Australian private equity firms increase their focus on public markets with $11bn in ‘dry powder’

(Getty Images)

As Australian markets attempt to recover from the impact of COVID-19, it will be interesting to watch how the private equity sector gets involved.

In its 2020 Yearbook released this week, the Australian Investment Council (a private markets industry group) said the sector was “well-placed to withstand the disruptions of COVID-19”.

“Notwithstanding this, the period ahead will undoubtedly present some unique and interesting challenges for all corners of the industry,” AIC said.

The report — compiled in conjunction with data analytics firm Preqin — highlights key trends for private markets in Australia, including fundraising insights and focus areas for investment.

Among the findings for private equity, the report found that fundraising “eased off in 2019”, as institutional investors committed just $778m in capital, down from a decade-high of $5.3bn in 2018.

“Elevated levels of capital raised over 2015-2018, averaging $3.4bn annually, led to a buildup of dry powder, which stands at $11bn as of June 2019,” the AIC said.

“This puts global and Australia-based private equity fund managers in a strong position to support domestic investee businesses – which will be crucial in the challenging period ahead.”

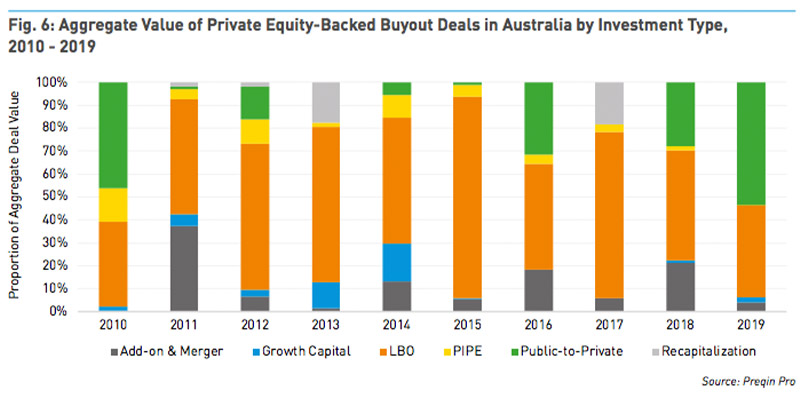

One unique trend that emerged in 2019 was a marked shift towards public-to-private transactions, highlighted by the $2.1bn privatisation of listed education business Navitas by BGH Capital.

In a sign of how major domestic PE firms are staying active in the current crisis, BGH has been named among a number of potential candidates that could make a play for stricken airline Virgin Australia (ASX:VAH).

Public-to-private transactions accounted for 53 per cent of PE-backed deal-flow in 2019 — a much higher percentage than previous years:

The report highlighted that economic conditions over the past decade — defined by steady growth and low interest rates — provided a positive operating environment for local PE firms.

“These conditions have helped Australia-focused private equity fund managers to distribute more than $4bn each year to investors from 2013 to 2018,” the report said.

The AIC also cited a recent trend among large PE firms to focus on acquisition opportunties in sectors that are more immune to a global economic slowdown, such as education and healthcare.

“The build-up of dry powder provides Australia’s private capital industry with the capacity to continue to fund investee businesses and projects, and to take advantage of opportunities arising from the economic downturn,” the AIC said.

“However, like many markets, fundraisings in the period ahead could come under pressure as institutional investors look to re-weight their strategic asset and target allocations on the back of the downturn.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.