Weekly Small Cap and IPO Wrap: ASX Emerging Companies Index in need of Christmas joy

Pic: Getty Images

- ASX Emerging Companies index fell this week as central banks lifted rates

- Meteoric Resources announces it is purchasing Ionic Clay Rare Earth Element (REE) project in Brazil

- Newly listed Patriot Battery Metals down for the week, despite positive news on its Corvette lithium property

Come on Santa what has happened to the traditional end of year Christmas rally in 2022 because the ASX Emerging Companies Index sure could use one. While the big end of town was fairly flat the small and mid caps on the ASX have fallen once again this week.

The S&P/ASX Emerging Companies (XEC) is a benchmark for Australia’s micro-cap companies, containing up to 200 stocks that ranked between 350 and 600 by float-adjusted market capitalisation at the time of their index inclusion.

The S&P/ASX 200 (XJO) is Australia’s leading benchmark index, home to the top 200 ASX listed companies by float-adjusted market capitalisation.

By 2pm AEDT on Friday the ASX Emerging Companies Index had fallen ~2% the past five days and is down more than 23% year to date. , The XJO was fairly flat and up 0.07% for the past five days and down ~4% year to date.

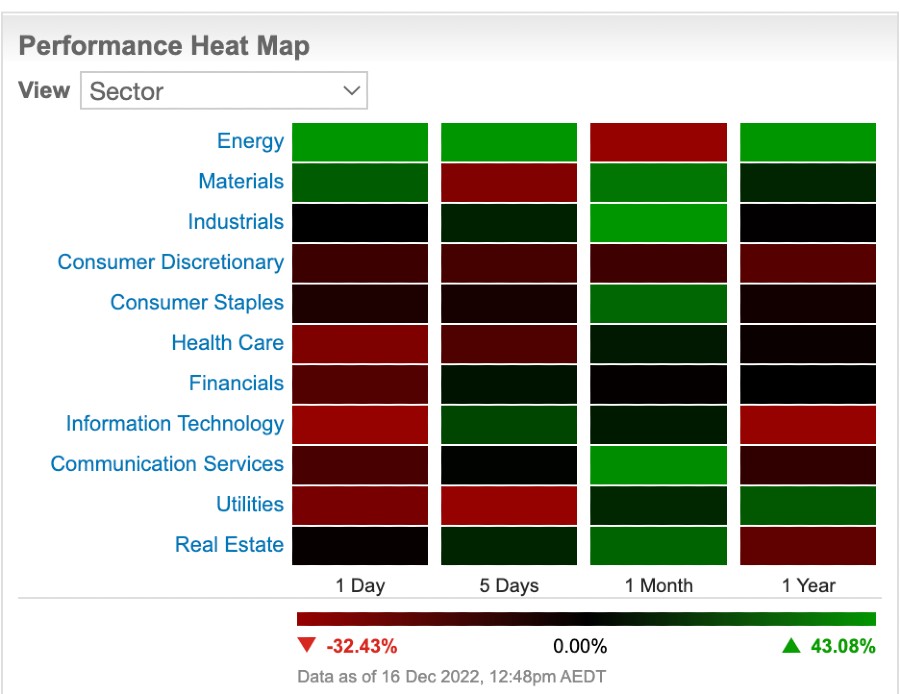

Leading the gainers for the past week was the energy sector, up more than 4% followed by IT up almost 2% and real estate up 0.99% for the past five days.

Utilities led the laggards, down ~3.13% for the past five days followed by materials which fell 2.70% and healthcare which dropped 1.69%.

Weekly economic overview

It’s been a big week on the econonomic front. Stocks in the US fell heavily on Thursday night following a US retail sales report, showing a fall of 0.6% in November, suggesting that consumers may have succumbed to inflation.

The Aussie dollar also fell by 2%, the worst daily fall since March 2020 and at the time of writing was 67 cents.

Meanwhile, global central banks have vowed to keep raising rates in the new year to control inflation, intensifying fears of a broad recession.

The US Federal Reserve opted for a 50 bp rate hike this week pushing the target range for its benchmark rate to 4.25% – 4.5% – the highest rate in 15 years.

The European Central Bank lifted interest rates by 0.5% to 2% in line with expectations.

The Bank of England (BoE) also raised its key rate by 0.5% to 3.50%,the highest level since 2008 with its minutes noting more rate hikes could be needed.

At home, the ABS said this week that Australia’s unemployment rate in November was 3.4%, the same as October. The rate remains at near 50-year low as the Australian economy faces labor shortages due to a significant reduction in migration.

In some Christmas joy, the Melbourne Institute December inflation expectations report was at 5.2%, declining from 6% the previous month.

ASX IPOs this week:

Listing: December 16

IPO: $12m at $0.20

As Stockhead’s Josh Chiat reported DES chairman Paul Roberts was founder and CEO of prospect generator Predictive Discovery (ASX:PDI) from 2007 to 2021. Roberts closed his stint with the discovery of the world class 4.2Moz Bankan gold project in Guinea.

Roberts and non-executive director Barry Murphy are aiming to recapture that success.

