Aldoro powers up in WA battery metals pursuit

Pic: Schroptschop / E+ via Getty Images

With an eye to an electric-powered future, mineral explorer Aldoro Resources recently made the call to spin out its promising gold interests and focus on battery metals.

That move is understandable in the current climate, as the world gears itself for a battery boom of unprecedented proportions which will require mineral feed to fuel it.

But to make it, you must have serious confidence that your assets are the real deal. It’s clear Aldoro (ASX:ARN) has full faith in its flagship Narndee nickel-copper-platinum group element (PGE) project in WA.

The project had been on the company’s books for a while when executive chairman Joshua Letcher took over the role in November last year, but attention had been on the gold assets for the 24 months prior.

“Just after I came on as chairman we started looking at the company’s nickel assets,” he told Stockhead.

“Obviously with the increase in demand for battery metals, the nickel started to make sense for us to pursue. So we started to have some conversations with our geological team and made the decision to focus on that.”

But it’s not enough to focus on a commodity – you also need assets worthy of that focus. In Narndee, early signs suggest Aldoro has exactly such assets given the area Aldoro holds is the 2nd largest layered mafic-ultramafic complex globally after the mine rich Bushveld complex of South Africa.

The company took a detailed approach to its early exploration strategy in a bid to de-risk its drilling efforts, and so far that work has provided Aldoro with exactly the kind of news its shareholder would be hoping to hear.

