What’s new and biblical in Cathie Wood’s ARK ETF?

Waiting on the rains. Via Getty

Such a delight to watch what Cathie Wood’s ARK Invest snaps up these days.

If you yourself are lacking in either self-belief or high-conviction but can’t afford a psychologist, then watch Wood double-down on the tech-leaning, high-growth calls that made her flagship ARK Innovation ETF (ARKK) the Love Boat of tech investing.

On a day when TSLA stock fell over 4%, Wood added over 190,000 shares worth about US$30 million, based on last night’s closing price.

Wood’s ARK Innovation ETF ARKK has Tesla as its top holding and some of the latest Elons went into her ARK Next Generation Internet ETF ARKW.

Earlier this month Wood got up in front of the doubters, as she likes to do, after TSLA dropped less than wholesome numbers and doubled down on her bullish double-downs deciding a good new price target for the stock would be around US$2,000.

By 2027.

We’ll get back to that, but in a busy week for pumping her plays, ARK added some 157,000 Coinbase (COIN) shares this week with three of ARK Invest’s funds making separate purchases of COIN shares worth a combined US$7 million.

Coinbase shares currently make up 4.74% of ARK’s combined portfolio.

The three funds’ estimated cost averages for COIN are $239.60, $254.65, and $242, all of which are appallingly higher than the prices ARK paid, with Coinbase shares around $57.00.

These purchases come as US regulators circle.

Coinbase filed a motion in court to compel the SEC to ‘please get back’ regarding an earlier Coinbase-led submission requesting guidance for the woefully unguided digital asset industry. Some observers (I met at the pub) note this is a bit like a drug addict begging for tougher drug laws.

But of course Coinbase isn’t the only stubbornly upbeat view in the Ark household tonight.

There’s always Bitcoin.

Cathie will go to bed just as bullish on the Bitcoin (BTC) story as she ever has. She slept through last year’s crypto winter, and waking up refreshed, forecast earlier in the year how BTC will shake off the cobwebs of reality itself and grow by exactly 2,000% within seven years.

Speaking of the lucky number 7…

…this week the 7th unhappy Wall Street TSLA analyst just slapped Cathie’s hombre Elon with another downgrade, post latest earnings.

On Wednesday night Sydenham time, the headline TSLA broker at Jefferies, Philippe Houchois downgraded TSLA to Hold from Buy, gutting the target price further, to US$185 from US$230 a pop.

Cathie’s not, but the street certainly seems to be, losing confidence as Tesla continues its price cuts and the CEO seems everywhere but there.

The new, newfound confidence (and angle) for ARK is Elon’s next unconfirmed moonshot – the robotaxi business backed by a bunch of AI and self-driving technology.

That’s the focus of ARK’s latest rampant optimism and typically monstrous enterprise value forecasts.

As Cathie says, Elon puts it, and therefore Cathie believes it and repeats it: “‘The autonomous ride-hail probably will be the biggest asset value increase in history.'”

So how much are we talking?

