Where no gold has gone before…

Gold is proving hard to stop

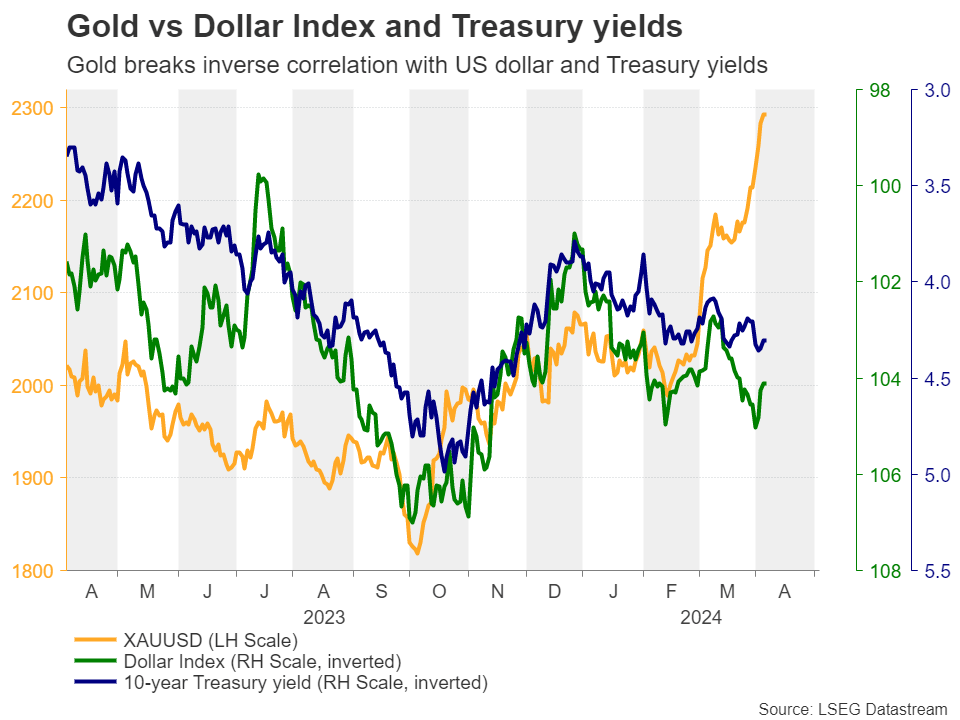

- Gold remains in rally mode despite rising USD and Treasury yields

- Central banks, geopolitics among drivers

- Supported also by Chinese demand and inflation hedging

Floats like a butterfly, stings like bullion

Hard not to discuss the adventures of gold with XM Australia CEO Mr Peter McGuire when wantons and coffee are on the menu.

Gold has been sizzling happily like the finest laziji (辣子鸡) since the beginning of March, surpassing even its previous record high of US$2,135 clocked back then.

Overall, bullion added another circa 4% last week, a third straight weekly spike, despite new US data pointing to a stronger jobs market.

Describing its flight, Pete told me the most precious of metals consolidated a lingering moment around the Ides of March before rallying through the final days of the month to continue its determined, Hobbit-like wander up into further uncharted territory.

And all this in the very face of typical golden headwinds like rising US dollar and Treasury yields boosted by the easing bets about Fed rate cuts.

“From pricing in around 160bps worth of reductions at the turn of the year, the market now believes that by December, Fed officials will lower borrowing costs by only around 70 basis points, even fewer than the Fed’s projection of 75.”

This was the result of stickier-than-expected inflation and data pointing to solid economic performance in the US. But why did gold traders remain indifferent to such developments?

And how the hell has the inverse correlation of gold with the US dollar and yields broken down?

Pete says there’s buying forces afoot which are hard to contend with.

“The fact that gold did not materially slide between December and February, when the dollar was outperforming all its major counterparts, suggests that there are other forces keeping the precious metal supported.”

