Weekly Small Cap and IPO Wrap: War and metal has emerging companies up 2pc this week, 10pc over the past month

Metallica, 1985. (Photo by Fin Costello/Redferns/ getty Images)

- The Emerging Companies Index (XEC) is 2% up for the week

- On light Friday trade the XJO is tracking higher for the 10th time in 14 sessions

- Metgasco (ASX:MEL), Imricor Medical Systems (ASX:IMR) among week’s best small cap gainers

Flat today, maybe even a little down, but the Emerging Companies Index (XEC) is still 2% healthier for the week and up 10% for the month.

On some light Friday trade, the ASX200 is quietly on its way to 10th positive closure out of the last 14 sessions, thanks in part to Wall Street ending at a new four week high overnight.

The benchmark is up 1.6% for the week and over 6% for the last month. Investors have adapted quickly to a very different trading landscape featuring the shadow of rising interest rates, geopolitical turmoil and incredibly volatile commodity prices.

There’s also an historically hefty volume of dividends in the post for the next few weeks.

War and metal

The war and geopolitics continue to make markets a volatile, tunny turning place to be. Commodities, energy and metals have been loopy and markets this week followed.

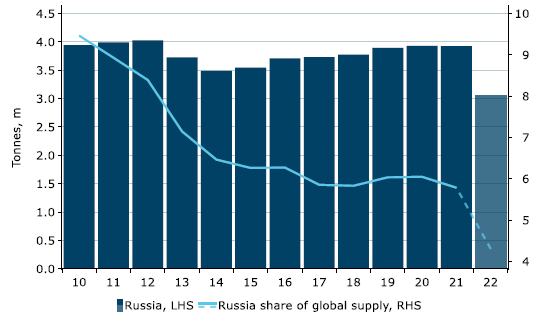

ANZ’s Daniel Hynes reckons we’re getting nearer the pointy bit too: now Russia is facing a raw material squeeze in the aluminium market.

The alumina and bauxite disruptions caused by Russia’s own hand in Ukraine, come amid record high energy prices. Hynes says this threatens to constrain aluminium supply in an already tight market.

So far US President Joe Biden has kept the powder dry by holding off sanctions on aluminium.

Russian aluminium supply to crash as inputs evaporate

Russia’s largest, naughtiest manufacturer, Rusal, was unsurprisingly forced to shutter its alumina refinery in Ukraine, and then this week Mr Morrison decided to ban alumina exports to Russia, ensuring mining giant Rio Tinto halted bauxite supply to Rusal’s Aughinish refinery in Ireland.

Rusal is running out of options and supply is vanishing amid record high prices.

“As a result, aluminium buyers will scramble to secure supply amid low inventories and strong demand. The upside pressure on prices is likely to remain for the foreseeable future,” Hynes said.

Next week

Looking ahead, well, The Fed does keep warning anyone that will listen that it is time for the big boys to shirtfront this whole inflation business.

And frankly, it will need to get down to business.

The coming week includes likely higher inflation reads and a lower unemployment rate is expected out of the Eurozone. There’s employment numbers from the states, the combination of these if not to expected settings, may set traders off ahead of central banks.

Undoubtedly, the highlight of the week at home will be the Federal Budget launch circa 7.30pm (AEDT), next Tuesday in Canberra. Because I will be at home watching Derry Girls and not getting locked in to pour over an encyclopeadic volume of numbers like so many wonderful journalists will be.

Elsewhere, we’ll get retail trade and job vacancies.

A bit of credit growth, dwelling prices and new housing lending data.

But Derry Girls. That’s your weekend.

How did this week’s IPOs perform?

Pinnacle Minerals (ASX:PIM) listed Thursday and ended 5% higher, after raising $4.5m at 20c a pop in a “heavily oversubscribed” IPO.

The kaolin play’s main focus is the Bobalong kaolin clay project near Albany in southern WA, where it has more than 115km2 of granted tenements and is targeting a ~10Mt resource. That’s possibly enough to support a 350,000tpa operation until 2052.

Executive director Robert Hodby says high-grades and brightness levels will support a direct shipping ore operation with minimal benefication, while drilling campaigns and a scoping study are done and dusted over at Bill’s Middle and the Tambellup East tenements.

Pinnacle is hoping to generate early cashflows to support exploration at its nearby Holly project, where Rio Tinto hit kaolin in historical drilling, and the Camel Lake and White Knight projects in South Australia.

At 3.30pm Sydney time, the stock was up over 4% for the day, to 24 cents.

Also joining the boards this week was Norfolk Metals (ASX:NFL) – an exploration firm which lays claim to the Roger River Gold Project and the Orroroo Uranium digs. NFL joined the lists on $5.5 million raised in an IPO at 20 cents a share.

