Achilles spurs influx of ASX juniors pouring into polymetallic South Cobar

ASX juniors are pouring into South Cobar's polymetallic prospectivity. Pic: Getty Images.

Explorers are hustling back into NSW’s Cobar Basin – long known for being one of Australia’s major copper-producing regions, with operations such as the CSA copper mine, stretching back to the late 1800s.

Cobar is well known for hosting outstanding high grade orebodies including Metals Acquisition’s (ASX:MAC) CSA copper mine, and Aurelia Metals’ (ASX:AMI) Peak and Hera polymetallic (gold-copper-silver-zinc-lead) mines.

The recent energy, however, is built upon Australian Gold and Copper’s (ASX:AGC) Achilles discovery in the southern end of the region back in April, containing high, shallow grades of gold, silver, copper, lead and zinc polymetals.

Discovery of Achilles

Across the 15km-long Achilles Shear within the Rast Trough of the southern Cobar Basin, mineralisation was first identified in the late 1990s and defined by Achilles 1, 2, and 3 – with AGC exploring Achilles 3 since 2021.

It was a bit of a slow burn for a couple of years, yet in April this year, as AGC was on the hunt for gold, silver and base metals in the historical Cobar Basin, it uncovered shallow, high-grade mineralisation extending for about 250m of strike.

Initial drilling at its South Cobar project proved up a top high-grade hit of 735g/t tonne (g/t) silver, spurring the explorer to begin an immediate follow-up drill program.

AGC hit straight into even higher grades of polymetallics, with a highlight 5m at 16.9 g/t gold, 1,667 silver, 0.4% copper and 15% lead-zinc from 112m – unearthing the ‘Achilles’ discovery.

That was enough for the junior to rattle the tin for $11m to continue exploration, and as it stands Achilles is defined as a >500m strike and extended mineralisation zone which is open to the north, south and at depth.

Explorers pouring in

While the gold hits are impressive, it’s slew of high-grade silver and base metals that really kicks off the prospectivity of the southern part of the Cobar Basin.

Super high grades of a variety of polymetallics are rare – and lucrative; able to douse the flames of depressed commodity prices that affect project economics of lower grades or just one or two viably produced materials.

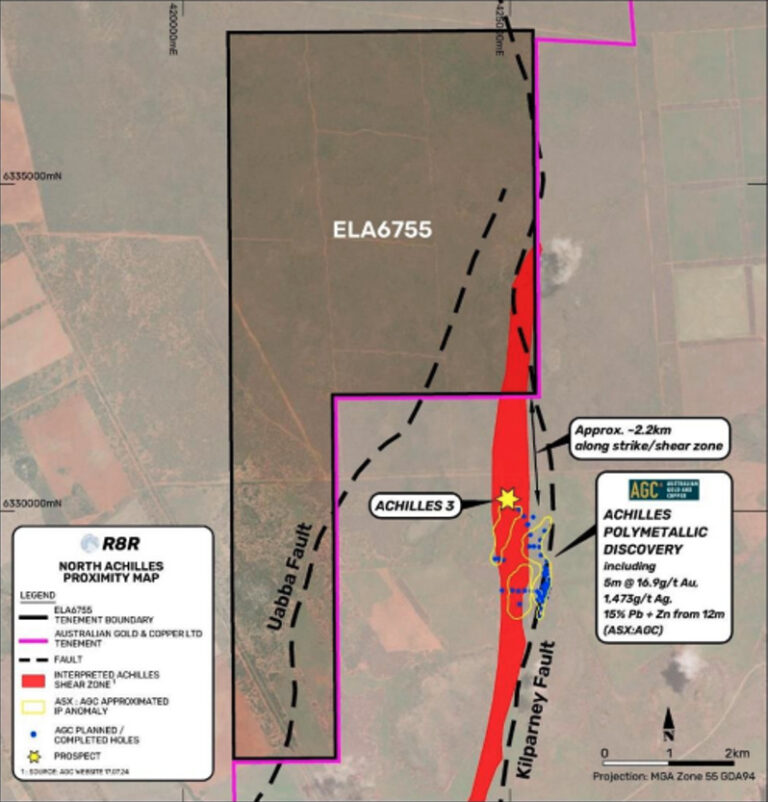

Regener8 Resources (ASX:R8R) hopes to replicate the success of AGC and follow a similar process to discovery.

“We think this is a fantastic opportunity in a great location – it’s essentially a greenfields exploration site because no previous work has been undertaken on this tenement in the past,” managing director Stephen Foley told Stockhead.

“We can see interpretations of the Achilles trend going into our tenement, appearing to continue to the north from AGC’s discovery into our ground.”

That trend rides north, with both the Uabba and Kilparney (where the interpreted Achilles Shear Zone lies) Faults.

When R8R decided to enter the region late last month, the share price shot up 27% on trade.

Its ELA6755 exploration license is just 2.2km and along strike from the Achilles 3 deposit.

READ MORE: R8R gears up for busy year with Cobar Basin critical minerals exposure

Strategic Energy Resources (ASX:SER) meanwhile has been accelerating exploration of its own South Cobar project, which sits on the eastern margin of the Rast Trough.

The tenements capture the northern and southern extensions of the Woorara fault – along strike from Eastern Metals’ (ASX:EMS) Brown’s Reef deposit, while the Achilles prospect lies about 7km south of the Achilles 3 discovery.

Permits have been granted and an extensive 40-hole RC drilling campaign is about to begin to test the Achilles polymetallic soil anomaly within its landholding.

Further north of the Achilles Shear Zone, Legacy Minerals (ASX:LGM) has identified new drill targets after wrapping up ground truthing at its Central Cobar project.

LGM reckons the 308km2 landholding has all the right ingredients for Cobar-type mineralisation and contains undrilled targets surrounded by operating and historical gold and copper mines.

Soil results show incident Cobar-type base and precious metal mineralisation pathfinder elements, with up to 2.63g/t silver, 45ppb gold, 132.5ppm arsenic, 15.3ppm antimony and 886ppm zinc.

At Stockhead we tell it like it is. While Regener8 Resources, Strategic Energy Resources and Legacy Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.