A sleeping giant: Could Mt Ida have multi-million ounce potential?

Pic: Schroptschop / E+ via Getty Images

Special Report: It took gold explorer Alt Resources (ASX:ARS) just 11 months to grow Mt Ida gold project resources from zero to 406,000oz gold and just under 4 million ounces of silver. That’s phenomenal.

Importantly, Alt did it very cheaply. Now, the plan is to upgrade and expand resources across the wider Mt Ida project area, north of Kalgoorlie, with the aim of establishing a long-life gold production hub.

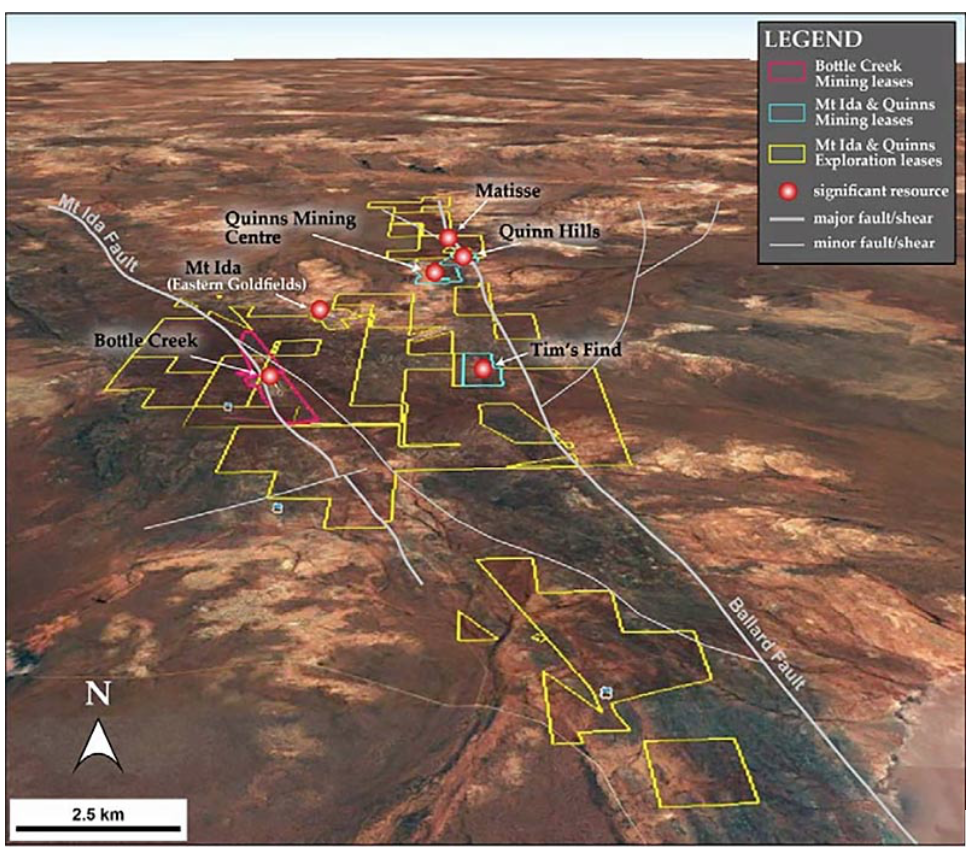

Alt believes the underexplored, 380sqkm Mt Ida tenement package has multi-million ounce potential.

In 2017, the explorer acquired the rights to the Bottle Creek open pit mine and then, in May 2018, the Mt Ida South and Quinns tenement packages. This made it the first company to consolidate this tenement package for more than 30 years.

Bottle Creek was mined in 1988-89, producing about 93,000oz across 18 months. As a former producer, there’s about $20 to $30m worth of mining infrastructure already on site, says Alt executive director Andrew Sparke.

“Airstrips, bore fields, on granted mining leases — there’s a lot of sunk capital there that will effectively provide a very low-cost start-up option,” he told Stockhead.

Cheap ounces

Since acquiring Bottle Creek and the Mt Ida South and Quinns projects, Alt Resources has been able to expand resources both quickly and cheaply.

This is due to a comprehensive historical database which includes 68,000m of drilling at Bottle Creek, much of which was drilled at very close spacing.

These records are an important asset that have helped the company to rapidly and efficiently target resources.

This saves time and money. It is the reason why Alt Resources has an average discovery cost of just $9.8/oz, compared with an average discovery cost in Australia of about $65/oz.

And yet this company remains slight unseen by many investors and undervalued compared to its peers on a per-ounce basis.

“For any junior to grow their resource by 406,000oz and 3.8 million ounces of silver in 11 months and then to do it at a $9.80/oz cost is phenomenal,” says Sparke.

“It just demonstrates how efficiently we’ve allocated our capital.

“But the key is that it’s not going to stop. We have three high profile exploration targets which are effectively infill drilling, so we know that the resource growth story will continue.”

Over the next 6 to 12 months, Alt will drill these 3 of these priority targets — Quinns, Mt Ida South and Bottle Creek South.

“We plan to start drilling over the next couple of weeks,” says Sparke.

“I imagine there will be quite a few drill results on the way for a number of areas.

“We expect to upgrade the resource later in the year, but also we have our maiden reserve to come out in the coming months. We have some pretty nice catalysts on the horizon.”

Blue Sky potential

A large part of the exploration effort to date has been to compile and interpret the large amount of historical exploration data. But the tenements remain largely undrilled and under explored.

At Bottle Creek, for example, the current resource comes from a 3.8km section of an 11km mineralised zone, and the deposit has only been tested to 60m-80m depth.

Across the wide Mt Ida area, historic geochemical sampling by miners like Newcrest have returned significant gold in soil geochemistry, which suggests the project area contains multiple significant gold prospects.

“There’s a very large gold in soils program that was done by La Mancha and Newcrest and it just lights up,” says Sparke.

“There’s just so many targets there — if you look on the Ballard Shear, there’s a gold in soils target that is 10km long and 1.5km wide.

“There are a lot of big scale targets that we need to go in and assess.”

To fund this exploration drive, Alt announced an offer to eligible shareholders to participate in the company’s $2m Share Purchase Plan (SPP).

The SPP entitles shareholders, irrespective of the size of their shareholding, to purchase up to $15,000 worth of fully paid ordinary shares priced at $0.024 per share – a discount of 9.11 per cent to the volume weighted average market price.

This story was developed in collaboration with Alt Resources, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.