A new potential chart topper? This IPO is looking to list with a nickel resource, major backers and a tonne of lithium upside

The Jimberlana project already has a nickel resource at the Bronzite Ridge prospect. Pic: via Getty Images.

- Western Australian Energy Resources is planning to list mid-November following a $5m IPO at $0.20 per share

- Its flagship Jimberlana project is prospective for nickel, lithium, rare earths and gold

- Jimberlana’s Bronzite Ridge prospect already hosts a 9.25Mt at 0.81% nickel and 0.051% cobalt resource

- The has already inked a processing MOU with experienced Chinese firm Minmetals CRIMM

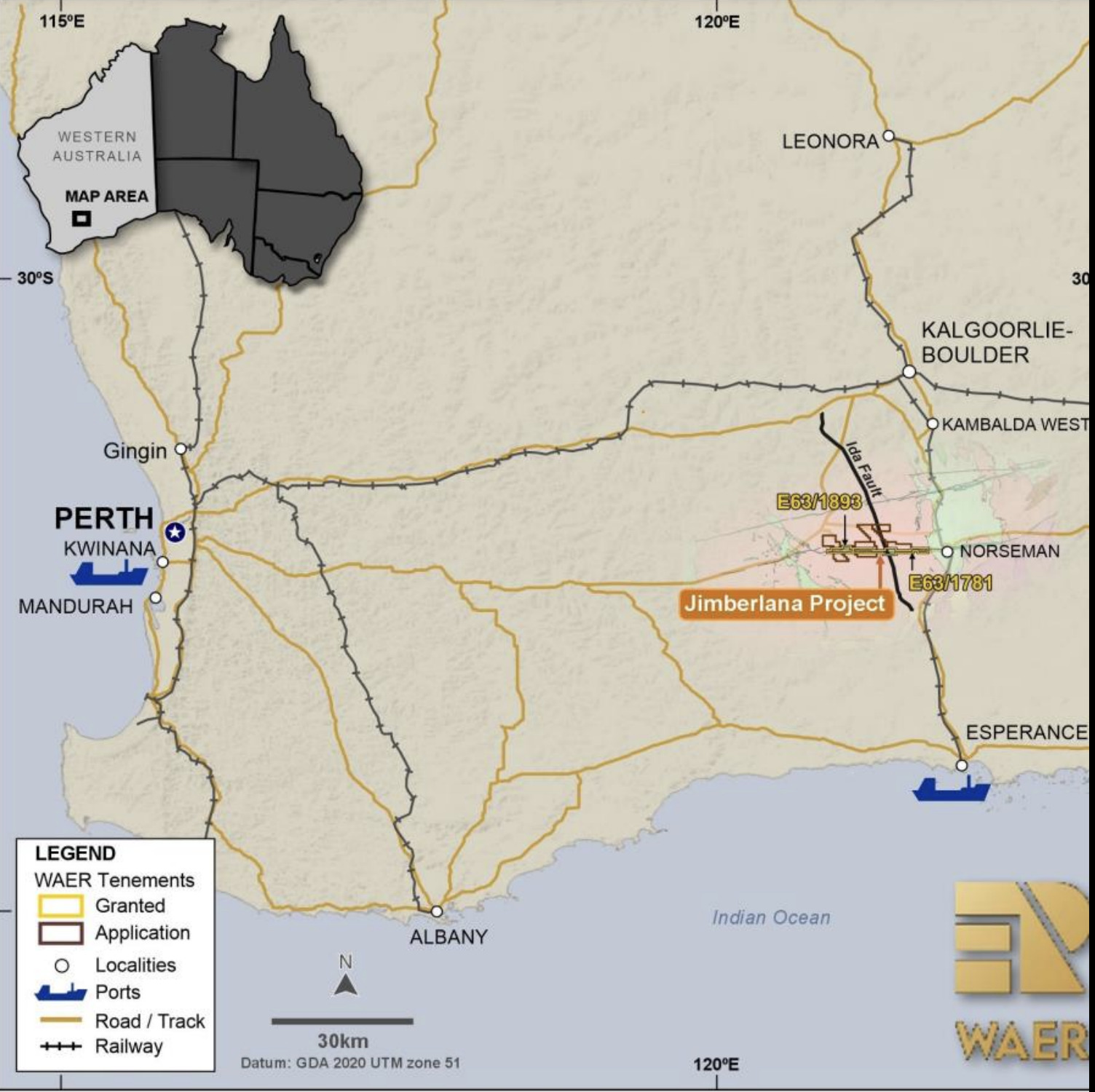

Western Australian Energy Resources plans to list on the ASX in mid-November following a $5m IPO, with its flagship Jimberlana project in WA hosting an existing nickel resource along with lithium, gold and rare earths potential.

