With record cash on the sideline, an under pressure Australian property market is starting to fragment

Via Getty

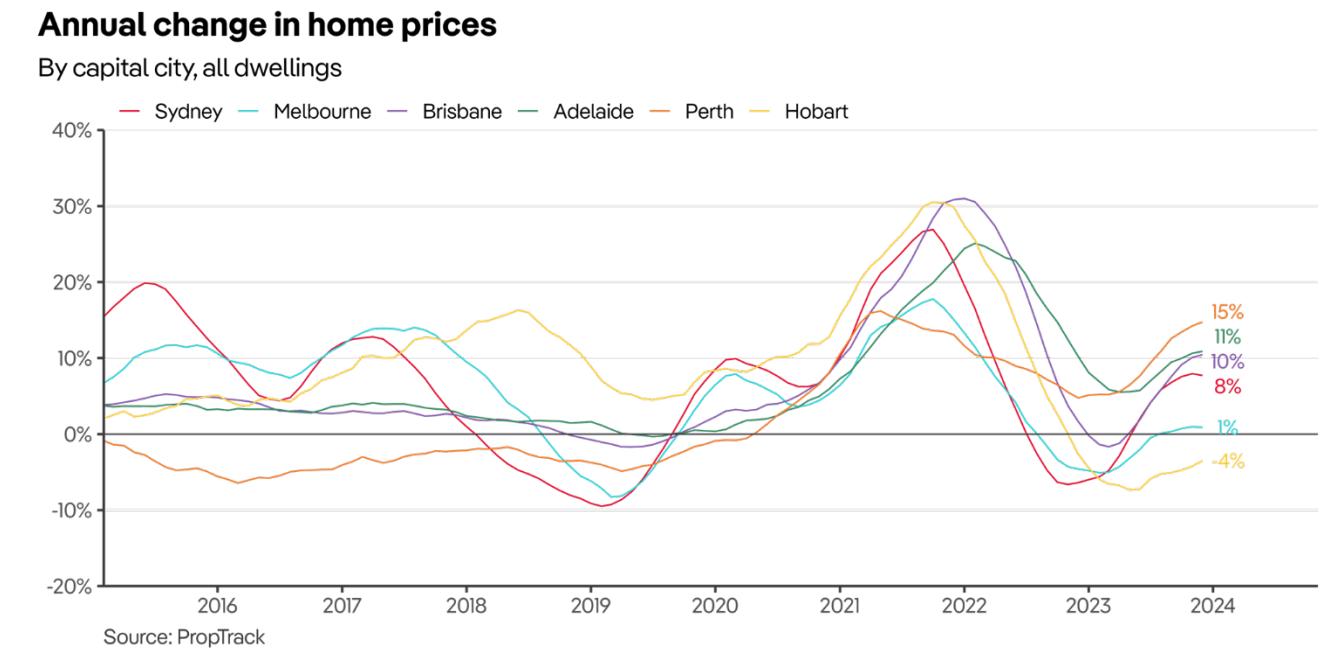

Following a notable slowing-surging in Aussie home prices over the last quarter of 2023, it would seem the national house market is starting to fragment.

It’s not quite coming apart at the seams, but it’s definitely starting to look more like a quilt.

The latest Proptrack Home Price Index has Aussie home values up 5.2% over the last 12 months, but while some states basked in the warmth of a double digit post-post-Covid slowdown rebound, others barely picked themselves off that doormat.

To you, Victoria, we say: improve.

Of course, even in these underperforming states, there’s always a few spots which enjoy stellar outperformance.

In fact during December, even as national home prices held steady, PropTrack’s Anne Flaherty says that surprise growth in many regional areas offset notable declines across capital cities.

Anne says there’s several factors at play to explain the divergence.

“There was an additional interest rate rise as well as an increase in the supply of homes listed for sale, which provided buyers more choice and helped to alleviate competition.”

At the same time, property prices might be sitting at record highs in many parts of the country, but there’s heaps of crazy-affordable suburbs and towns where buyers can score an inexpensive home or unit.

The PropTrack economist Anne Flaherty says the toppy cash rate and reviving property prices were leading people to explorers seeking out more economically viable – regions.

Some of the hotspots bucking the trend with >10% price falls over the past 12 months include:

- Carlton, TAS – 13.3% fall in home price year-on-year

- Mullumbimby, NSW – 11.9% fall in home price year-on-year

- Kurrajong Heights, NSW – 11.3% fall in home price year-on-year

Meanwhile, Elizabeth North in South Aussie was apparently ‘the most affordable of the capital cities, with the median home value for a house sitting at $368,000.’