The stock has had a volatile week jumping to 26 cent highs and since eased lower, and is trading up about 10% from its listing price.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for March 21 – March 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % WEEK | MARKET CAP |

|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0025 | 150.0% | $45,866,882 |

| IMR | Imricor Med Sys | 0.7 | 89.2% | $73,079,908 |

| ZNO | Zoono Group Ltd | 0.315 | 80.0% | $47,427,336 |

| IPB | IPB Petroleum Ltd | 0.021 | 75.0% | $5,389,678 |

| RGL | Riversgold | 0.061 | 69.4% | $28,808,085 |

| ARL | Ardea Resources Ltd | 1.62 | 67.0% | $280,585,013 |

| WNX | Wellnex Life Ltd | 0.135 | 64.6% | $36,396,698 |

| ECT | Env Clean Tech Ltd. | 0.037 | 60.9% | $60,433,815 |

| CLA | Celsius Resource Ltd | 0.03 | 57.9% | $34,201,042 |

| ICG | Inca Minerals Ltd | 0.15 | 57.9% | $67,369,631 |

| KLI | Killiresources | 0.41 | 57.7% | $13,860,000 |

| NC1 | Nicoresourceslimited | 1.065 | 55.5% | $87,250,002 |

| GFN | Gefen Int | 0.3 | 50.0% | $15,547,091 |

| KEY | KEY Petroleum | 0.003 | 50.0% | $5,903,784 |

| MAN | Mandrake Res Ltd | 0.066 | 50.0% | $22,655,789 |

| PBX | Pacific Bauxite Ltd | 0.15 | 50.0% | $1,189,876 |

| WOO | Wooboard Tech Ltd | 0.0015 | 50.0% | $3,822,163 |

| MEL | Metgasco Ltd | 0.043 | 48.3% | $39,003,602 |

| BNR | Bulletin Res Ltd | 0.205 | 46.4% | $60,807,581 |

| MPG | Manypeaksgoldlimited | 0.34 | 44.7% | $11,235,700 |

| BTN | Butn Limited | 0.3 | 42.9% | $20,364,890 |

| ICN | Icon Energy Limited | 0.02 | 42.9% | $14,340,516 |

| AGH | Althea Group | 0.2 | 42.9% | $63,105,579 |

| LRS | Latin Resources Ltd | 0.074 | 42.3% | $109,889,424 |

| LSA | Lachlan Star Ltd | 0.027 | 42.1% | $34,294,330 |

| BKY | Berkeley Energia Ltd | 0.5675 | 41.9% | $249,646,160 |

| VRC | Volt Resources Ltd | 0.017 | 41.7% | $45,818,456 |

| ABX | ABX Group Limited | 0.19 | 40.7% | $43,600,209 |

| EUR | European Lithium Ltd | 0.14 | 40.0% | $155,504,394 |

| BDX | Bcaldiagnostics | 0.13 | 39.8% | $17,104,368 |

| BLU | Blue Energy Limited | 0.082 | 39.0% | $136,011,125 |

| BMM | Balkanminingandmin | 0.36 | 38.5% | $10,807,500 |

| MIO | Macarthur Minerals | 0.565 | 37.8% | $85,994,558 |

| GTR | Gti Resources | 0.03 | 36.4% | $36,120,999 |

| BIR | BIR Financial Ltd | 0.034 | 36.0% | $4,693,085 |

| MTM | Mtmongerresources | 0.19 | 35.7% | $5,892,206 |

| QPM | Queensland Pacific | 0.19 | 35.7% | $285,475,929 |

| MCA | Murray Cod Aust Ltd | 0.25 | 35.1% | $179,834,546 |

Metgasco (ASX:MEL) had a cracking week.

They hit a major milestone with the ATP 2021 joint venture executing a definitive gas sales agreement with everyone’s fav AGL Wholesale Gas.

Cash flow from the sale of gas could begin by the middle of this year, but the share price isn’t waiting.

MEL is up about 50% and not just ‘cos AGL is buying the entire production of the Vali field from field start-up through to the end of 2026. The firm holds 25% of ATP 2021, and reckons production is close on completion of the field’s three wells and connection to the close by Moomba gas hub.

MD Ken Aitken said the deal is a significant milestone for Metgasco, and will see the company’s transition into a bone fide gas producer by the middle of the year.

Things at Sanitiser maker Zoono Group (ASX: ZNO), have been mysteriously terrific this week as well.

The group, responding to a speeding ticket on the exchange yesterday told the ASX it is ‘not aware of any information concerning it that has not been announced to the market which, if known by some in the market, could explain the recent trading in securities.’

