Another spoke secured in Thomson’s landmark silver strategy

Pic: Tyler Stableford / Stone via Getty Images

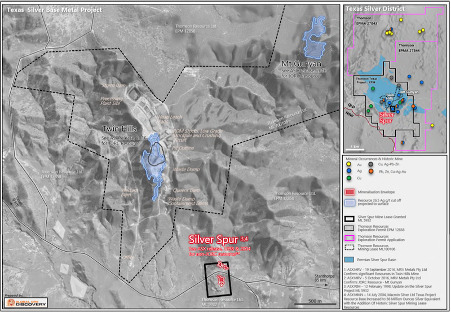

Thomson Resources will take full control of the Texas silver-base metal district in southern Queensland, after agreeing to acquire ML 5932 that covers the Silver Spur mine.

Thomson (ASX:TMZ) has entered a binding term sheet to acquire Silver Spur from privately-owned Cubane Partners Pty Ltd in a move which adds to its Fold Belt Hub and Spoke Silver Strategy.

Silver Spur historically produced 2.19 million ounces of silver at an average grade of 800 grams per tonne, as well as 690 tonnes of zinc, 1050 tonnes of lead, 990 tonnes of copper and by-product gold from around 100,000 tonnes of ore.

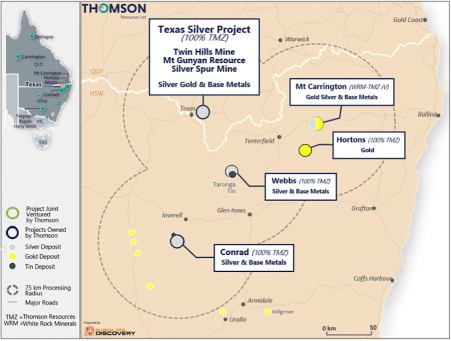

The mine is 3.5km southeast of the Twin Hills silver mine, part of the Texas silver project Thomson entered an agreement to acquire earlier this year, which has produced 1.4Moz of silver via a heap leach operation since 2008.

The acquisition means Thomson now controls the entire prospective silver, gold, zinc and other base metals area of the Silver Spur Basin, which sits on a granted mineral lease within the Texas silver project.

The area forms part of the Fold Belt Hub & Spoke Silver Strategy for Thomson, where the company plans to process ore from a number of deposits owned either side of the New South Wales-Queensland border at a centralised location.

Executive chairman David Williams said the acquisition of Silver Spur was an important step in that plan.

“This is a key strategic acquisition for Thomson with the Silver Spur ML representing delivery of an additional silver resource and prospective exploration targets to be included within our Fold Belt project portfolio,” he said.

“We now feel we have the “complete package”, controlling over 518km2 of granted mining and exploration licences and new exploration licence applications covering, and surrounding the prospective Texas silver district, a cornerstone asset in the company’s Fold Belt Hub and Spoke Strategy.

“The board of Thomson, with the assistance of its close advisors, continue to demonstrate the ability to move quickly and decisively to add value for Thomson’s shareholders.

“I would also like to thank Cubane Partners for the speed and commerciality in which they have acted on the negotiation of this transaction, along with their belief in Thomson’s central processing strategy that will make this transaction a win-win.”

Massive project potential

In picking up Silver Spur, Thomson has acquired a project with significant potential to add to its regional silver holdings.

Between 1998 and 2012, a number of explorers undertook drilling and geophysics on the project, reporting significant silver and base metals mineralisation near surface.

Previous owner Macmin Silver announced an inferred multi-million-ounce silver equivalent JORC compliant mineral resource for Silver Spur in 2004 – though a significant portion of the drilling mentioned above was not included in it.

Thomson is now in the process of collating all historic exploration for the Texas Silver District with the aim to state new, JORC 2012 compliant silver polymetallic resources for its projects in the district, including the Twin Hills, Mt Gunyan and Silver Spur deposits.

Thomson is also undertaking preliminary metallurgical studies on these deposits to determine potential processing pathways to maximise the recovery of silver, gold and the base metals for the Texas District deposits within the context of the Ford Belt Hub and Spoke Strategy.

The Fold Belt Hub and Spoke Strategy encompasses Thomson’s 100% owned Texas, Webbs and Conrad silver projects and the Thomson-White Rock Minerals (ASX:WRM) Mt Carrington joint venture.

Thomson said it was working with its advisors to review the projects with a view to restating or defining new resources compliant with JORC 2012 standards.

Terms of the deal

Under the terms of the deal between Thomson and Cubane, the former acquires the Silver Spur tenement and all resources and information in exchange for $100,000 on signing, $200,000 on deal completion, and the issue of 5 million fully paid ordinary shares to Cubane shareholders.

The deal is subject to conditions precedent and Cubane will retain rights to a slag deposit onsite until the end of CY2025.

Thomson is also progressing tin interests in the Lachlan Fold Belt, with drilling just completed at the exciting Bygoo tin project and underway at the Wilgaroon tin-tungsten project 60km north of Cobar.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.