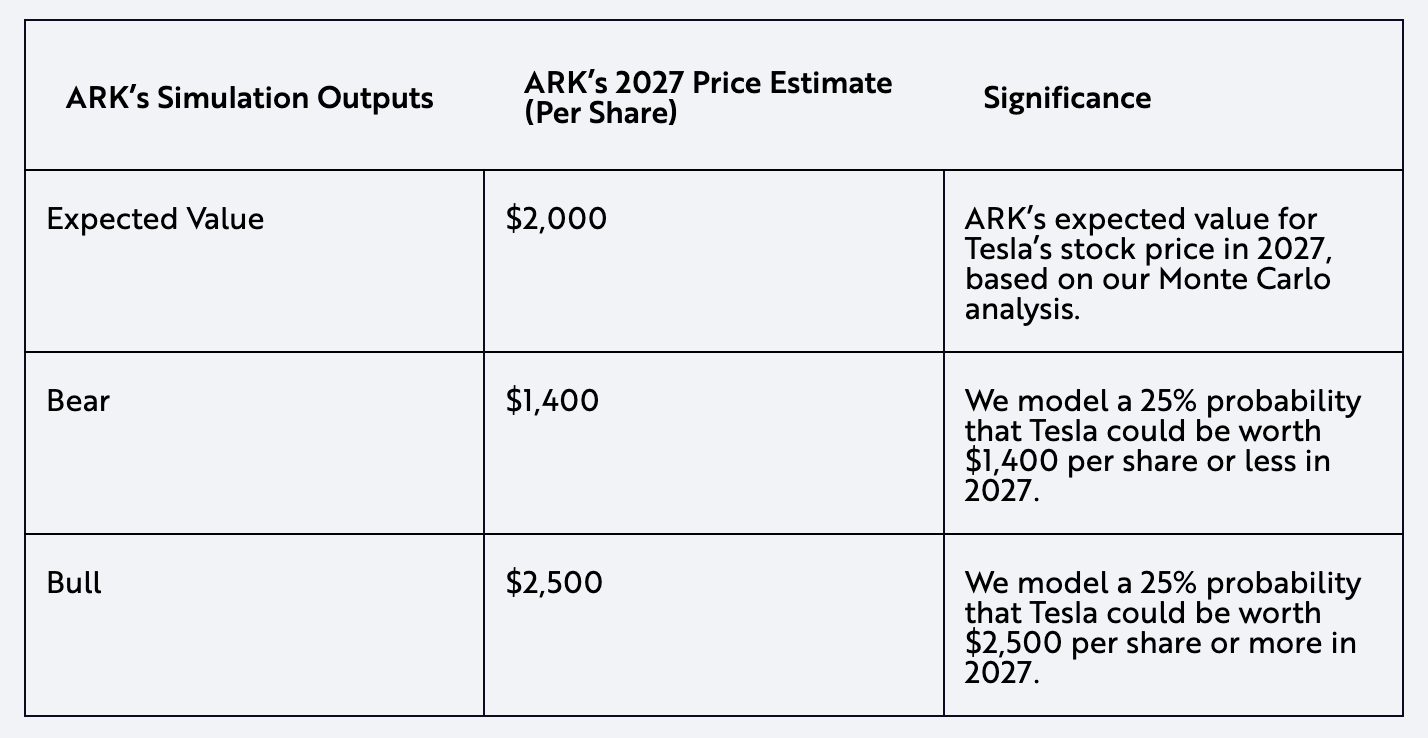

The bull and bear cases, tuned to the 75th and 25th percentile Monte Carlo outcomes, respectively, are approximately US$2,500 and US$1,400 per share, as shown below.

