The charts that show a small cap resources revival could be lurking just behind a tech bubble

Pic: John W Banagan / Stone via Getty Images

Recent history tells us that the underperforming small cap resources space could be rapidly approaching a turning point.

Right now, the ASX-listed resources space is a two-speed market.

At one end you have the high performing ASX 100 Resources Index – led by companies like BHP and Rio Tinto. Since 2016, ASX100 investors have more than doubled their returns.

The performance of the struggling junior end of the market could not be starker.

Check this out:

It looks pretty stuffed, says Lion Selection Group executive director Hedley Widdup.

“I was recently asked ‘is the junior model broken?’ by someone who had seen the junior stocks in their portfolio perform horribly,” he told delegates at the Resources Rising Stars conference on the Gold Coast.

“But the junior model isn’t broken — the problem is liquidity.”

There’s just not much investor cash going into junior resources right now. Instead, it’s being funnelled into things like unlisted tech and cannabis.

This low liquidity is exacerbated by the sheer number of small cap resources plays for investors to choose from. On the ASX there are about 1800 listed companies. About 650 are metals and mining companies, and many of those are junior explorers.

“This becomes an issue when liquidity is low, like it right now,” says Widdup.

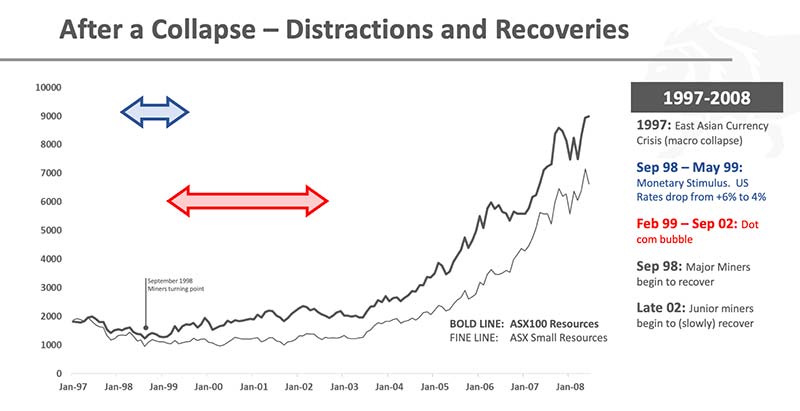

History is repeating itself

In 1997, the East Asian currency crisis saw the heat come out of the share market. The aftermath of that was monetary stimulus, Widdup says.

“As soon as money started returning to the market the mining majors, who are judged on their cashflow, began to recover,” he says.

But investors didn’t want put cash back into exploration plays after seeing all that money turn to dust just a few years prior.

They still wanted to take risks on investment, though, so that money went elsewhere – the dot com bubble.

The dot com bubble was a period a speculation driven by the growth of the internet. It peaked in March 2000, before crashing. Badly.

“It wasn’t until that dot com bubble burst and all that money washed out, that the junior mining market started to recover in 2002,” Widdup says.

“We didn’t just see a recovery in stock prices; we saw in it in capital raisings, and we saw it in IPO trends.

“Money can pour back into the junior mining space when these ‘distractions’ go away.”

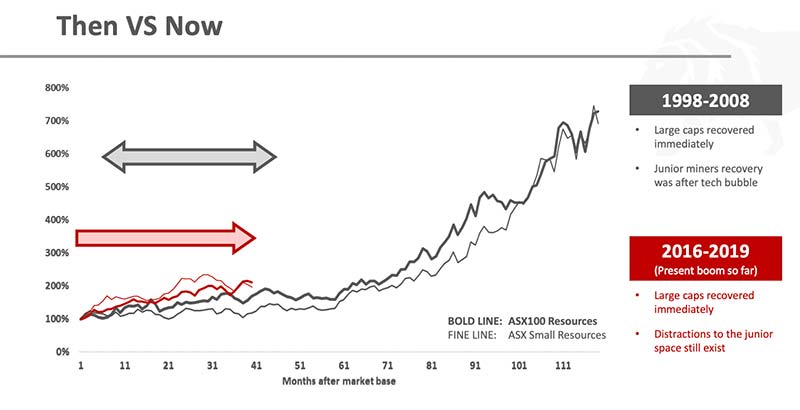

The cycle we are in now is not massively dissimilar from the cycle we saw from 1999/2000 onwards, says Widdup.

This time, 2011 was the peak of the mining market, and 2016 was when it hit rock bottom.

Here are the two cycles on top of each other:

The larger, investment grade mining stocks have recovered at almost the same rate as they did almost 20 years ago, says Widdup.

The ‘distractions’ – unlisted tech and cannabis this time — have also existed for about the same amount of time.

‘Unlisted tech is the dot com bubble of 2019’

The global population of tech unicorns subsequent to QE3 (third round of quantitative easing by the US Federal Reserve in 2012) went from 33 to about 150 in about four years, says Widdup.

The valuations have increased markedly as well.

“On any chart we are seeing more or less the same shape, with similar characteristics, as we saw during the dot com boom,” he says.

And we all know what happened there.

On the tail end of this part of the cycle, we have seen cannabis plays dominate the Canadian market.

“An awful lot of money has flown into that space,” says Widdup.

Cannabis companies – comprising just 2 per cent of the listed capitalisation on the TSX — were responsible for raising 22 per cent of the fresh equity on the TSX last year.

“You have a huge amount of money trying to force itself into a small space which causes phenomenal capital growth.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

How do we spot a junior resource rebound?

Investor sentiment is global, and the Australian population of resources juniors can’t accelerate until these ‘distractions’ disappear.

Right now, mining juniors are beginning to think “well, there’s no investor interest for what we are doing”, says Widdup.

But this despondency and capitulation came before the turning point in 2002.

In the early 2000s, capitulation saw juniors moving into the dot com space. In 2018/2019, capitulation has seen some mining juniors jump into cannabis, albeit to a lesser extent.

“If we are to see a turning point in the junior resources space, then these are the things that are going to precede that,” says Widdup.

“Then we will see liquidity, raisings, and share price increases coming back into the market.”

Widdup says he is looking for indicators that money in the tech and cannabis sectors is starting to get skittish.

“In 2002 we saw the small resources index finally start to pick itself back up again – and I wonder if we are approaching that point right now.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.