We didn’t fudge it! General relief Albo’s Budget not full of stupid, inefficient ideas

One is food. One is drink. Simple. Picture: Getty Images

Let’s get straight down to the brass tacks.

Treasurer Jim Charmers didn’t break anything last night with his first budget.

Ex-Stockhead Secret Budget Analysis Weapon, Trained Accountant, Cheese Monger and Former Deputy Editor Sam Jacobs, (a far more relaxed and approachable human now he’s chilling with the high flying corporate consultancy, Six Degrees IR), tells me the single most important takeaway from last night are the numbers, and the numbers fit.

“The math is good,” Jacobs says. “The math. Is good.”

We could end it right there. All you need to know.

But elsewhere, Adelaide’s a bit sick of the haughty way Canberra conducts itself:

My thoughts on the new 2022-23 Budget straight from Parliament House. And if you’re wondering why I’m outside it is indeed because I was kicked out of the building before I could record a video!#budget #BudgetEstimates #Budget2023 @ANZ_Research pic.twitter.com/ADH5eI0AG9

— Adelaide Timbrell (@AdelaideTimbrel) October 25, 2022

Always impartial, Stephen Koukoulas (aka TheKouk) seems pleased:

I rate the budget an 8 out of 10.

A great effort in the context of the trashed P76 left in the drive way for Chalmers, the near certainty of global recession in 2023 and lingering inflation pressures. They have fixed labour shortages but at a cost of lower wages growth— Stephen Koukoulas (@TheKouk) October 25, 2022

Less of a fan, a furious Lady Liberty over in beautiful and sensible WA:

<

.@JEChalmers applying for the treasurer job #auspol #Budget2023 pic.twitter.com/oC37NFcHyx

— Kate FANTINEL Lady Liberty (@ladylibertyWAus) October 25, 2022

/p>

The Kouk a few hours earlier, betraying the slightest hint of playing the budgeter, and not the budget. Eh. The Kouk can have friends!

It’s budget day.

My mate Jim Chalmers is delivering his first budget. What a privilege and responsibility for him.

Congratulations Jim!— Stephen Koukoulas (@TheKouk) October 24, 2022

What’s important for us Stockheaders that’s not already baked into market prices? Not a lot.

As I think everyone’s pretty much been saying, Chalmers played it all with a straight bat, kept it simple and he can reboot in May anyway, when the real deal is up for grabs.

The Albo Government’s first dabble in running the country’s accounts was less policy and more ‘hey we’re fighting inflation and culling the dumb and inefficient ideas the last lot left’.

There’ll be none of that tax reform on resources firms (like via a windfall profits tax or reforms to the PRRT); none until May next year anyway.

CEDA chief economist Jarrod Ball says the budget is a grim and cold-light-of-day take on the economic reality of the day. Although as Scutty points out, that’s been de rigeur of late for the Treasury boffins.

Treasury has consistently understated nominal GDP in recent years, coinciding with the emergence of extremely conservative commodity price forecasts #Budget2023 pic.twitter.com/8WV06drBxp

— David Scutt (@Scutty) October 25, 2022

“Amid a sobering economic outlook, this is a prudent Budget that sensibly avoids stoking inflation as global recession fears stalk Australia’s economy,” Ball says.

“However, the Government has delayed the more fundamental reform needed to sustainably shore up the nation’s finances.”

What is the Gov’s latest economic outlook?

