Altona Mining’s boss is taking his $270 million Chinese breakup pretty well

Brief affair … Altona’s relationship with its Chinese-backed partner was over before it began. Picture: Getty

A $270 million deal between a Chinese state-owned enterprise and aspiring copper-gold miner Altona Mining to build a large-scale copper mine near Mount Isa in Queensland has been scuttled.

Stockhead caught up with Altona’s MD who is on the lookout for other potential suitors for the project, but won’t be rushed into any old deal.

Late last month, Perth-based Altona (ASX:AOH) announced it had called quits on its proposed funding deal with Sichuan Railway Investment Group (SRIG) to build the Cloncurry copper-gold project in northwest Queensland.

The news comes after a very lengthy and drawn out process with the Chinese-backed company. The joint venture was originally announced way back in June 2016 with a transaction deadline in October of that year. However, SRIG had issues getting Chinese regulatory approvals resulting in the deadline being extended several times.

The latest deadline of 22 July 2017 was not going to be met since the Chinese regulator had not completed its assessment of the transaction and couldn’t provide SRIG with necessary approvals by the date.

This was the last straw for Altona with the company halting any further extensions for SRIG to get approvals and terminating the transaction under the framework agreement, freeing it from exclusivity with SRIG.

The company said it would look to other third parties to bring Cloncurry into production.

Two weeks on from the news and Altona Mining managing director Alistair Cowden remains optimistic about the future of the company and the development of the Cloncurry project.

“Altona has moved on,” he told Stockhead.

“Copper markets are now very different from when the SRIG deal was struck. Altona is in a position of strength, it is cashed up with $36 million and need not be desperate to accept any deal. We are focussed on finding a transaction structure which generates shareholder value.”

Mr Cowden said Altona was focussed on finding a value adding transaction.

“Altona does not wish to finance the project development through conventional debt and equity. We believe this to be high risk and overly dilutive. We are open to a range of project level and corporate transactions.”

Despite eventually scuttling the deal, Cowden said the SRIG transaction was nevertheless an excellent opportunity and worth pursuing.

“The deal was struck when copper markets were weak and there were no better alternatives,” he said.

“One reason the deal was terminated was to end SRIG’s exclusivity and permit Altona to engage with other parties.”

Cloncurry is recognised as one of the bigger copper-gold projects in Australia with a current resource of some 1.66 million tonnes copper and 0.41 million ounces of gold.

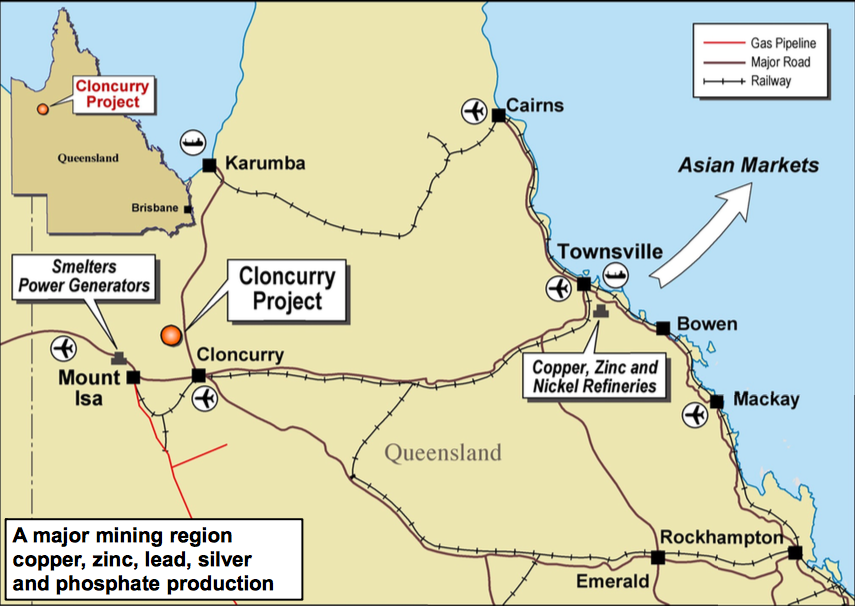

Location of the Cloncurry copper-gold project in Queensland. Picture: Altona Mining

It is located 95km north-east of Mt Isa, a region considered one of the world’s foremost base metal mining provinces. It is estimated that the area hosts approximately 11 per cent of the world’s zinc, 5 per cent of its silver and 1 per cent of its copper.

“The project is without peer,” Mr Cowden said.

“There are no comparable robust, ready to build large scale copper opportunities in such a favourable jurisdiction. There are also few comparable exploration opportunities.”

Recently, Altona announced an updated Definitive Feasibility Study (DFS) for the project which delivered significant improvements on the previous DFS released in March 2014.

Cloncurry is expected to annually produce 39,000 tonnes of copper and 17,200 ounces of gold in concentrate.

The project is expected to generate $1.48 billion of cashflow (pre-tax and sustaining capital) over an initial mine life of 14 years with average annual operating cashflow of $141 million per annum for first five years of production.

Shares in Altona closed on Wednesday at 13c.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.