What influences ESG investing in Australia? We’re about to find out

Pic:Getty Images

- Macquarie University and trading platform moomoo to undertake study on what impacts ESG investing in Australia

- Australian research follows a US study which found ESG investing had risen significantly in recent years

- Generation X and Baby Boomers lead charge of ESG investing in US, while Millennials, Gen Y and Z are laggards

ESG or Sustainable, Responsible, and Impact-based (SRI) investing, which prioritises both financial returns and social change, has been gaining popularity among investors in recent years amid a global shift towards more socially conscious behaviour of business.

We may soon find out just how important ESG investing in Australia is with Macquarie Business School at Macquarie University and Futu Securities’ global online trading platform moomoo joining forces for a national study.

The industry-first study will investigate how sustainable trading education and transparency of company social responsibility credentials impact Australian investor behaviour.

The study will monitor the behaviour of multiple groups of investors to understand how Macquarie Business School research and exposure to a company’s ESG score influences a person’s decision to invest.

Macquarie Business School Professor Tom Smith said it is still unclear to what extent the social responsibility of an organisation influences Australian retail investors.

“We have a good understanding of the importance of a company’s financial performance in investor decisions, but we don’t yet have enough information in Australia to truly understand the role a company’s ESG performance plays in the decision process,” said Smith.

Participants will trade ASX and US stocks over a three-month period using moomoo’s simulated trading environment. Macquarie Business School researchers will examine several cohorts of investors with varying levels of intervention relating to access to information on an organisation’s social impact and training sessions around socially responsible investing (SRI).

“This study will help us better understand the drivers and barriers affecting socially-conscious investor behaviour – and shed insight on how decisions change when investors have greater transparency around where their money is really going,” said Smith.

Vice president and chief market strategist for moomoo Matt Wilson told Stockhead the platform’s investment and analysis tools will provide insightful and real-time data to support Macquarie in understanding the impacts of ESG reporting in a simulated trading environment.

He said moomoo wants to better understand what influences investor behaviour decisions, and whether an organisation’s socially responsible activity needs to be more accessible to investors.

“There has been very little work done on ESG investing in Australia and investment behaviour around ESG in particular,” Wilson said.

Founded in Silicon Valley, moomoo’s Hong Kong-based parent company is Futu Holdings (Nasdaq:FUTU).

“We like to think of ourselves as having a strong commitment to responsible investing and jumped at the opportunity to partner with Macquarie to do what is an Australian-first study.”

Will ESG investing in Australia follow US results?

Moomoo has already undertaken research on US trading behaviours around ESG with more than 100,000 participants with key findings including:

- In the past two years, the proportion of investors trading and holding ESG-focussed stocks has trended up each quarter, especially over the last three quarters

- Over the last two years, the number of investors holding ESG stocks increased at more than twice the rate of investors overall

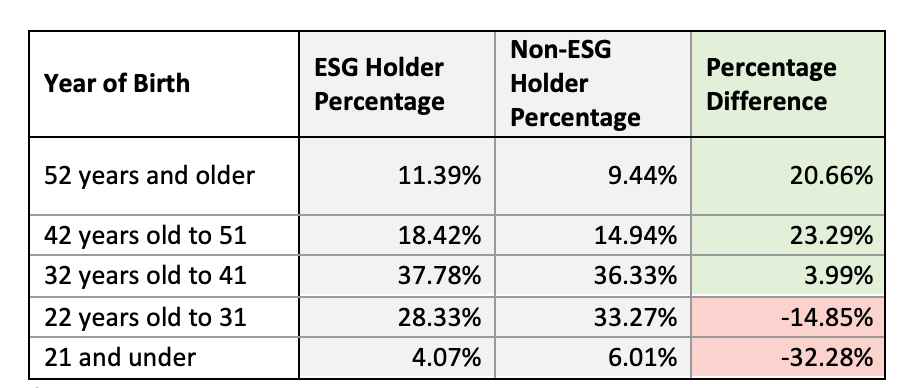

- Older investors have demonstrated a higher propensity to invest in ESG stocks than younger investors

- Defence workers led the way on ESG investing, closely followed by real estate industry workers, those in health care and then telecommunications.

- Conversely, workers in sales, mining and media were the least likely to invest in ESG stocks

- California was the most progressive US state when it comes to investing in ESG stocks, followed by New York, New Jersey, and Washington

- Proportion of investors trading and holding ESG stocks has trended up each quarter, despite these stocks underperforming in general against three major indexes (trailing by 11%)

In the last two years, the traded-value of ESG is stocks is:

- Almost nine times higher than two years ago, rising from US$374m to US$38m

- Has increased at almost three times the rate of non-ESG stocks

“What stood out to me is the price performance of ESG stocks over the past couple of years has under-performed the wider market,” Wilson said.

“There’s a lot of different studies concerning ESG versus non-ESG investing and over the years it has proven to be stronger but the last couple of years it has fallen behind.

“But in spite of the recent underperformance people are still increasing their exposure to ESG stocks which I think says a lot that it’s more important to them than the actual financial performance, which is still ok but maybe just not as good as it has been.”

ESG price performance VS Index

Generation X and Baby Boomers distinctly led the charge in ESG investing in the US as opposed to Millennials, Gen Y and Z.

“The Millennials, Gen Y and Z talk a big game when it comes to saving the planet but they’re not leading with their wallet and that was a big standout in the US,” Wilson said.

“Maybe Baby Boomers tend to have bigger portfolios, maybe they have a longer-term horizons or perhaps they see the positive investment returns whilst doing good for the world.

“I’m not sure we can draw too many conclusions but it stood out given the rhetoric around doing the right thing by the world.”

The study will run for three months with analysis and results to follow early next year. In July, moomoo released another study into trading retail investor trading behaviour and investment strategy in response to heightened market volatility.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.