Alloy is gearing up with a pipeline of work on four projects

Pic: Tyler Stableford / Stone via Getty Images

Getting on investors’ radars is increasingly important given the market uncertainty brought about by the COVID-19 pandemic, and Alloy Resources (ASX:AYR) is lining up a pipeline of activity that could put it in the spotlight.

With shareholder approval for the major part of a $1m share placement required to complete its acquisition of Dingo Resources – and the two projects it adds to the portfolio – now under its belt, the company can push ahead with its plans.

First off the blocks are its older projects with joint venture partners Rio Tinto (ASX:RIO), which is poised to kick off activity at their project in the exciting Paterson province.

Rio agreed in June 2018 to earn up to a 70 per cent stake in the Paterson JV project by completing a planned drilling program.

While the exact timing of the program is still uncertain due to travel restrictions put in place to check the spread of the virus, Rio has flagged that it will drill eight reverse circulation holes up to 250m deep to test six targets.

Alloy executive chairman Andy Viner says his understanding is that Rio is moving to start drilling very soon.

“We have the perfect partner up there. These guys have been madly exploring (at the Winu project) and making big discoveries,” he told Stockhead.

“They have got the knowledge and it can all be sucked down into our exploration property.”

READ: These small caps are chasing elephants in the Paterson

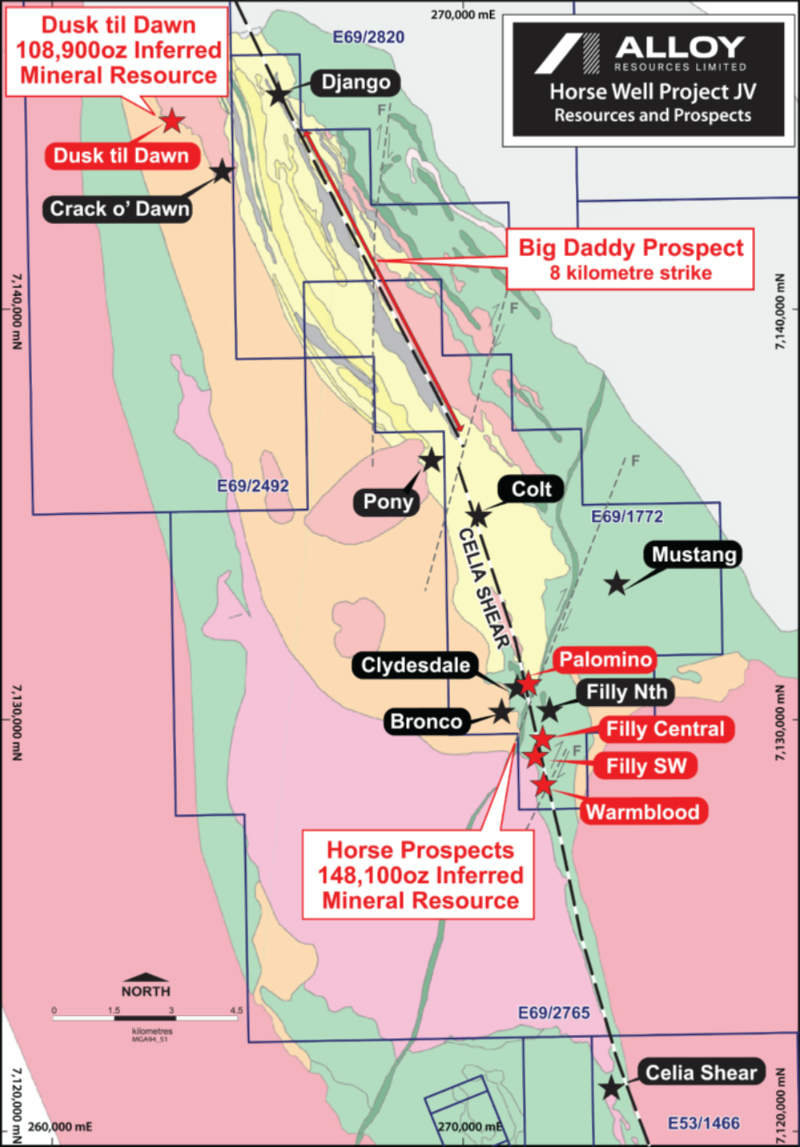

While activity in the Paterson is being carried out by Rio, Alloy’s initial focus for its own activity will be on its advanced Horse Well joint venture project with Silver Lake Resources (ASX:SLR).

Notably, the project is close to both Northern Star Resources’ (ASX:NST) Jundee gold mine and Blackham Resources’ (ASX:BLK) Wiluna gold operations.

Horse Well already features an inferred resource of 257,000 ounces of gold, about half of which is a shallow resource grading 2.7 grams per tonne (g/t) gold.

Viner says this project offers Alloy opportunities to create a small mining operation that could deliver early cash flow.

“We are committed to doing some further work on the Horse Well gold project, so we are going to do some preliminary mining work, metallurgy and some more analysis of drill samples,” he explained.

Early cash flow would also alleviate the need for the company to seek capital from a volatile market and help fund exploration on the projects from the Dingo acquisition.