Central banks

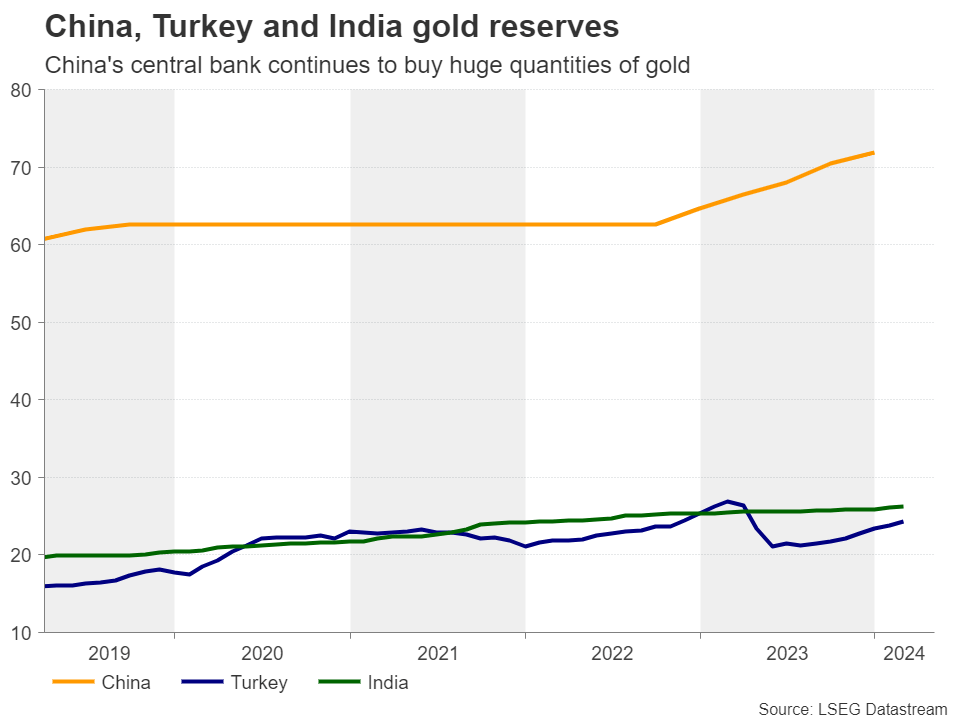

The continued splurging by central banks, with the frontrunners being China, Turkey, and India, are laying a foundation.

“Although the latest publicly available data is for February point(ing) to a notable slowdown in central bank buying from January, those three central banks continued their purchases at elevated pace, with China holding a long distance from the other two. Whether the overall central bank buying accelerated during March, when the precious metal skyrocketed, will be confirmed on the first days of May.”

Safe-haven flows

Then there’s the geopolitical uncertainty which is always a decent reason for investors to canalise flows into gold, Pete says.

“The Israeli strikes on the Iranian embassy in Syria with Iran promising payback, as well as Ukraine’s attack on Russia’s oil infrastructures, are far from suggesting that the conflicts are nearing resolution. And with the yen staying wounded even after the BoJ’s decision to lift interest rates, gold may be the only safe haven in town.”

What Beijing wants…

Traditionally, Peter says, deftly skewering a most piquante chilli, India usually offers a helping hand during the first few months of any given year, as demand in the world’s second largest consumer for the precious metal increases due to the wedding season.

“But, as gold prices already hit a record in December, demand was dampened this year, with India’s imports likely plunging by more than 90% in March according to rumours out of Delhi.”

