” Lockyer explained.

“We think this has massive expansion capacity but we figure we start with 38 years and see where we go from there.”

He added that Nolans’ NdPr enrichment was comparable to Lynas’ Mt Weld mine and Hasting’s Yangibana project while most other projects were either enriched in the heavy rare earths or lighter rare earths with much less NdPr endowment.

Lockyer also pointed out that while the company was previously guilty of the same failing that other companies had of chasing all 17 REEs, it now only attributed value to the project’s NdPr content.

That this resource is well-located near existing infrastructure in central Australia just adds further to its attractiveness.

“There is the all-weather Stuart Highway just 10km away and the Amadeus gas pipeline that runs through the tenement and will be adjacent to our processing plant,” Lockyer explained.

Arafura’s plans to go all the way from mining through to a refined rare earth oxide using a well-established process not only ensures that customers receive a product that meets their specifications but also one that provides transparency over where it was produced and processed.

Offtake agreements

The strength of Arafura’s offering is also reflected in its offtake agreements, which would account for more than 260% of its planned production if they all signed binding agreements.

“We have been advancing greatly our discussions with offtakers, we have advanced term sheets with many of them,” Lockyer noted.

“We announced the Hyundai transaction earlier this year and the GE Renewable Energy deal recently, and we will look to make those into more binding arrangements in the coming weeks.”

Hyundai is seeking between 1,000t and 1,500t per annum of NdPr oxide per annum on a cost, insurance, and freight (CIF) basis over a seven-year period from 2025 while the GE memorandum of understanding relates to collaboration in establishing a sustainable NdPr supply chain.

“That then allows us – the Hyundai arrangement in particular – to then go to the Korean government or the Korean ECA for guarantees against those offtake agreements,” he explained.

“And those guarantees can go against some debt funding, which we are trying to bring together, and we hope to get a significant rerating on our stock such that we can raise the equity we require for the project financing.”

This is also in line with strategy of targeting customers in regions that have strong Export Credit Agency backing or support, and typically that’s South East Asia, Japan, South Korea, and into Europe.

That these are all countries that are dependent on rare earths magnets for their manufacturing capacity isn’t entirely coincidental either.

Arafura is also talking to potential offtake partners about possible strategic equity investments with Lockyer noting that GE was interested in discussing and exploring the opportunity for strategic equity in conjunction with the NdPr sale and purchase agreement.

Current progress and financing

One of the Nolan’s project’s biggest advantages over its peers is its advanced nature with front-end engineering and design, which started in the middle of last year, now nearing completion.

“We will look to roll that FEED program over into more detailed engineering, but at the same time, we are looking at the moment to go out and tender for construction contractors and we are targeting to get to a point where we get some fixed price contracts for construction towards the end of the third quarter this year,” Lockyer outlined.

This work is aimed at enabling a final investment decision by the end of this year following which the company will firm up offtake agreements, announce further offtakes, and secure a clear line of sight for its debt sizing and what it means in terms of the amount of equity it would need to raise.

“On the financing side, which is running in parallel, we are working with the Australian government through export finance Australia and the NAIF, and we already have a total of $300m debt facilities provided via letters of support for a 15-year term,” Lockyer added.

“In the new year, we are looking to commence the early earthworks and obviously be in full construction mode by middle of next year.”

All this is aimed at bringing the project into production by the end of 2024 or early 2025.

This article was developed in collaboration with Arafura Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.