You might be interested in

Mining

Resources Top 5: Lightning could strike twice in West Arunta as Encounter drills high grade niobium next door to WA1

News

ASX Lunch Wrap: ASX flattens as Webjet, Accent tumble; Nvidia disappoints

News

Now that the interest rate dramas are totally behind us, it’s safe to look back on a third quarter which was pretty tough on all of us.

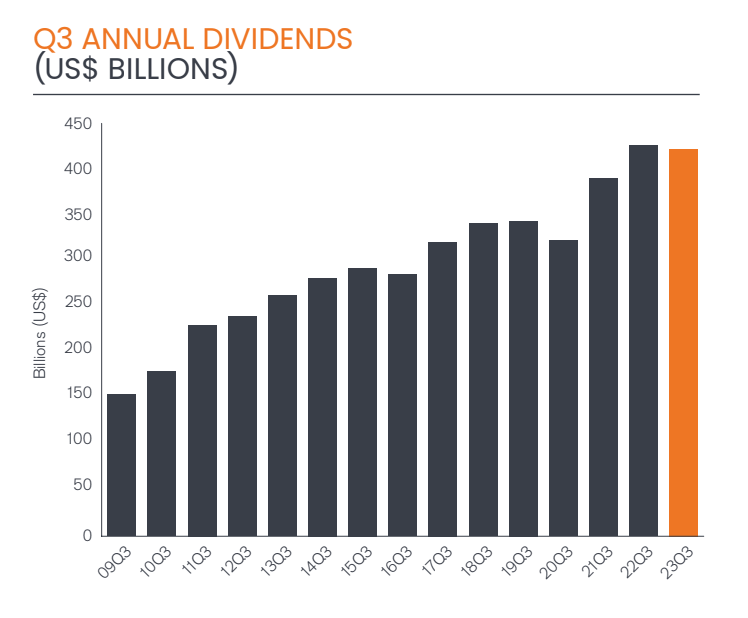

But spare a thought for income investors who just missed out on some US$4.2bn in Q3 payouts – compared to same-same last year.

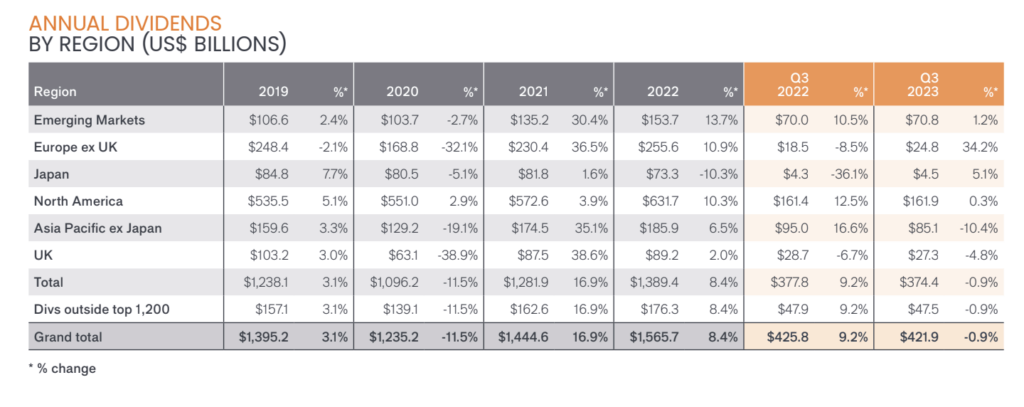

Janus Henderson says Australia’s mining sector was front and centre of the near -1% fall in global dividends over the last three months, as payouts dropped to a combined total of US$421.9 billion in Q3 2023.

BHP (ASX:BHP), the world’s largest dividend payer in 2021 and 2022, saw its final 2023 dividend cut by more than half year-on-year. Cuts at Fortescue Metals Group (ASX:FMG) and Rio Tinto (ASX:RIO) also weighed on the global reduction in dividends over the quarter.

The miners were right in the crosshairs of rising costs, slowing consumer demand and an unreliable Chinese economy. Profits are down over the past year reflecting lower realised iron ore prices.

As a result, the big iron ore miners took the axe to payouts.

Although, let’s not forget the big diggers are coming off the back of a dividend bonanza.

In the case of BHP, the FY23 payout of $6.3bn was down 51% on a year ago after the mining giant slashed its interim dividend by 40%.

In Australian dollar terms, Rio Tinto cut divvys by a full third after slashing its interim dividend by 34% compared with the previous FY.