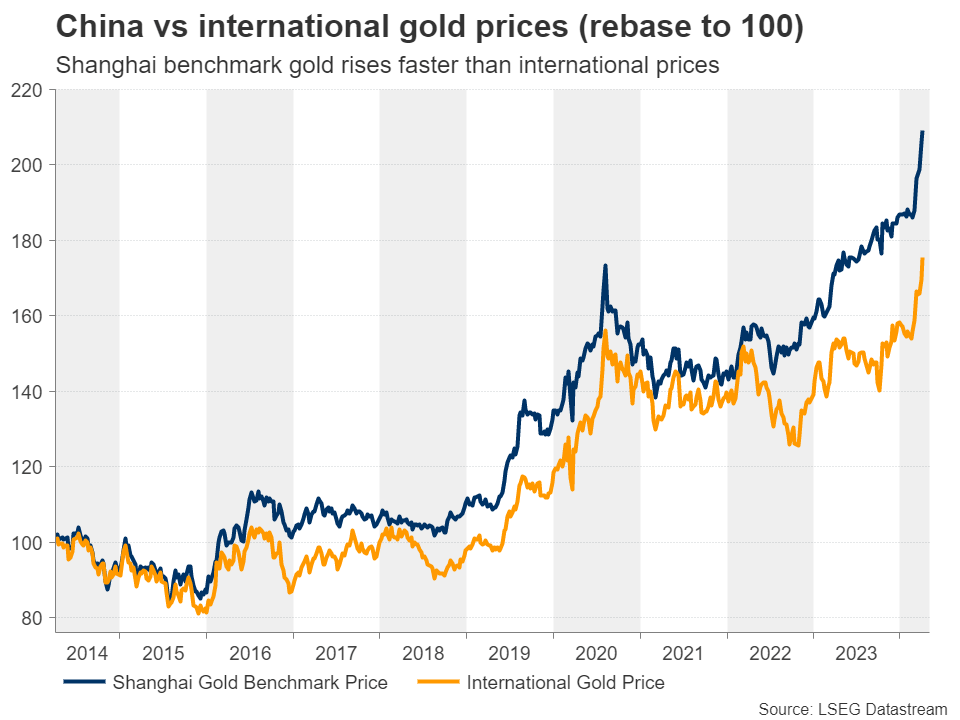

Considering that China and India account for more than half of total global gold demand, the yellow metal is more than likely drawing massive support from the world’s No. 2 economy.

“With the Chinese stock market suffering and cryptos being banned there, the options for vehicles that local investors can profit from become very limited, and that’s maybe one of the reasons for increasing demand for gold. Indeed, the Shanghai benchmark gold has been rising faster than international prices for the last couple of years.”

Fed rate cuts, even delayed

“As for expectations regarding the Fed’s future course of action, delayed rate cuts may not be much of a concern for gold investors whose horizons are likely longer than those of forex traders,” Peter says.

“The fact that the Fed’s next policy move is likely to be a cut may be more than enough, as it keeps the upside potential in Treasury yields limited. And with inflation data suggesting that prices in the US are stickier than previously expected lately, some participants may have viewed gold as a hedging vehicle against inflation for now.”

Will the rally continue?

Moving ahead, there’s a fair amount of agreement the prospect of lower interest rates in the US, the elevated demand from China, and the uncertainty surrounding the geopolitical landscape are likely to keep gold supported for a while longer.

