An ASX investor couldn’t find a good, cheap research site – so he started one himself

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

A stockmarket site that started out as a hobby has turned into a flourishing business that takes the hard work out of research for ASX mining investors.

MakCorp is an extensive database of information on all ASX-listed mining companies that can save investors up to 90 per cent research time.

Subscribers can find information on everything from a company’s top 20 shareholders and directors to all of their projects, the stage the projects are at and cash inflows and outflows.

The best news? While well-known ASX data sites can cost thousands of dollars, MakCorp’s price starts at $40 a month.

MakCorp is the brain child of Steve Rosewell, who started out as a typical, part-time retail investor trying to cut his teeth on lithium and cobalt stocks.

Three years ago, Mr Rosewell decided to do a bit of research into mining stocks so he could pick a few to inject some cash into. But the task proved more difficult than he thought.

“Back then lithium was starting to get some attention,” he explained.

“So I started doing some research and looking for stocks that were involved in lithium and honestly it just took so long to find.

“I reckon it took a good 30 to 40 hours-plus to actually put a list of all the ASX-listed lithium stocks together.”

The average investor will spend 20-plus hours a week researching which stocks they want to sink their hard-earned money into.

Mr Rosewell spent the first two years building up a detailed database of information, and averages around three days to update the information – a much quicker turnaround than many other providers.

“When starting the MakCorp website my goal was to develop an affordable, informative research platform on ASX mining companies for retail investors, sophisticated investor, brokers and corporate advisory firms,” he told Stockhead.

Now he’s aiming to reach 500 subscribers — which he is building to quite quickly as the product gains traction.

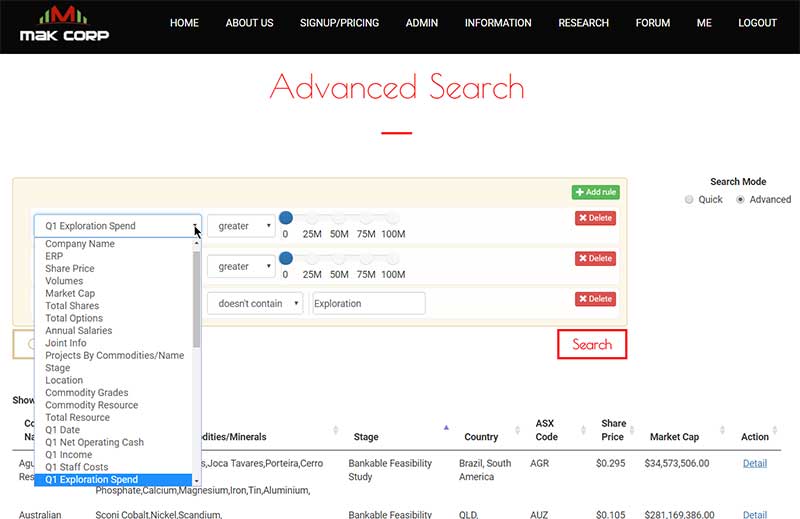

“One of the most powerful features of the website is the advanced search tool,” he said.

“For example, I had a customer a couple of days ago who wanted a list of uranium stocks that are in advanced project stage – any projects in scoping study up to production – and located in Australia.

“If you were to go and try and research that information it would take many, many hours. I was able to provide that in about 15 to 20 seconds.”

There has been plenty of good feedback on MakCorp, with one investor saying it is “a huge time saver by being able to filter by commodity, country and project stage”.

Another said he found it very useful to quickly go through quite a few cobalt stocks and that the links to projects and cash positions are “massive time savers”.

Because Perth-based MakCorp only focuses on Australian miners, a subscription is much more affordable for the average retail investor than other competitors that are global.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Mr Rosewell is continuing to build up the database and is even looking to add more sectors to the product.

“There are lots of new features happening with the website to continue to make it a valuable asset to many markets,” he said.

“That’s what we’re exploring. It’s a powerful platform that many, many different types of industries and people can use.”

Stockhead is proud to use MakCorp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to MakCorp’s website. MakCorp’s twitter handle is @makcorppl

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.