Anne reckons these are the most affordable suburbs in Australia:

- Elizabeth North, SA – $368,000 median home value

- Moulden, NT – $369,000 median home value

- Gagebrook, TAS – $373,000 median home value

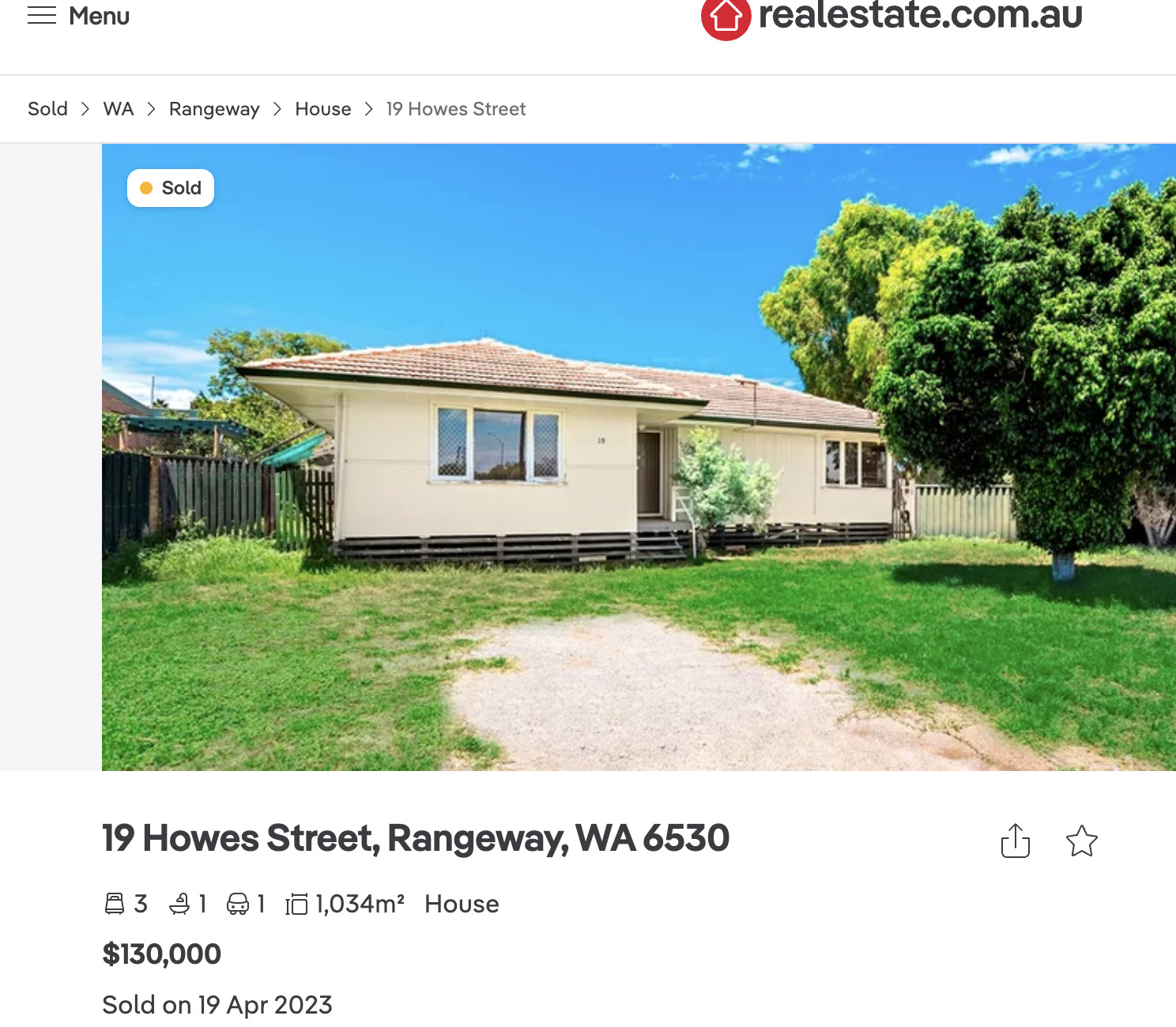

Rangeway, in the inner east of WA’s sunny (very sunny) Geraldton, offers the cheapest homes in the nation, with an average price of $174,000.