Dingo projects

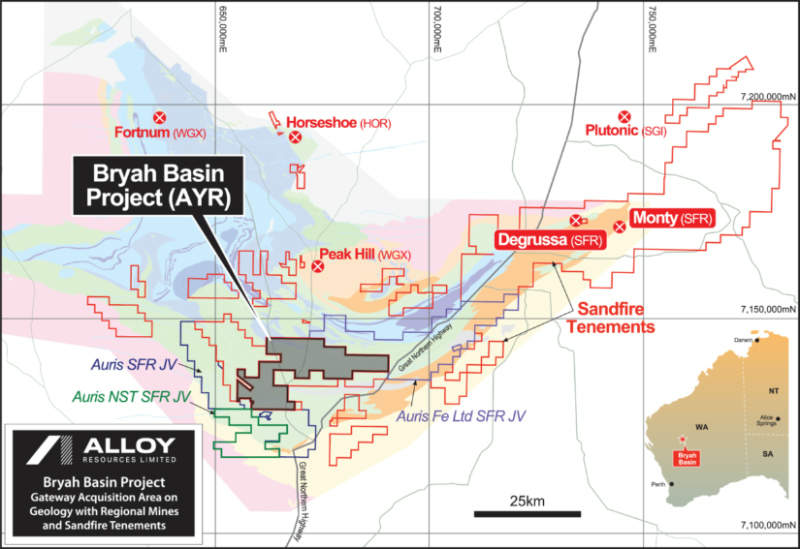

The recent discovery of gold by Sandfire Resources (ASX:SFR) at its Morck Well JV with Auris Minerals (ASX:AUR) has got Alloy excited for the prospects of its Bryah Basin project.

And that’s because the gold hits of up to 10m at 3.55g/t gold are just northeast of the Bryah Basin in what Viner says is exactly the same geological setting as the targets Alloy is eyeing.

“We feel pretty happy that we have got the same sort of thing,” he said.

“I think it just reinforces how valuable our new project is. They are spending hundreds of thousands of dollars and that drilling is going to be coming closer to us over the next month.

“There’s just a little more work to do to completely understand the value of the ground and at some stage further down the line, it would make sense to talk to Sandfire about the prospects of working together.”

Sandfire’s tenements and JVs completely surround the Bryah Basin project.

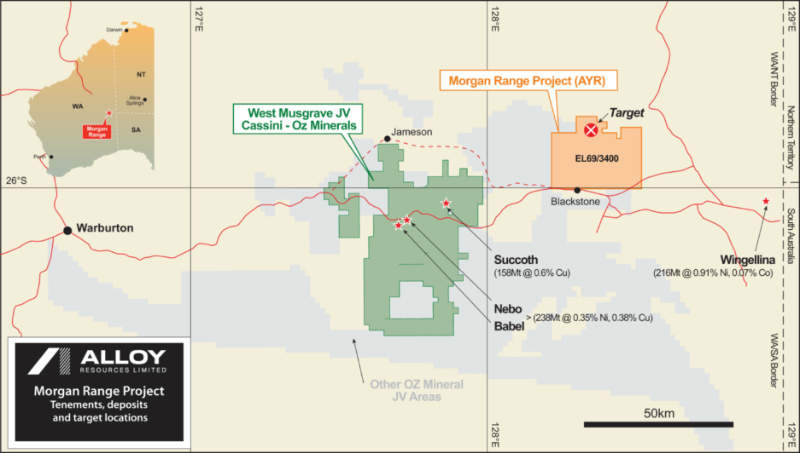

However, it is the second project acquired from Dingo that is potentially the most exciting for Alloy.

The Morgan Range project in the West Musgrave area is just 10km east of the West Musgrave JV between OZ Minerals (ASX:OZL) and Cassini Resources (ASX:CZI).

The West Musgrave JV is a very large nickel-copper project that is the subject of a pre-feasibility study and a commitment by the companies to push forward its development, which could support development of other projects in the area given that it had been considered as being very remote and difficult to start mining operations there in the past.

“What we are looking for in the Morgan Range is a brand new hidden nickel-copper sulphide deposit. They are very rare beasts and when you find one you can become a billion dollar company very quickly,” Viner told Stockhead.

Viner is particularly excited by the fact that its Morgan Range project was recognised by Rio Tinto as a priority target in 2015 during a regional technical review.

However, the major decided to put its resources into the Paterson and the project fell down Rio’s priority list before it was optioned to Dingo.

“It suits a small company like us because the target is already there, Rio already flew the electromagnetic surveys, looked at all the anomalies and picked the one they wanted to test,” he explained.

Rio has the right to re-acquire a 60 per cent JV interest in Morgan Range if Alloy defines a resource with an ‘in the ground’ value of +$1bn by reimbursing Alloy’s exploration spend and sole funding the first $40m of joint venture expenditure.

“All we have to do is finalise the deal with the traditional owners and get our geophysicists to tell us where to drill and go and drill it. It is a low-cost, high-reward opportunity for Alloy.”

While the travel restrictions put in place to protect Aboriginal communities means that the company is unable to get to the project at this stage, it is doing what it needs to do to ensure that when restrictions are lifted it can hit the ground running.

NOW READ: This $3m market cap explorer now has four potential dial-movers in its portfolio

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.