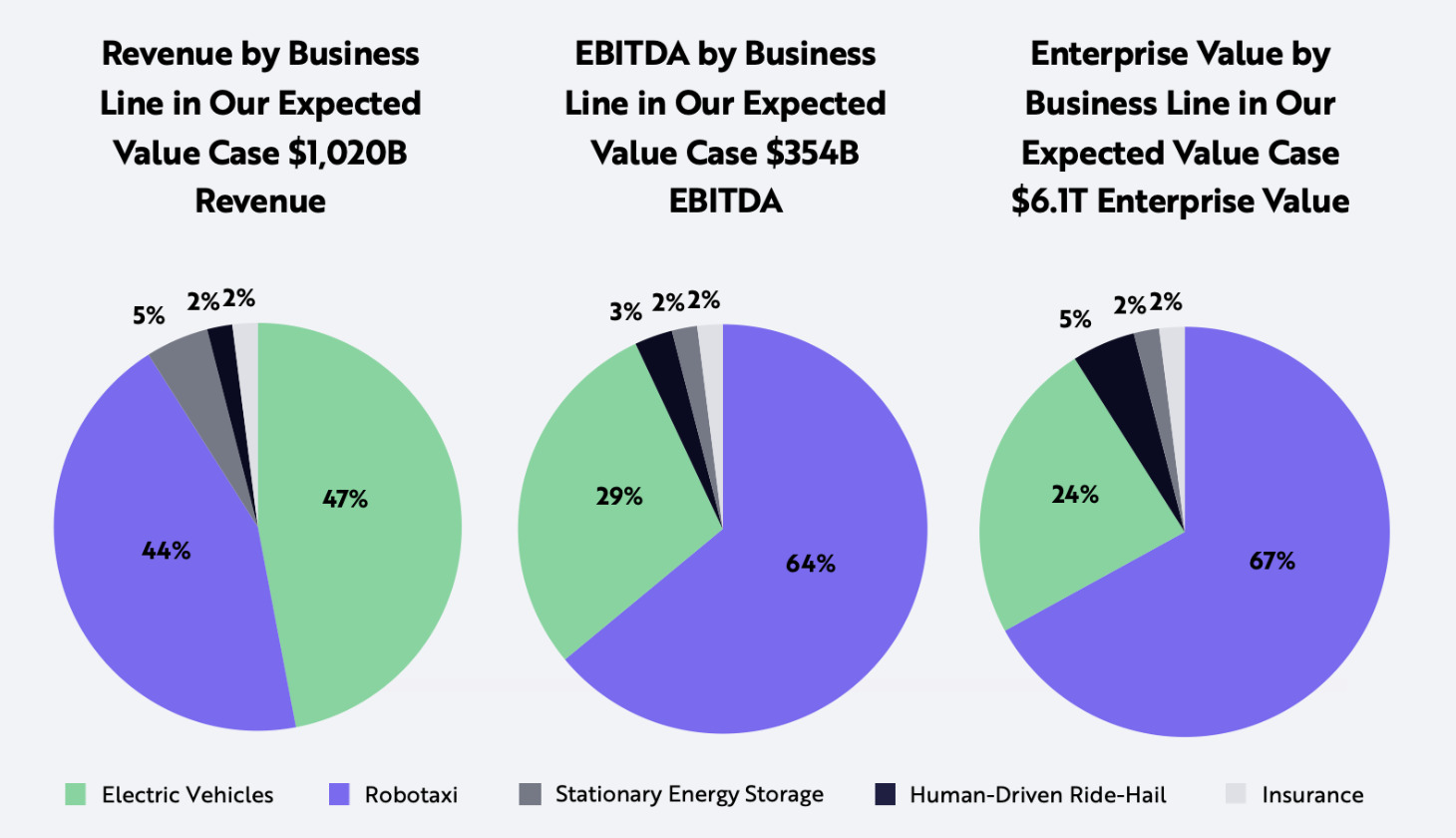

In ARK’s new bull case scenario, Tesla’s robotaxi business could bring in US$613 billion in revenue by 2027 and account for two-thirds of Tesla’s value.

