Weekly Small Cap and IPO Wrap: The battery metal in finest fettle goes to…

Via Getty

Yeah, of course it’s lithium. Lithium is killing it.

Fascination with lithium has helped steer local caps, small and large through an extraordinarily volatile week of trade across global equity markets.

The lithium hydroxide price is $US70,625/t and isn’t afraid to keep climbing like a madmen looking for a banana.

Doing the lithium story in math, Stockhead’s head of geek, Emma Davies says the value of lithium hydroxide – in all its battery making glory – rose by a full third from US$9,400/t in Q1 2021, to more than US$12,750/t .

Then things got weird. It was US$17,369/t by the end of 2021… and here we are.

But what makes this week meaningful is that finally IGO (ASX:IGO) and its patient JV partner Tianqi Lithium Corp have got all vertically integrated by producing their first battery grade lithium hydroxide from out of its Kwinana refinery.

The JV has produced battery grade lithium hydroxide from spodumene sourced directly from the Greenbushes mine 250km southwest of Kwinana, but as IGO MD and CEO Peter Bradford says:

“Vertical integration into downstream processing is a key plank in IGO’s strategy and we are proud to be involved in the first production of lithium hydroxide in commercial quantities in Australia,”

Word, Peter. Word.

Righto. So it was sweet madness across global share markets with heady fears that rate hikes, cost pressures and totally shot Chinese supply lines would hit profits. This left US and European markets rattled and shook down, while Asian markets led by us , the Japanese and the Hang Seng were boosted late by monetary easing in China.

Here at home, gains in IT, utility and material shares more than offset falls in consumer and energy shares. Over the last five days, the ASX200 index has gained about 1%.

