How to make share trading your side-hustle

Ahh, Venezuela. Picture: Getty Images

Been reading about all the latest stocks on Stockhead and decided to get in on the market? Here’s how you do it, and what to avoid.

We all have that fantasy of sitting back in a hammock with a cocktail and a laptop playing the market from a sunny villa somewhere.

But achieving that sort of trading nirvana more often than not takes years of discipline and research (and a touch of luck). It’s what separates the serious traders and the weekend gigglers.

So, if you wanted to take a serious and studious approach from a standing start, how would you do it? Here’s an outline, and a few things to take into account when trading.

And as a bonus, a few tips from Angie Ellis – a regular winner of ASX share trading races and seasoned small cap investor.

How much do I need to get started?

The ASX dictates that an individual investor will need at least $500 in one given company to get started. This is the amount set by the bourse in case everything goes belly up, and basically covers administration costs.

However, you should have more than $500 to get started.

Not only does this allow you to buy more than one parcel of shares for crucial diversification, it’s also a signal that you’re serious about making a go of this as a side-hustle.

You should only really invest what you’re willing to lose, and if you can’t afford to lose more than $500 then maybe share trading isn’t for you (although there are a few low-cost ETFs which cater for you).

In any case, if you’re serious about making share trading a side-hustle rather than a weekend giggle, you should be looking at about $5000.

The magical figure

Why $5000? According to the latest ABS data, the median income in Australia is $1066 per week.

If you think of a “side-hustle” as 10 per cent of income, you should be aiming for about $106 per week.

If you’re investing purely as a dividend yield play, then this equates to about $5000 per year. Given the average dividend yield is about 4 per cent, you’d need a portfolio worth $125,000.

But, more likely than not, if you’re thinking of share trading as a side-hustle, you’re not in it for the accrual of dividends — you’re in it for the profit from active trading.

The return you’ll get from trading is up to the skill you have as a trader, but as a rough guide the ASX all ordinaries returned 8.66 per cent in 2017, a loss of 7.11 per cent last year, and so far this year has returned 14.4 per cent.

In trading, a lot is about the timing.

So if you wanted to make 10 per cent of the median income of Australia, assuming an 8 per cent return, you’d want a portfolio of $62,500.

But, that’s a heck of a lot of money and doesn’t take into account dividend returns.

So, you should probably look to invest $2000-5000 to start and see how that goes before investing tens of thousands of dollars.

Where should I invest?

If you’re here, you’re probably looking to invest in shares — but there are a few instruments available to you as investment options.

The first, obviously, is the shares themselves.

But exchange-traded-funds (ETFs) have become increasingly popular as investment vehicles for people looking for market exposure. These typically aren’t traded in the same way shares are though, as they’re set up specifically to track an index and not the fortunes of one particular company.

Some even offer buy-in prices as little as $100, making them ideal for first-timers in the market.

In much the same way, real estate investment trusts (REITs) are traded on the market, but are inherently pegged to the value of the real estate market.

For those looking to take a highly speculative punt, contracts for difference (CFDs) may be for you — essentially a bet on the future value of any financial instrument — whether that’s a particular share or the value of oil.

Where you invest is entirely up to you, but should you choose to load up in shares, we have a few bits of advice before you get started.

Going on a dry run

If you’re new to the world of trading, then it’s a great idea to simulate your strategy for about six months before you dive in with your own money.

You can do this by signing up to the ASX’s sharemarket game, which runs twice a year.

It will give you access to 200 stocks to virtually trade in, with an investment pool worth $50,000.

It’s a great way of testing your market strategy against what happens in the market in real-time — and will give you a taste of what to expect.

You can also set up your own “game” by building a watchlist of stocks you might be interested in and track them over six months to see how it’s playing out.

I’m ready to invest *now* — how do I do it?

If you think you’re ready to invest and you’ve drawn up your investment strategy, it’s time to start trading.

Unfortunately, you can’t just rock up to the ASX office and order some shares — you need to go through a broker.

Brokers will buy and place trades on your behalf, and charge a fee for doing so.

Depending on how involved they get (some will offer advice, for example), they’ll charge different rates — either as a percentage of each trade or a flat fee.

Our advice is to shop around to see what’s right for you.

Online trading

Increasingly, the art of broking is being conducted entirely online with people effectively able to process their own trades.

The broker, legally, is still placing the trades, but for all intents and purposes the user is trading.