Former PDI corporate development officer and BPM Minerals (ASX:BPM) CEO Chris Swallow is also on board as managing director.

The explorer is focused on the 345km2 Fenix lithium and gold project in the Pine Creek pegmatite field, located near Core Lithium’s (ASX:CXO) 110,000tpa spodumene mine Finniss.

Desoto also owns the Fenton gold project, which sits in the 17Moz Pine Creek field near the Cosmo Howley deposit, with wide gold hits from limited drilling of 55m at 0.88g/t gold from 418m including 20m at 1.74g/t gold from 423m.

ASX SMALL CAP LEADERS:

Here are the best performing ASX small cap stocks for December 12 to 16

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MEB | Medibio Limited | 0.002 | 100% | $6,641,188 |

| MEI | Meteoric Resources | 0.029 | 81% | $24,420,758 |

| TKL | Traka Resources | 0.009 | 80% | $6,198,971 |

| PXX | Polarx Limited | 0.012 | 71% | $14,017,004 |

| GRV | Greenvale Energy Ltd | 0.1675 | 68% | $67,475,553 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | $35,540,162 |

| PGD | Peregrine Gold | 0.57 | 50% | $18,794,666 |

| WBE | Whitebark Energy | 0.0015 | 50% | $9,697,329 |

| 3DA | Amaero International | 0.105 | 50% | $45,700,623 |

| PAT | Patriot Lithium | 0.295 | 48% | $17,678,563 |

| FZR | Fitzroy River Corp | 0.17 | 48% | $18,352,223 |

| AVE | Avecho Biotech Ltd | 0.01 | 43% | $20,216,563 |

| PUR | Pursuit Minerals | 0.017 | 42% | $15,970,867 |

| CLE | Cyclone Metals | 0.002 | 33% | $12,233,474 |

| GES | Genesis Resources | 0.008 | 33% | $6,262,730 |

| NTL | New Talisman Gold | 0.002 | 33% | $6,254,451 |

| OAU | Ora Gold Limited | 0.008 | 33% | $6,889,619 |

| PRM | Prominence Energy | 0.002 | 33% | $4,849,218 |

| ARU | Arafura Rare Earths | 0.515 | 32% | $1,023,079,295 |

| HTG | Harvest Tech Grp Ltd | 0.08 | 31% | $45,200,659 |

| NWE | Norwest Energy NL | 0.0605 | 29% | $302,110,722 |

| NSM | Northstaw | 0.125 | 28% | $15,015,875 |

| HXL | Hexima | 0.023 | 28% | $3,841,911 |

| SIX | Sprintex Ltd | 0.032 | 28% | $7,884,984 |

| HFY | Hubify Ltd | 0.038 | 27% | $18,853,179 |

| NIS | Nickelsearch | 0.1525 | 27% | $9,347,340 |

| PAB | Patrys Limited | 0.029 | 26% | $59,652,993 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | $5,500,625 |

| BXN | Bioxyne Ltd | 0.025 | 25% | $15,309,844 |

| CRB | Carbine Resources | 0.015 | 25% | $4,098,582 |

| DDT | DataDot Technology | 0.0075 | 25% | $9,950,956 |

| DOC | Doctor Care Anywhere | 0.065 | 25% | $24,198,388 |

| RR1 | Reach Resources Ltd | 0.005 | 25% | $9,550,253 |

| MYE | Metarock Group Ltd | 0.21 | 24% | $27,508,435 |

| FG1 | Flynngold | 0.12 | 24% | $7,482,021 |

| MAY | Melbana Energy Ltd | 0.062 | 24% | $202,212,246 |

| MEG | Megado Minerals Ltd | 0.049 | 23% | $6,737,500 |

| SRN | Surefire Rescs NL | 0.0135 | 23% | $22,139,089 |

| HCD | Hydrocarbon Dynamic | 0.016 | 23% | $9,392,968 |

| AKO | Akora Resources | 0.195 | 22% | $11,746,935 |

| GCM | Green Critical Min | 0.0195 | 22% | $21,372,530 |

| SOP | Synertec Corporation | 0.25 | 22% | $86,929,106 |

| COY | Coppermoly Limited | 0.011 | 22% | $24,133,526 |

| NUC | Nuchev Limited | 0.22 | 22% | $9,831,436 |

| JXT | Jaxstaltd | 0.04 | 21% | $13,703,128 |

| SMX | Security Matters | 0.17 | 21% | $25,186,730 |

| BIR | BIR Financial Ltd | 0.036 | 20% | $10,113,702 |

| BMM | Balkanminingandmin | 0.33 | 20% | $13,333,334 |

| BOA | Boadicea Resources | 0.12 | 20% | $7,769,990 |

| ICN | Icon Energy Limited | 0.006 | 20% | $3,840,068 |

Meteoric Resources (ASX:MEI) was one of the big winners for the week on news after announcing it had purchased a “Tier 1” Ionic Clay Rare Earth Element (REE) project in the Minas Gerais State of Brazil.

The Caldeira Project comprises 30 licenses (21 Mining Licenses and 9 Mining Licence Applications) and has previously had significant exploration conducted including 1,311 shallow auger drill holes for 13,037m.