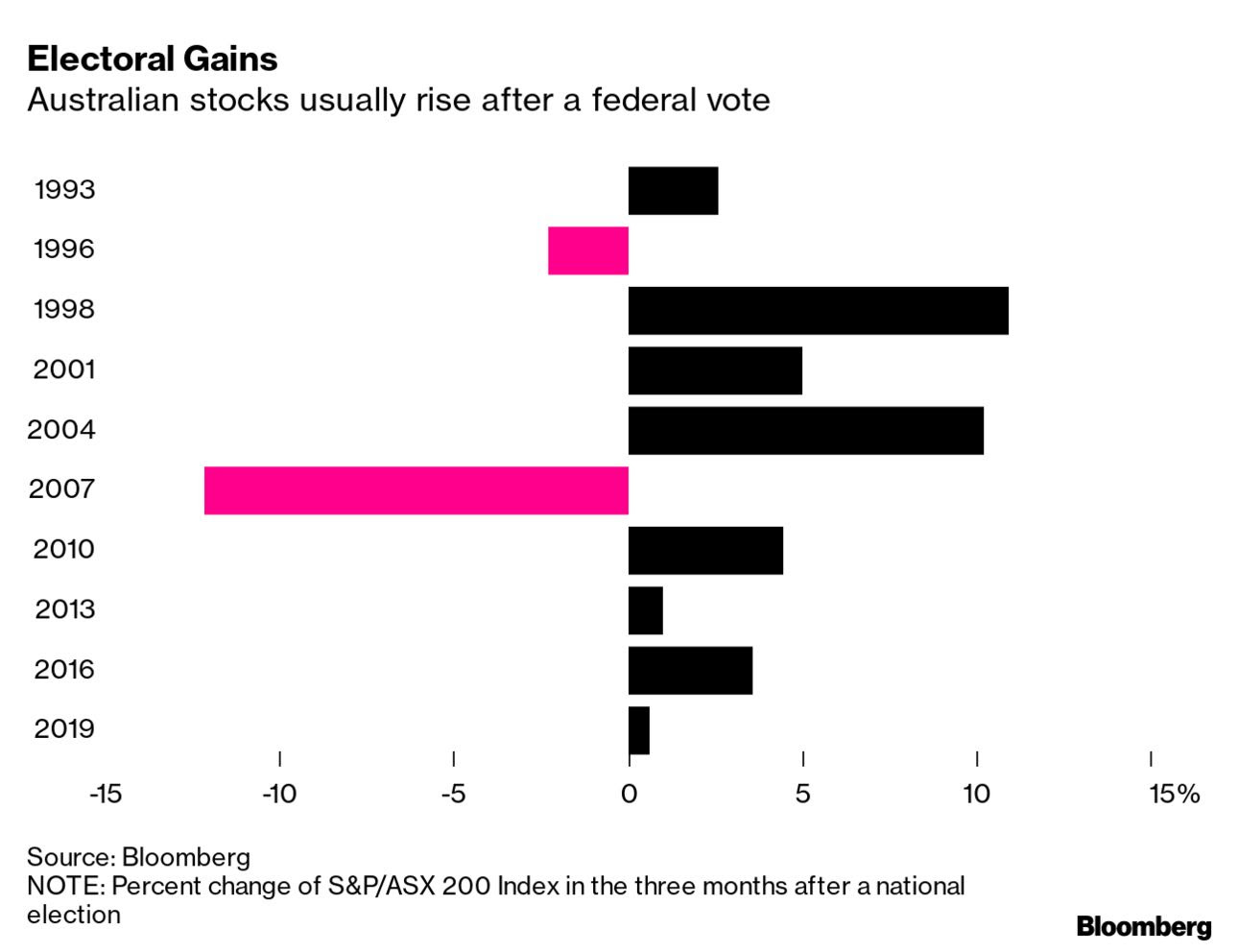

We also like this from our direct competitors at Bloomberg. While they make prettier pictures, we do have the quality gags. We use theirs, they ignore ours.

Anyways. It turns out, if history is any guide, we may be good on local shares for a wee bit longer yet.

Saturday’s election could be a filip local markets no matter who wins.

The S&P/ASX 200 has risen in the three months after eight of the last 10 trips to the polls, by an average of 2.4%, according to this picture compiled by… Bloomberg.

How did this week’s IPOs perform?

It’s day three as a listed concern for Aurora Energy Metals (ASX:1AE) and the newcomer remains totally, entirely, ‘whateverly’ unconcerned by the madness and cut and thrust of volatile life across volatile listed markets.

After a hat trick of strong performances the share price is ending Friday’s session at 36 cents after gaining about 30% on Wednesday from its original IPO of 20 cents.

The $35 million market cap uranium and lithium play is exploring south-eastern Oregon with the $8 million it raised.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 16 – 20:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| GAL | Galileo Mining Ltd | 1.155 | 136% | $181,881,941.40 |