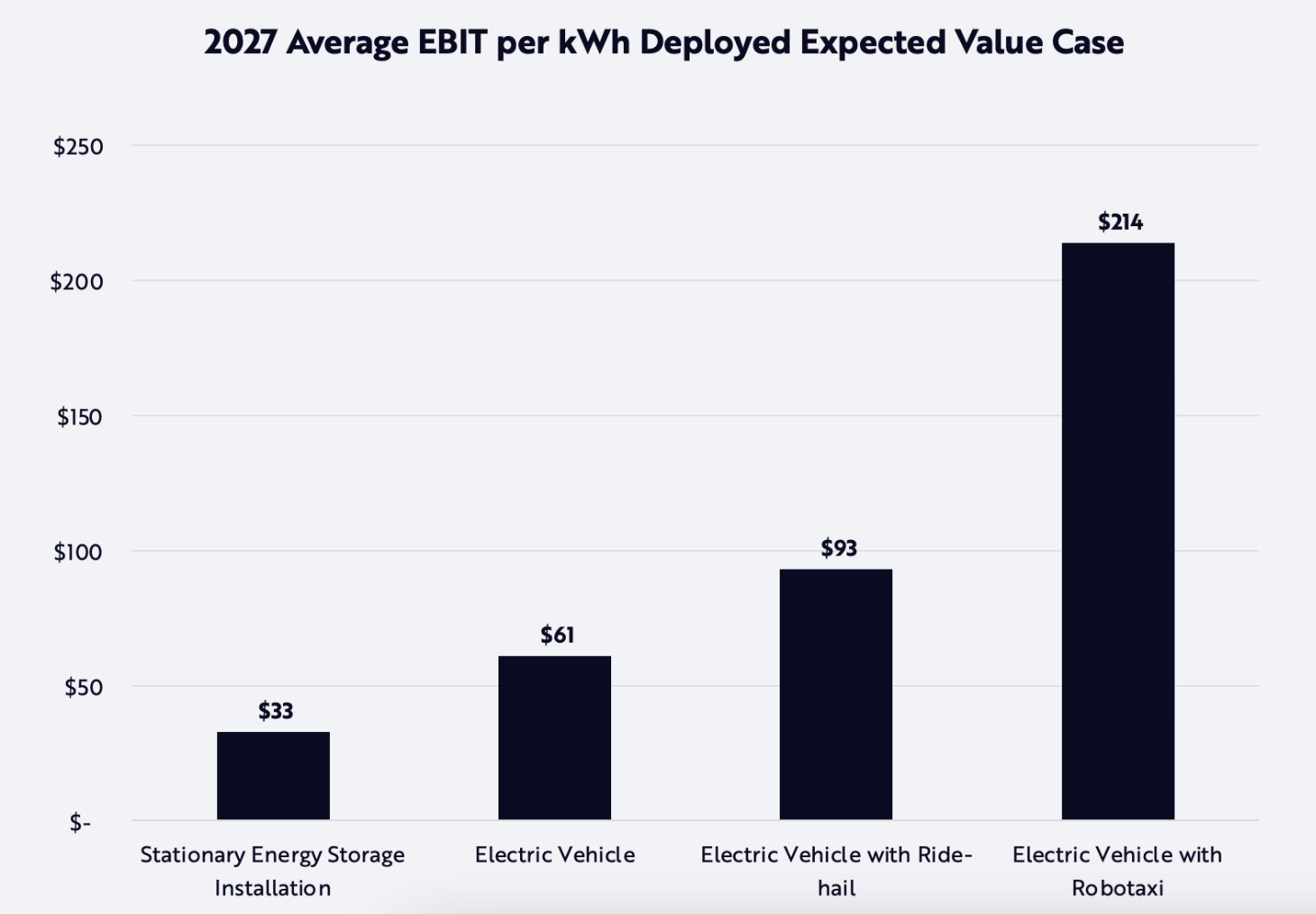

A robotaxi should provide the highest investment return on batteries for Tesla, as shown below. With a robotaxi platform, Tesla should be able to generate earnings from both the vehicle sale and a recurring ride-hail revenue stream, which ARK believes could generate software-like margins.

“Across our simulation set, electric vehicles account for 47% of revenues in 2027, at substantially lower margins than robotaxi revenue. The chart below breaks down attributable revenue, EBITDA, and value by business-line.”

