Weekly Small Cap and IPO Wrap: No Mr Bond, I expect you to die

Pic: Getty

Well there’s certainly been some very fine hijinks across global markets this week – in these conditions, one might even discover the true mettle of the market.

Ours (the S&P/ASX200) is up sharply today, after the shame of setting a new 100-day low yesterday when it fell into an official correction. Making everyone officially incorrect since August.

Overnight on Wall Street the now familiar early yards were followed by late, fearful reversals — one might even observe that the whiny response to the Fed’s totally telegraphed decision to raise a bunch of rates may reflect poorly on investors and, well, the essential nature of mankind.

The RBA next week: Goodbye, Mr Bond

The CBA’s Gareth Aird says its time for the inflation narrative to change, so you’ll have the weekend to reconcile that.

“We expect the RBA to announce the cessation of the bond buying program (QE) at the upcoming February Board meeting.”

The bank maintains the central bank will leave the cash rate target unchanged at 0.1%.

And elsewhere this week…

Crude oil prices rallied crudely as the cowardly market’s fears of another COVID-induced hit to demand failed to materialise.

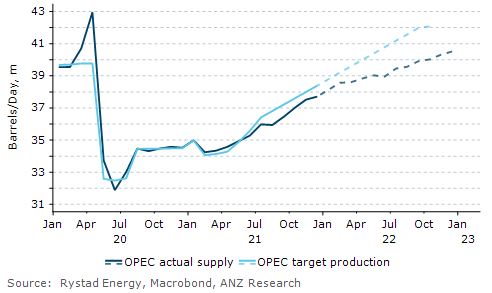

The ANZ’s senior commodities strategist David Hynes says supply side constraints have sustained the rally.

That’s a nice way of also saying OPEC+ just can’t get it’s shit together on meeting production targets.

Hynes says with spare capacity falling sharply, the market will struggle to handle any more unplanned disruptions.

“Traffic numbers in Europe are rebounding as Omicron case numbers start to decline. In the US, gasoline demand is only 4% below 2019 levels, which is a better outcome than expected in November,” Hynes said on Friday.

Jet fuel demand is the laggard, because you’ll never go on a big holiday again ever.

Gold’s been hammered this week. And bond yields are rising.

Time to test the true metal of the market?

But the World Gold Council – that’s an actual thing, btw – just released a shiny new Gold Demand Trends Report and the truth about gold from the people who own www.gold.com is trendy demand for gold hit its highest quarterly level since mid-2019, a hike of circa 50% year-on-year.

Gold bar and coin demand rose by a full third to an near decade high as retail investors – cowards all – sought a safe haven against the dreary (and let’s be honest here not unexpected) backdrop of rising inflation, rate hikes and ongoing global uncertainty.

But wait, what’s this…?

The US economy. Is booming.

December Quarter GDP growth was 6.9%, bringing 2021 GDP growth to 5.7% for what everyone’s been otherwise calling a crap 2021.

I’ll extrapolate this chart using my arts degree: Many, many Americans are very, very rich and in a rather tragic reflection of the world you live in, that’s about the best news the global economy deserves this week.

How did this week’s IPOs perform?

Viridis Mining and Minerals (ASX:VMM) listed on Monday after raising $5m at $0.20 per share.

As Stockhead’s uncanny resources reporter Emma Davies so succinctly puts it, “VMM went off like a frog in a sock.”

Nice. On the day – the share price peaked at $0.40 before levelling off at $0.38 cents – a massive 90% gain

Viridis has five projects in Australia and Canada: encompassing gold, nickel, copper, PGEs and kaolin-halloysite.

The newest member of the ASX family is explorer Belararox Limited (ASX:BRX).

After IPOing today with $6m at $0.20, non-executive chairman Neil Warburton just wants to crack on at the company’s Belara Native Bee zinc copper project in NSW.

The company plans to report an upgraded resource mid-year, with the IPO funding around five and a half kilometres of drilling starting next month.

Also off to a Friday start and going awfully gangbusters is Firebrick Pharma (ASX:FRE) – they of the nasal spray which targets the viral cause of the common cold — it’s raised ~$7m at $0.20 a pop.

Finally… there’s a new tough guy on the lists – Haranga Resources (ASX:HAR) which rose on debut, Thursday despite a military coup currently taking place in Burkina Faso — one of its three jurisdictions alongside Senegal and Côte d’Ivoire.

The gold and uranium junior closed $0.06 higher after a $6.5m raise at $0.20c per share.

