America First strategy pays off for Red Mountain Mining

Antimony has become central to America’s bid to maintain its dominance on the world stage, and Red Mountain Mining is in the thick of it. Pic: Getty Images

- Red Mountain Mining shares have run 200% in a month

- It has adopted an America First strategy – securing three historical antimony projects across the USA

- Idaho’s historic Silver Dollar mine added this week to Yellow Pine and Utah claims

Special Report: America was once a hive of antimony mining activity, its control of a catalogue of domestic production centres forming a key part of the military giant’s successful World War 2 strategy.

At the time, around 90% of America’s antimony – used in tungsten steel and hardening lead bullets – was made at home.

Today antimony’s uses are broader but no less strategic. Night vision goggles, lasers, radars and photovoltaic solar cells are all key technologies of modern warfare and energy security. All need antimony. And almost all of that comes these days from China.

When China turned off the taps to the US and EU last year, it sent prices skyward, five bagging to ~US$60,000/t, making the development of new antimony mines in the West not just strategic but also lucrative.

It’s into that environment Red Mountain Mining (ASX:RMX) has waded this year. And its early steps have brought investors well and truly along for the ride.

Staking its claim

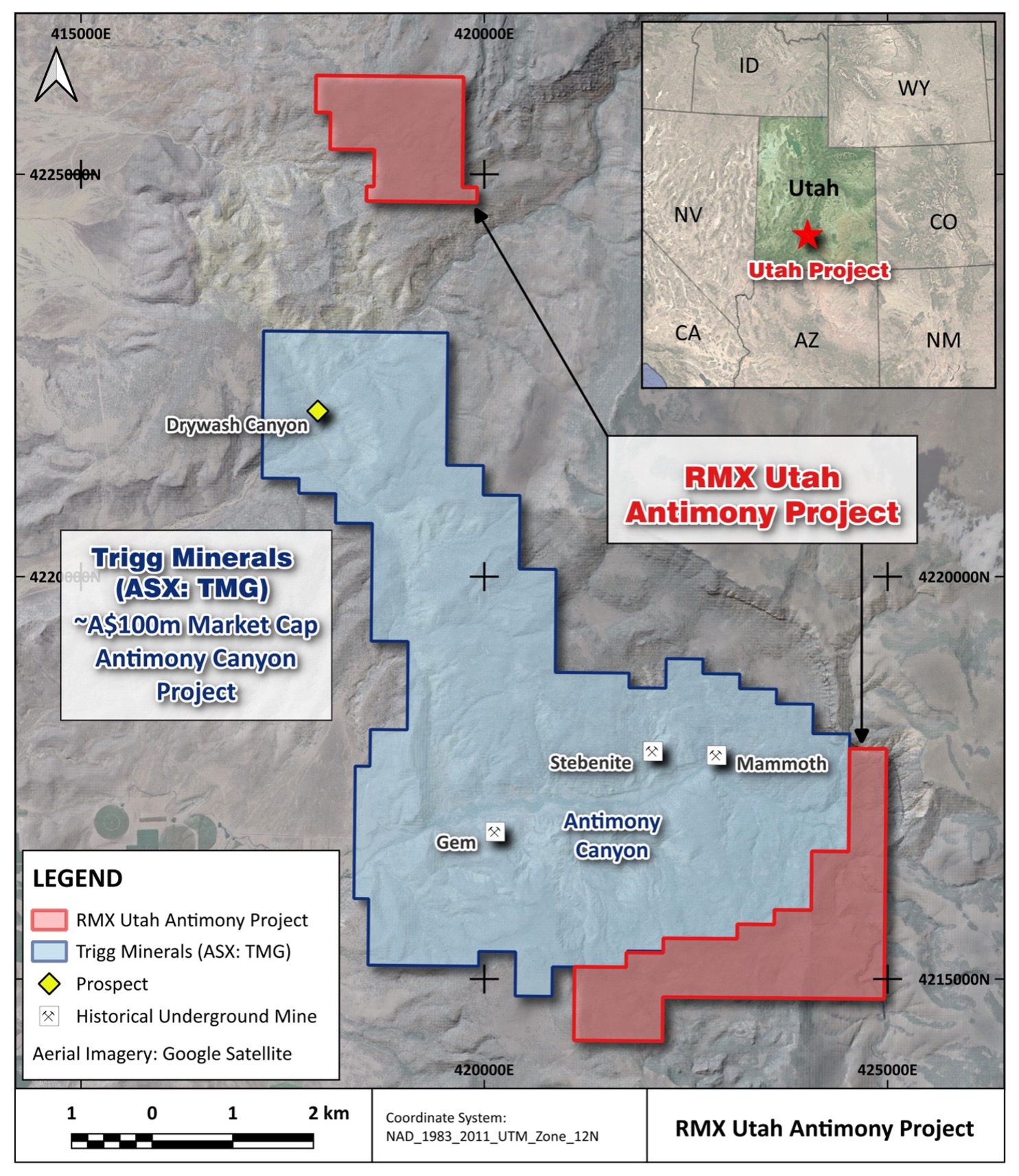

Red Mountain’s surge up the ASX boards began with the acquisition of 87 claims in the Antimony mining district of Utah, unsurprisingly termed the Utah antimony project.