For the second half of FY 2023, Fortescue declared a fully franked final dividend of $1.00 per share, which brought the final Fortescue dividend to $1.75 a pop, for the full down 15.5% from the $2.07 per share of a year earlier.

One-fifth of Australian companies in the index made a cut year-on-year, leading to a one-sixth decline in Australian dividends (-17.5% underlying).

However, according to the latest Janus Henderson Investors’ Global Dividend Index, Aussie miners – whose dividends are tied to the mast of the commodity cycle – made an outsized contribution to the multi-billion dollar divvy-deficit.

Although, they add “…beneath the surface, there is a growth story.”

When accounting for one-off special dividends, exchange rates and other technical factors, the JH index actually saw underlying growth of +0.3%.

Now, were you to exclude both BHP and Brazilian oil giant Petrobras from the study, then the Global Dividend Index sees an underlying growth of +5.3%, which is in line with the long-term trend.

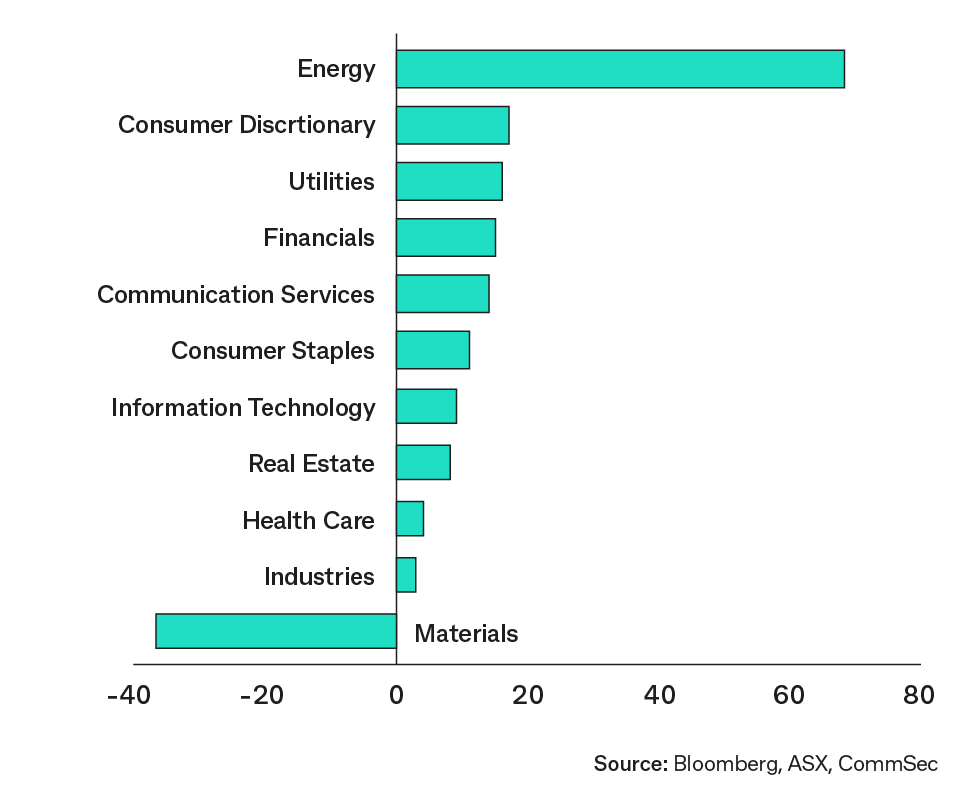

Banking, utilities, vehicles as well as most oil companies, showed strong growth, JH reports.

The cuts by more than half of mining companies globally were offset by strong banking dividends in most parts of the world (up 9.3% underlying), and by rising payouts across a wide range of other sectors, especially utilities and vehicle manufacturers.

Globally, nine companies in 10 raised payouts or held them steady, though there was wide variation across sectors and countries.

Australian banks each increased their dividends by around 14% year-on-year, and a strong contribution from the oil sector (+19% YoY) also eased some of the decline.

According to Matt Gaden, head of Australia at Janus Henderson, tougher market conditions for Australian and global miners sucked the oxygen out of what could’ve been an otherwise positive third quarter – with almost every other sector seeing dividend growth.

“Investors often seek refuge in high dividend-yielding companies or sectors such as mining and banks, but it’s not always a sure thing.

“The findings of our dividend index reinforce why global diversification is critical for Australian investors that are often dependent on dividends for income generation.

This has become ever more important as the cost of food, fuel, housing and energy soars, Gaden says.

“Investors must grasp the nuances of dividends, their advantages and the potential risks tied to high dividend-paying shares for a successful investment strategy.”

