8 Rivers Capital agreement has PGY right in the hydrogen and carbon capture pilot’s seat

Pilot Energy is flying high with a jet-fuelled MoU with 8 Rivers Capital for the Mid West Clean Energy Project. Pic via Getty Images.

Aussie hydrogen and carbon capture developer Pilot Energy has just locked in a Memorandum of Understanding with US-based 8 Rivers Capital to invest in Australia’s next carbon capture and storage (CCS) project.

According to the MOU on Pilot’s Mid West Clean Energy Project, 8 Rivers will look to invest $1 million – split equally in cash and in-kind – for project costs, while 8 Rivers will receive an option on offtake of ammonia once the project hits production.

A leading international full-service net-zero solutions provider, 8 Rivers currently serves as Pilot’s technical adviser on its clean hydrogen ambitions. News of the Pilot MOU closely follows 8 Rivers recently announcing a US$100m investment from SK Group in Korea to establish a JV focused on decarbonization of Korean and Asian markets.

Over the past 12 months, Pilot has assessed the feasibility of deploying the 8 Rivers lean hydrogen tech and has concluded the MOU to extend the successful working relationship into the development and execution of the Mid West Clean Energy Project.

Excitement around the project and the other interests driving Pilot Energy’s (ASX: PGY) focus has been building with Pilot already attracting analyst attention across the year to date.

In February, Research as a Service (RaaS) analyst Andrew Williams was particularly voluble about the upside potential in emerging ASX-listed renewables, singling out Pilot and predicting as much as a ten-fold increase in valuation if the company continues to build out its success.

Williams placed a valuation of $130m, or 26c per share, on Pilot – a 400% gain on the current $10m market cap and circa 2c share price.

Implementation of the MOU will align the companies for proceeding to development of the ground-breaking WA Carbon Capture and Storage (CCS), clean hydrogen and ammonia production project.

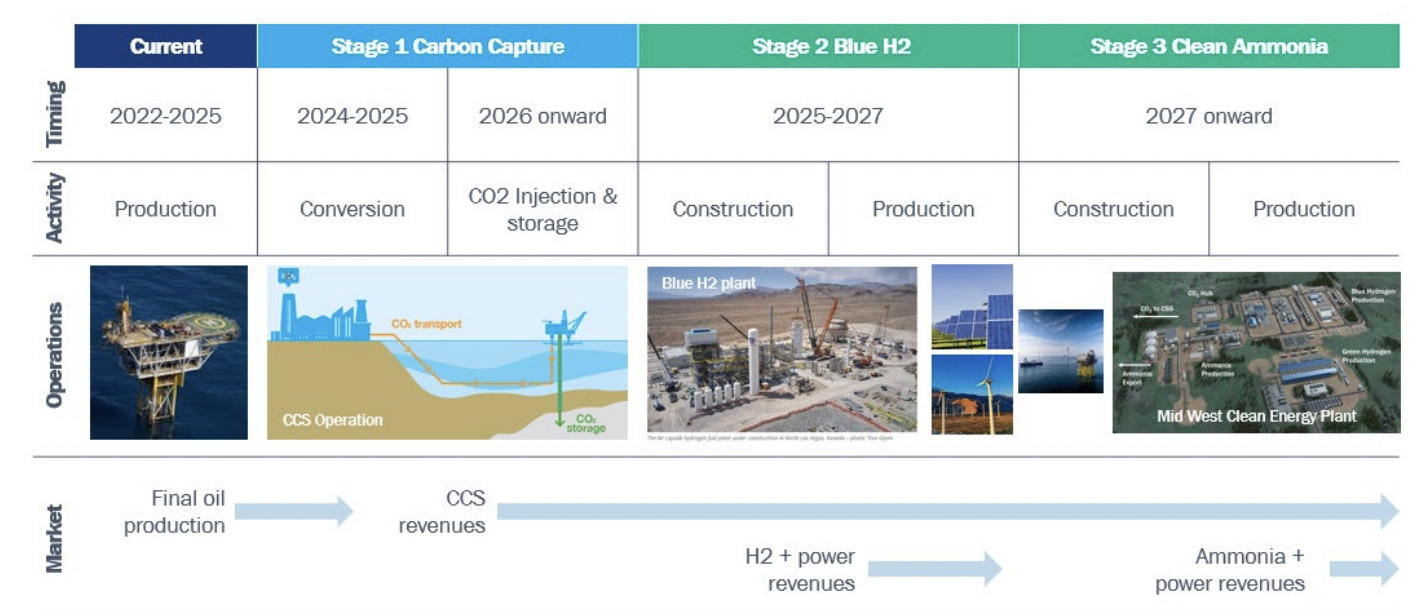

Pilot says the 8 Rivers Investment would focus on progressing engineering and commercialisation for the Project’s Stage 2 Blue Hydrogen and Stage 3 Clean Ammonia production structured as:

- A$1.0 million in a combined cash and in-kind contribution involving the deployment of 8 Rivers internal technical team to prepare design basis and engineering documentation required for the Stage 2 and 3 pre-FEED and FEED for deployment of the near-zero emissions 8RH2 hydrogen production process.; and

- 8 Rivers (or an affiliate/joint venture) being granted a priority right to enter into a long-term ammonia offtake agreement for an initial tranche of up to 172,500 tonnes.

Staged pathway for Mid West Clean Energy:

An at-a-glance look at how the Mid West Clean Energy Project will work. Pic: Supplied

The MOU comes after the latest study of Pilot’s Cliff Head CCS Project placed the project as one of Australia’s first significant offshore CCS projects – estimated to deliver a gross project real pre-tax net present value (NPV) of between $110-$210m at an internal rate of return IRR) of about 30-40%.

Both NPV and IRR are metrics used to assess the profitability of a project and these numbers are certainly a down payment for Pilot’s enthusiasm for Cliff Head, with the project approval process now underway.

Studies confirm that the Cliff Head CCS project can safely and permanently provide up to 16 million tonnes of CO2 storage at a CO2 injection rate of up to 1.1 million tonnes each year, placing it firmly in the mid-tier, in terms of size, of current CCS projects globally.

This article was developed in collaboration with Pilot Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article also appeared on The Australian

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.