Alicanto kicks off maiden drilling in the hunt for a VMS monster

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

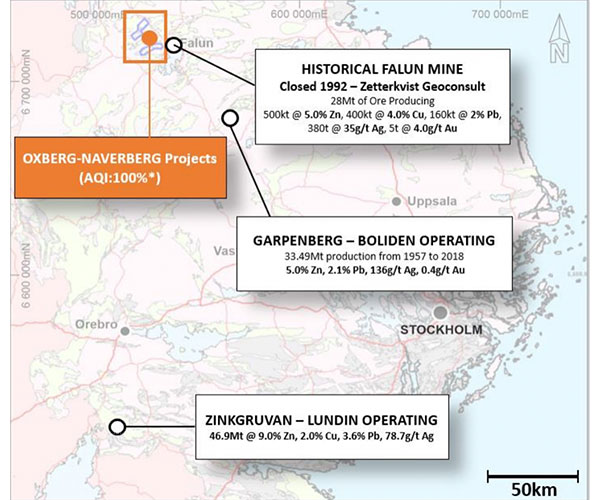

Special Report: Alicanto has launched into maiden drilling at its Oxberg and Naverberg projects, located within the famously rich Bergslagen volcanogenic massive sulphide (VMS) mining district of Southern Sweden.

VMS deposits are rich in base and precious metals like copper, zinc, lead, gold and silver.

Because these deposits tend the ‘cluster’ together, VMS camps can often be mined for a very, very long time.

At Bergslagen, the well-known monster deposits (greater than 25 million tonnes) include the Falun, Garpenberg and Zinkgruvan orebodies.Falun and Garpenberg have been mined for at least the best part of 700 years.

Alicanto’s (ASX:AQI) Naverberg project is immediately along strike from Falun, while Oxberg lies within the same geological setting about 15km away.

The explorer is launching a +1000m maiden diamond drilling program to target copper, zinc and gold at three initial VMS targets.

At Naverberg, Alicanto will test for extensions to the historic high-grade Skyttgruvan mine (which produced at an incredible 38 per cent zinc) — but there’s numerous advanced targets ready for drill testing along 10.5km of strike.

At Oxberg, the maiden program will test the Lustebo and Oxberg targets.

High-grade deposits in the region such as Garpenberg, Zinkgruvan and Falun highlight the prospectivity of these targets, Alicanto chief executive Peter George says.

“Results will be eagerly anticipated over the coming months,” he says.

But that’s just the start, because Alicanto has more than 30km of mapped prospective VMS mineralised trend to play with.

Multiple targets have been revealed along this trend by recent high-grade rock chip sampling, which returned up to 11 per cent zinc, 4.43 per cent copper, 4 per cent lead and 56 grams per tonne (g/t) silver.

“The company is advancing exploration throughout the highly prospective tenement package and has already identified more than 30km of prospective ore-horizon from surface mapping of proximal alteration and observations of mineralisation in rock chips,” George says.

READ: Alicanto Minerals is in “monster VMS territory” as it builds momentum in Sweden

And there’s further upside for Alicanto, which recently signed a big $11.6m farm-in dealwith gold major Nordgold over the Arakaka project in South America.

Nordgold can acquire Arakaka by sole funding $4.3m in exploration expenditure over the next year. After this, it can give Alicanto an extra $7.3m to finalise the acquisition.

“We are also excited that the drilling is now well underway at our Guyana gold project that is being fully funded by Nord Gold,” George says.

“We expect first results back in the coming weeks.”

This story was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.