ASX SMALL CAP WINNERS:

Here are the best performing ASX small cap stocks for January 24 – 28:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| FRE | Firebrickpharma | 0.58 | 187.5% | $63,136,442 |

| VMG | VDM Group Limited | 0.00 | 100.0% | $10,391,491 |

| FAR | FAR Ltd | 0.64 | 76.4% | $58,377,438 |

| AUH | Austchina Holdings | 0.01 | 75.0% | $25,165,341 |

| AUQ | Alara Resources Ltd | 0.07 | 72.1% | $41,620,325 |

| MAY | Melbana Energy Ltd | 0.04 | 71.4% | $90,892,525 |

| SHH | Shree Minerals Ltd | 0.02 | 68.2% | $22,327,975 |

| AKO | Akora Resources | 0.39 | 63.8% | $19,367,079 |

| CDT | Castle Minerals | 0.06 | 61.1% | $52,965,267 |

| BLZ | Blaze Minerals Ltd | 0.04 | 59.3% | $14,300,004 |

| IS3 | I Synergy Group Ltd | 0.08 | 56.9% | $14,329,036 |

| PHO | Phosco Ltd | 0.15 | 53.1% | $37,401,149 |

| ANL | Amani Gold Ltd | 0.00 | 50.0% | $34,400,162 |

| PBXDA | Pacific Bauxite Ltd | 0.15 | 50.0% | $1,189,842 |

| BRX | Belararoxlimited | 0.30 | 47.5% | $7,082,505 |

| BPM | BPM Minerals | 0.28 | 47.4% | $9,940,375 |

| BCK | Brockman Mining Ltd | 0.06 | 46.3% | $612,429,321 |

| JRL | Jindalee Resources | 3.29 | 44.3% | $165,558,136 |

| CPM | Coopermetalslimited | 0.43 | 44.1% | $9,862,300 |

| RNU | Renascor Res Ltd | 0.29 | 42.7% | $511,345,166 |

| BNR | Bulletin Res Ltd | 0.13 | 41.3% | $33,306,909 |

| FZR | Fitzroy River Corp | 0.18 | 40.0% | $15,653,366 |

| LRV | Larvottoresources | 0.25 | 40.0% | $8,255,550 |

| RTR | Rumble Res Limited | 0.53 | 40.0% | $297,802,874 |

| MLM | Metallica Minerals | 0.03 | 39.1% | $16,472,671 |

| CAE | Cannindah Resources | 0.31 | 38.6% | $146,836,242 |

| SAN | Sagalio Energy Ltd | 0.02 | 38.5% | $3,683,882 |

| RAP | Resapp Health Ltd | 0.07 | 38.5% | $63,580,584 |

| HVY | Heavymineralslimited | 0.22 | 37.5% | $7,883,531 |

| XTC | Xantippe Res Ltd | 0.01 | 37.5% | $57,785,810 |

| PVW | PVW Res Ltd | 0.57 | 37.3% | $38,792,250 |

| THR | Thor Mining PLC | 0.02 | 36.4% | $11,897,043 |

| AMT | Allegra Orthopaedics | 0.17 | 36.0% | $17,758,065 |

| MAD | Mader Group Limited | 2.44 | 34.4% | $480,000,000 |

| NTL | New Talisman Gold | 0.00 | 33.3% | $6,254,451 |

| ATC | Altech Chem Ltd | 0.12 | 33.3% | $159,912,280 |

| CNB | Carnaby Resource Ltd | 1.84 | 32.4% | $191,127,944 |

| ARR | American Rare Earths | 0.37 | 32.1% | $143,472,676 |

| TD1 | Tali Digital Limited | 0.02 | 31.3% | $17,706,210 |

| SMI | Santana Minerals Ltd | 0.38 | 31.0% | $49,075,797 |

| ADY | Admiralty Resources. | 0.02 | 30.8% | $20,857,266 |

| EPX | Ept Global Limited | 0.13 | 30.0% | $20,510,443 |

| ODM | Odin Metals Limited | 0.03 | 30.0% | $12,124,953 |

The near-term copper-gold miner Alara Resources (ASX:AUQ) is up about 90% this week on no discernible news but has taken on market leading gains either side of Aussie Day. The $35m market cap minnow is now up almost 170% year-to-date.

The former coal stock Intra Energy Corp (ASX:IEC) has pivoted its way into less world-endy commodities like copper and gold. This week its acquisition of a nickel-copper-PGE project near Kalbarri, WA, called ‘Yalgarra’, where initial looks have, “already defined a number of new magmatic NiCu-PGE±Au prospects.”