The bulk of those claims sit directly adjacent to Trigg Minerals (ASX:TMG) Antimony Canyon project, a purchase that has pushed Trigg’s market cap to $225m.

RMX, by comparison, is still priced at a tenth of that, and has evidence of the same antimony-bearing Flagstaff Formation under less than 20m of shallow cover just metres away on its side of the tenement boundary.

The historical record is promising. Antimony was discovered in the district in 1879, with high grade production from 1880 to 1908, and then intermittently until the Vietnam War in the 1960s.

TMG’s channel sampling program at Antimony Canyon has returned multiple assays above 10% Sb, including 1.5m at 33.2% Sb from the old Stebenite mine.

A conceptual exploration target of 12.8-15.46Mt at 0.75-1.5% Sb for 96,000-234,000t on Trigg’s side of the border shows the potential for RMX as it maps under cover extensions of the north-south structures that host antimony mineralisation at Antimony Canyon and Dry Wash Canyon.

A desktop study assessing available magnetic and topographic data which will be reviewed initially, and augmented if necessary by high resolution drone magnetics and surface reconnaissance mapping, which may be able to confirm the locations of subcropping structures.

There should be plenty of news flow to come, with ground electromagnetics, shallow trenching and/or RAB drilling likely to be required to identify sulphide mineralisation and antimony under cover.

Private Idaho

But that’s not all.

