ASX silver stocks guide: Here’s everything you need to know

100 ounce silver bullion bars are arranged for a photograph in Singapore. Photographer: Munshi Ahmed/Bloomberg/ Via Getty Images

For years silver has been the bridesmaid to gold’s bride, as the glamorous yellow metal has outshone its grey rival.

Gold has grabbed investor headlines because of its much higher price and bigger profile but things may be about to change in silver’s favour, and this is down to an obscure trading tool called the gold to silver ratio.

The ratio highlights how many ounces of silver are required to buy one ounce of gold.

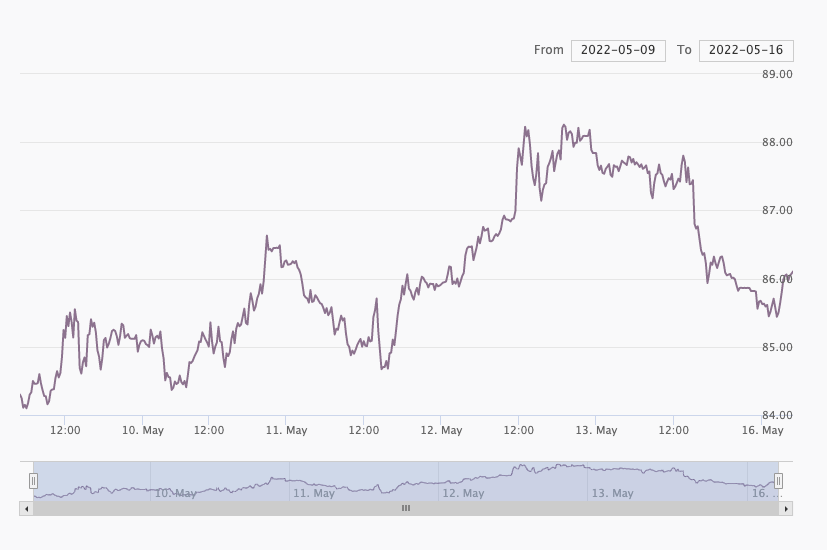

Two years ago, when this silver guide was originally written, prices were sitting at $US1,810/oz for gold and $US19.30/oz for silver, meaning the ratio was 94:1.

Today, the gold price is hanging around the $US1,811.28/oz mark while the silver price has shot up to $US21.09/oz.

This highlights a narrowing in the gold-silver ratio, which currently sits at 86:1.

While it has narrowed somewhat over that time period, the ratio is still very much higher than the long-term average of 63:1, meaning that silver still looks relatively cheap compared to gold.

And if prices do catch up to this average, it translates into plenty of improvement in the silver price.

Merchants would sell their gold and buy silver when the ratio was high in anticipation that the market would correct, and when the ratio fell, they would sell their silver to buy more gold.

This trading mechanism enabled merchants and traders to profit from price movements in silver and gold. It also worked in different countries.

For example, the gold-silver ratio may have been higher in France and lower in the United States, enabling keen-eyed merchants to profit from the difference or arbitrage.

The ratio increased in volatility from the 1870s. In some rare cases it soared close to 100:1 as in 1941 and 1991, and in other times dipped under 20:1 as in 1919, 1968 and 1980.

Silver as a currency

Silver was a monetary metal used in international trade throughout the 19th and early 20th centuries. For example, the US minted a special silver dollar for trading purposes.

Hong Kong minted its first silver dollar in 1866 for trade between Western nations and China.

Gradually, silver coins became less relevant to international trade, and nations stopped minting them for overseas and domestic markets.

The United States was one of the last countries to stop using silver currency.

In 1964-65 under President Lyndon Johnson, silver coins such as the dime (10c) and quarter (25c) that had a silver content of 90 per cent were withdrawn from circulation.

Part of the reason for this was silver’s price had become too high. The value of silver in a coin could be more than its face value.

Silver coins, bullion now collectables

Today, silver is a demonetised metal in that it is generally not used as legal tender to pay government taxes or for goods and services.

Silver coins and bullion still have a role to play, as collectables, as does the gold-silver ratio.

The ratio’s relevance was highlighted again in March 2020, when something remarkable happened.

The gold-silver ratio at the height of COVID-19 hit 120:1 – its highest ever recorded – before heading back down to 90:1, which is still very high by historical standards.

Any investor that sold one ounce of gold to buy 120 ounces of silver in March 2020 could theoretically be sitting on a 25 per cent profit several months later.

