What the ETF: As gold passes US$1900, ASX Gold ETFs are back in vogue with investors

ASX gold ETFs are on the rise again

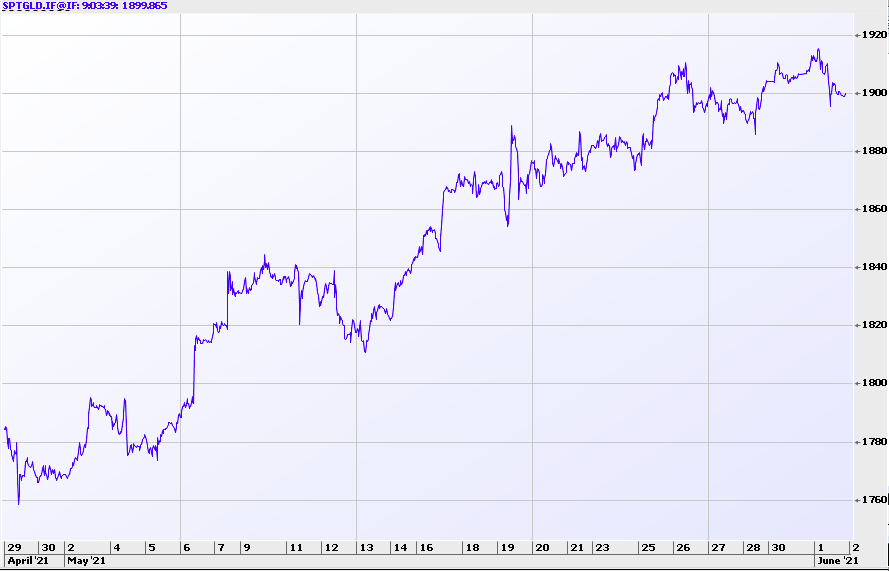

As the spot gold price continues to rise, the top two ASX ETFs in the past month are gold ETFs.

The spot gold price has teetered on US$1,900 in recent days after starting the month below US$1,800.

Analysts have credited rising inflation caused by government stimulus and gold has been perceived as a safe return in that context.

Riding the ups and downs have been the Van Eck Gold Miners ETF (ASX:GDX) and Betashares Global Gold Miners (ASX:MNRS) which gained 15 per cent and 11 per cent during the past month.

However the pair are slightly below the average ETF return in 2021, which is 7.7 per cent. Van Eck’s ETF is up 7.33 per cent while BetaShares’ ETF is up 5.47 per cent.

On a 12-month basis Van Eck is down 0.17 per cent while Betashares is up 12.64 per cent.

The top performing ASX ETF in 2021 comes in at 10th in the top 10 – BetaShares Global Banks ETF (ASX:BNKS) which has gained 28.43 per cent in 2021 and 4.78 per cent in May.

Here are the top 10 ASX ETFs in May…

| Code | Name | Price | MTD Return | YTD Return |

|---|---|---|---|---|

| GDX | VanEck Vectors Gold Miners ETF | 50.83 | +14.96% | +7.33% |

| MNRS | Betashares Global Gold Miners | 7.07 | +11.34% | +5.47% |

| NDIA | ETFS-NAM India Nifty 50 ETF | 54.38 | +7.09% | +9.56% |

| IIND | Betashares India Quality ETF | 9.55 | +6.83% | +5.18% |

| CETF | Vaneck Vectors FTSE China A50 | 73.44 | +6.57% | +5.72% |

| OZF | SPDR S&P/ASX 200 Financials Ex | 21.4 | +5.81% | +20.65% |

| QFN | BetaShares S&P/ASX Financial S | 11.94 | +5.61% | +21.33% |

| CNEW | Vaneck Vectors China New Econo | 9.42 | +5.11% | +7.67% |

| VVLU | Vanguard Global Value Equity A | 57.92 | +4.86% | +27.64% |

| BNKS | BetaShares Global Banks ETF - | 7.1 | +4.78% | +28.43% |

Taking out third and fourth position are two ETFs relating to India despite the nation being a major COVID-19 hotspot.

Namely, ETF Securities NAM India Nifty 50 ETF (ASX:NDIA) and Betashares India Quality ETF (ASX:IIND) which have gained approximately 7 per cent.

The former tracks the Nifty 50 which is India’s equivalent of the ASX 200, tracking the largest 50 companies in the Indian bourse. The Nifty 50, like its ETF, has made a gain in May as well of 6 per cent.

Betashares’ ETF however tracks 30 “high-quality” Indian companies including tech giant Infosys, carmaker Tata and Axis bank.

Both ETFs have also made healthy 12-month returns, 43 per cent and 30 per cent respectively.

China-focused ETFs took up another 2 spots in VanEck Vectors’ FTSE China A50 ETF (ASX:CETF) and Van Eck Vectors China New Economy (ASX:CNEW).

Rounding out the list of the top 10 ASX ETFs in May is VanGuard’s Global Value Equity (ASX:VVLU) and two ETFs tracking ASX financials in SPDR S&P/ASX200 Financials ETF (ASX:OZF) and BetaShares S&P Financials ETF (ASX:QFN).

Global ETF news

The ASX is far from the only exchange to have gold ETFs that have boomed.

The top Wall St gold ETFs SDPR Gold Trust (NYSEARCA:GLD) and SPDR Gold Shares (NYSE:GLD) both had positive months gaining 6 per cent.

One unique ETF to catch Stockhead’s eye was Tuttle Capital Management’s FOMO ETF which began trading this week on the Cboe Options Exchange.

As its name implies, it shifts exposure to whatever is trending at the time rebalancing every week. It will offer exposure to stocks like GME as well as crypto exposure, owning shares in Grayscale Bitcoin Trust among other crypto investments.

Yet it is not the first ETF to the party. Van Eck launched a Social Sentiment ETF back in March which offers exposure to stocks with “the most bullish investor sentiment and perception”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.