Nickel may not be investors’ most sought after commodity at the moment, but it is only a matter of time before the important metal re-enters the limelight.

In mid-September, Westpac analysts forecast a near-term rebound in the price to ~US$23,000/t by mid-2025 – a 21% jump on levels at the time of writing.

Long-term demand is also positive, as nickel use in EV batteries ramps up.

It’s why mining majors are investing heavily, with the head of BHP’s (ASX:BHP) resurgent nickel division Jessica Farrell recently saying that it already sells 85% of its product to battery makers, up from under 10% five years ago.

Within only a few years, as much as 15Mt of nickel could be needed for the EV market – equivalent to around five years of global nickel production.

By 2035, Benchmark Minerals Intelligence reckons the world will need around 72 new nickel mining projects with an average size of 42,500 tonnes.

This bodes well for diversified ASX explorers, like these ones, who have solid nickel resources in their collective back pocket for when the market invariably turns.

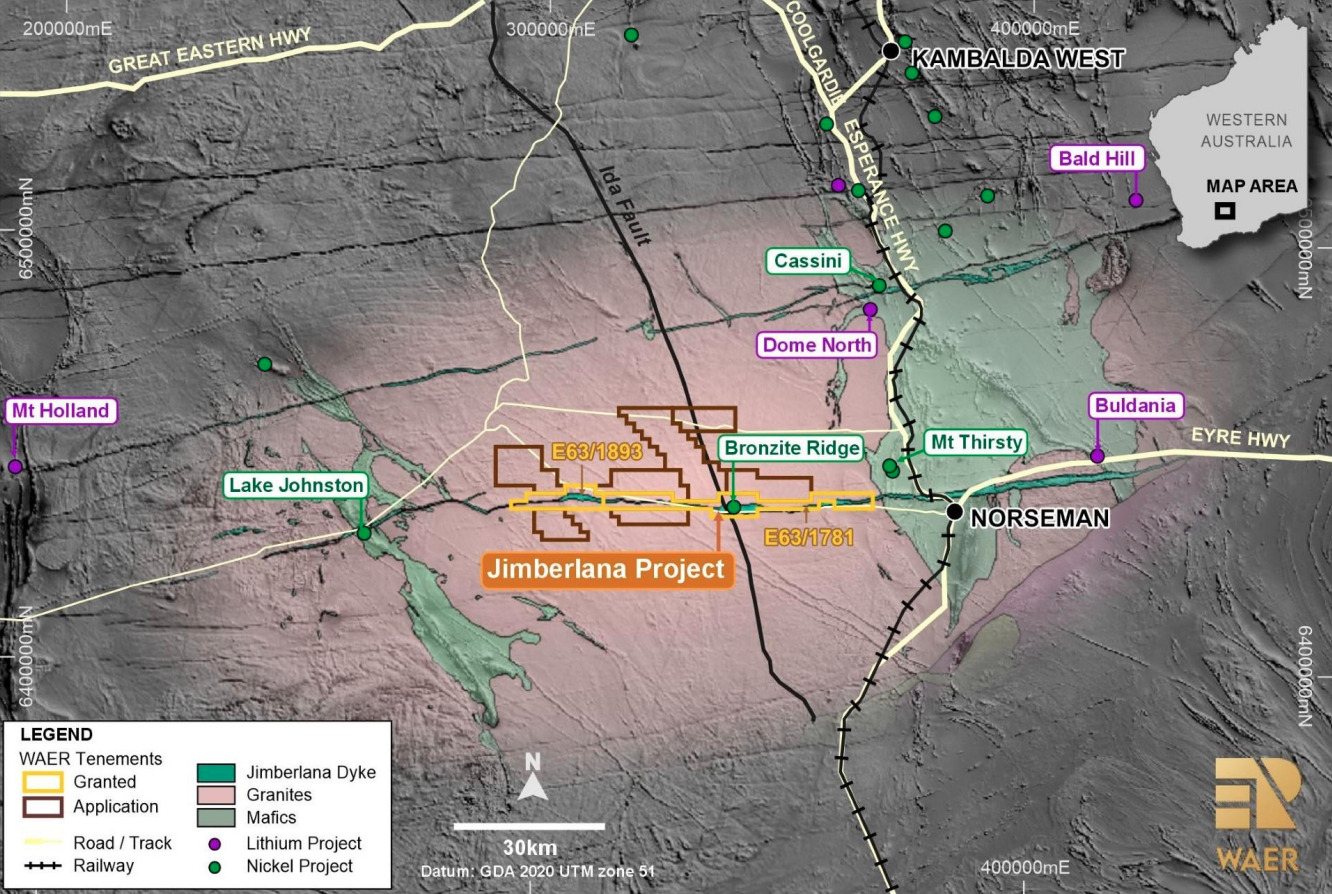

Soon to join the bourse is Western Australian Energy Resources (WER), which is looking to list with an existing 9.25Mt at 0.81% nickel and 0.051% cobalt resource at Bronzite Ridge prospect, part of its flagship Jimberlana project west of Norseman.