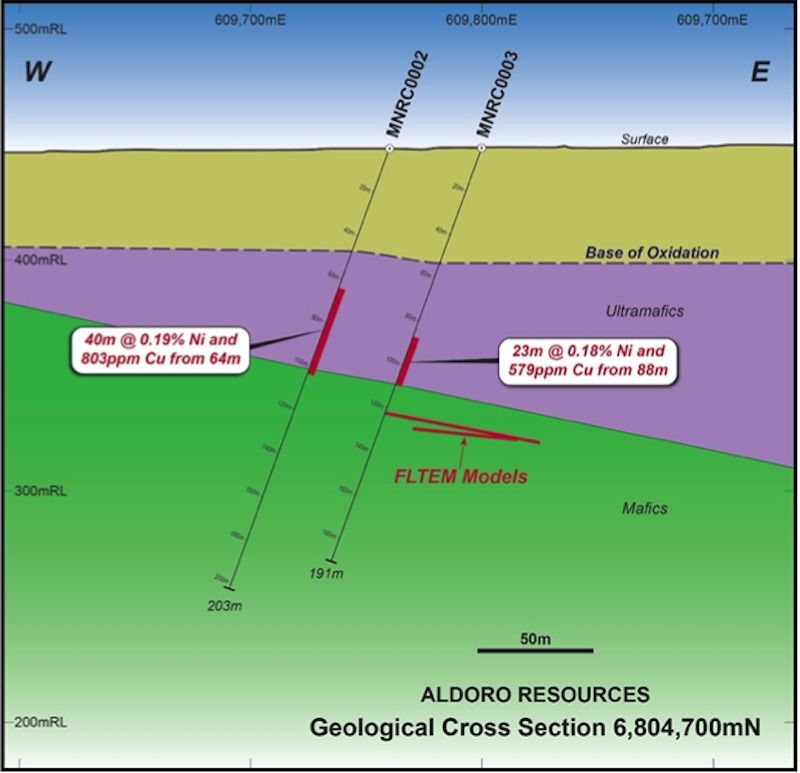

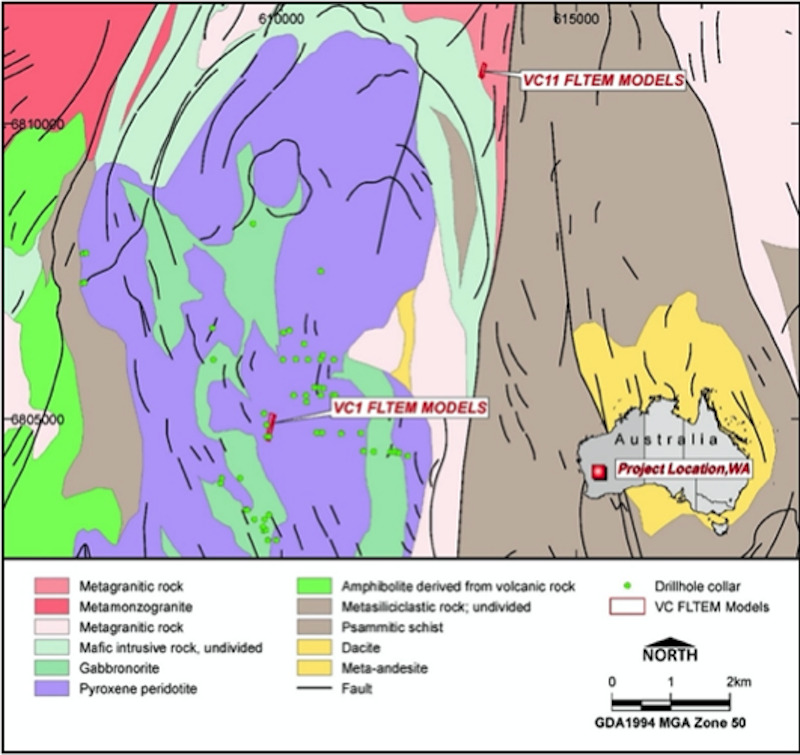

Fixed-loop time domain electromagnetic (FLTEM) surveying results received in March identified two walk-up drill ready targets – VC1 and VC11 – with structural signs and conductors that resemble the types of deposits you’d be looking for on a project of Narndee’s ilk.

Then came the kicker. Desktop work on past drilling data around the targets revealed a series of exciting historical nickel sulphide intercepts made by Mark Creasy-backed Maximus Resources in 2007, which were near VC1.

“They were looking for nickel, but back then the market wasn’t as hot for it as it is now for battery metals, so they didn’t really get any traction even though they hit nickel sulphide,” Letcher said.

“Two of their holes right next to our VC1 target intersected nickel, copper and PGEs, and importantly the ratio between nickel and copper supports the likelihood for magmatic nickel sulphides.

“That’s roughly 40m from the FLTEM target VC1. Given those two match up, and they’re roughly 40m from what we think will be the main body of the target, we’re confident we’ll make an intersection which will have nickel and copper in it.

“We’re on the side of the fence which we feel indicates we may intersect something much greater than that which was previously intersected.”

In contrast to the Maximus work at VC1, VC11 has never had any historic exploration work carried out around it.

Aldoro geologist Luke Marshall is heading to site to do some XRF sampling and moving-loop time domain electromagnetic follow-ups are planned also for the coming weeks.

“We’ve got a rig coming later this month that should be putting some initial holes in there, and we’re also planning to drill an inspection hole at our very large VC8 target,” Letcher said.

All the planned holes will then be surveyed using downhole EM – again part of the Aldoro approach to de-risking the exploration effort.

“From my view, it’s better for us to do more surveys and understand the ground better than just drilling and slightly missing the targets,” Letcher said.

As for the ground, you’d be hard-pressed to find territory as prospective.

“The location is the largest layered ultramafic complex in Australia, and the second largest globally,” Letcher said.

“Aldoro owns 100% of that, they’re our tenements, so that gives us a really good foundation to commercially develop a discovery should we be successful in intersecting mineralisation.”

Liking the look of lithium

Narndee is the focus for Aldoro at the moment, but the 192km2 Windimurra lithium project granted a few months ago on the same geological complex is also of serious interest.

The project features a number of underexplored lithium pegmatites, and Aldoro is in the process of carrying out groundwork.

We’ll be looking to pursue that with the rig out there, and as activities are picking up at Narndee we’ll be utilising some of that at the lithium project as well,” Letcher said.

“Basically we’re building ourselves up to be a quite significant battery mineral company. Having lithium, nickel, PGEs, we’ve essentially got everything to make batteries in such a fine location where we own 100%.”

With companies such as Tesla looking to buy up to $1 billion worth of battery metals each year, the project has some serious investment appeal.

Gold story ongoing

The divestment plan for Aldoro’s gold interests – the Penny South, Ryans Find and Unaly Hill South projects – would see the company’s wholly owned subsidiary Aurum listed on the ASX.

Adoro will retain a 16.17% stake in Aurum and receive reimbursement for past costs.

Letcher said geologist Margaret Hawke had been brought in to review the projects, and based on her feedback the company had determined a spinout to be the best path forward.

“We did have a lot of interest in the assets from various companies, but we decided for our shareholders that the best option would be to do an IPO, which allows our shareholders the advantage of getting some equity in that IPO as well,” he said.

This article was developed in collaboration with Aldoro Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.