Boron for Morons: Everything you need to know about the world’s most perplexing mineral

Pic: Getty Images

When it comes to boron, a quiet and unassuming metalloid, the question is not ‘what is it used in’ but more ‘what isn’t it used in’.

Due to its wide range of properties and uses experts have coined it the ‘WD-40’ of minerals – from insulation, agriculture, soaps, cosmetics, TVs and mobile phones, boron is used in just about everything you can think of and is an integral part of modern life.

What is boron used in?

Borate silica allows glass to be made thin and strong enough to withstand heating and cooling without cracking, while boron carbide – the second hardest material behind diamonds – is used by militaries in tanks, body armour, and drones.

Borax, another soft, colourless compound of boron, can be dissolved in water, finding use in things like laundry detergents and cleaning products as well as a water clarifier in swimming pools, aquariums, and in enamels that cover the steel of refrigerators and washing machines.

According to the New South Wales Food Authority, some Asian cultures even use borax during food preparation as a firming agent, meat rub, preservative, or tenderiser while borates coat the ceramic tiles on the underside of a space shuttle to help it with withstand the thermal shock of re-entry.

Where is it found?

Most of the world’s boron is found in dried up lake beds and rivers in the form of borax deposits in Turkey and the United States, and mined industrially as evaporites (layered crystalline sedimentary rocks).

Discovering new boron deposits has proved to be challenging as it requires three key parts to converge – a former inland evaporated water body, a fault, and volcanic activity.

Because it exists in these rare geological settings, there are very few known sources of it and only two companies in the world providing most of the world’s supply – Turkey’s Eti Maden (65%) and Rio Tinto (20%).

Boron and food security

Boron is one of seven essential micronutrients vital to fertilisation.

Experts says boron deficiency is the most widespread of all micronutrient deficiencies – affecting root crops, vegetables and many fruit trees.

A micronutrient solution, or fertiliser, which contains boron can increase the quality of the soil, and increase the water retention of cells within plants, which is why it’s an emerging market.

It’s integral to a plant’s reproductive cycle, and helps control flowering, pollen production, germination, as well as seed and fruit development.

The worldwide fertiliser market was worth US$83.5 billion in 2020 and is estimated to grow at a compound annual growth rate (CAGR) of 1.69% during 2020–2027.

By 2027, the global fertiliser market will be worth more than US$93.9 billion, placing boron in the box seat as it helps maximise food production for a growing population by increasing crop yields.

New applications and demand

Although the global market is small and opaque – just 4.5 million tonnes – future facing industries are creating new demand dynamics with experts forecasting 1.6 million tonnes of new demand from trends such as the electrification of transport and green energy generation.