ZNO believes the recent share price appreciation – it’s ahead this week about 80% – ‘is a recovery to the market price that existed in late January 2022.’

Back when life was a bit more Omicrony than now – altho0ugh there’s the rub – maybe the bug is back, and we just don’t know it yet.

For me, the standout Charlie Sheen stock of the week was Cardiac ablation specialist Imricor Medical Systems (ASX:IMR).

Now, while I haven’t unlocked the secret to its success – gaining about 60% since yesterday and some 89% for the week – I can tell you that Ablation is a procedure to treat atrial fibrillation. The good folks at the University of Utah hospital I Googled, say they uses small burns or freezes to cause some scarring on the inside of the heart to help break up the electrical signals that cause irregular heartbeats. This can help the heart maintain a normal heart rhythm.

ASX SMALL CAP LOSERS:

Here are the worst performing ASX small cap stocks for March 21 – March 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % WEEK | MARKET CAP |

|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.07 | -64.1% | $18,523,838 |

| BAS | Bass Oil Ltd | 0.002 | -33.3% | $9,225,363 |

| EVE | EVE Health Group Ltd | 0.002 | -33.3% | $8,619,617 |

| RAB | Adrabbit Limited | 0.016 | -33.3% | $3,158,625 |

| OXX | Octanex Ltd | 0.019 | -29.6% | $5,956,487 |

| SIS | Simble Solutions | 0.018 | -28.0% | $6,945,853 |

| UUL | Ultima Utd Ltd | 0.245 | -27.9% | $17,960,343 |

| IEC | Intra Energy Corp | 0.015 | -25.0% | $11,129,831 |

| MOQ | MOQ Limited | 0.05 | -24.2% | $9,527,821 |

| SIH | Sihayo Gold Limited | 0.005 | -23.1% | $18,427,307 |

| TYX | Tyranna Res Ltd | 0.005 | -23.1% | $6,411,803 |

| ABV | Adv Braking Tech Ltd | 0.031 | -22.5% | $12,132,761 |

| BEX | Bikeexchange Ltd | 0.062 | -22.5% | $10,054,268 |

| OAU | Ora Gold Limited | 0.014 | -22.2% | $13,754,238 |

| GO2 | Thego2People | 0.022 | -21.4% | $8,946,042 |

| AAP | Australian Agri Ltd | 0.019 | -20.8% | $5,796,890 |

| AIR | Astivita Ltd | 0.57 | -20.8% | $14,159,925 |

| 88E | 88 Energy Ltd | 0.0335 | -20.2% | $540,097,052 |

| TTA | TTA Holdings Ltd | 0.036 | -20.0% | $4,947,243 |

| SLM | Solismineralsltd | 0.17 | -19.0% | $6,312,785 |

| NRX | Noronex Limited | 0.06 | -18.9% | $11,063,636 |

| REY | REY Resources Ltd | 0.13 | -18.8% | $30,729,493 |

| MAY | Melbana Energy Ltd | 0.155 | -18.4% | $447,712,507 |

| CTT | Cettire | 1.305 | -16.9% | $487,984,922 |

| AFW | Applyflow Limited | 0.0025 | -16.7% | $7,394,020 |

| ARO | Astro Resources NL | 0.005 | -16.7% | $23,526,206 |

| CXU | Cauldron Energy Ltd | 0.015 | -16.7% | $8,298,875 |

| DCX | Discovex Res Ltd | 0.0075 | -16.7% | $17,980,649 |

Something happened on the way to Alaska for 88Energy (ASX:88E). On Wednesday Managing Director Ashley Gilbert said new results from the Merlin-2 well were bloody encouraging:

“Initial indications are that all three target reservoirs in the Merlin-2 well were penetrated, demonstrated elevated gas readings, and observation of cuttings samples have revealed oil shows over the target intervals,” he said.

The stock has been flailing ever since, down 20% for the week.

Melbana Energy (ASX:MAY) has also given away 20% this week. On Monday it triggered a 32m shares of Performance Rights to executive chairman Andrew Purcell.

Around half of those vested because Melbana stock has jumped more than 200% in a 20-day trading period. Only the week before, MAY’s share price spiked 13% – on thw whiff of an oily drilling update on the Block 9 area in onshore Cuba.

T contract which envelopes 2,400km2 oof the north coast of sunny Cuba which the company says is also located within a proven hydrocarbon system and a hell of a lot like the many-billion barrel Varadero oil field.

As for Mr Purcell?

The other ~15m vested when MAY shares topped 400% over the same period. MAY is up about 520%.

So technically, it’s a loser.

But perhaps not a big one to end the week on.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.