What’s your spending? 50% of Australians don’t know how much they spent in past month

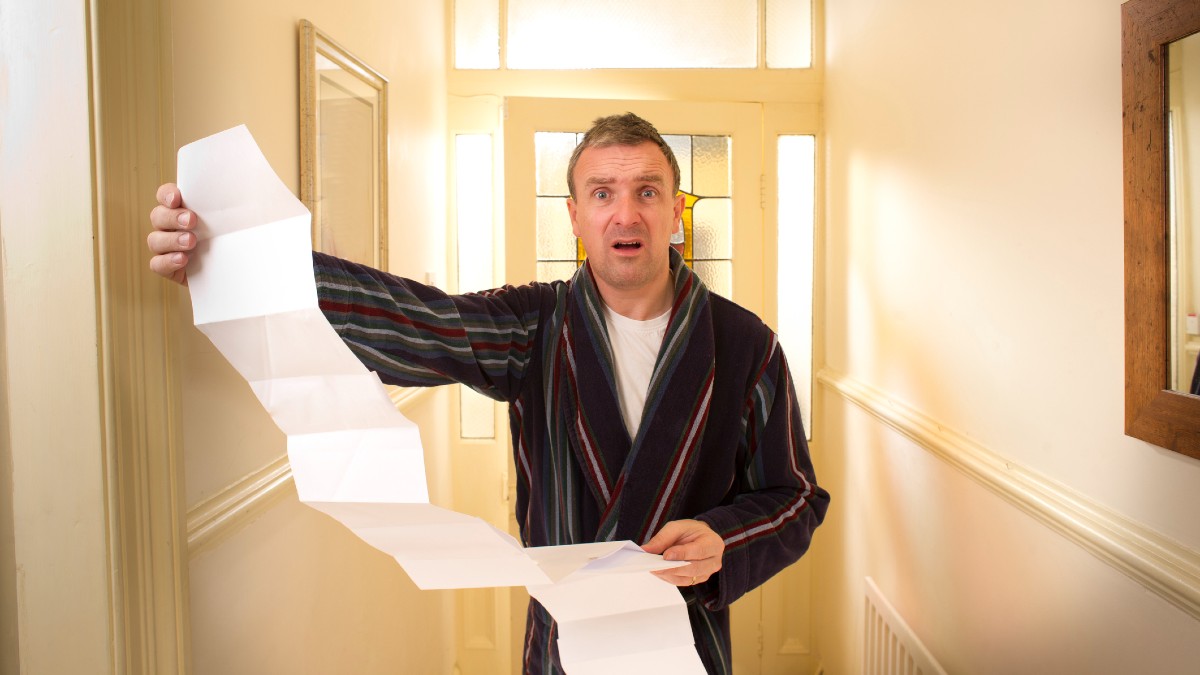

Do you know where you're spending your money? Pic: Getty Images

- Survey finds 50% of Aussies don’t know how much they spent in the past month

- Over 50s more likely to not know their credit score compared to other age groups

- Almost 25% of Aussies charged fees for late payments in 2022 such as overdrawing account

The RBA’s 10th consecutive cash rate hike to 3.6% will have many Aussies motivated to reassess their finances and work out where they can save some money.

But a new survey of an independent panel of 1,010 Australians commissioned by finance platform Money.com.au has found 50% don’t know how much they spent on general expenses and discretionary spending in the past month.

Forecasts predict a further rise on cost of living with the chances of an Australian recession not ruled out but financial pressures don’t appear to be impacting consumer spending just yet.

The survey report said this suggests consumers aren’t reviewing spending habits or looking at where to reduce costs, despite higher inflation.

The proportion remains consistent across age groups, genders, and states, indicating that this is a national sentiment towards spending and consumers may not be too bothered by rising costs at present.

Licensed financial adviser and Money.com.au spokesperson Helen Baker told Stockhead she is concerned by the lack of financial comprehension and Australians spending.

“We’ve noticed that despite the current squeeze on our finances, Aussies aren’t changing their way of living too drastically,” she said.

Baker said by not knowing how much they’re spending, and what bills need to be paid, what can be termed as ‘lifestyle creep’ can occur.

“You continue living as normal, without noticing bills and interest rates are increasing, and by the time you notice the consequences may have snowballed,” she said.

“That’s why getting ahead of the game is so important.”

Who knows their credit score? Not likely if you’re over 50

A closer look at the data reveals 2 in 3 or 67% of survey participants aged over 50 didn’t know their credit score, compared to 45% of 18-30s and 53%of 31-50s.

Money.com.au noted for anyone looking to refinance their home, which may include a lot of over-55s, credit report familiarity is crucial, as a lower credit score may mean higher interest on repayments, and therefore longer to pay off loans.

Credit scores heavily influence financial profiles of people with banks and other lenders using them to determine whether those applying for credit, including home loans, credit cards, new mobile plans, and personal loans are likely to honour repayments and credit commitments.

The higher the score, the more trustworthy the loanee appears. A lower credit score may limit financial opportunities and, while they fluctuate, it’s crucial for consumers to know their credit score so they know whether they need to improve or protect it.

“Baker said when it comes to your credit score, ignorance is very much not bliss.

“Credit scores are not final and can be improved, but it’s much better to know whether you need to explore options to improve your score ahead of applying for credit,” she said.

“This is particularly important to those applying for mortgages or trying to get a better deal on their mortgage, which I expect more homeowners will do now after the latest cash rate increase.

“If your credit score is low, lenders may not accept your application, or you’ll have to pay a premium on interest to receive these loans.”

Baker said the data may indicate a lack of understanding.

“I’ve found that many Australians don’t know their credit score because they don’t know where to check it, think it comes at a cost, or think their credit score will be impacted negatively if they do check it,” she said.

“This is not always the case, and with platforms like Money.com.au, Aussies can check their score for free, safe in the knowledge that the check will not impede their score.”

Almost 25% charged fees on late payments in last year

While fortunately the majority 79% of survey respondents read their bank statements, a concerning proportion were charged additional fees in the last year.

Nearly a quarter of respondents (23%) admitted they had been charged fees, such as overdrawing their account or missing a payment on a loan, at least once in the last year.

This percentage rises further for 18-30s, with over a third (34%) revealing they had been charged fees at least once in the last year.

Credit scores deteriorate if multiple bills are missed, and the more it happens the more problems it can cause.

Whoops the electricity has been cut

Other areas a high proportion of survey respondents (42%) are lacking awareness in is their credit card interest rate along with how much they paid in interest on their credit card (25%) and and their monthly bank account fees (27%).

And if the electricity was cut off recently there’s probably good reason with a high proportion of respondents also unfamiliar with the date they need to pay bills, particularly their electricity bills (chosen by 35%).

“I think there’s a sense that people are not adjusting to the changes in cost of living yet,” she said.

“There’s an awareness that prices are rising but Australians need to really start focusing on the details of their spending to save funds.

“By being aware of where their money is going they can look for better deals, cheaper alternatives or even put pressure on providers of different services.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.