-

GDP expected to be just 1.5% by 2023-24

-

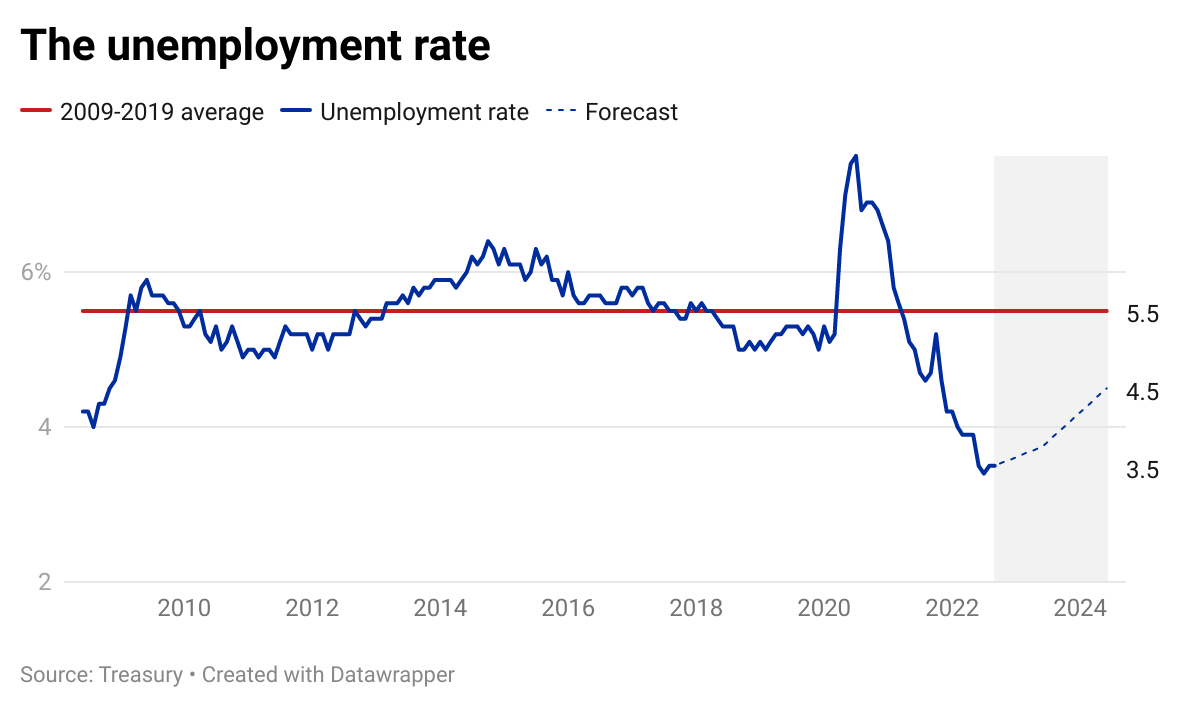

Unemployment ticking up to 4.5%

-

Inflation is killing wage gains (real wage growth to turn positive in 2023-24)

-

Australia’s weak-arse productivity growth under a decade of Liberal/Nats control has Chalmers trimming long-term productivity assumptions from 1.5% to 1.2%

“This is a more realistic assumption but makes the challenges of debt and deficit all the greater over the next decade, with economic growth providing less support to the budget position,” Jarrod Ball reckons.

What’s in the books?

-

The government is planning $111.3m worth of grants of its own over four years to support domestic manufacturing, with the bulk flowing to an upgrade of Nyrstar Hobart zinc smelter.

-

It’s also got $150m in the kitty to back the critical minerals guys – to overcome technical and market access barriers – and there’s a critical minerals research hub in the post.

-

There’s some $47m to produce more Aussie sci-tech talent, including $13.5m to back critical technologies.

-

Unsurprisingly the cashed up and terrifying geeks at the Australian Signals Directorate have been staying mum since ScoMo gave them $9.9bn in March.

-

Although a cyber hubs pilot part of a 2020 cybersecurity strategy will be getting some new funding, details sketchy.

-

There’s a $275m carrot for the EVs.

-

Add as well, a $345m cut to fringe benefits tax which can save employers who provide EVs $9000 per annum, or individuals $4700.

-

There’s $25bn in climate-related spending, ’till 2030, including $20bn for Anthony Albanese’s “rewiring the nation” plan, which is designed to upgrade the electricity grid so renewables can be integrated better.

And some frank tax decisions

Extra cash in the kitty comes from cuts and the extra revenue of rising tax receipts, predicted to top $142bn more in the next four years.

Most of these revenue gains were expected in the first two years and the vast majority came from higher company tax receipts, particularly from miners.

The government assumes commodity prices will fall back towards long-run averages in the later years of the forward estimates.

“High commodity prices and the appreciation of the US dollar are driving stronger corporate profits in the near-term, particularly in the mining sector where company tax receipts are approaching record levels,” the government said.

So to get in on the action, Treasury is swooping in on the BHPs et al who’ve been using off-market share buybacks to reduce tax costs, a move the boffins reckon could pull in well over half a billion in extra dosh out till 2026.

The change targets ASX-listed companies from paying shareholders a lower price for off market buybacks than the on-market price using franking credits to equalise the value.

Off-market buybacks by major companies include BHP and Rio Tinto at lower prices than the market prices. In 2018, BHP spent $7.3bn on an off-market buyback paying $27.64 a share at a time when the market price was $32.14, a price which would have cost the company $8.5bn.

