Hebe says: Let’s slam the door on 2022 and wake up refreshed to a new year of opportunity

Via Getty

So many billions in equities made and lost, bond markets turned upside-down, USD smashed currencies left everywhere and China-cooled commodities treading water…

And we’d certainly be remiss not to mention the self-immolation of the occasional crypto fortune – yep, 2022 has been right up there for tricky and fickle trade.

As James Whelan, Josh Chiat and now from down in sub-glorious Melbourne*, IG Markets’ market analyst Hebe Chen, have told me in the last 49.5 hours – that 2022 was a tale of two halves for markets.

We survived a brutal decline in H1 followed by a meritorious recovery in H2.

The ASX can take its hat off now, rest a few days… maybe have that well deserved heart attack we’ve been expecting and get back to business in the New Year.

Because wile Australian markets are down 3.45% in the last 12 months, the combined world indices are short about 18%, according to Goldman Sachs.

The inherent defensiveness of the ASX and its relativity to a reopening China is back attracting global funds which have begun moving back into our US$2.5 trillion dollar, resources-heavy Top 200 index.

“The ASX200 faired better than most however it’s certainly been a tougher period overall, one of significant change at the macro-economic level and one that no doubt has tested us all in various ways,” James Whelan told me.

Tallying the final numbers is useful but doesn’t even come close to telling the whole story.

Yes, global equities are down $14 trillion and heading for their second worst year on record, but there have been nearly 300 interest rate hikes and a trio of 10%-plus rallies in that time making the volatility freakish.

US Treasuries and German bonds, the benchmarks of global borrowing markets and traditional go-to assets in troubled times, lost 16% and 24% respectively in dollar terms.

And so with the year coming to a close and a new chapter just round the corner, Stockhead asked Hebe Chen to take us all for one more spin around 2022 and give us a peek at her idea of 2023.

What just happened, Hebe?

“Well, there’s no denying 2022’s been a fairly unpleasant year for most of us – a year of of decades-high inflation and seemingly non-stop rate hikes.

“With no exception to the previous rate-rising periods, Australia’s stock market has gone through a turbulent time. In June, the benchmark index tumbled into the correction zone for the first time in two years, which is defined by a 10% drop from the recent peak.”

Nevertheless, Hebe notes that the local benchmark index still enjoyed monthly gains for the majority of the time (check out Hebe’s monthly chart below).

“By the end of November, the index has pared more than half of the loss and sat only 3% below the level where the year started.”

Volatile enough for ya?

According to IG Markets, the primary drivers remained a consistent thematic throughout the year.

“Namely, the rapid change in global monetary policies and a cloudy economic outlook, threatened by global forces unique to 2022.”

The main drivers have been the war in Ukraine, combined with rampant inflation as global economies broke out of the pandemic, but China remained shackled by it.

“Since May, the Reserve Bank of Australia has delivered 275 basis points of rate hikes, including a record consecutive run of four 50 basis-point increases, taking borrowing costs to a level not seen since April 2013. The tightening journey that Australian people have experienced this year is the fastest pace since 1994,” Hebe said.

“At home, the macro themes above were compounded by soaring costs, floods in Eastern Australia, multiple Covid-19 waves, supply-chain challenges, labour shortage and housing cycle fluctuations continue to weigh on the ASX investor’s confidence over the local economy.

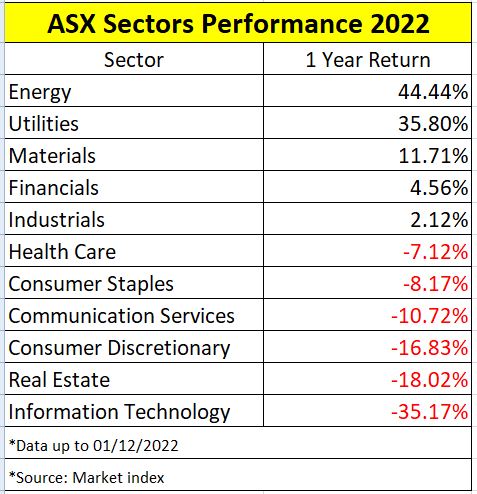

As such, the performance of each ASX sector varied widely, Hebe says.

“Energy, utilities and material sectors have benefitted the most from robust demand and higher price as the Ukraine war boosted the demand for Australian exports. Mining companies, in particular, are seeing their earnings and profits rising to a record level. On the other hand, the information and real estate sector are the first-row victims hammered by the higher interest rates.”