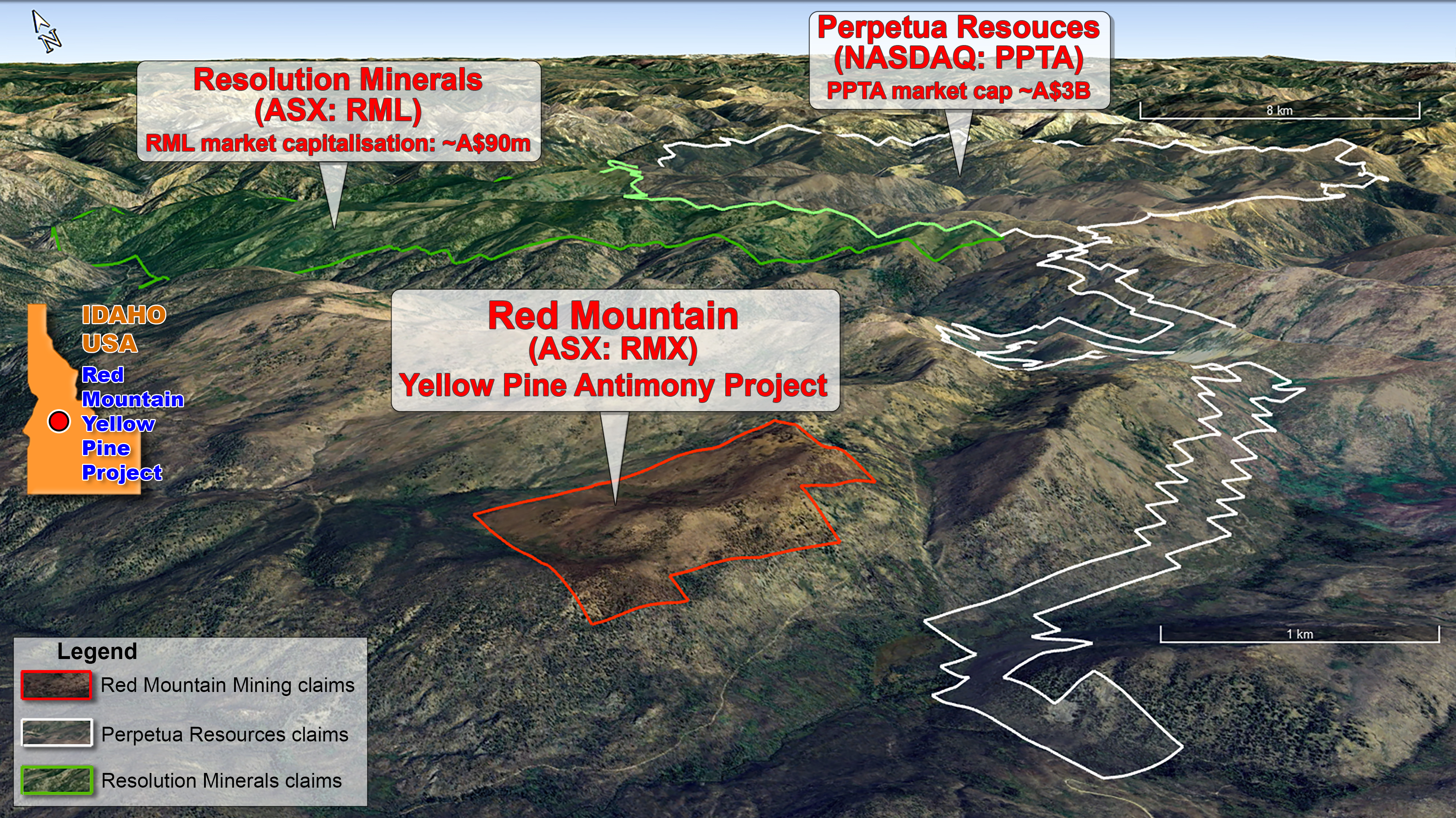

Red Mountain’s aggressive move into the US’ hottest antimony districts has extended into Idaho, where its pick up of the Yellow Pine project was complemented this week with the purchase of the historic Silver Dollar mine.

Yellow Pine is just 2km from the Stibnite gold and antimony project owned by NASDAQ and TSX listed Perpetua Resources, currently worth C$3.65bn, which contains a proven and probable mineral reserve of 4.8Moz gold and 148Mlb antimony.

That asset last month received final federal clearance to head into construction, promising to return the site to operation for the first time since 1997, when Stibnite’s West End deposit was mined for gold and silver.

Perpetua’s Yellow Pine and Hangar Flats delivered 39,930t of antimony between 1932 and 1952, while $74m capped Resolution Minerals (ASX:RML) has also made strides to define antimony mineralisation 5km north of RMX’s project area at Horse Heaven – already the subject of an aborted $225m bid from NASDAQ listed Snow Lake Resources

Red Mountain’s 29 claims feature similar geology to the Stibnite project, where folded Ordovician to Cambrian metasediments are intruded by Idaho Batholith granite and cut by a major north-northeast trending Tertiary fault.

There’s evidence of previous mining activity, but none in the modern day. The whole deal cost just $52,000 through direct staking with the US Bureau of Land Management, with Red Mountain’s geologists already locating historical workings mapped by the Idaho Geological Survey and shallow pits targeting brecciated quartz veins, likely seeking gold and/or antimony.

Then came Silver Dollar, where mining in the 1940s pulled up ore averaging 17.7% Sb, with a stockpile sample in USGS mineral database records outlining a grade of 14.6% Sb and 6.3ppm Ag.

Located 70km southeast of Yellow Pine, the additional 24 claims make RMX one of the largest players in the Stibnite mining district and include a 10m shaft sunk by prospector Arthur McGowan in 1944.

He received US$56/t for the ore at the time, uncovering a vein that swelled beneath a thin surface expression. With antimony prices surging, RMX is well positioned to resume exploration on a site that has seen little attention in over 60 years.

With $1.5m in the bank from a recent placement, it’s well positioned to do just that, while Red Mountain is also continuing to pull up high-grade antimony from its Armidale project in New South Wales near Australia’s largest antimony deposit, Larvotto Resources (ASX:LRV) Hillgrove mine, and gold at the Fry Lake project in Canada.

Federal cash flows for antimony players

America’s antimony dreams have coalesced into real action to build domestic supplies.

The US Export-Import Bank is expected to deliver a ~US$2bn loan for the Stibnite project, which will cover around 35% of domestic antimony demand for its first six years of mining.

There’s support on the downstream end as well, with the Pentagon delivering a US$245m contract for smelter owner US Antimony Corp to help build a defence stockpile.

Rebranding its military administration unofficially as the Department of War, the US has grown more aggressive in its efforts to brand critical minerals as national security assets.

And the power of a US Government partnership has been shown with the enormous share price gains from rare earths miner MP Materials and copper explorer Trilogy Metals following direct investments from the DoD.

As exploration outcomes are delivered, there’s a strong chance Red Mountain’s assets could enter the radar screens of those key decision makers.

Director Comment

Lincoln Liu, executive director of Red Mountain Mining says “Red Mountain’s US Critical Minerals Projects align with the US Government’s urgent push to secure its critical mineral supply chains by rapidly building domestic supply.

“All of our projects are in known, significant historical Antimony districts. Our Utah Antimony Project is contiguous with Trigg Minerals’ Antimony Canyon Project, which is leading the way to becoming one of the first significant modern domestic producers of Antimony for the US market.

“Our Idaho Projects include the recently acquired historical Silver Dollar mine and the Yellow Pine Antimony Project, which sits next to Perpetua’s Stibnite Project, which is heading towards production.

“We are advancing an aggressive growth and exploration strategy to cement Red Mountain’s leadership in the US critical minerals sector. We have only just commenced a growth strategy with a much larger ascent ahead.”

This article was developed in collaboration with Red Mountain Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.