| CNJ | Conico Ltd | 0.029 | 107% | $36,807,907.36 |

| AFW | Applyflow Limited | 0.002 | 100% | $5,915,216.07 |

| BEZ | Besragoldinc | 0.08 | 100% | $8,592,498.00 |

| RMI | Resource Mining Corp | 0.11 | 86% | $36,217,923.08 |

| AR1 | Australresources | 0.415 | 84% | $88,276,892.40 |

| UBN | Urbanise.Com Ltd | 0.645 | 79% | $35,038,728.98 |

| RCW | Rightcrowd | 0.098 | 72% | $22,740,520.14 |

| HAV | Havilah Resources | 0.285 | 68% | $85,196,858.18 |

| MYD | Mydeal.Com.Au | 1.005 | 65% | $166,943,612.37 |

| DAF | Discovery Alaska Ltd | 0.065 | 59% | $10,045,561.41 |

| FRX | Flexiroam Limited | 0.043 | 54% | $23,450,515.73 |

| FRB | Firebird Metals | 0.345 | 53% | $17,320,976.64 |

| SCT | Scout Security Ltd | 0.041 | 52% | $5,828,996.70 |

| BIO | Biome Australia Ltd | 0.11 | 51% | $14,618,940.01 |

| ALT | Analytica Limited | 0.0015 | 50% | $6,920,701.69 |

| KEY | KEY Petroleum | 0.003 | 50% | $3,935,856.25 |

| TAR | Taruga Minerals | 0.024 | 50% | $12,717,061.28 |

| TYX | Tyranna Res Ltd | 0.009 | 50% | $11,811,246.00 |

| KNM | Kneomedia Limited | 0.03 | 50% | $36,338,697.17 |

| SPN | Sparc Tech Ltd | 0.845 | 48% | $51,253,753.24 |

| SRN | Surefire Rescs NL | 0.037 | 48% | $43,219,511.90 |

| NIM | Nimyresourceslimited | 0.495 | 48% | $21,127,379.40 |

| ALY | Alchemy Resource Ltd | 0.028 | 47% | $26,686,073.60 |

| ESR | Estrella Res Ltd | 0.028 | 47% | $27,615,675.42 |

| RKN | Reckon Limited | 1.24 | 47% | $143,884,436.64 |

| SHE | Stonehorse Energy Lt | 0.022 | 47% | $12,319,831.49 |

| GED | Golden Deeps | 0.019 | 46% | $18,482,549.54 |

| PYR | Payright Limited | 0.19 | 46% | $14,860,701.23 |

| MEK | Meeka Gold Limited | 0.057 | 46% | $45,098,877.99 |

| OZM | Ozaurum Resources | 0.205 | 41% | $12,301,440.00 |

| IVZ | Invictus Energy Ltd | 0.275 | 41% | $185,486,809.48 |

| 3DP | Pointerra Limited | 0.265 | 39% | $149,117,364.88 |

| EMS | Eastern Metals | 0.215 | 39% | $6,230,000.00 |

| 1AG | Alterra Limited | 0.018 | 38% | $4,181,644.11 |

| RDT | Red Dirt Metals Ltd | 0.555 | 37% | $152,263,964.51 |

| RTR | Rumble Res Limited | 0.41 | 37% | $207,841,589.43 |

| BNR | Bulletin Res Ltd | 0.195 | 34% | $52,216,240.86 |

| CCE | Carnegie Cln Energy | 0.002 | 33% | $30,205,147.42 |

| RXH | Rewardle Holding Ltd | 0.012 | 33% | $6,315,857.86 |

MyDeal (ASX:MYD), might be staring down the barrel of being delisted from the ASX if Woolworths (ASX:WOW) ends up acquiring an 80% controlling interest in online retail marketplace. be that as it may, MYD has had a wonderful run on the bourse on Friday and joins the weeks’ small cap leaders.

The all-cash consideration of $1.05 per share represents a significant premium of 62.8% to the last closing price.

MyDeal chairman Paul Greenberg says the Scheme is an “attractive transaction which provides an all-cash option for MyDeal shareholders”.

“The price is a very tangible measure of the value and quality of MyDeal’s industry-leading online marketplace platform,” he said.

A ‘mouth-watering ‘run for Auric Mining (ASX:AWJ)has ended with another spike in the share price. First the results of metallurgical testwork at the Munda project returned 96.57% gold extraction, clearly implying that Munda gold mineralisation is ideally suited to conventional CIL (carbon-in-leach) processing. Nice one.

Then the digger announced earlier it had secured an option to acquire more than 340km2 of ground that includes a drill-ready target with remarkable similarities to the nearby Chalice gold mine.

The Chalice West project in Western Australia’s headline Norseman area covers largely “unrecognised greenstones” about 43km southwest of Widgiemooltha and 25km southwest of the company’s existing Widgiemooltha gold project.

Besides being a lookalike of the Chalice mine that produced more than 672,000oz of gold over seven years, the project also includes defined nickel drill targets and potential for both lithium and rare earths.

Chalice West consists of two exploration licences under application with Auric expecting the principal tenement to be granted on or about 31 May 2022.

The option agreement with Mineral Business Development, which is controlled by well-known local geologist John Williams, follows recent drilling at the Guest prospect that returned hits such as 4m grading 4.5 grams per tonne (g/t) gold from 14m and 3m at 5.25g/t gold from 53m.

“The Chalice West Project tenements are an exciting addition to our footprint in the Widgiemooltha area,” Auric managing director Mark English said. “This is a large and underexplored area of Western Australia. We believe this project provides excellent opportunity for gold deposits and for a suite of other minerals.”

