Why dividend growth matters more than yields, and the ASX stocks with the highest growth rates

We explore why dividend growth is more important than dividend yields. Picture Getty

- Stocks with dividends provide protection in volatile markets

- We explore why dividend growth is more important than dividend yields

- We look at ASX stocks with the highest dividend growth rates

We all know that dividends provide protection in down markets while giving investors access to cash flows and passive income.

Overtime, consistent dividends can also help build wealth when reinvested to take advantage of compounding.

Experts say that one of the most important aspects of dividend investing is consistency; in other words, investors must be careful to chose those stocks that pay a consistent and growing dividend.

“It’s really important not to get fooled by companies that are paying a higher dividend in one year, but then no dividends at all the next,” Bell Direct’s market analyst, Grady Wulff, told Stockhead.

Wilson Advisory’s Rob Crookston agrees, saying that he looks for dividend-paying companies that can deliver growth year over year, continuously compounding his cash flows each year.

“This is the template for companies we consider when thinking about income investing,” he said.

Crookston reminded investors that income from dividends is tax-advantaged compared to income from fixed income investments, due to franking credits.

However he warned that historically speaking, high dividend yields tend to underperform the market on a long-term view, adding that as a dividend strategy, one must think more about dividend growth over time.

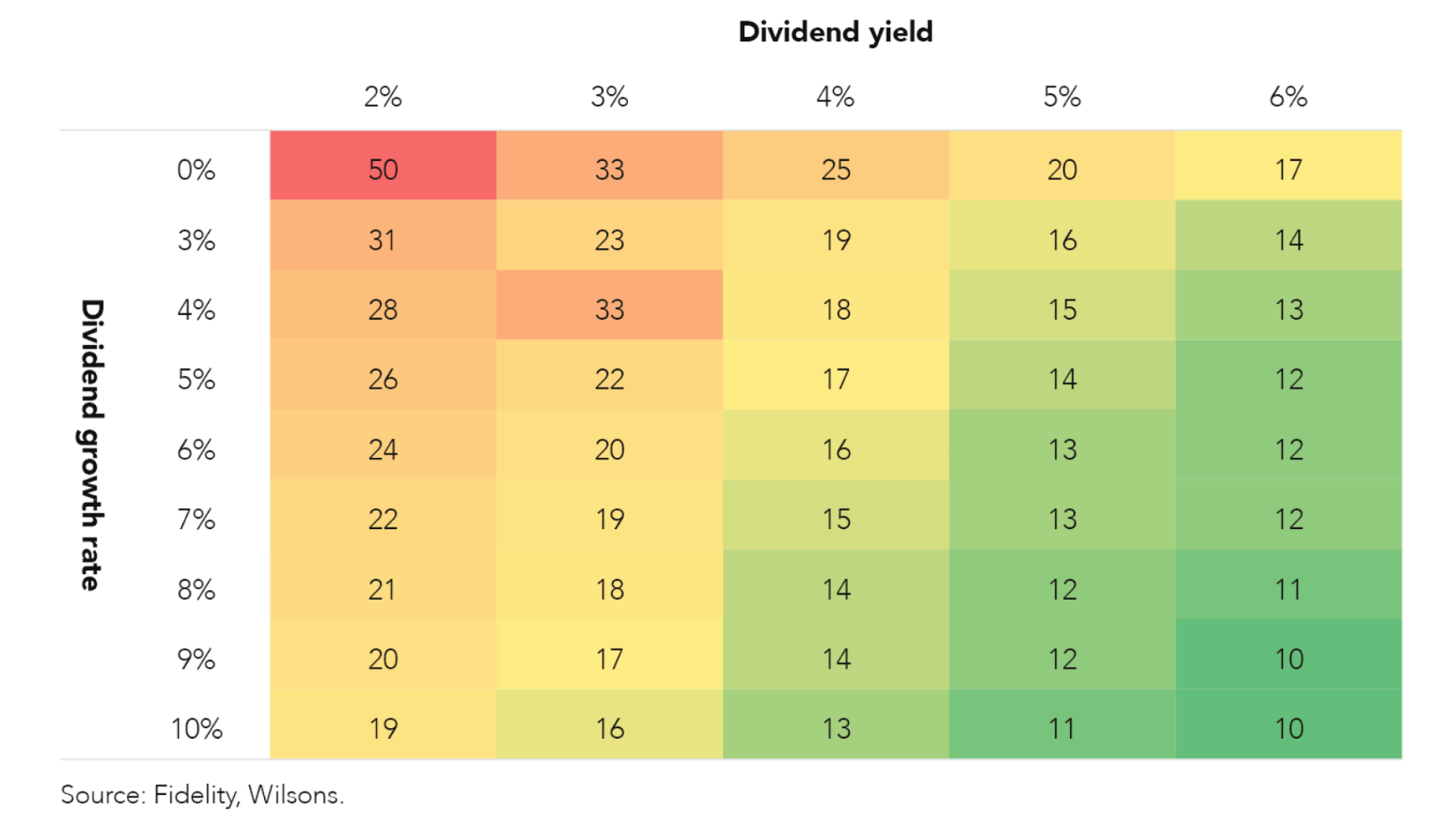

“We think selecting a dividend strategy by its initial dividend yield is a poor choice because the growth of the dividend over time ultimately determines the income payouts in future years,” he said.

Dividend growth matters more than dividend yield

According to the table above, stocks with higher dividend yields tend to have lower dividend growth, and vice versa.

High growth dividend stocks tend to outperform

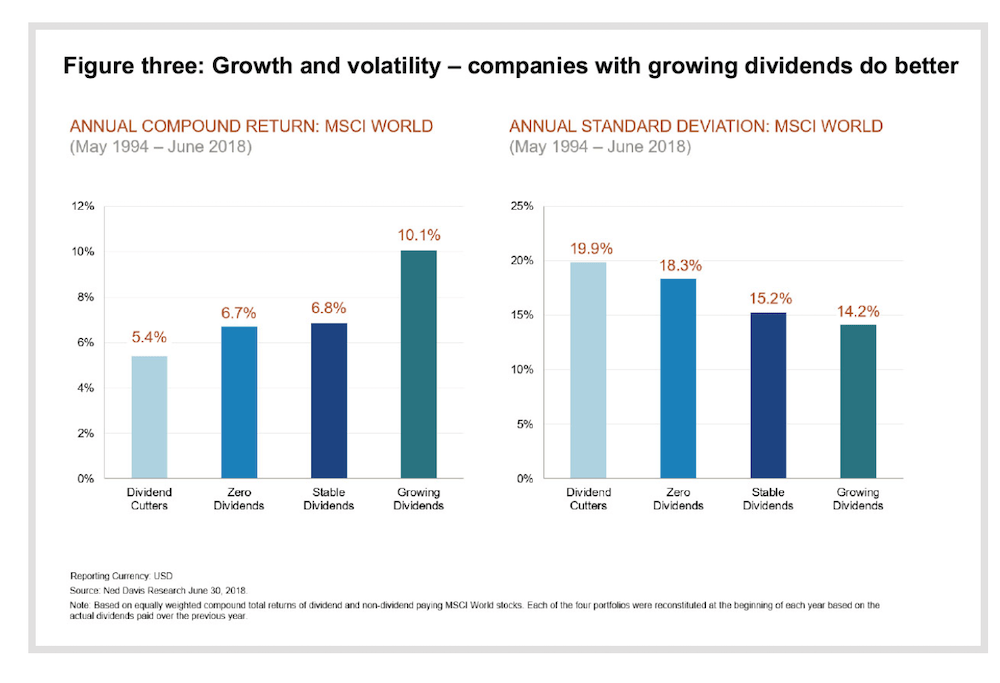

Dividend paying stocks also provide some hedge against inflation and, on average, they tend to be less volatile than non-dividend-paying stocks.