The volatile swings in the silver-gold ratio are an opportunity for some traders and may also illustrate that silver is relatively undervalued compared to gold.

Could it be that silver is again becoming a monetary metal akin to gold? Time will tell.

Silver’s role in medicine, industry

Silver has a myriad number of uses in medicine because of its anti-microbial qualities and in industry due to its electrical conductivity and anti-tarnish properties.

The white metal is sprayed as a thin film on computer discs, and silver nitrate is used in medicines.

Stained glass is coloured yellow or orange by silver, and silver-coated ball bearings are a key component in aero engines.

Silver has been used by NASA in an ionised form to purify water for astronauts, and the metal has other uses in photography, solar panels, and in motor vehicles.

Industrial, medical and clinical uses account for up to half of silver’s production, according to the BullionVault website.

There is also silver jewellery and tableware, accounting for 20 per cent of the market.

Demand and supply for physical silver is fairly evenly matched, according to data from industry body The Silver Institute.

Silver’s potential in green energy

When discussing ‘the green economy’, the usual contenders such as lithium, zinc, and copper spring to mind but some would argue silver plays an even more critical role across many green energy technologies.

Because silver is one of the most efficient conductors of electricity, it is an obvious choice for everything from printed circuit boards to switches and tv screens – if it has an on/off button, chances are silver is in it.

According to The Silver Institute, silver membrane switches are used in buttons on televisions, telephones, microwave ovens, children’s toys, and computer keyboards.

“These switches are highly reliable and last for millions of on/off cycles – it is also used in conventional switches like those used for controlling room lights,” the organisation said.

With industrial demand forecast to rise 6% to a record high of 539.6 million ounces this year, silver’s end-use in the green economy will benefit from rising vehicle electrification and the investment in renewables, especially photovoltaics.

Silver’s conductivity and corrosion resistance makes it necessary for conductors and electrodes with almost every electrical connection in an EV using the grey metal.

The Silver Institute estimates that nearly 90 million ounces will be used in the automotive industry by 2025.

Thomson Resources (ASX:TMZ) executive chairman David Williams said we are now starting to see the influence of silver’s demand as a technology metal, which is interfering with its traditional role as a precious metal.

“The simple fact is when you talk about solar panels, wind turbines, electric vehicles, 5G networks, smart phones and tablets – you will need more of that electricity conductor being silver,” he said.

“There will be this continuous growth in demand.”

Silver supply and demand

According to the World Silver Survey 2022, global mine production increased by 5.3% year-on-year to 822.6Moz, marking the biggest annual rise in silver output since 2013.

This was due to a recovery in production following disruption to mining from the COVID-19 pandemic in 2020.

“Output from primary silver mines increased by the most, up 10.2% y/y to 229.9Moz (7,152t), as these operations were disproportionately impacted by pandemic-related restrictions in the previous year,” the survey said.

“By-product silver output from lead-zinc and gold mines rose by 5.1% to 252.8Moz (7,862t) and 5.8% to 127.6Moz (3,967t), respectively while silver production from copper mines grew by a more modest 0.7% to 208.2Moz (6,476t).”

The largest gains emerged where mining was most heavily impacted by COVID-19 lockdowns in 2020, which subsequently led to a rebound in output.

This was the main reason behind significant rises in Mexico (+16.5Moz, 514t), Bolivia (+11.6Moz, 359t) and Peru (+6.2Moz, 194t).

After a slump in 2020, global silver demand rose by a healthy 19% in 2021 to 1.05Boz (32,627t), surpassing pre-pandemic volumes and achieving its highest level since 2015.

All categories of demand saw gains, with the largest in volume terms being coin and bar purchases.

ASX silver stocks

Silver stocks are enjoying a timely revival as investors are drawn to the potential profit from trading in the grey metal.

Investors wanting to put some money into silver equities can go down two routes.

Pure-play silver miners are few on the ASX and are one way for investors to stake a claim in the metal.

Silver Mines (ASX:SVL)

SVL is a dedicated silver play and owns the Bowdens project in NSW.

Bowdens is sitting on one of the world’s largest undeveloped silver deposits, and a feasibility study completed for the project back in 2018 indicates production of 3.4 million ounces per year of silver, together with roughly 6,9000t of zinc and 5,100t of lead.

Manuka Resources (ASX: MKR)

MKR was the first gold and silver IPO of 2020 and is the other ‘go to’ silver play.

The company started silver processing operations during March after first silver pour occurred in late April.

