Acquisitions deliver ‘pipeline of opportunities’ to increase Hot Chili’s copper resources at Costa Fuego

Surfs up as Hot Chili signs options to acquire two previously producing copper mine areas near Costa Fuego. Pic: via Getty Images.

- Hot Chili is acquiring two previously producing copper mine areas that have never been drill tested

- The acquisition is in line with strategy to increase resources at Costa Fuego to underpin a copper production profile of 150,000tpa

- First pass RC drilling at the newly acquired Marsellesa and Cordillera tenements to begin in the coming week

Special Report: Flush with the ongoing success of its Costa Fuego development in Chile, Hot Chili is now moving to acquire two nearby copper mine areas that have never been drill tested before, despite previously reaching production.

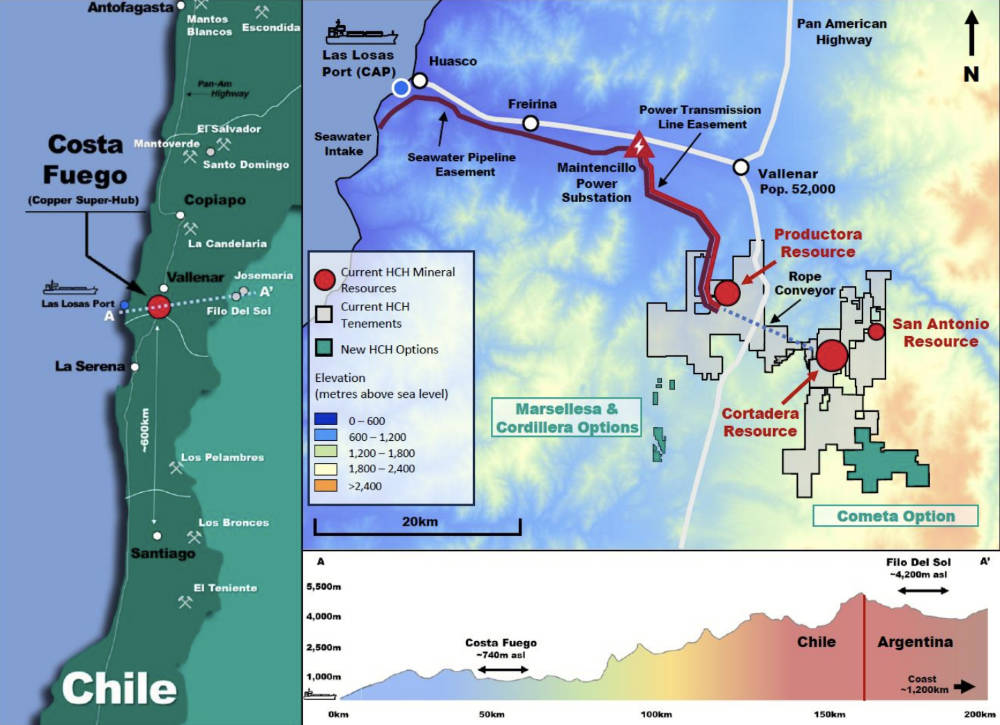

With an indicated resource of 725Mt grading 0.47% copper equivalent underpinned by an attractive preliminary economic assessment (PEA) (a rough equivalent to a scoping study), Costa Fuego is rapidly emerging as one of the few projects in the world capable of delivering meaningful new copper supply that isn’t controlled by a major.

Under the PEA, Hot Chili (ASX:HCH) estimated the US$1.05bn project would be capable of producing 112,000t of copper equivalent (95,000t of copper and 49,000oz of gold) per annum over 14-years of a 16-year mine life.

Over this time, it would deliver revenue and free cash flow of US$13.52bn and US$3.28bn, respectively.

Post-tax net present value and internal rate of return – both measures of a project’s profitability – are estimated at US$1.1bn and 24% respectively.

While certainly attractive, the company is looking to increase its resource base to support an increase in Costa Fuego’s copper production profile to 150,000tpa ahead of its pre-feasibility study, which is expected to be delivered in the first half of 2024.

One of the first steps to achieve this objective was signing a binding letter of intent to acquire Bastion Minerals’ (ASX:BMO) ~56km2 Cometa project about 15km from Costa Fuego’s planned operating centre.

Historical producers offer “pipeline of opportunities”

HCH’s latest option agreements to acquire the Marsellesa and Cordillera copper mine areas about 10km from the planned central processing hub at Costa Fuego are part of the company’s strategy to increase resources.

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material, but have never previously been drill tested.

Marsellesa measures 400x200m with mine workings exposing multiple zones of shallow-dipping, strata-bound (manto-style) copper mineralisation.

The smaller Cordillera mine workings expose outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.

Along with Cometa, the new project additions provide the company with a pipeline of opportunities and additional optionality for the discovery of new mineral resources.

HCH will pay Marsellesa vendor Hermanos Pefaur up to US$1.35m and a 1% net smelter royalty (NSR) to acquire the project while Mr Arnaldo Del Campo – the holder of the concessions comprising Cordillera – could receive up to US$4m and a 1% NSR from underground operations and 1.5% NSR from open pit work if the option is exercised.

Drill plans

The company plans to start first pass reverse circulation drilling at both projects in the coming week.

This will follow completion of drilling at its Corroteo exploration target about 5km southeast of the primary Cortadera porphyry copper-gold deposit.

This article was developed in collaboration with Hot Chili, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.