Alicanto’s latest assays strengthen upcoming JORC resource at Sala polymetallic project

The resource estimate is scheduled for July. Pic:urbazon / iStock / Getty Images Plus via Getty Images.

Alicanto says its impending maiden JORC resource for the Sala Zinc -Silver-Lead-(Copper-Gold) Project in Sweden has been bolstered by strong final assay results grading up to 12.7% zinc.

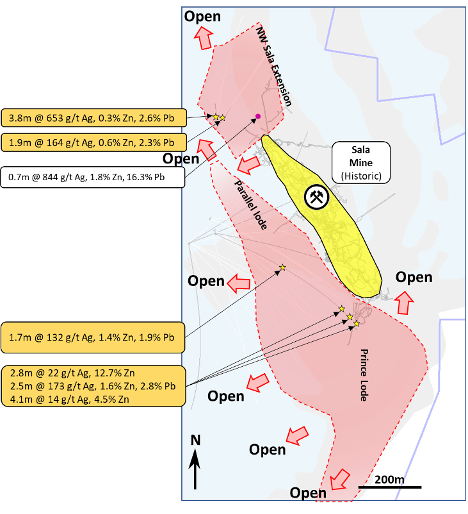

The assays include intersections of high-grade mineralisation in the gap between the Sala and Prince lodes – which the company interprets as to be one large system.

Massive sulphide intersections include:

- 2.8m at 12.7% zinc, 22g/t silver;

- 2.5m at 1.6% zinc, 173g/t silver, 2.8% lead; and

- 4.1m at 4.5% zinc, 14g/t silver.

Drilling at the North-West Extension of Sala intersected:

- 3.8m at 653g/t silver, 0.3% zinc, 2.6% lead; and

- 1.9m at 164g/t silver, 0.6% zinc, 2.3% lead.

The resource estimate is scheduled for completion in July.

Sala has ‘significant’ scale

Production in the historic region was last undertaken at the Bronäs mine (about 400m from Sala) in 1962, by which time more than 200Moz of silver had been produced at grades of up to 7,000 g/t2 as well as 35,000 tonnes of lead.

The company has been conducting the first systematic diamond drilling at the property since the mine closure, and Alicanto Minerals (ASX:AQI) MD Peter George said the latest results provided more strong evidence of the project’s high grades and significant scale.

“These grades are exceptional and entirely consistent with the grades which established Sala as a world-class asset in its previous life,” he said.

“The results also extend the known mineralisation along strike at Prince and establish the presence of high-grade mineralisation in the gap between the Sala and Prince lodes.”

Ongoing growth potential

Both the Prince and Sala Lodes are now interpreted to be part of the same larger skarn system and drilling is continuing to expand the footprint at the project, targeting further growth.

“As well as helping to further strengthen the upcoming Resource, these intersections demonstrate the immense potential for ongoing growth,” George said.

“We have two rigs continuing to drill as part of that growth strategy.”

Alicanto is well-funded with $6.1m cash as at 31 March 2022.

This article was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.