241 reasons why Latin Resources is on its way to becoming a Tier 1 lithium developer in Brazil

Latin Resources’ Colina deposit has had a significant increase to its mineral resource. Pic via Getty Images.

With a project-defining update, Latin Resources’ Colina lithium deposit at its Salinas project has increased its mineral resource estimate (MRE) by over 241%, as it continues on a path to becoming a globally significant Tier 1 lithium asset.

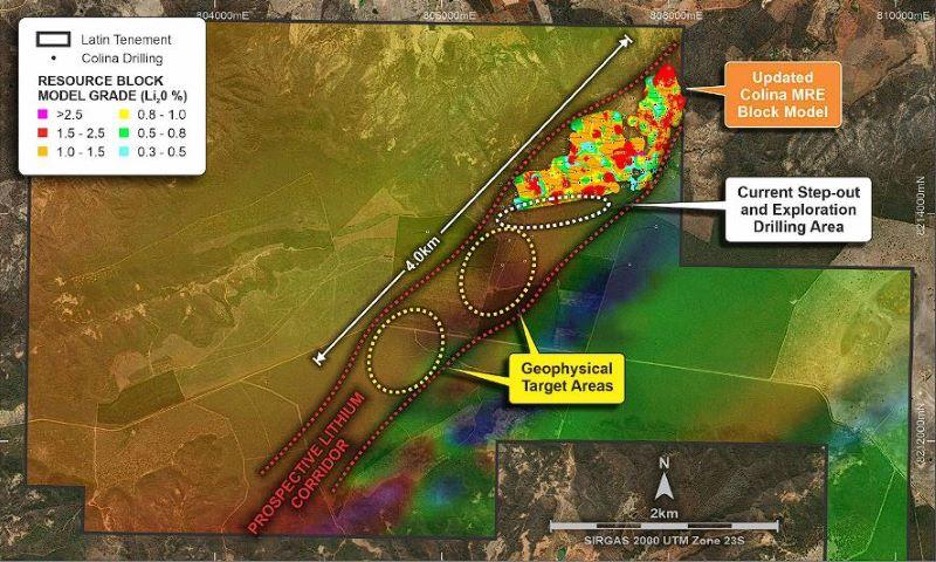

After an extensive diamond drilling program – which saw 135 holes drilled for almost 40km down and along the Colina strike – Latin Resources (ASX:LRS) has produced an extraordinary upgrade to its mineral resource totalling 45.2Mt @ 1.34% Li2O above a 0.5% cut-off grade for ~1.5Mt of contained lithium carbonate (LCE).

This is a big leap from its 2022 maiden resource of 13.2Mt @ 1.2% Li2O.

The updated MRE also sees a significant 67% of that classified into the measured and indicated categories totalling 30.17Mt @ 1.37% Li2O for 1.02Mt of LCE.

Latin’s managing director Chris Gale said the significant upgrade to the JORC resource is starting to show the true potential of the Colina deposit.

“The increase in both size and grade reflects our early confidence in the prospective nature of our tenure in Brazil to potentially produce a Tier 1 lithium deposit,” Gale said.

“This significant upgraded resource, and the potential value-add of strengthening lithium prices, will provide solid inputs into our Preliminary Economic Assessment (PEA) which we believe sets us up well for future success and is part of the broader Salinas project in Brazil’s Minas Gerais state.”

“Tony and the team in Brazil are to be congratulated on another valuable milestone delivered on time and on budget for shareholders.”

Salinas is located in Brazil’s ‘lithium valley’ in the state of Minas Gerais and looks set to become one of the largest projects in the region.

Lithium Valley Brazil

The Federal and State-backed Lithium Valley Brazil initiative is tasked with transforming the Jequitinhonha Valley into a technology hub for battery production and other value-added products by formulating public policies to attract companies and investments, qualify the workforce, promote technology, and provide the necessary infrastructure for the region’s growth.

Minas Gerais is quickly becoming one of the most prolific hard rock lithium hubs in the world, with projects such as TSX-listed Sigma Lithium’s Grota do Cirilo project taking just 14 months to start shipping from its enormous 106.8Mt deposit at an initial annual production rate of 270,000t.

Well-funded LRS is positioned to capitalise on this too, and once into production, both projects could see Brazil becoming the world’s 3rd-largest lithium producer.

Ongoing exploration

Flatteringly touted as Sigma 2.0 in many a research report, the company looks to be well on track to emulating Sigma’s roaring success.

Ahead of its planned PEA, another 25,000m of drilling is currently underway to expand the overall footprint of Colina to the west and southwest where the resource remains open along strike.

The company will also be exploring regional targets along the geophysical corridor.

“Our eight drill rigs will remain busy with this program through to the end of the year, and we eagerly await more resource upgrade results from these potential expansion areas,” Gale said.

Additionally, ongoing infill drilling within the existing resource will underpin the basis for the project’s definitive feasibility study next year.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.