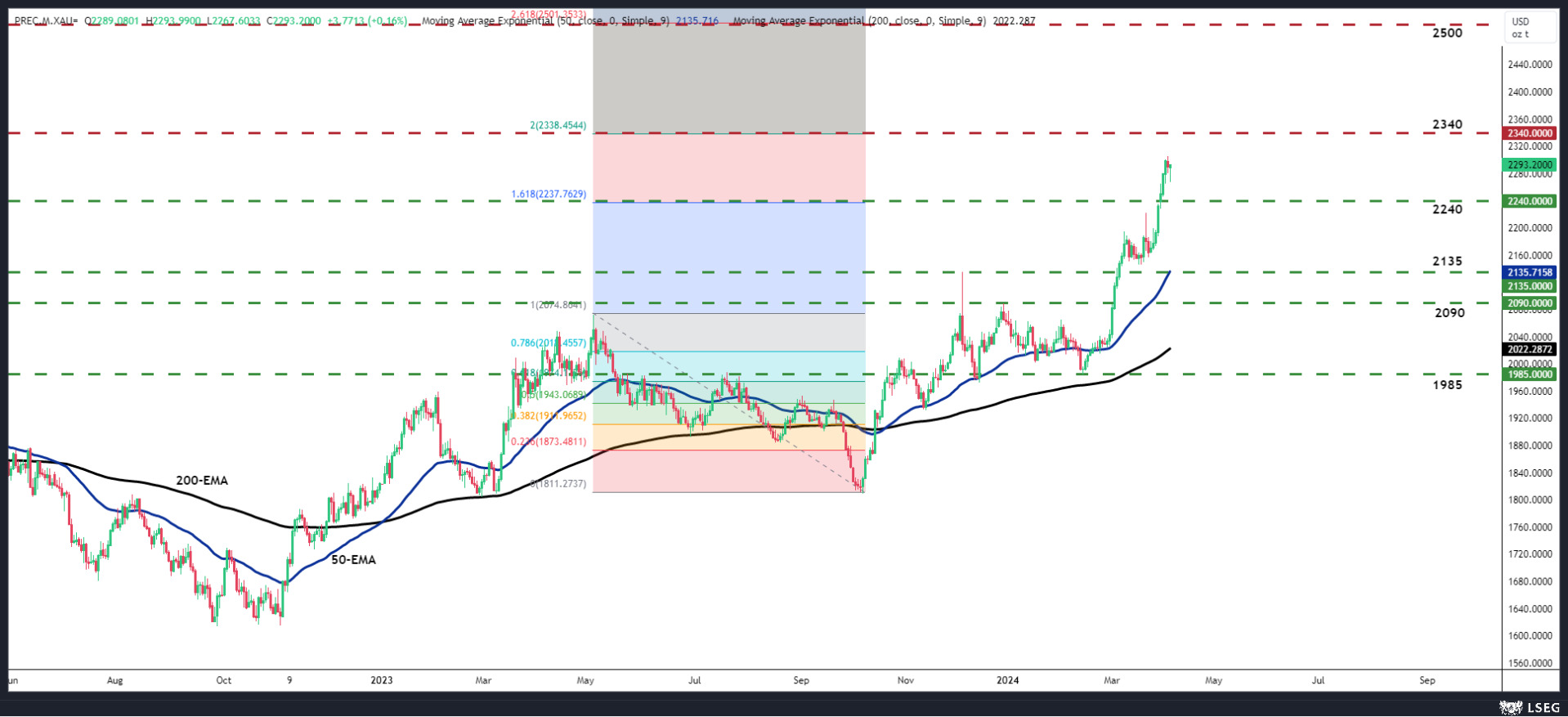

“With no prior highs or inside swing lows to mark potential resistance levels on the metal’s way higher, the next zone that could play such a role may be the 200% extension level of the May – October 2023 decline, at around $2,340.”

Technicals:

Pete says a break higher “may encourage traders to aim for the psychological level of $2,500, which is the 261.8% Fibonacci extension level of the aforementioned slide.”

For the outlook to change

For the picture to darken, the precious metal may need to slide below $2,135, a level which now coincides with the 50-day exponential moving average (EMA).

“That said, for such a fall to materialise, some fundamental themes may need to change.”

For example, the Chinese economy may need to improve to the point where local investors feel more confident to divert flows to the Chinese stock market.

Or, Pete suggests, tensions between the world’s two largest economies – the US and China – may need to diminish, something that may prompt the PBoC (People’s Bank of China) to slow substantially its gold purchases.

“After all, the PBoC’s gold buying rampage is driven by a desire to weaken its dollar dependency. Other narratives that could weigh on gold may be the resolution of the geopolitical conflicts in the Middle East and Ukraine, or a phase out of all the basis points worth of Fed rate cuts for this year.”

“Having said all that though, all these changes seem unlikely to happen anytime soon.”

“I feel like something sweet.”

As did I.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.