Just over $32 billion was paid to ASX investors between August and October, down 24% on a year ago. If you include dividends by major banks in early July, dividends fell 12% on a year ago to $43.6bn

Last full year, CommSec says, analysts cut dividend payout estimates at a pace not seen since 2009 (outside of COVID-19 period). In fact, forward 12-month dividend per share estimates have been cut by 14% year-over-year to September 6, 2023.

The 12-month forward estimated dividend yield for the S&P/ASX 200 index is currently 4.06%, below the long-run average near 4.7% (since 2005).

The average dividend payout ratio on the ASX benchmark index is near decade lows at 62%, compared with 72% prior to the pandemic, according to Bloomberg estimates.

CommSec says returns on Aussie shares remain attractive versus bank deposits, bonds and overseas shares with grossed-up dividend yields of around 5.7%.

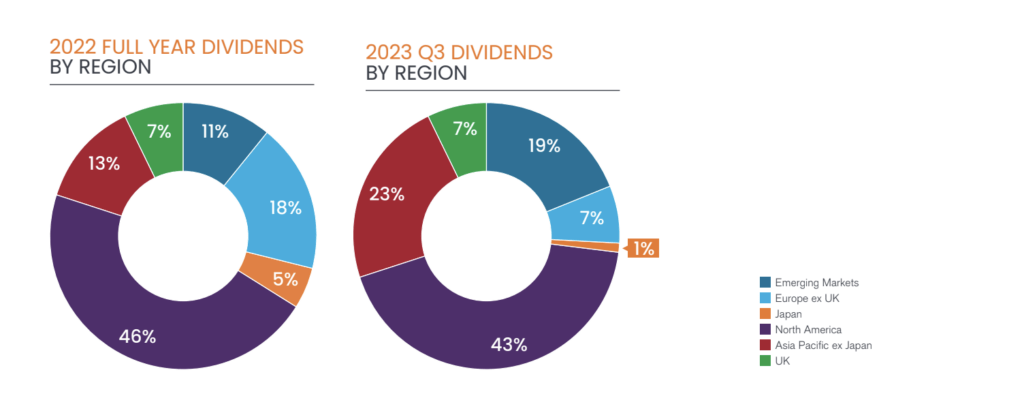

The third quarter marked a seasonal high point for China and most of Asia Pacific ex-Japan.

Chinese dividends reached a new record thanks to a large increase from PetroChina, but this also masked weakness among China’s banks and property companies, Janus reports.

A one-sixth fall in Taiwanese payouts reflected difficulties in the oil, chemicals, steel and insurance sectors. Growth in Hong Kong was held back by the property sector where every company either reduced its dividend or held it steady.

Elsewhere, US dividends grew at 4.5%, a healthy rate of growth albeit slower than preceding years/periods, and 98% of US companies either raised payouts or held them steady.

The US was outpaced by Canada which is benefiting from strength in the banking and oil sectors. Europe continued to show very strong growth, extending the pattern seen in its seasonally important second quarter.

In the UK, lower mining payouts largely balanced increases from banks, oil producers and utilities. Among emerging markets, there was a wide dispersion – China, India, Saudi Arabia and Czechia were strong, but weakness in Brazil meant payouts were down for emerging markets as a whole.

Janus Henderson’s forecast for this year has reduced slightly, reflecting lower special dividends and the strengthening dollar.

The 2023 headline forecast drops from $1.64 trillion to $1.63 trillion, an increase of 4.4% year-on-year. But underlying growth, which is unaffected by exchange rates and one-off special dividends, is stronger than expected. Moreover, several countries, including the US, France, Canada, Switzerland and China, are on track to deliver record payouts.

The global fund manager is therefore upgrading its forecast for underlying growth from 5.0% to 5.3%.

Ben Lofthouse, head of global equity income at Janus Henderson Investors, said:

“Apparent weakness in Q3’s global dividends is not a cause for concern, given the large impact a handful of companies made. In fact, the level of growth and its quality look better this year than seemed likely a few months ago as payouts have become less reliant on one-offs and volatile exchange rates.”

Dividend growth from companies generally remains strong across a wide range of sectors and regions, with the exception of commodity related sectors like mining and chemicals.

Lofthouse says it’s all quite normal that commodity dividends will rise and fall with the cycle, however, he says – this doesn’t indicate a wider malaise.

“Our figures show that a globally diversified income portfolio has natural stabilisers – sectors in the ascendance, such as banking and oil, have been able to counteract those with declining dividends, like mining and chemicals. And of course, dividends are typically much less volatile than earnings over time, providing comfort in times of economic uncertainty.”