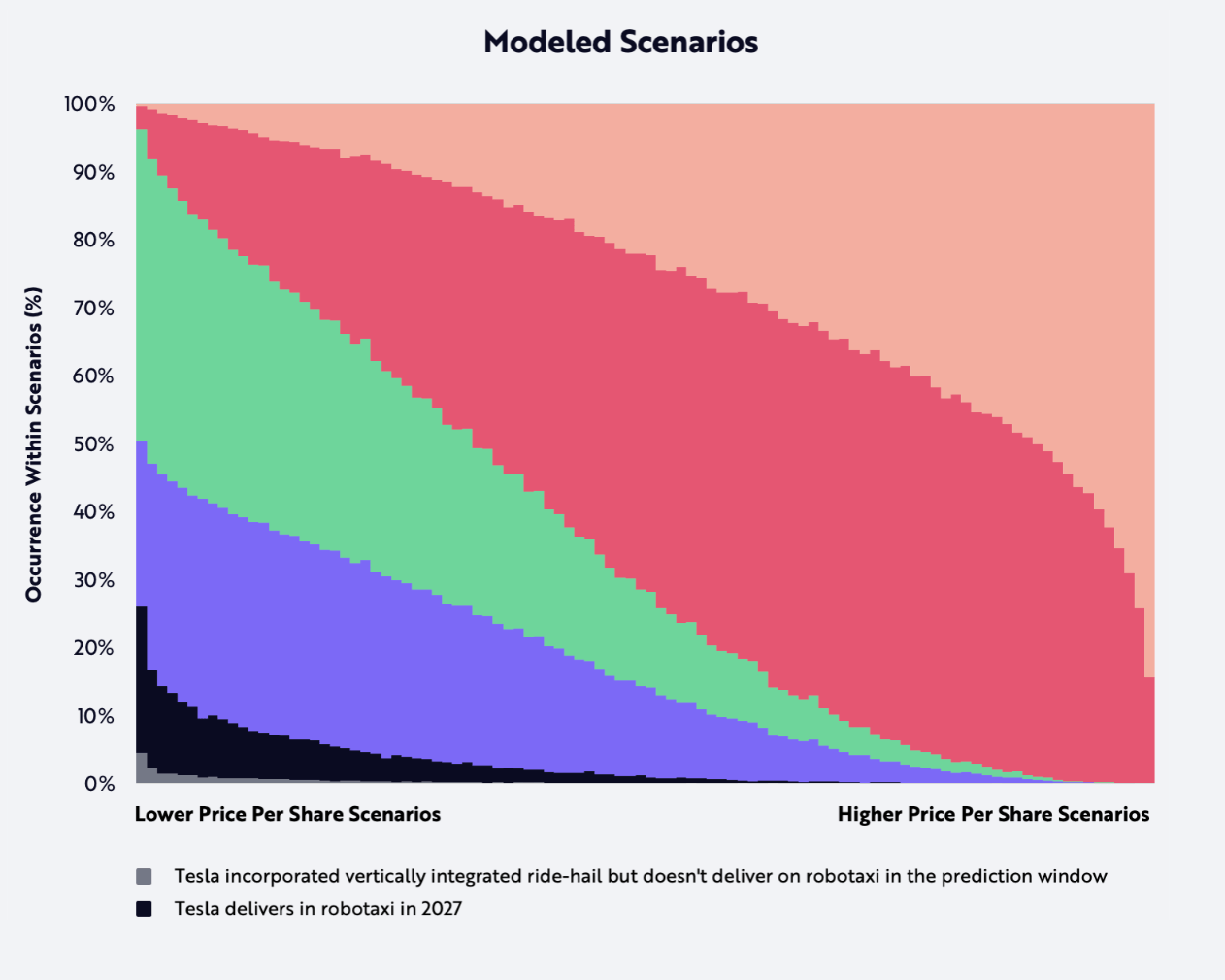

The Atari-style chart below titled “Modeled Scenarios” illustrates the mix of robotaxi and human ride-hail outcomes that corresponds with each share price represented in the next one: the “Modeled Share Price Outcomes” chart.

“In our lowest price-per-share scenarios, Tesla launches a vertically-integrated, human-driven ride-hail service but does not launch a robotaxi network — as shown in dark grey on the lower left-hand corner.” (Ed: It’s there, but very small and you might need a magnifying glass as these guys have been using throughout)

Reality bites

Never mind that Tesla hasn’t committed publicly to launching human-driven ride-hail robotaxi Teslas. Because ARK says it’s previously detailed the strategic and tactical advantages of doing so.

So it’s worth remembering that in most of these higher price-per-share scenarios, Ark just assumes Tesla gets on and launches a robotaxi network within the next 24 months. Nevertheless…