ASX 2023 Outlook

“Looking ahead, it is foreseeable that the headwinds and issues dominated over the past six months will continue to be concerns for investors,” IG’s Sydney-based market analyst Tony Sycamore told Stockhead.

“The rising inflation, despite an early sign of cooling starting to surface, is still a long distance away from the ideal territory. Australia’s consumer prices index increased 7.3% in the third quarter and is expected to peak at around 8% by the end of 2022, based on RBA’s recent forecast.

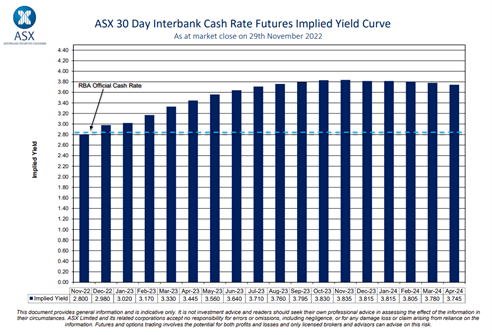

“With that in mind, there’s no doubt that the interest rate will continue rising towards and potentially surpass the decade-high level. Based on the future market’s prediction, the third quarter of 2023 will see the interest peak at around 3.8%.”

ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve

However, Hebe says that once everyone’s digested their fill of Turkey, lobster, candy and family, the months awaiting us in the new calendar might prove decisive.

“We will soon have the opportunity to see the inception point finally arrive for the trajectory of local monetary policy.”

“Even with the absence of the first rate-cut to occur, the pause of the current tightening journey is likely to reignite the risk appetite for Australian equities.

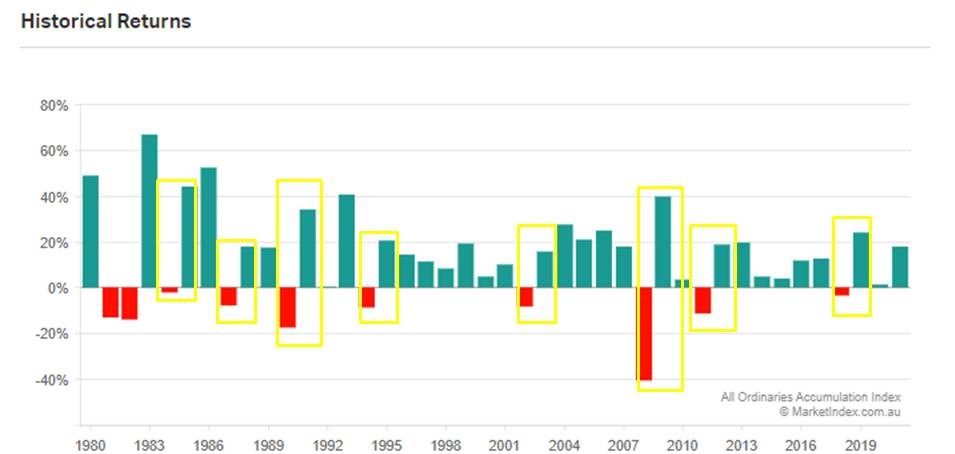

During the past 40 years, the Australian share market has shown a strong pattern of outperforming with a double-digit rebound following a year of decline. The only exception Tony says was during the recession in 1982-1983, but the stock market then made a record 60% jump in the following year.

ASX historical returns

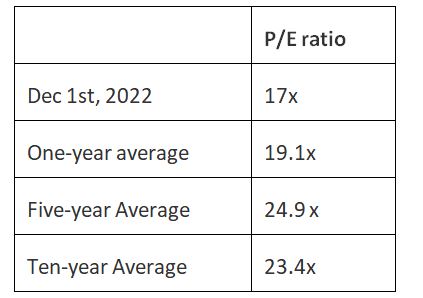

Aside from the arc of monetary policies, attractive valuations are another source of optimism for Hebe in 2023.

“The Aussie sharemarket’s valuation has become much more appealing today compared to a year ago, with the Price to Earnings (P/E) ratio is now below the five and ten-year average.”

All Ords P/E Ratio Dec 1st

Put this under the tree

“Overall, it’s foreseeable that the year and months ahead will have no shortage of challenges and headwinds,” Hebe says, but with this rider…

“However, with the potential slowdown in monetary tightening and the cooling of inflation, some of the forces that have been dragging on shares in 2022, now stand a good chance of easing, releasing some of the 2022 pressure and with the likelihood of generating some real investment opportunities.”

“Merry Christmas to all!”

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.