After success with Iron Ridge, Fenix 2.0 has just snapped up another 10Mt high grade iron ore deposit for $1/tonne

Fenix has another 10Mt of iron ore to its name after penning a $1/t agreement for tenure with strategic partner Sinosteel. Pic via Getty Images.

- Fenix has bought a 10Mt deposit from Sinosteel next to its Iron Ridge mine

- The company has already mined more than 3Mt from its flagship mine at Iron Ridge and generated more than $150 million in free cashflow

- With circa 6Mt left to mine at Iron Ridge the acquisition of a further 10Mt nearby significantly extends mine life and should be a valuation catalyst

With $10m for 10 million tonnes of iron ore added to its books, Fenix Resources’ acquisition of the Beebyn-W11 iron ore deposit in Weld Range looks like an absolute steal.

Fenix Resources (ASX:FEX) has thrived where other WA iron ore juniors have failed, thanks to its high grade asset base, savvy hedging, strategic acquisitions, and infrastructure and partnerships.

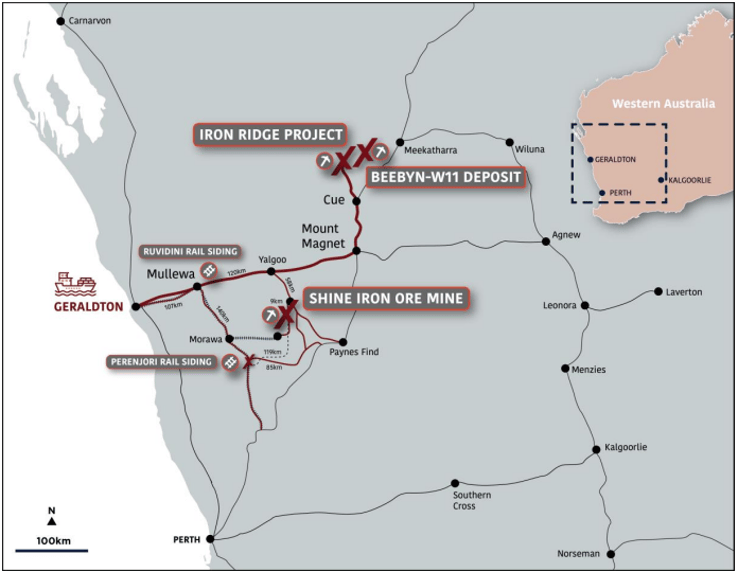

Cornerstoned by this well-storied success, Fenix Resources (ASX:FEX) 2.0 has begun with the recent acquisition of Mount Gibson’s Geraldton Port infrastructure, regional rail sidings and Mid West iron ore assets, the consolidation of the Fenix-Newhaul logistics business, and now 10Mt of high grade iron ore from Sinosteel’s Beebyn-W11 deposit.

Another 10Mt and Fenix 2.0

Strategically located around its Iron Ridge and Shine iron ore projects, the cost-effective acquisition of Beebyn-W11 at Weld Range has positioned Fenix well for future cash flow and project extension opportunities.

W11 itself has a total resource of 20.5Mt @ 61.3% Fe and is only 20km from Fenix’s current Iron Ridge mine.

Due diligence by Fenix indicates that the resource “can be mined in a similar manner to the company’s existing operations at Iron Ridge,” the company says.

One could assume this indicates the successful miner is considering operating Beebyn-W11 at a similar scale to Iron Ridge of circa 1.3Mtpa producing similar lump and fines iron ore products.

Sinosteel’s Weld Range project, including the identified iron ore deposits at Beebyn and Madonga, has long been expected to be a catalyst for major infrastructure development in the Mid-West – and Fenix is in pole position to take advantage.

Fenix’s says its unique road, rail and port infrastructure and capabilities provide an advantage which enables the efficient monetisation of high-quality regional deposits.

“We started small, yet have huge ambitions. Our partnership with Sinosteel is a big win for us and has massive upside potential for the future of our company,” Fenix chair John Welborn says.

“We’re going to have a real crack at this and regardless of past successes under our belt, this really is only the start for Fenix.”

“We’ve done superbly well with Iron Ridge and acquiring 10Mt of high-grade iron ore close by will increase our production rate and extend the mine life across our project areas.”

Acquisition

For $10m, Fenix will snap up 10Mt of iron ore tonnage at the W11 deposit at Weld Range for just $1 per tonne plus various royalty payments on production. As part of the terms, Fenix will pay Sinosteel $5m in cash upfront and another $5m when mining approvals have been received.

Fenix will pay Sinosteel a fixed base royalty of $2 per tonne and a variable profit share royalty while retaining exclusive, sole control over all aspects of mining, hauling, logistics, and port operations related to the mining and export of iron ore through the Port of Geraldton.

The acquisition aligns with Fenix’s vision of growth and cost-efficiency – previously demonstrated that ability to rapidly develop ore projects into production at Iron Ridge.

Upside potential

With the Beebyn-W11 addition and its recent acquisition of Mount Gibson’s Geraldton Port infrastructure, Fenix is well-poised for substantial growth in iron ore production and further cost reductions through economies of scale.

“From the inception of Fenix’s production from Iron Ridge, Sinosteel has been a valued partner both as an off-taker and a provider of infrastructure,” Welborn says.

“Our unique road, rail and port infrastructure and capabilities provide an advantage which enables the efficient monetisation of high-quality regional deposits which for too long have been stranded.

“We are delighted to have secured this initial 10 million tonne right-to-mine opportunity with Sinosteel and look forward to working with them in partnership to unlock the immense value in their extensive iron ore holdings in the Mid West.

“Our strategic intent is to expand our resource inventories, maintain the quality of our operations, and materially boost production to enable cost reduction and the generation of strong profit margins to reward our shareholders.”

Approvals are immediately progressing and Fenix expects to commence mining of Beebyn-W11 next year.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.