A single wind turbine can contain up to $350,000 worth of copper. Plus zinc. Plus tungsten…

Mining

Mining

We’ve all heard about the challenges that come with the world’s transition to net-zero where fundamental demand shifts are expected to change the mining sector as we know it.

No matter which decarbonisation pathway we follow, new sources of value from relatively niche commodities will be created to help feed the demand for renewable energy technologies and in turn, shrink the value of others.

But whilst experts have been sounding the alarm over growing shortages for commodities like lithium for batteries and copper for electrical wiring over the last few years, a demand crunch might also be on the horizon for some lesser-known minerals set to play an important role in the years ahead, too.

New research out of German non-profit, Climate Analytics, the world needs to add 1.5TW (terawatt) of new wind and solar each year to restrict global warming to within the 1.5C limit.

This amounts to a five-fold increase on the 0.3TW of new wind and solar capacity installed in 2022, and it means a great amount of humankind’s oldest metal, copper, is required to get the turbine going.

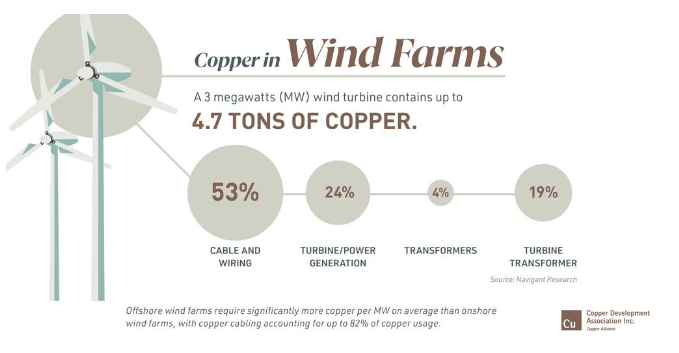

According to the Copper Development Association, a standard 3-megawatts (MW) wind turbine can contain up to 4.7t of copper with 53% used for cable and wiring, 24% for turbine and power generation components, 4% from transformers, and another 19% from turbine transformers.

When it comes to offshore wind turbines, those numbers jump up a notch.

Around 8t of copper for every megawatt of generating capacity is needed, and citing data from the International Energy Agency, an average 3.6MW turbine, which can power more than 3,300 homes, contains about 29t of copper ($353,000 at $12,187 per tonne) where the cabling of wind farms accounts for the bulk of the copper usage.

But as well as copper, a whole spate of other critical minerals are needed, from rare earths to zinc and tungsten.

For corrosion protection, wind turbines heavily on zinc with the World Bank estimating about 98% of renewable energy’s demand for the mineral is driven by its useage in wind turbines.

Despite its status as one of the few metals where recycled material fills a large chunk of demand, the International Zinc Association still says mined supply will need to rise from 12Mt in 2020 to 17-22Mt by 2050.

Tungsten, known for its exceptional strength and melting point, is also a vital component in the manufacturing of wind turbines.

As highlighted by TSX-listed Northcliff Cliff Resources, the metal is used to produce turbine blades, critical for capturing the energy present in wind.

Tungsten’s unique properties allow for the construction of longer, and more efficient turbine blades, the company says, resulting in increased energy production.

As it stands, China currently dominates the world’s tungsten production with limited supply out of the Western world.

Along with its importance in tooling and defence applications, this has resulted in its listing on the US and Canada critical mineral lists.

New sources of these two lesser known yet equally critical metals look to be essential to meet their increasing demand and thankfully, there are a number of Australian companies out exploring for them.

Variscan recently completed a comprehensive review and validation of historical drill holes in preparation for an upcoming mineral resource estimate and a mine restart concept study at the San Jose mine in northern Spain.

As a result of this work, VAR says the quality of its drill hole database has improved significantly, highlighting the in-mine and near-mine exploration upside.

Underground targets will be drill-tested shortly with step-out surface drilling to be conducted in the second half of this year.

This in-fill drilling will address strategic spatial gaps which could yield further tonnage, the company says.

Alicanto’s new step-out drilling and recently identified historical core have resulted in the definition of high-grade silver and zinc zones outside the current 9.7Mt resource at its Sala project in Sweden’s Bergslagen region.

Bergslagen is renowned as a Tier-1 jurisdiction due to its large mineralised systems and pro-mining regime.

Re-assaying of the historical core at Sala recently returned up to 1.1m grading 1,326 grams per tonne (g/) silver, 0.8% zinc and 6.6% lead as well as 3.9m at 737g/t silver, 1.2% zinc and 11.8% lead, at the Bronäs target about 600m north of the Prince Lode and near the historic Bronäs mine.

Alicanto is now undertaking down-hole induced polarisation surveys to test for mineralised extensions and new mineralised zones.

During the March quarter Anax completed its definitive feasibility study for the Whim copper-zinc project in Western Australia, which laid the groundwork to bring the mine back into production at 10,000 – 12,000t of copper equivalent metal a year.

Whim Creek stands out in an environment where grade decline is becoming a massive problem for established producers. Final regulatory approvals to allow for construction of a concentrator, as proposed in the DFS, are well-advanced and expected to be received later this quarter.

“Anax now looks forward to completing the final stage of permitting in preparation for the mine development,” Laing said.

The company will review the potential to recommence heap leaching at the project, either before, or at the commencement of mining of sulphide ore at Mons Cupri.