As a matter of fact, a few places in Rangeway have gone for as little as $130,000 in the last year…

Despite regional areas enjoying higher growth in December, the combined capital cities remained the outperforming engine of property growth last year, with prices up 6.44% vs. the 3.2% seen across the combined regional markets.

Even though recent months have seen a rise in the number of properties listed for sale, overall supply remains relatively constrained, particularly in Perth and Brisbane.

This has been a key contributor to price rises in these markets, Ms Flaherty says.

“Despite the cool down in capital city prices seen over December, prices in 2024 will be supported by population growth and what looks likely to be a more stable interest rate environment.”

Cash on the side

It’s never a bad time to be an Australian bank.

As talk turns to the potential for peak interest rates and a rewinding Reserve Bank, Aussies have meanwhile squirrelled away record amounts of cash across the various deposit-taking institutions around the place.

Here we’re talking term deposits, transaction accounts, mortgage offset accounts, and the amusingly-titled ‘savings’ accounts.

That’s according to the latest prudential regulator’s (APRA) monthly authorised deposit-taking institution stats*, which shows we held around $100bn more in November, when compared to the same time in 2022.

(*Ed: I warn you, that’s a remorseless spreadsheet)

APRA’s data shows household deposits continue to surge, with Aussies stashing an extra $10.5 billion in the bank in the month of November alone, bringing the national total household deposits to a new record high of $1.43 trillion.

The total value of home loans also grew in the month of November to a total of $2.15 trillion, up 0.43% on October and 4.77% higher than in 2022.

APRA says all the Big 4 banks lifted their loan books, with CBA’s growth of 0.24% the smallest of the majors as a proportion of its loan book. Westpac at 0.48% and ANZ at 0.47% outpaced NAB at 0.32%

Smashing them all was Macquarie Bank, with a handsome 1.07% boost in November, the fourth straight month the bank has recorded more than a full per cent growth rate.

The news of such an impressive stash of dry gunpowder accumulating so close to the property market throws into sharpest relief the rising rate of Australians falling down on their mortgage repayments.

Late last year investor services group Moody’s pinged Melbourne’s CBD as home to the highest delinquency rate in the country at 4.87% way back in May, and the wider Victorian capital could boast Australia’s fastest-rising rate of owners missing payments compared to a year earlier.

Victoria was also home to 10 out of Australia’s worst 20 postcodes for homeowners becoming mortgage arrear-ers.

Sydney home prices fell 0.08% in December after reaching a record high in November.

This was the first time home prices have fallen in Sydney in 13 months, with values down across both house and unit markets.

Despite this, prices remain very close to peak levels and are sitting 7.72% higher compared to 12 months ago.

Melbourne saw its median home price fall by 0.55% in December, the second sharpest monthly fall behind Canberra. Home prices in Melbourne rose just 0.89% over 2023, remaining 4.6% below their peak levels reached in March 2022.

Melbourne has been the weakest performing property market in the nearly four years post-COVID, with prices sitting just 15.5% higher compared to March 2020.

Brisbane home prices rose 0.27% to reach a new peak in December, bringing total growth over 2023 to 10.45%.

High levels of population growth have supported demand for real estate in recent years, particularly post-COVID, making Brisbane one of the strongest performing capital city markets.

Brisbane’s median home price is now sitting an extraordinary 57% higher compared to March 2020.