Project results include intercepts from surface that include 20m @ 8,924ppm TREO ending in 9,945ppm TREO, 11m @ 6,763ppm TREO ending in 25,341ppm TREO and 19m @ 6,895ppm TREO ending in 7,840ppm TREO.

Here are the worst performing ASX small cap stocks for December 12 to 16:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PMT | Patriot Battery Metals | 0.865 | -51% | $5,775,000 |

| XST | Xstate Resources | 0.001 | -50% | $4,822,772 |

| LLI | Loyal Lithium Ltd | 0.315 | -47% | $15,657,900 |

| TAR | Taruga Minerals | 0.024 | -37% | $18,845,759 |

| MKR | Manuka Resources. | 0.083 | -36% | $37,962,611 |

| GGE | Grand Gulf Energy | 0.017 | -35% | $27,838,992 |

| MBX | My Foodie Box | 0.03 | -34% | $1,139,000 |

| WA1 | WA1 Resources | 1.3 | -34% | $44,841,303 |

| WRM | White Rock Min Ltd | 0.062 | -33% | $13,610,975 |

| WR1 | Winsome Resources | 1.025 | -32% | $141,279,901 |

| VSR | Voltaic Strategic | 0.02 | -31% | $6,741,474 |

| MQR | Marquee Resource Ltd | 0.038 | -31% | $12,387,086 |

| PR1 | Pure Resources Limited | 0.28 | -28% | $7,632,628 |

| RB6 | Rubix Resources | 0.13 | -28% | $3,651,750 |

| MME | Moneyme Limited | 0.24 | -27% | $68,660,570 |

| BTH | Bigtincan Hldgs Ltd | 0.525 | -27% | $325,269,084 |

| TOE | Toro Energy Limited | 0.0095 | -27% | $38,973,422 |

| AD1 | AD1 Holdings Limited | 0.011 | -27% | $9,109,507 |

| CST | Castile Resources | 0.099 | -27% | $23,948,340 |

| MHK | Metalhawk | 0.17 | -26% | $12,299,725 |

| SGA | Sarytogan | 0.38 | -25% | $24,085,286 |

| DOU | Douugh Limited | 0.015 | -25% | $13,560,231 |

| GCR | Golden Cross | 0.006 | -25% | $6,583,537 |

| MTB | Mount Burgess Mining | 0.003 | -25% | $3,007,099 |

| VIP | VIP Gloves | 0.003 | -25% | $2,360,344 |

| VPR | Volt Power Group | 0.0015 | -25% | $21,432,416 |

| RMI | Resource Mining Corp | 0.07 | -25% | $40,479,474 |

| RNU | Renascor Res Ltd | 0.235 | -24% | $568,114,066 |

| IMB | Intelligent Monitor | 0.13 | -24% | $16,991,038 |

| SXG | Southern Cross Gold | 0.65 | -24% | $57,009,275 |

| IMI | Infinity Mining | 0.28 | -23% | $22,544,879 |

| KFM | Kingfisher Mining | 0.415 | -23% | $22,902,750 |

| RDN | Raiden Resources Ltd | 0.005 | -23% | $8,272,912 |

| CAI | Calidus Resources | 0.27 | -23% | $111,672,585 |

| SNS | Sensen Networks Ltd | 0.054 | -23% | $46,827,729 |

| LPM | Lithium Plus | 0.39 | -23% | $19,535,762 |

| FFF | Forbidden Foods | 0.031 | -23% | $4,006,870 |

| 1AD | Adalta Limited | 0.042 | -22% | $13,824,129 |

| AL8 | Alderan Resource Ltd | 0.007 | -22% | $4,047,863 |

| CBR | Carbon Revolution | 0.105 | -22% | $21,725,541 |

| CXU | Cauldron Energy Ltd | 0.007 | -22% | $4,890,732 |

| TOU | Tlou Energy Ltd | 0.035 | -22% | $31,951,685 |

| PNR | Pantoro Limited | 0.0975 | -22% | $177,882,057 |

| BVR | Bellavista Resources | 0.25 | -22% | $8,211,940 |

| LVT | Livetiles Limited | 0.036 | -22% | $39,792,296 |

| AQI | Alicanto Min Ltd | 0.047 | -22% | $22,680,394 |

| COI | Comet Ridge Limited | 0.145 | -22% | $151,555,963 |

| IR1 | Irismetals | 1.35 | -22% | $89,076,600 |

| CZN | Corazon Ltd | 0.022 | -21% | $13,427,272 |

| OAK | Oakridge | 0.11 | -21% | $1,891,525 |

Recent IPO Patriot Battery Metals (ASX:PMT) tops the list of biggest losers this week, as investors pocketed some of last week’s monster gains.

This week it announced that Corvette lithium property in Quebec has returned some of the highest individual sample grades yet, including 113.4m at 1.61% Li2O (including 2m at 6.41% Li2O).

On top of this, the CV5 pegmatite system remains open in all directions with wide widths and strong grades encountered along its currently defined 2.2km length.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.