There’s a saying that “profits are a matter of opinion, but dividends are a matter of fact”.

“This encapsulate the reason that dividend paying companies tend to hold up well during volatile times,” said a report from Epoch Investments.

Stocks that pay a consistent dividend generally provide investors with tangible returns on a regular basis, irrespective of market conditions.

They also tend to outperform those that either cut or cancel announced dividends or don’t pay any at all.

So for dividend investing, the key words are “consistency” and “growth”.

While identifying the companies with the highest dividend yields is easy, figuring out which ones will be able to sustain their dividends over time is another matter.

ASX stocks with the highest dividend growth

Here we’ve listed ASX stocks which have the highest dividend growth (not dividend yield) over a 5-year and 10-year period.

We have separated the stocks into two tables – large caps and small caps.

ASX Large Caps with highest dividend growth

| Code | Name | Price | Current Div. Yield | 1 Year Div. Growth Rate | 5 Year Div. Growth Rate | 10 Year Div. Growth Rate | Market Cap |

|---|---|---|---|---|---|---|---|

| ARF | Arena REIT. | 3.77 | 4% | 8% | 6% | 51% | $1,311,636,981 |

| FMG | Fortescue Metals | 22.36 | 13% | -42% | 36% | 39% | $69,399,869,252 |

| PME | Pro Medicus | 67.02 | 0% | 47% | 41% | 31% | $6,944,744,825 |

| ILU | Iluka Resources | 10.635 | 3% | 92% | 23% | 29% | $4,545,556,640 |

| CNI | Centuria Capital | 1.67 | 7% | 10% | 8% | 28% | $1,315,665,726 |

| MFG | Magellan Fin Grp | 9.115 | 14% | -15% | 16% | 27% | $1,631,072,772 |

| ALD | Ampol | 33.14 | 6% | 196% | 18% | 26% | $7,754,350,301 |

| DDR | Dicker Data | 7.8 | 7% | 29% | 26% | 26% | $1,412,487,320 |

| SNZ | Summerset Grp | 9.53 | 2% | 20% | 16% | 24% | $2,212,702,094 |

| EVN | Evolution Mining | 3.62 | 1% | -50% | 4% | 23% | $6,624,408,912 |

| NST | Northern Star | 11.635 | 2% | 13% | 12% | 22% | $13,422,888,429 |

| NHC | New Hope Corp | 5.37 | 11% | 682% | 54% | 21% | $4,588,450,386 |

| DMP | Domino Pizza | 49.77 | 3% | -10% | 11% | 20% | $4,383,247,778 |

| IGO | IGO | 14.09 | 2% | 0% | 38% | 20% | $11,048,537,392 |

ASX Small Caps with highest dividend growth

| Code | Name | Price | Current Div. Yield | 1 Year Div. Growth Rate | 5 Year Div. Growth Rate | 10 Year Div. Growth Rate | Market Cap |

|---|---|---|---|---|---|---|---|

| HIT | HiTech Group | 1.83 | 6% | 5% | 13% | 41% | $75,960,000 |

| JIN | Jumbo Interactive | 14.63 | 3% | 16% | 13% | 34% | $912,026,713 |

| JYC | Joyce Corp | 2.57 | 7% | 6% | 9% | 30% | $71,293,079 |

| AEF | Australian Ethical | 3.61 | 2% | -25% | 18% | 24% | $404,887,567 |

| SDI | SDI | 0.85 | 4% | 3% | 7% | 23% | $101,035,701 |

| NCK | Nick Scali | 9.76 | 7% | 8% | 16% | 22% | $783,270,000 |

| BWF | Blackwall | 0.59 | 9% | 0% | 7% | 18% | $39,475,939 |

| FID | Fiducian Group | 5.83 | 5% | 10% | 13% | 17% | $183,514,542 |

| ADA | Adacel Tech | 0.58 | 15% | 0% | -13% | 17% | $43,829,369 |

| SNL | Supply Network | 15.00 | 2% | 60% | 26% | 17% | $622,500,222 |

The company’s core business is the recruitment of ICT professionals and the supply of contracting services to the public and private sectors.