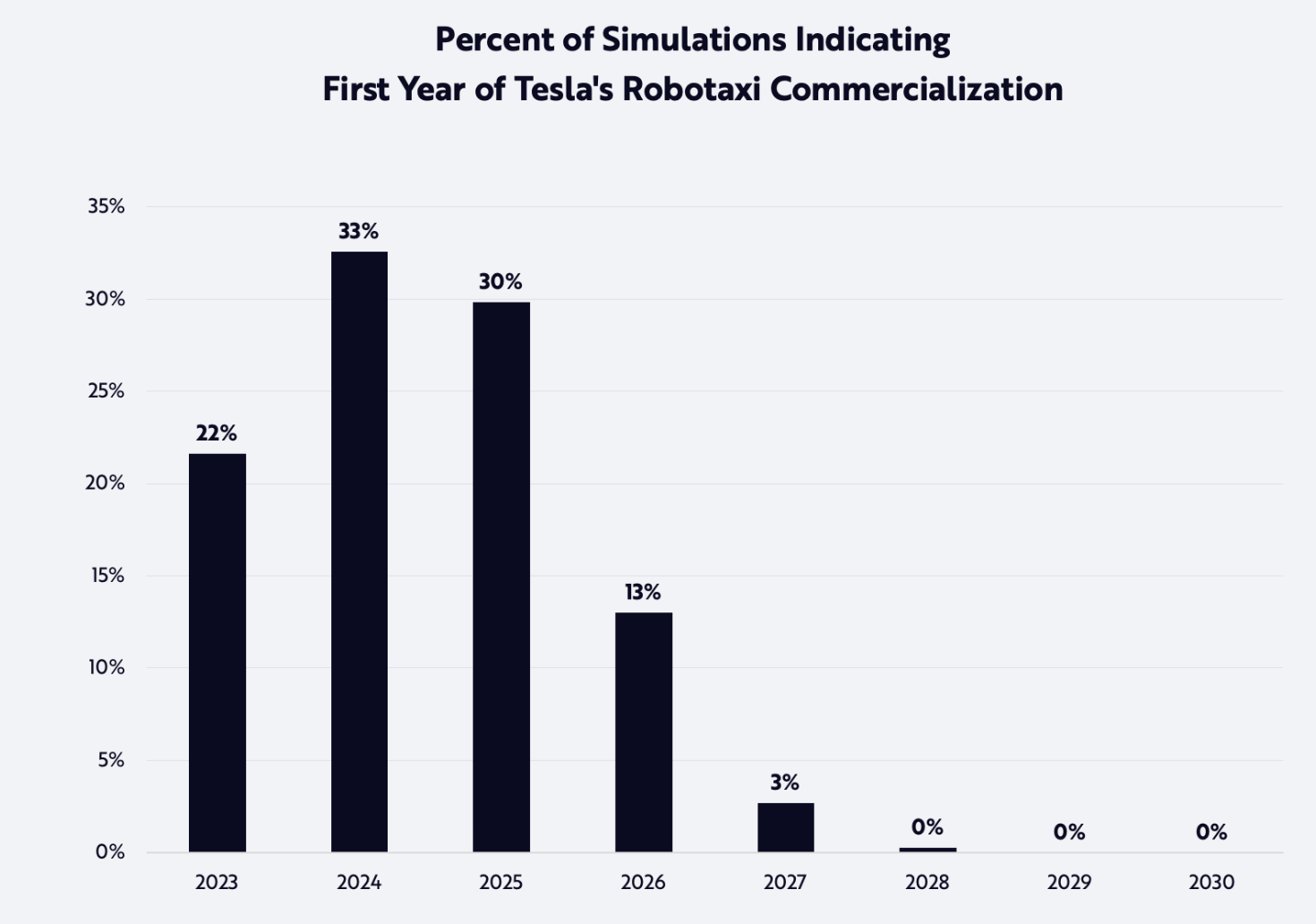

“ARK has grown increasingly confident that Tesla will launch a robotaxi service soon. Our updated Monte Carlo model includes a range of launch dates, with late 2024 as the weighted average of all cases, as shown below.”

This bull case scenario would see Tesla stock hit US$2,400 per share and the company’s market cap approach US$8 trillion.

Tesla shares closed Monday’s trading session at around US$165.50, giving the company a market cap just over half-a-trillion US dollarbucks.

That’s about half the one trillion it was worth a year ago.

Cathie’s Tesla

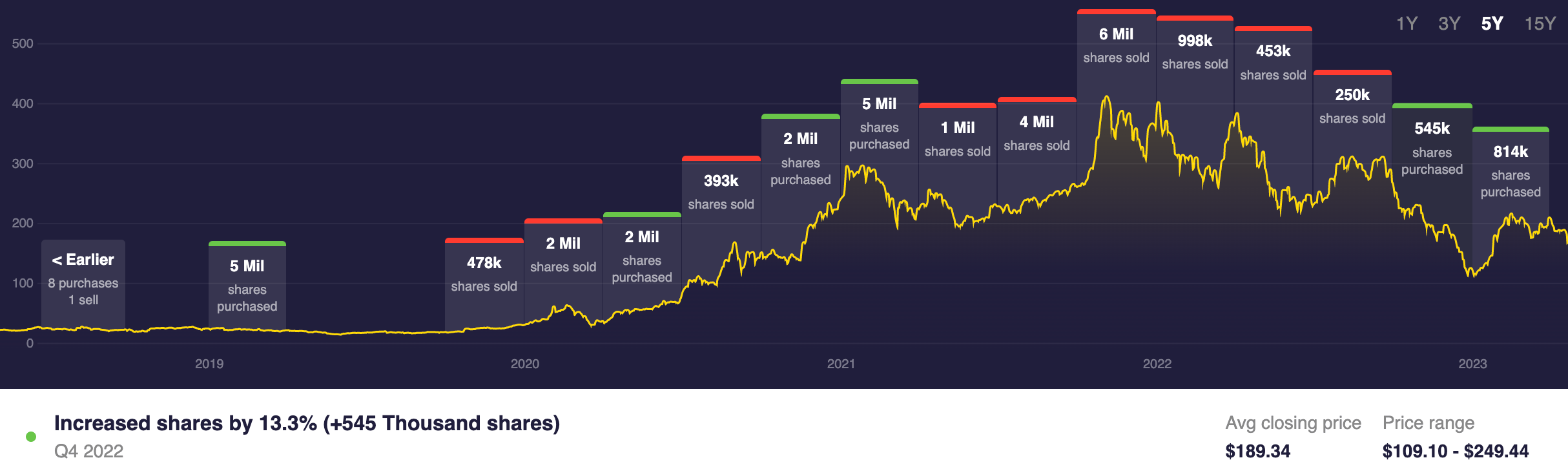

Stock holdings: 4.63 Million

Current value: US$752 Million

Total make up of portfolio: 5.39%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.