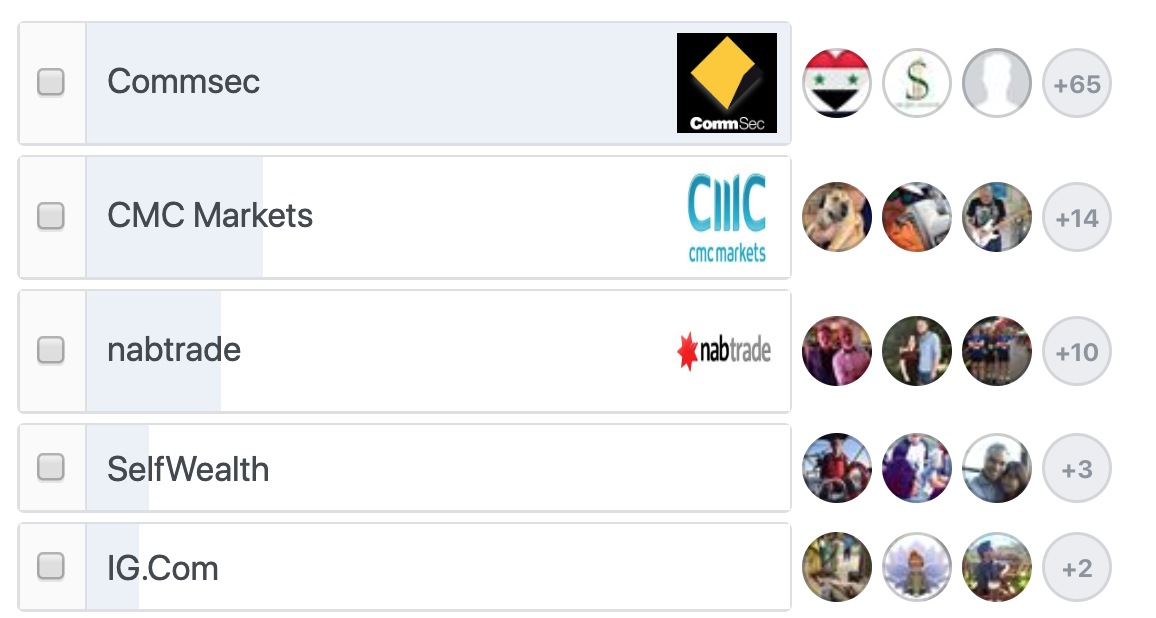

There are several online platforms available, but these are the ones Stockhead regulars use and recently voted on for us:

There’s a lot more information on what they cost and how easy they are to use here.

Now you know what you want to trade, where to trade it, and how to trade it, it’s time for a few general tips to avoid costly mistakes.

Research, research, research

It turns out that trusting Johnno from the pub’s opinion on the hot stock of the day isn’t the key to becoming a sustainable trader.

Instead, good traders will do their own quantitative and qualitative research on what makes a good investment.

The quantitative will go to looking at metrics such as price to earnings ratio, PEG ratio, or debt-to-equity when evaluating a trade.

The qualitative will look at things like the industry a company is in, the background of directors, or the underlying commodity the company is trading in.

By doing research, you give yourself a better opportunity to buy at the bottom of the value cycle.

Generally speaking, buy what you know

You may have heard a lot about FAANG stocks (or the ASX equivalent, WAAAX stocks) and want in on the tech action, but not know a thing about how tech is commercialised.

In our humble opinion, you probably should be trading tech stocks for the sake of it in that case.

One of Warren Buffett’s golden rules is that you should always trade what you know — and we can’t disagree.

An informed trader is a great trader, which is why resources like Stockhead are great if you’re interested in the smaller end of the market and emerging investment themes.

Yes, it’s a blatant plug, but hey, it’s what we do. You’ll find some great tips, mostly in our Experts section, including:

- These are the two mistakes this expert says are costing investors money

- Five warning signs an investment is too good to be true; and

- 7 investing mistakes that’ll lose you money

And we even have our own pet former broker, The Secret Broker, who has a (often colourful) lifetime’s worth of stories and warnings, such as:

- How to take your tax time losses and still enjoy your breakfast

- What it really means to ‘go short’ and why you’re probably not ready for it

- How to value options and what not to do in Amsterdam

- A short lesson in valuing small cap stocks

Only trade what you can afford to lose

Panic buying or panic selling is the key to losing your shirt, so generally it’s advisable to only trade in what you can afford to lose.

It’s why we recommended a starting figure of $5000 and then building from there.

If you only invest what you can afford to lose, you can avoid the sort of emotion-driven trading that is generally a garbage idea.

As we stated before, if you can’t afford to lose $5000, then maybe share trading isn’t for you — as it’s inherently higher-risk than holding money in a savings account.

Don’t take our word for it, here’s the expert

Angie Ellis has been trading stocks for the last 15 years, full-time for the last five.

She’s a regular winner of ASX share trading races and is a seasoned small cap investor, so she knows her stuff.

But even she makes mistakes.

“I would say the biggest mistake I’ve made is buying too much into the story of a stock and not watching my stops,” she told Stockhead.

Ellis says she sees too many investors get into the market without a clear plan of what happens when things go wrong.

“People don’t watch their stops, and they don’t have a trading plan that they have back-tested,” she said.

She also said that traders, including herself, could be impatient with smaller cap stocks.

“I often exit a few times only to buy back in and then it finally takes off. Sometimes you can be too early and the market may take a while to catch on,” she said.

Ellis said the best part of trading stocks was doing the research to look for opportunities in the smaller end of the market — and to do so she uses a mix of real-world experience and conference intelligence to inform her choices.

“I knew Afterpay would be huge as I peeked into the layby room at a high end fashion store at Chadstone and saw how big this problem was for retailers. Also my hairdresser and all her friends were obsessed with Afterpay!” she said.

“I also like to talk to and meet management, contact competitors and customers to understand the business.

“Finally, I attend IMARC, Microcap conference, Techknow and wholesale investor events.”

Tax implications

Remember, if you trade right you’ll be making a capital gain, which brings capital gains tax into play.

There are also tax implications on dividends from share trading (although there are fewer thanks to the recent federal election result).

The tax levied on capital gains and dividends can be enough to dampen the whole exercise altogether, so make sure you talk through the tax implications of trading with a qualified accountant or business advisor.

The final word

Trading in stocks can be exciting and profitable, or terrifying and ruinous. It all depends on what approach you take to investment.

A studied and cautious approach to trading sets you up for the long-haul, and sets apart those who are looking for a stable side-income from those who trade on weekends and troll on message boards.

Whatever you decide to do, we hope we’ve given you a couple of pointers to mull over before going lock-stock into trading.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.