HiTech has been capitalising on strong demand for ICT talent and services as organisations embark on the complex task of building new digital services and integrating them with legacy national systems.

FY22 saw another record result with operating revenue of $63m (an increase of 49.6%) making it the eighth consecutive year of double-digit revenue growth.

In the first half of FY23, HIT’s revenue increased by a further 37% on pcp and EBITDA increased by 10% on pcp.

In the latest outlook guidance, the company stated:

“As the global and local economy experiences uncertainty, we are well positioned for changes in demand for our service and are working on bolstering our talent pool with more specialised talent at the highest government security levels in readiness for increased demand.”

Jumbo offers its lottery software platform and lottery management expertise to the government and charity lottery sectors in Australia and globally, and by retailing lottery tickets in Australia and the South Pacific via ozlotteries.com.

Jumbo’s performance has been constrained by a poor run of Powerball and Oz Lotto jackpots, but investors have overlooked the company’s success in increasing its per-ticket commissions.

For FY23, the company expects its underlying EBITDA margin to be at the upper end of the original range of 48% to 50%.

Disciplined cost management including lower than anticipated lottery retailing marketing spend (due to jackpots) will be key to achieving these margins, the company has said.

Australian Ethical Investment (ASX:AEF)

This fund manager specialises in environmental and socially responsible investments.

Stocks in the AEF’s $8 billion portfolio must meet the requirements of the company’s Ethical Charter, which steers the fund into parts of the economy that are good for the planet, people and animals, and away from harmful sectors.

In the latest update, AEF said its funds under management (FUM) rose 48% year on year.

Recently, the fundie has been turning its focus to extracting further middle and back office synergies, initially through the transition of superannuation administration services to a single provider.

Nick Scali sources and retails household furniture and associated accessories across Australia and New Zealand.

The company operates under two brands, Nick Scali Furniture and Plush-Think Sofas, with 85 Nick Scali Furniture stores and between 90 and 100 Plush stores.

The integration with Plush is now complete, with IT & distribution now fully integrated, with around $20m run rate synergy savings to be realised.

While we’ve all seen its retail stores, Nick’s online platform is also starting to gain popularity, with online sales soaring during the pandemic.

Separately, the company has plans to expand its ANZ footprint by opening dozens of new showrooms across both markets over the coming years.

In the last half, Nick’s sales revenue was $283.9m, up 57.4% on pcp.

Supply Network provides after-market parts to the commercial vehicle industry in Australia and New Zealand under the Multispares brand.

The company says there is strong demand from commercial vehicle customers for parts, driven by industry tailwinds such as an ageing vehicle fleet, increasing freight task, and the increasing complexity of vehicles.

Broker Ord Minnett has put out a Buy recommendation on SNL with a target price of $15.40.

“The commercial vehicle automotive aftermarket industry is fragmented, and we believe there is scope for further market share gains and consolidation,” said the broker.

“We see a meaningful opportunity for expansion in SNL’s operations. We expect sales to continue to grow at above-average levels.”

Adacel deals in the air traffic management and air traffic control simulation in the global civil and military aerospace sector.

Its products and services include Air Traffic Control Simulators, Air Traffic Management, Voice Activated Cockpit, Speech Recognition, Support Services, ATC Environment, Airport Driver Training and Homeland Security.

Analysts believe that ADA has the opportunity to double its annual revenues over the next 18 months based on the recent award of six tenders.

In June, the company announced the award of a significant contract valued at approximately USD$7 million over 11 years.

Under thayt deal, Adacel will deliver a comprehensive range of solutions to a military organisation of a NATO nation.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.