Andromeda Metals’ scoping study shows numbers stack up for HPA production plans

The scoping study justifies the commercialisation of Andromeda’s HPA production tech using Great White kaolin feedstock. Pic: Getty Images

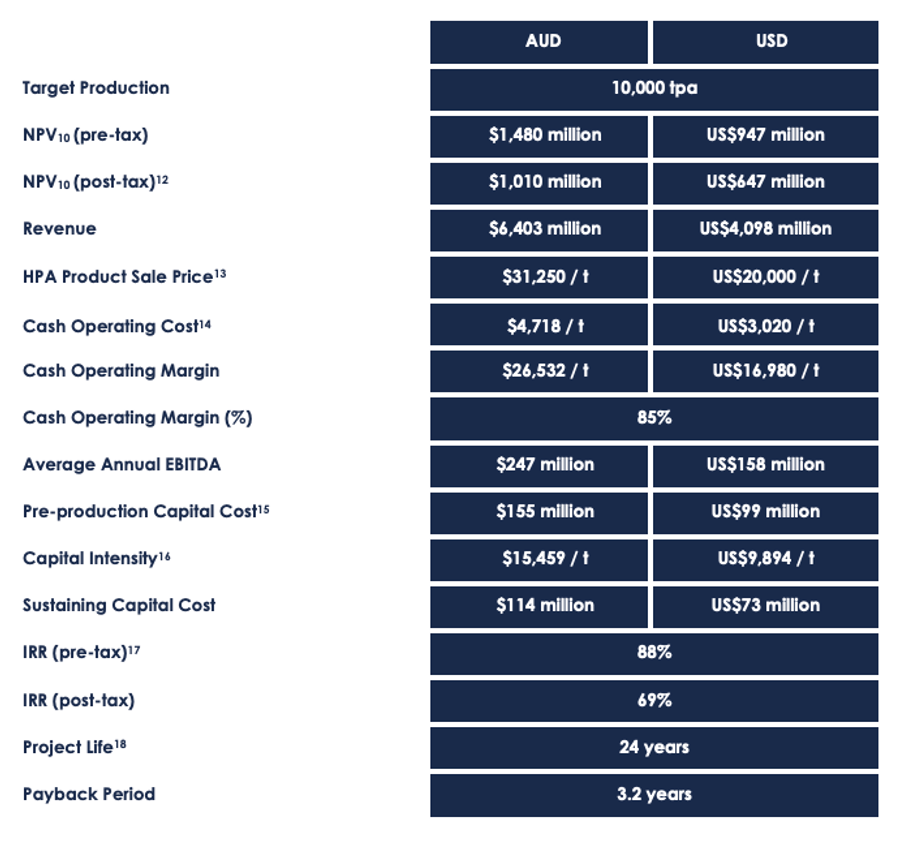

- Andromeda’s scoping study shows a HPA processing facility is capable of producing 10,000tpa of 4N HPA

- Key highlights include NPV of $1.48bn pretax and a high product margin of 85%, equivalent to approximately $26,532/t

- Next steps include the investigation of production and sales of 3N and 5N HPA products

Special Report: Andromeda’s scoping study for producing high purity alumina (HPA) from refined kaolin products from the Great White Project in South Australia has highlighted the potential to become a leading producer of low-cost, low-carbon HPA.

The scoping study provides a preliminary market, technical and economic review of the opportunity and justifies the HPA project progressing towards development.

Key highlights include the production of ~10,000t a year of 4N HPA from 30,000t of Great White kaolin products as feedstock, with pre-production capital costs of $155m and operating costs well below other reported processes.

With an NPV of up to $1.48bn (pre-tax) and an estimated product margin of 85%, the equivalent to approximately $26,532 (US$16,980) per tonne, the project shows impressive economics even under conservative pricing assumptions.

This is based off pre-production and operating costs which the scoping study found were significantly below those for established processes used by existing producers of HPA and other planned projects.

HPA demand, driven by its use in ceramics, catalysts, the manufacture of sapphire glass used in light-emitting diodes and mobile phones, as well as semiconductors, is booming at a 20% annual growth rate, potentially leaving the market short-supplied by 78,000t by 2030 according to CRU, a market research firm.

Established processes for producing HPA emit up to 12.44 tonnes of carbon-dioxide, while its proprietary HPA process could see Andromeda (ASX:ADN) step in as a global leader, producing HPA with emissions 48% lower than conventional processes.

The company plans to supply kaolin products for HPA production through an independent offtake agreement using refined kaolin from its fully owned Great White Project, backed by a 15.1Mt ore reserve.

Drivers of HPA value

A sensitivity analysis shows that the value of Andromeda’s HPA project is most affected by changes in the AUD–USD exchange rate and HPA commodity prices.

For example, a 20% drop in the AUD price boosts the NPV by 30%, while a 20% rise cuts it by 20%.

Similarly, a 20% swing in HPA prices can increase or decrease the NPV by 26%.

On the other hand, the project is much less sensitive to operating costs or capital expenditure, with a 20% change in either affecting the NPV by only about 3%.

Commercialisation targeting $159m investment and funding strategy

Based on the scoping study assumptions, the HPA project is expected to cost around $159m, including $155m in pre-production capital costs and about 30% contingency.

While funding the Great White Project is Andromeda’s priority, it plans to raise equity investment initially to move the project toward commercialisation and spend around $4m on a PFS covering plant design, cost refinements, marketing and ongoing testwork.

Should those be successful, it would then look to raise an additional $155m to cover pre-production capital costs for full development and will likely use a mix of debt and equity.

It will also explore government grants, incentives, and other investment opportunities, while actively seeking offtake partners once commercial HPA samples are ready.

Andromeda to expand into HPA market

Acting ADN CEO Sarah Clarke said the HPA scoping study demonstrates the exciting potential for Andromeda to become a global producer of low-cost HPA products.

“The production of HPA is a high-value growth opportunity, which is not only complementary to the existing high-quality kaolin products planned to be produced from the Great White Project, but would also see Andromeda’s product range extend into critical minerals,” she said.

“The HPA scoping study supports progressing the HPA Project to the next stage and demonstrates its potential for unlocking significant value for Andromeda and its shareholders.”

Next steps, subject to funding and approvals, include the investigation of production and sales of 3N and 5N HPA products, the establishment of a continuous pilot plant for process flow sheet optimisation and production of commercial samples for potential customers.

This article was developed in collaboration Andromeda Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.