3 key copper trends to watch in 2020

Pic: Schroptschop / E+ via Getty Images

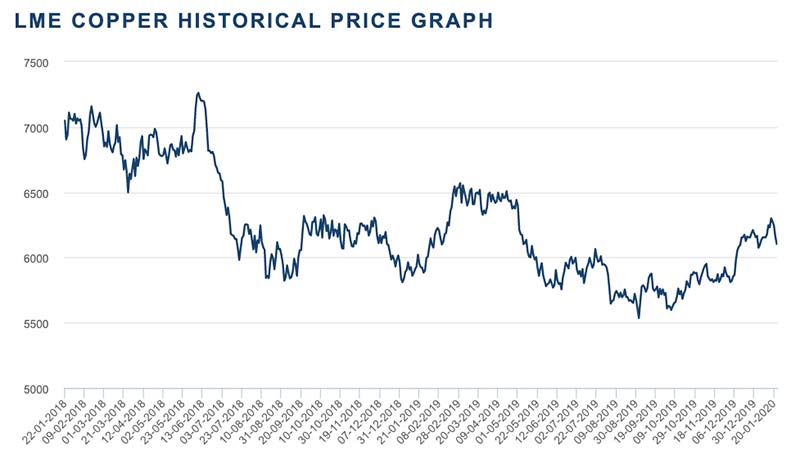

Copper prices are up over 10 per cent since September last year, touching an eight-month high of $US6,300/t ($9,168/t) in mid-January.

This tentative recovery has been driven by positive market sentiment generally (thanks US-China trade deal), and for copper specifically, the belief that more supply is needed — right now.

Wood Mackenzie says that, in the absence of a major economic downturn (fingers crossed), copper’s supportive fundamentals “should keep price risk skewed to the upside” in 2020.

But don’t get comfy.

Wood Mackenzie is also predicting another year of rollercoaster-like volatility for the red metal – much like 2019 and 2018 — as fundamentals and “strong geopolitical headwinds across the global landscape” keep things interesting.

So what are the major trends to watch in the global copper market in 2020?

Fundamentals vs Sentiment

During 2019, copper prices were largely determined by US-China trade-related news rather than copper’s own fundamentals, says Eleni Joannides, Wood Mackenzie principal analyst.

In fact, the fundamentally bullish outlook for copper hasn’t changed for ages.

READ: There’s a compelling case for copper to suddenly follow zinc’s epic trajectory two years ago

But the latest shift in sentiment only came once a long-awaited US-China phase one trade deal was agreed to in December.

“As we look to 2020, the risk is that wider factors will once again influence price,” Joannides says.

“The geopolitical issues that have surfaced since the start of the year could derail the rally that emerged in December 2019.

“On the other hand, further progress in resolving trade disputes will likely encourage a faster than anticipated recovery in demand and underpin prices.”

Mine supply will start growing again… but not enough to offset demand

Mine supply is expected to return to growth in 2020, partly driven by new mining developments. It’s not going to be enough.

“This year, we are forecasting that positive mine supply growth of 1.3 per cent – after disruptions – will be offset by a recovery in demand,” Joannides says.

“The resulting draw down in total cathode stocks by year-end should be positive for prices.”

READ: S&P confirms – the world is struggling to find more copper

Renewable tech policy will impact copper demand in 2020

EVs need up to 350 per cent more copper than an internal combustion passenger car and, like lithium to a lithium-ion battery, there are no viable substitutes.

By 2040, Wood Mackenzie predicts that passenger EVs will consume more than 3.7 million tonnes of the red metal every year.

The need for copper is even more significant when you take into account charging stations and supporting electrical grid infrastructure, as well as wind and solar project applications.

Renewable tech is a long-term demand story for copper, but different incentive approaches will lead to varied impacts on copper demand in 2020.

“In 2020, electric vehicles (EVs), wind and solar projects will see a range of incentives accelerate, stop and reverse,” Joannides says.

“In some cases, this will be a drag on the development of projects. In other cases, however, a possible front-loading of projects ahead of further subsidy removal could emerge.”

For example — the Chinese government recently announced that it has no plans to further reduce the subsidy on EVs in 2020. This is expected to boost EV sales and related copper demand in 2020.

Along with everything else battery metals related.

China’s new pro-EV approach compliments developments in other regions, Joannides says.

“In Europe, the likes of Germany and Norway continue to ramp up EV-related incentives, supporting copper consumption in the region. In the US, some states have extended subsidy offerings, while others are introducing similar incentive programs.”

In the solar and wind space, government subsidies in the US and China on new projects will start to ‘wind’ down (haha) this year and next.

“As a result, we believe that demand for copper will be brought forward in both China and the US in 2020, as developers rush to install new capacity ahead of these changes,” Joannides says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.