He added that the new acreage and its combination of enormous gold potential along with the possibility of nickel and lithium made for a “mouth-watering concept” for the company.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 16 – 20:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| STP | Step One Limited | 0.29 | -40% | $66,722,504.76 |

| PO3 | Purifloh Ltd | 0.275 | -39% | $8,511,344.46 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $9,354,152.77 |

| ANR | Anatara Ls Ltd | 0.063 | -32% | $4,495,404.12 |

| CFO | Cfoam Limited | 0.005 | -29% | $3,669,203.17 |

| RAB | Adrabbit Limited | 0.023 | -28% | $4,459,234.97 |

| BRX | Belararoxlimited | 0.615 | -25% | $18,414,513.00 |

| MEM | Memphasys Ltd | 0.041 | -25% | $34,855,846.83 |

| RD1 | Registry Direct | 0.012 | -25% | $5,852,621.67 |

| ST1 | Spirit Technology | 0.052 | -25% | $37,224,520.42 |

| AHI | Adv Human Imag Ltd | 0.155 | -24% | $25,846,154.21 |

| EQS | Equitystorygroupltd | 0.095 | -24% | $2,795,373.77 |

| PPG | Pro-Pac Packaging | 1.02 | -24% | $84,354,826.40 |

| GO2 | Thego2People | 0.016 | -24% | $6,506,212.06 |

| SWP | Swoop Holdings Ltd | 0.635 | -23% | $94,461,439.80 |

| KCC | Kincora Copper | 0.07 | -23% | $5,419,435.81 |

| PFT | Pure Foods Tas Ltd | 0.3 | -23% | $18,544,941.00 |

| IMR | Imricor Med Sys | 0.3 | -23% | $49,436,408.27 |

| VBC | Verbrec Limited | 0.12 | -23% | $26,577,140.40 |

| 1ST | 1St Group Ltd | 0.007 | -22% | $5,541,538.08 |

| CMP | Compumedics Limited | 0.165 | -21% | $31,003,515.90 |

| IGN | Ignite Ltd | 0.13 | -21% | $11,645,682.75 |

| HCD | Hydrocarbon Dynamic | 0.023 | -21% | $13,502,391.50 |

| ALM | Alma Metals Ltd | 0.02 | -20% | $17,007,861.91 |

| AUR | Auris Minerals Ltd | 0.028 | -20% | $15,252,030.62 |

| COY | Coppermoly Limited | 0.008 | -20% | $17,551,655.43 |

| JXT | Jaxstaltd | 0.04 | -20% | $11,990,236.97 |

| LNY | Laneway Res Ltd | 0.004 | -20% | $31,510,082.05 |

| PLG | Pearlgullironlimited | 0.048 | -20% | $2,690,213.09 |

| RBR | RBR Group Ltd | 0.004 | -20% | $5,150,481.38 |

| SI6 | SI6 Metals Limited | 0.008 | -20% | $12,853,295.87 |

| ILA | Island Pharma | 0.145 | -19% | $6,270,717.56 |

| REY | REY Resources Ltd | 0.23 | -19% | $48,743,333.97 |

| EBR | EBR Systems | 0.445 | -19% | $121,440,191.42 |

| FMS | Flinders Mines Ltd | 0.41 | -19% | $75,981,859.65 |

| MBX | Myfoodieboxlimited | 0.13 | -19% | $5,359,999.20 |

| TD1 | Tali Digital Limited | 0.0065 | -19% | $8,573,541.66 |

| IRI | Integrated Research | 0.57 | -19% | $99,181,204.90 |

| BMM | Balkanminingandmin | 0.27 | -18% | $8,842,500.00 |

| ERG | Eneco Refresh Ltd | 0.027 | -18% | $7,081,317.02 |

I did notice those indefatiguable bunnies at AdRabbit (ASX:RAB) step back about 25% this week.

RAB’s main game is that it provides an easy and inexpensive SaaS solution that allows small-to-medium businesses to create and manage their own mobile application.

But, after finding a lack of local interest, adRabbit is being pulled by it’s Darth Vader daddy, AppsVillage in Israel and is being re-listed on the TSXV.

After the company’s delisting set down for June 2, Australian-based shareholders who wish to sell up will need to make arrangements with a broker that’s registered with the TSXV. I don’t know that one, but Google will.

The last time we saw RAB was at the end of April, when it had cut quarterly spend on marketing and promos to focus on getting its next-gen Software-as-a-Software (SaaS) platform kicking more advertising goals. To be more specific, the company designs and creates various templates for social media ads and marketing via their AI platform.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.