300pc rise in potash prices to supercharge Colluli economics

Pic: Tyler Stableford / Stone via Getty Images

Potash prices have soared by up to 300% since the beginning of this year and that could deliver significant upside to the economics of Danakali’s (ASX:DNK) Colluli project.

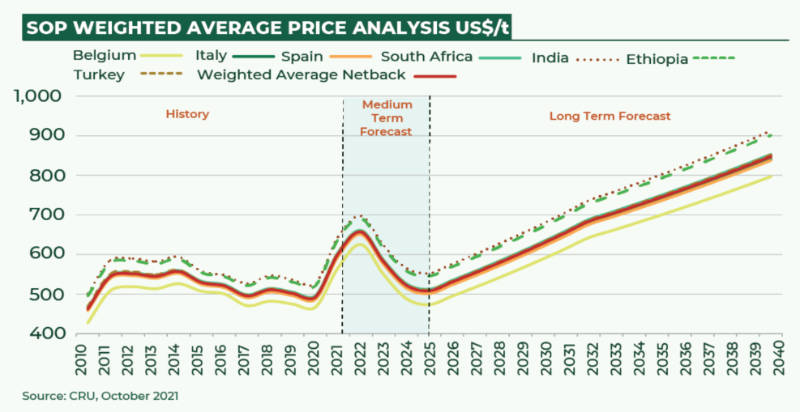

In its updated ‘Sulphate of Potash Price Forecast Analysis’, CRU International noted rising demand, poor international crop yields, surging crop prices and margins along with supply-side risks in Belarus.

These have combined to drive regional potash prices up 200%-300% to above US$700 per tonne (CFR Brazil Spot) and US$520/t (CFR SE Asia Spot).

Additionally, Bloomberg’s Green Markets reported that North America’s nutrient gauge (fertiliser prices) surged past the 2008 peak to hit a new record of US$996.32/t while current muriate of potash (MOP) prices FOB Vancouver are at over US$550/t.

The last is a positive for Danakali’s sulphate of potash (SOP) project given that the 10-year average premium of SOP to MOP is US$221/t.

SOP is considered to be a premium product as it is chloride-free, making it suitable for use on high-value crops such as avocados that are chloride intolerant as well as in areas such as Western Australia’s Wheatbelt where soil salinity is a major issue.

More importantly for the company, the long-term outlook for the weighted average netback price to Massawa for the target markets of Colluli SOP is US$668/t, with CRU forecasting that all specialty potash fertiliser prices will move higher through 2021-23 with a pullback from 2024-2027 before rising steadily until 2040.

This is massively beneficial for the Colluli project as every 10% increase in SOP price over the US$569/t assumption used in the company’s front-end engineering and design study will increase its net present value by US$250m.

Danakali is also likely to benefit from the fact that this price assumption is for standard grade SOP that makes up 56% of its proposed production with the remaining 44% expected to be a higher value granular product that has a 10% price premium applied to it.

“Colluli is a unique game-changing asset on so many levels. We are excited to see this SOP forecast from CRU which is well above the long run average price we have used in FEED, particularly as we are on the cusp of coming into production,” chairman Seamus Cornelius said.

“It’s more than fair to say that given Colluli will operate in the bottom quartile of the cost curve, if we were producing today at these prices the margins on this project would be nothing short of spectacular.”

Colluli SOP project

The Colluli project in Eritrea has a giant resource of 1.289 billion tonnes grading 11% K2O, or about 260 million tonnes of SOP, enough to support production for more than 200 years.

FEED work had estimated Phase I post-tax NPV and internal rate of return (IRR) at US$505m and 28.1% respectively and Phase II NPV and IRR at US$902m and 29.9% respectively.

Recent test work has resulted in the optimisation of the process plant design and mass balance using filtered sea water that will reduce costs across the board while maintaining SOP production at the rate of 472,000 tonnes per annum.

The use of seawater is also expected to reduce its environmental impact.

This article was developed in collaboration with Danakali, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.