At a steady state production, MKR says it will be producing >150,000oz of silver per month with a maiden ore reserve expected by mid-year.

Alternatively, investors can pick from a large number of miners that produce silver alongside other metals such as copper or gold.

There are around 30 ASX companies that have interests in silver.

Large cap silver miners

They include some larger miners such as South32 (ASX:S32), which mines silver at its Cannington site in Queensland – the world’s biggest silver mine.

The company also owns the Hermosa Project in the Patagonia Mountains, about 80km southeast of Tucson, Arizona where the company promises to be a major source of zinc, lead and silver, producing 111,000t of zinc, 138,000t of lead and 7.3Moz of silver a year over a 22-year mine life according to a 2022 PFS.

Sister company BHP (ASX:BHP) has some silver production from its Olympic Dam mine in South Australia that is better known for its uranium-copper output.

Smaller Australian-listed miners, meanwhile, provide a wider choice of silver projects for investors.

Small cap silver miners

WA-based Boab Metals (ASX:BML) is developing the Sorby Hills lead-silver-zinc project in WA’s Kimberley region, which has a JORC resource of 44.9 million tonnes at 4.3 per cent lead equivalent which includes 54 million ounces of silver.

BML also acquired the Manbarrum Zinc-Lead-Silver Project, only 25km east of the company’s flagship Sorby Hills project.

Boab managing director Simon Noon said the synergies between the two projects are “clear” and will allow for economic evaluation of a highly prospective and under-explored geological domain.

Meanwhile, White Rock Minerals’ (ASX:WRM) portfolio includes the Mt Carrington gold-silver mine in northern NSW, where Thomson Resources (ASX:TMZ) entered into an earn-in and JV agreement back in 2021.

WRM has so far defined a shallow indicated and inferred resource totalling 341,000oz gold and 23.2 million ounces of silver.

TMZ holds a diverse portfolio of mineral tenements across gold, silver, and tin in NSW and QLD with its primary focus being on the ‘Ford Belt Hub and Spoke’.

The company’s strategy has been to create a large precious (silver-gold) base and technology metal (zinc-lead-copper-tin) resource hub that could be developed and potentially centrally processed.

All key projects have been acquired in a short four-month period including the Webbs and Conrad Silver Projects, Mt Carrington, the Texas Silver Project and the Hortons Gold Proejct.

Investigator Resources (ASX:IVR) owns the Paris silver project, a potential 1-million-tonne-per-year mine, which the company says is the highest grade non-by-product undeveloped silver project in Australia.

Following an extensive infill drilling program in late 2020, an updated mineral resource estimate of 18.8Mt at 88g/t silver and 0.52% lead for 51.1Mozs and 97.6kt lead was reported in June 2021.

Anything over about 50g/t is generally considered high-grade when it comes to silver.

Alicanto Minerals (ASX:AQI) is returning high-grade silver, zinc and lead hits at its Sala project which was once Europe’s largest silver producer.

In November 2021 the company raised $7m to fund an ongoing drilling program and complete a maiden inferred resource at the project, which has seen hits of up to 87m at 5.3% zinc and 40g/t silver.

Earlier this month AQI made a major breakthrough after hitting a potential repeat of Sala-style mineralisation with 4.7m of massive sulphides at 24.4% zinc, 875g/t silver and 3.7% lead.

Adriatic Metals (ASX:ADT) is advancing the Vares polymetallic project in Bosnia & Herzegovina.

Phase-two metallurgical test work has shown the project can produce concentrate grading 25.1 per cent copper and containing significant quantities of payable gold (20.9g/t) and silver (9,550g/t).

ADT says it is on track to begin production in Q2, 2023.

Mithril Resources (ASX: MTH) will carry out drilling at its Copalquin gold and silver project in the west of Mexico after raising $3.5 million from investors.

Copalquin is home to more than 32 historic gold and silver mine workings and is within the Sierra Madre gold-silver trend that hosts Coeur Mining’s Palmarejo and Agnico Eagle’s Altos mines.

Historic drilling data shows the Copalquin project has multiple high-grade hits including, 17.77m at 45.16g/t gold and 118.2g/t silver from 31m at the El Cometa mine, and 4.5m at 28g/t gold and 2,350g/t silver from 138m at La Soledad mine.

Other small cap miners with exposure to silver include several companies that listed last year – Eastern Metals (ASX:EMS), Peregrine Gold (ASX:PGD), and West Cobar Metals (ASX:WC1).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.