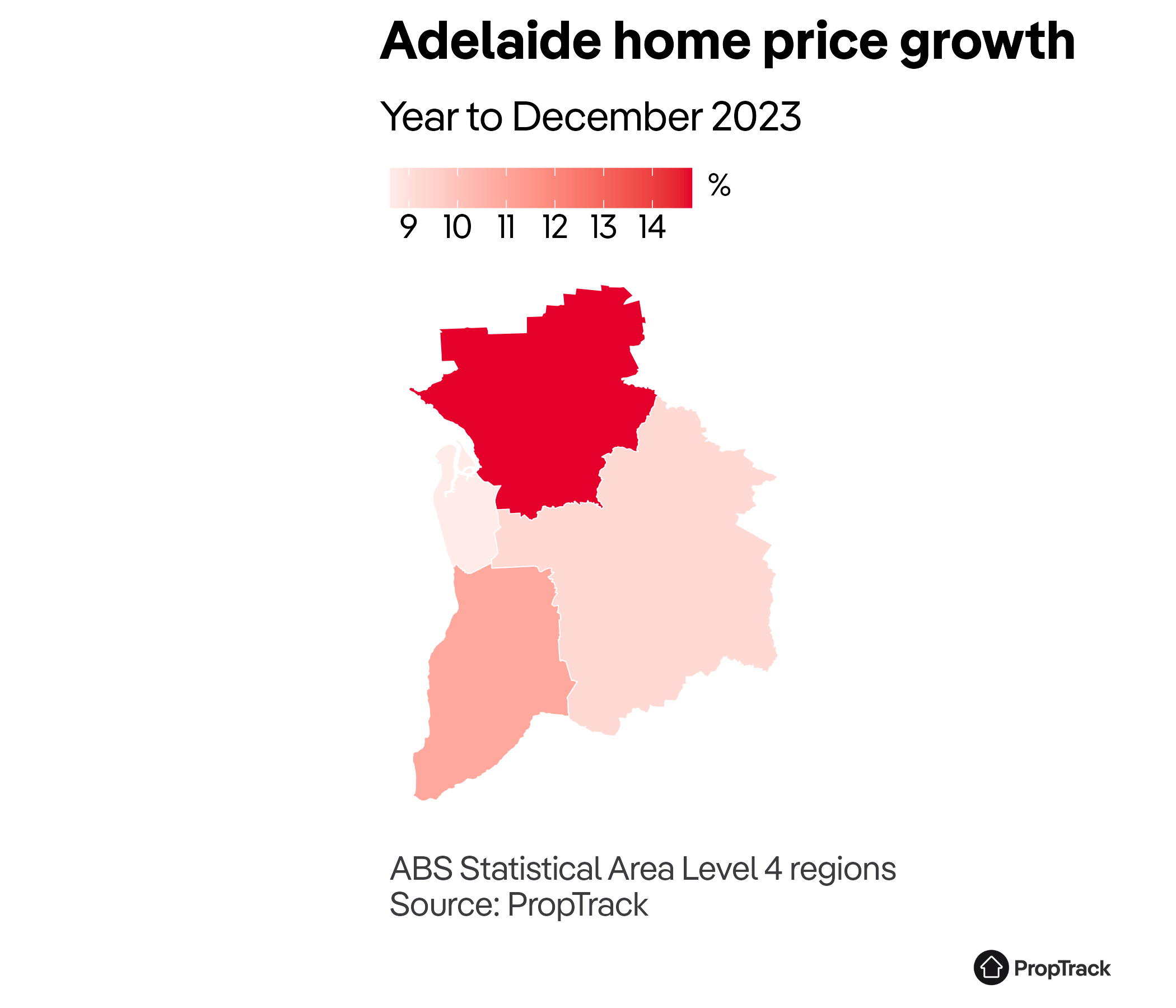

Adelaide as the second strongest performing market behind Perth in 2023, according to PropTrack.

Adelaide home prices reached a new peak in December, rising 0.59% over the month and bringing total growth over 2023 to 10.89%.

A tighter market and the relative affordability of the City of Churches has been a main driver of growth, providing Adelaide with more demand and greater resilience amid a lift in demand and a backdrop rising interest rates.

Perth was the strongest performing property market in 2023, recording the highest growth of any capital city or regional area.

Median home prices in Perth reached a new high in December, rising 0.69% over the month and 14.75% over the year.

Supporting home prices, buyers in Perth have faced relatively limited choice. As a result, those properties that are hitting the market are attracting high levels of buyer interest and properties are selling at close to record speeds.

Hobart

Home prices in Hobart have been trending downwards for close to two years, declining by a further 0.41% in December.

Hobart was the weakest performing capital city market in 2023, with prices down 3.5% over the year and 8.18% lower than their peak level reached in March 2022.

Lower trending prices in Hobart can, in part, be attributed to the abnormally high levels of growth seen during 2020 to 2021, driven by exceptionally strong buyer demand. Buyer demand has since normalised, and prices have corrected in response.

Darwin and the ACT

Darwin home prices edged up 0.1% over December to reach a median value of $482,000.

Compared to 12 months ago, Darwin’s median home price is sitting 1.49% lower and remains 2.26% below its peak level reached in May 2022.

Canberra was the weakest performing market in December, with the median home price falling 0.66%.

Home prices in Canberra are up just 0.25% compared to 12 months ago and remain 5.86% lower than the peak levels reached in March 2022.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.