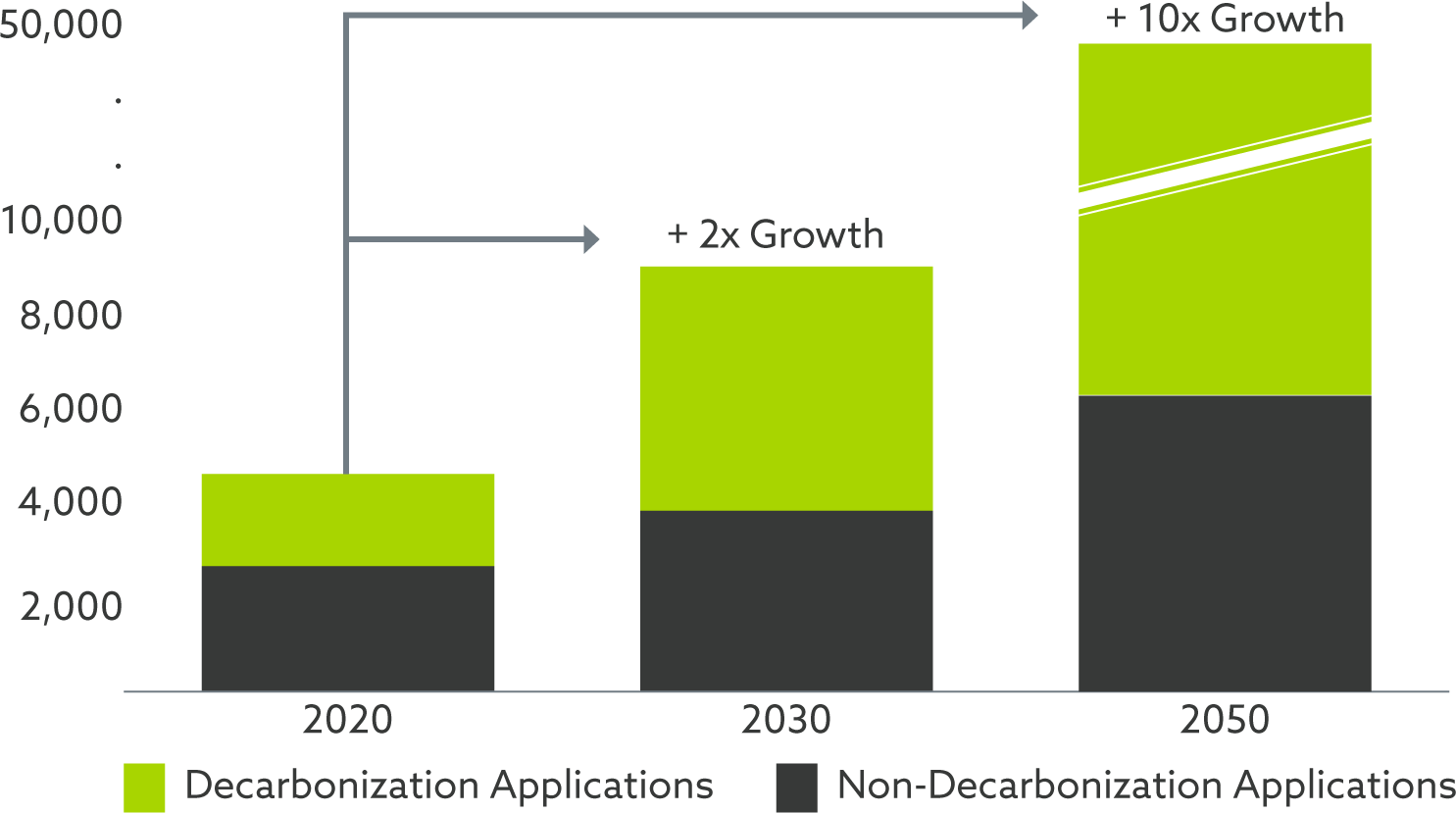

Boron demand is forecasted to increase 10x by 2050 from 2020 levels driven by an acceleration of both future facing and traditional applications (including glass, ceramics, agriculture and cleaning products).

Around 40-50 kilograms of boron is used in the average EV, from neodymium-iron-boron (NdFeB) permanent magnets to ceramic brakes, high-strength steel chassis, dashboard screens, body panels and acoustic insulation.

Market analysts are particularly excited about boron’s use in NdFeB magnets, not just because they are highly cost effective and offer high resistance to demagnetisation, but because the market is expected to grow at a CAGR of 7.59% during 2021–2027.

These NdFeB magnets are also used in wind turbines and with the rise in demand for renewable energy sources, this is expected to be a key factor driving the use case for boron.

Researchers at Arizona State University are also working on a new project to create power transistors from diamond and boron nitride.

While diamond is the research team’s chosen material for the main body of a transistor, they are investigating the use of boron nitride for the transistors’ electrical contacts.

Like diamond, boron nitride has a high breakdown field and high thermal conductivity, meaning these transistors could greatly reduce the cooling power needed for cell towers and reduce the size requirements for electricity grid substations.

ASX players with exposure to boron

Rio Tinto’s (ASX:RIO) Boron Mine in California has been the only supplier this century, and after operating for 100 years, is reaching the end of its life with reserves due to expire in 2042.

Mining at Boron began in 1927 and today, the mine – home to one of the richest deposits of borates in the world – produces 1 million tonnes of refined borates every year, or around 30% of global demand.

In January 2022, the Government of Serbia revoked RIO’s licences relating to its proposed Jadar lithium-borates project due to concerns around the potential impact of the mine on local communities within the Jadar Valley.

With Turkey’s Eti Maden mines the only other producer globally, there is a growing desire among customers to secure alternative long-term supply sources.

5EA Advanced Materials (ASX:5EA), formerly listed as American Pacific Borates, is one of them.

The company is working to bring its flagship project, the Boron Americas Complex in southern California into production by the end of Q1, 2023.

It is tipped to become the first new producer of boron this century and the next US-based lithium producer.

With the plant undergoing commissioning, 5EA says production is set to start in another six to eight weeks with a target of 500,000tpa of boric acid equivalent and several thousand tonnes of lithium carbonate at full production.

Ioneer (ASX:INR) is another key player with exposure to boron.

The company recently received a loan of up to US$700m from the United States Department of Energy (DOE) in January 2022 to finance the construction of Rhyolite Ridge – a large-scale, open-pit project in southern Nevada, US.

Rhyolite Ridge is estimated to contain 1.3 million tonnes of lithium carbonate and 12.4 million tonnes of boric acid.

Once in operation, the project is set to produce 24,000 tonnes per year of lithium carbonate and around 192,000 tonnes per year of boric acid.

In December 2022 the project advanced into the final stage of federal permitting with the decision by the Bureau of Land Management (BLM) to publish a Notice of Intent (NOI) in the Federal Register, marking a major milestone toward the completion of the permitting process and approval of the plan of operations.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.