It’s up 57% for the week. Nice.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 24 – 28:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| VMG | VDM Group Limited | 0.001 | -50.0% | $6,927,661 |

| OXT | Orexploretechnologie | 0.135 | -46.0% | $14,512,987 |

| CAD | Caeneus Minerals | 0.008 | -42.9% | $35,044,841 |

| ARE | Argonaut Resources | 0.0035 | -41.7% | $10,818,614 |

| PAB | Patrys Limited | 0.024 | -38.5% | $49,361,340 |

| ADO | Anteotech Ltd | 0.24 | -35.1% | $621,830,283 |

| HT8 | Harris Technology | 0.072 | -34.5% | $22,334,661 |

| OAR | OAR Resources Ltd | 0.006 | -33.3% | $11,127,388 |

| DUG | DUG Tech | 0.53 | -32.1% | $65,558,479 |

| NXL | Nuix Limited | 1.4225 | -30.9% | $439,480,990 |

| SPN | Sparc Tech Ltd | 1.47 | -30.7% | $88,004,270 |

| AQX | Alice Queen Ltd | 0.007 | -30.0% | $12,332,007 |

| GSN | Great Southern | 0.045 | -29.7% | $23,424,152 |

| 4DS | 4Ds Memory Limited | 0.081 | -29.6% | $117,213,062 |

| BMM | Balkanminingandmin | 0.35 | -29.3% | $11,462,500 |

| EUR | European Lithium Ltd | 0.11 | -29.0% | $121,746,442 |

| CAE | Cannindah Resources | 0.2425 | -28.7% | $115,371,333 |

| AUA | Audeara | 0.1 | -28.6% | $6,419,932 |

| TYM | Tymlez Group | 0.025 | -28.6% | $23,684,437 |

| SKY | SKY Metals Ltd | 0.1 | -28.6% | $37,678,347 |

| GRE | Greentechmetals | 0.29 | -28.4% | $7,721,000 |

| CGS | Cogstate Ltd | 1.67 | -28.0% | $272,135,947 |

| GSM | Golden State Mining | 0.09 | -28.0% | $7,477,919 |

| KFM | Kingfisher Mining | 0.245 | -27.9% | $8,047,575 |

| BTR | Brightstar Resources | 0.047 | -27.7% | $25,155,600 |

| MM1 | Midasmineralsltd | 0.145 | -27.5% | $7,713,728 |

| KRM | Kingsrose Mining Ltd | 0.073 | -27.0% | $52,254,056 |

| AAJ | Aruma Resources Ltd | 0.084 | -27.0% | $10,454,805 |

| BRN | Brainchip Ltd | 1.45 | -27.0% | $2,374,391,569 |

| VRC | Volt Resources Ltd | 0.019 | -26.9% | $48,172,989 |

| CRR | Critical Resources | 0.1025 | -26.8% | $127,367,931 |

| HMX | Hammer Metals Ltd | 0.052 | -26.8% | $43,194,715 |

| RLC | Reedy Lagoon Corp. | 0.033 | -26.7% | $18,079,289 |

| RMI | Resource Mining Corp | 0.022 | -26.7% | $7,826,189 |

| AHI | Adv Human Imag Ltd | 0.55 | -26.7% | $99,119,078 |

| ADD | Adavale Resource Ltd | 0.047 | -26.6% | $15,845,931 |

| LPD | Lepidico Ltd | 0.036 | -26.5% | $211,595,838 |

| NET | Netlinkz Limited | 0.014 | -26.3% | $45,684,245 |

| WR1 | Winsome Resources | 0.41 | -26.1% | $53,783,998 |

| MEP | Minotaur Exploration | 0.2 | -25.9% | $99,737,082 |

| ONE | Oneview Healthcare | 0.23 | -25.8% | $124,042,982 |

| CXM | Centrex Limited | 0.078 | -25.7% | $31,192,194 |

| NC1 | Nicoresourceslimited | 0.425 | -25.4% | $34,900,001 |

| FEX | Fenix Resources Ltd | 0.235 | -25.4% | $107,975,993 |

| ANL | Amani Gold Ltd | 0.0015 | -25.0% | $22,875,564 |

| BNR | Bulletin Res Ltd | 0.105 | -25.0% | $25,535,297 |

| HLX | Helix Resources | 0.015 | -25.0% | $18,877,189 |

| NPM | Newpeak Metals | 0.0015 | -25.0% | $7,649,750 |

| NTL | New Talisman Gold | 0.0015 | -25.0% | $4,690,838 |

| PCH | Property Connect | 0.0015 | -25.0% | $1,028,795 |

| RNX | Renegade Exploration | 0.006 | -25.0% | $6,157,386 |

Amani Gold ASX:ANL has shed some 25% this week and so has Bulletin Resources (ASX:BNR).

The latter, another goldie dipping a leg into the lucrative lithium exploration game, BNR surged earlier this week after spotting a 2.5km stretch of spodumene.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.