Are we saving or spending?

First up – and unlike the lessons of Trussy – what this budget does not do in the short-term is stoke inflation. This would make the Reserve Bank’s job harder, leading to more interest rate rises to slow down the economy.

Chalmers hardly touches the $145 billion of resources-led tax windfalls bulging Treasury coffers.

Over 90% of these windfalls are banked to the budget over the next four years and in real terms, spending increases by just 0.3 per cent on average over the budget period. Policy decisions cost the budget $9.8 billion in net terms. But economic conditions including high inflation and increased unemployment are putting pressure on programs such as income support, adding $92 billion in spending over four years.

The end result is a $52 billion improvement in the budget position compared to the pre-election outlook. However, most of it falls in 2022-23, reducing the budget deficit by $42 billion in that year.

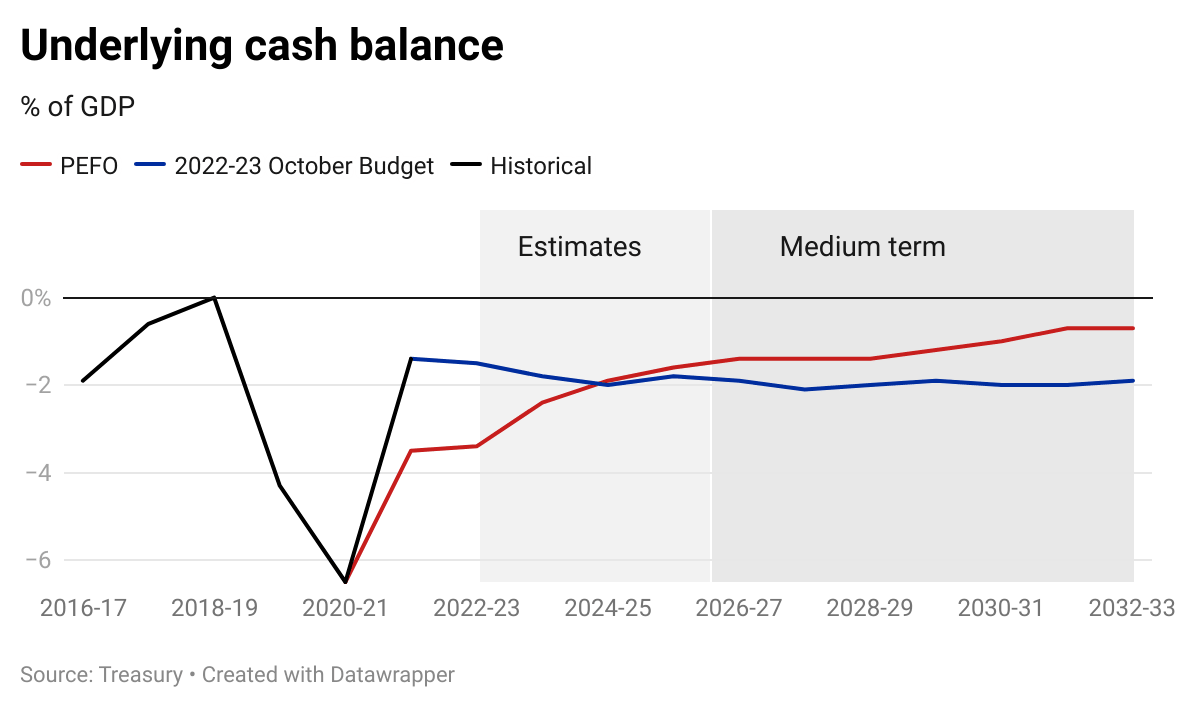

The good news ends there with a two per cent of GDP budget deficit becoming entrenched across the next decade.

Almost homes

First-home buyers will be delighted as the Albanese government ramps up its commitment to affordable housing by unveiling a National Housing Accord. The plan builds on election promises to set up a housing future fund, for a government co-investment scheme and a regional housing scheme. But it will be two years before anyone starts building one of these homes.

To be clear, the target is to build 1,000,000 new homes from 2024 – 2029.

Not ‘by 2024’ as what @SkyNewsAust just had on their summary.

That would have been quite the ambitious target!

As it stands we are on track to complete 240,000 dwellings over 2023.#Budget2023 pic.twitter.com/hhuBd4jgjU

— Louis Christopher (@LouiChristopher) October 25, 2022

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.