Belara is the company’s flagship project located in New South Wales approximately 50km southeast of Dubbo in the East Lachlan Orogen.

The project hosts an inferred mineral resource of 5Mt at 3.41% zinc equivalent and two historical mines from which mineralisation is yet to be constrained along strike and at depth.

During the March quarter the company kicked off phase 2 drilling at Belara and increased its landholding by 300%.

The granting of these applications will unlock a further 20km of prospective host rocks and structural corridor south of Belara where no exploration work has been carried out, a trend that includes the historic Ben Buckley base metal deposit.

Apollo Minerals’ flagship project is the Kroussou zinc-lead project in Gabon, Africa where it hit 40% zinc and lead in October last year.

Since then, rock chip samples of up to 2.6% zinc and lead have identified a new structural trend at the Target prospect 1, which continues over 6km to the north.

On-ground field work is confirming new structural trends that are interpreted to have strong potential to host mineralisation similar to the massive sulphides displayed at TP13.

Follow up field work is being planned with a view to extending the strike length of trend and generating drill-ready targets.

Aeris owns the underground zinc, copper, gold and silver Jaguar operations about 65km north of Leonora in the Eastern Goldfields region of Western Australia.

Operations include an underground mine at the Bentley deposit utilising open stoping methods and a 600,000tpa processing plant producing copper and zinc concentrates with precious metals by-products.

At the end of May, resource definition drilling continued to intersect high-grade mineralisation at the Bentley mine, returning zinc grades over 30% as well as strong precious metal grades – supporting the company’s view that the resource will continue to grow.

During the March quarter, zinc production reached 4,200t at an AISC of A$3.14/lb zinc, which was lower than the previous quarter due to lower grade stopes.

To date, four significant deposits have been discovered within the Jaguar tenement package: Teutonic Bore; Jaguar; Bentley; and Triumph.

Work is underway by the team at Jaguar to include Bacalar and Java Deeps in the Bentley deposit mineral resource estimate and technical studies will commence to incorporate them into the life-of-mine plan.

EQR holds the title of Australia’s only primary tungsten producer at its Mt Carbine tungsten mine near Cairns in North Queensland.

In March the company received environmental authority to restart open pit mining last month, providing access to material far above the 0.075% WO3 grade of stockpiles currently processed on site.

Once mining can resume, the $92 million company says it will become a major tungsten producer, filling a gap in production from the West in a market mostly controlled by Chinese and Russian output.

It plans to begin the ramp up of mining at the Andy White pit in June, and employ or contract over 150 people from nearby Mt Molloy and communities like Mareeba.

Tungsten Mining has become a bit of a ghost in recent years with little news to speak of and a list of ASX announcements that boil down to quarterly reports and housekeeping.

Chaired by GWR Group’s Gary Lyons, Tungsten boasts a total inventory of 41m MTUs (~10kg per unit) of tungsten trioxide or WO3, 71,000t of molybdenum, 1Moz of gold, 44Moz of silver and 92,000t of copper.

Its main game is the Mt Mulgine project in the Murchison region of WA, which contains a JORC reserve of 140Mt at 0.1% WO3, 288ppm Mo, 0.12g/t Au, 5.9g/t Ag and 0.03% Cu.

In May, TGN received $1m in grant funding through the Australian Government Critical Minerals Development Program (CMDP) to explore low-cost development options of the Mount Mulgine Tungsten project (MMP).

Funds will also be utilised to support the downstream production of Ammonium Paratungstate (APT), an important raw material for most tungsten products used in manufacturing, aerospace, electric vehicle (EV) technology and defence industries.

Group 6 is one of the most advanced tungsten developers on the ASX, with plans to return the Dolphin tungsten mine on King Island, located in the Bass Strait between Victoria and Tasmania, to production this year.

Containing a JORC 2012 compliant mineral reserve of 4.43Mt at 0.92% WO3 from a mineral resource of 9.6Mt at 0.9% WO3, the project is one of the highest grade on the market.

Opened as King Island Scheelite in 1917 and shut in the early 90s after four decades under the direction of Peko-Wallsend, G6M plans to produce a 63% WO3 concentrate to supply the ammonium paratungstate tungsten market via an eight-year open cut and six-year underground.

VMS is in the process of dusting off the Mt Lindsay Tin-Tungsten project situated in northwestern Tasmania with the commencement of a feasibility study based on a JORC resource comprising 45Mt at 0.40% tin equivalent.

Venture’s study work has identified the potential for additional, large-scale quantities of tin and boron throughout the greater Mount Lindsay skarn system.

The tin-boron zones are in the form of borate minerals and have not previously been assessed in any mining studies at Mount Lindsay.

Venture believes the inclusion of tin-rich borates into the current underground feasibility studies could deliver a major economic benefit to the study through the recovery of boron and additional tin and iron.

The Mount Lindsay deposits, and the surrounding exploration target areas are all defined as skarn style mineralisation and are closely analogous to well-known large skarn deposits in Russia and China.

Venture has already engaged CSIRO to commence metallurgical recovery work on the tin-rich borates.

At Stockhead we tell it like it is. While Variscan Mines, Alicanto Minerals, Anax Metals, Belararox, and Venture Minerals are Stockhead advertisers, they did not sponsor this content.