This resource is based on historical drilling, which leaves the door wide open for the company to potentially boost those numbers.

Hitting the ground running at Jimberlana

WER is planning a three-pronged exploration strategy, including infill drilling to increase the nickel laterite resource at Bronzite Ridge and obtain metallurgical samples for ore characterisation and processing studies; RC drilling to investigate the untested nickel sulphide potential at depth; and following up on some potential lithium targets.

Nickel is usually found in two main ore types – sulphide or laterite. Barry FitzGerald wrote about nickel laterite here.

Sulphides (class 1) are much cheaper and easier to turn into battery grade nickel sulphate than nickel laterites and fetch a higher price. But supply of nickel sulphides is also declining because of a lack of new discoveries.

Luckily for WA Energy Resources, Jimberlana has the potential for delineating nickel sulphides.

“We’ve got the nickel laterite, we’ve got to get some more metallurgical samples so we can get some tests work done on that and try and figure out exactly where we’re at with a processing technique,” WER CEO Greg Almond told Stockhead.

“Then we’re going to be looking at the nickel sulphide as well, following up on the historic work that’s been done in the past, and then chasing up the lithium.

“We’ve got some targets that we’ve identified, so we’re going to go and ground truth those and follow it up.”

While exploration is ticking along, WER also plans to complete the compilation, reprocessing and reinterpretation of the historical geological, geophysical, and geochemical data that extends intermittently from the 1970’s and prioritise any areas of interest for follow-up work.

Nickel processing MOU a huge strategic advantage

Nickel, vital to the global energy transition due to its use in electric vehicle batteries, is increasingly earmarked as a strategic resource by governments around the world.

The largest nickel consumer and importer of nickel globally, China, is investing in nickel mines and smelters and encouraging the development of new technologies for nickel extraction.

This is a strategic advantage for WER, which has already secured a Memorandum of Understanding (MOU) with Chinese company Minmetals CRIMM to access processing and plant technology to develop Bronzite Ridge.

For WER, the agreement is a clear pathway to monetise the nickel laterite resource, as well as a unique opportunity to leverage Chinese innovation and strategic metallurgy and off-take/demand relationships as it progresses its Jimberlana project.

“Nickel laterites have had a little bit of a tough story in Australia and while sulphides are easier and cheaper to process, they’re often quite a bit deeper – whereas the laterites are pretty much at surface,” Almond said.

“Laterites can often have a bit more of a complicated processing pathway, but we’re hopeful that with our relationship with the Chinese group Minmetals CRIMM that they’ll be able to figure out a processing pathway for us – because they’ve already got a lot of experience.”

A cornucopia of mineral wealth

But that’s not all that’s on offer at Jimberlana. The project is also prospective for lithium, gold and rare earths which is no surprise when you consider its located smack-bang in the middle of the Mount Ida fault.

The fault, dubbed the ‘lithium corridor’ has seen substantial M&A activity over the last few months including a $102m takeover of Essential Metals by Develop Global (ASX:DVP) and the current battle to gain control of Liontown Resources (ASX:LTR).

Notably, the project’s eastern boundary also joins the western edge of Galileo Mining’s (ASX:GAL) Norseman project, where platinum group element (PGE) and nickeliferous massive sulphides were discovered at Callisto.

A recent maiden resource at Callisto – the first discovery of a South African-style ‘Platreef’ PGE-gold-nickel-copper deposit in Australia – came in at 17.5Mt @ 1.04g/t 4E, 0.20% nickel and 0.16% copper (2.3g/t PdEq or 0.52% NiEq).

That’s ~1.27Moz palladium equivalent, or ~91,000t nickel equivalent, with plenty of opportunities for growth.

Jimberlana has a potential cornucopia of mineral wealth itself.

“We’ve got a ground position that extends along the Jimberlana dyke and has the Mount Ida fault cutting across it,” Almond said.

“This gives us a position with a whole bunch of contrasting rock types; granites, the greenstones and the ultramafics and a whole bunch of structures that are chopping those up and pushing them up against each other.

“Based on the geology and some of the historic work that’s been done – as well as what some of our neighbours have found – we’re very confident of exploration success.”

To hear more about the WER story, click here to listen to Barry FitzGerald’s interview with Almond on the Stockhead Explorers Podcast.

This article was developed in collaboration with Western Australian Energy Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.