Wall Street’s best and brightest are already taking bets on where we’ll end next year

Via Getty

It’s that time of year on Wall Street.

The big show analysts are putting your money where their mouth is and plotting a myriad of upbeat forecasts for CY24, wherein equity markets break various records.

Deutsche Bank has come out as the Bull’s Bull this year, foreseeing the benchmark US index, the S&P 500, doggedly gaining more than 11% to close out what would be a record year.

The S&P 500 is up close to 19% so far this year. And that’s just Deutsche’s conservative case.

According to DB’s in-case-of-Goldilocks-break-glass-case case, analysts are seeing the S&P500 clamber on up to +5,500 points – which is a full fifth more than where the benchmark closed last night.

In a Monday note surely dropped to set the tone heading into the last week of November on Wall Street, Deutsche Bank backed US corporate earnings to stand tall, expecting resilience even in the scenario where the US wanders off briefly into recession territory.

The bank forecasts company earnings on the US benchmark to rise 10% in 2024, even factoring in a “mild, short” US recession.

If all goes well, on the other hand, it’ll be a circa 19% rise, should US gross domestic product (GDP) grow 2%.

The investment bank set its 2024 year-end S&P 500 target at 5,100, or more than 11% above where it’s currently sitting and about 8.5% higher than the 4,700 median forecast of analysts polled by Reuters.

“If earnings growth continues to recover as we forecast, valuations will remain well supported around the top of the range as is typical on the pricing in of a pickup in earnings growth,” Deutsche predicts

If US consumer prices also returned to pre-COVID levels without crunching US economic growth then this scenario would also support equity markets in the States, according to Deutsche, since it’d imply The US Fed wouldn’t start trimming the cash rate unless the US was in recession.

The Street has all but locked in the odds (CME’s FedWatch says it’s at 99.4%) that the Fed will keep its hiking cycle on pause next month, with bets around a rate cut for mid-2024.

But the bank said either scenario is a moderate assumption when compared with where the index is trending.

“We note that the S&P 500 has been in a clear trend up channel since the GFC (Circa 2008)…. After falling below last year, the rally in the first half this year took it back up to the bottom and it has been muddling along at the lower end since. A continued muddle through along the bottom implies 5300 by end 2024, while a move to the middle to 6000.

“By comparison, our base case target of 5100 and even the upside scenario of 5500 look conservative,” DB added.

That kind of thinking rates Deutsch’s forecast above and beyond some of Wall Street’s other recent 2024 crystal balling.

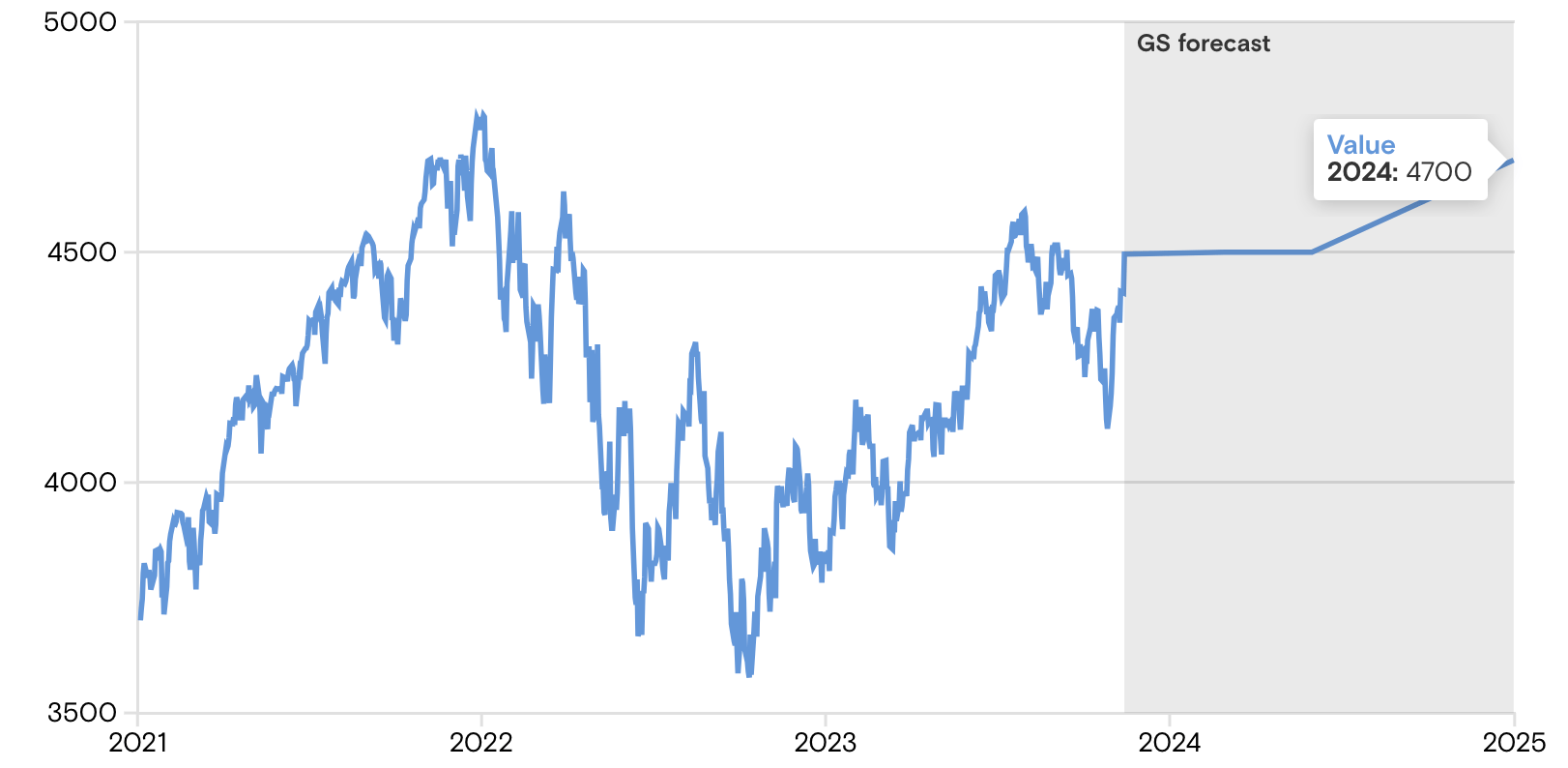

Goldman Sachs Research: Forecast gains for S&P 500 Index, 2024

US stocks are forecast by Goldman Sachs Research to enjoy but a modest return next year, “as above-consensus economic growth is partly offset by high equity valuations.”

The S&P 500 index is expected to rise to 4700 by the end of next year GS says, representing a price gain of about 5% and a total return of around 6% including dividends.

Goldman’s economists’ forecast for US GDP growth of 2.1% in 2024 “is already reflected in stock prices.”

GS: The S&P 500 index is expected to rise to 4700 by end 2024

Shaded area shows GS forecast

“Our macro forecasts imply a benign outcome for equities, but the current starting point will limit the potential appreciation for the benchmark US equity index in 2024,” Goldman Sachs Research chief US equity strategist David Kostin wrote in the GS 2024 US Equity Outlook (lovingly called “All You Had To Do Was Stay.”)

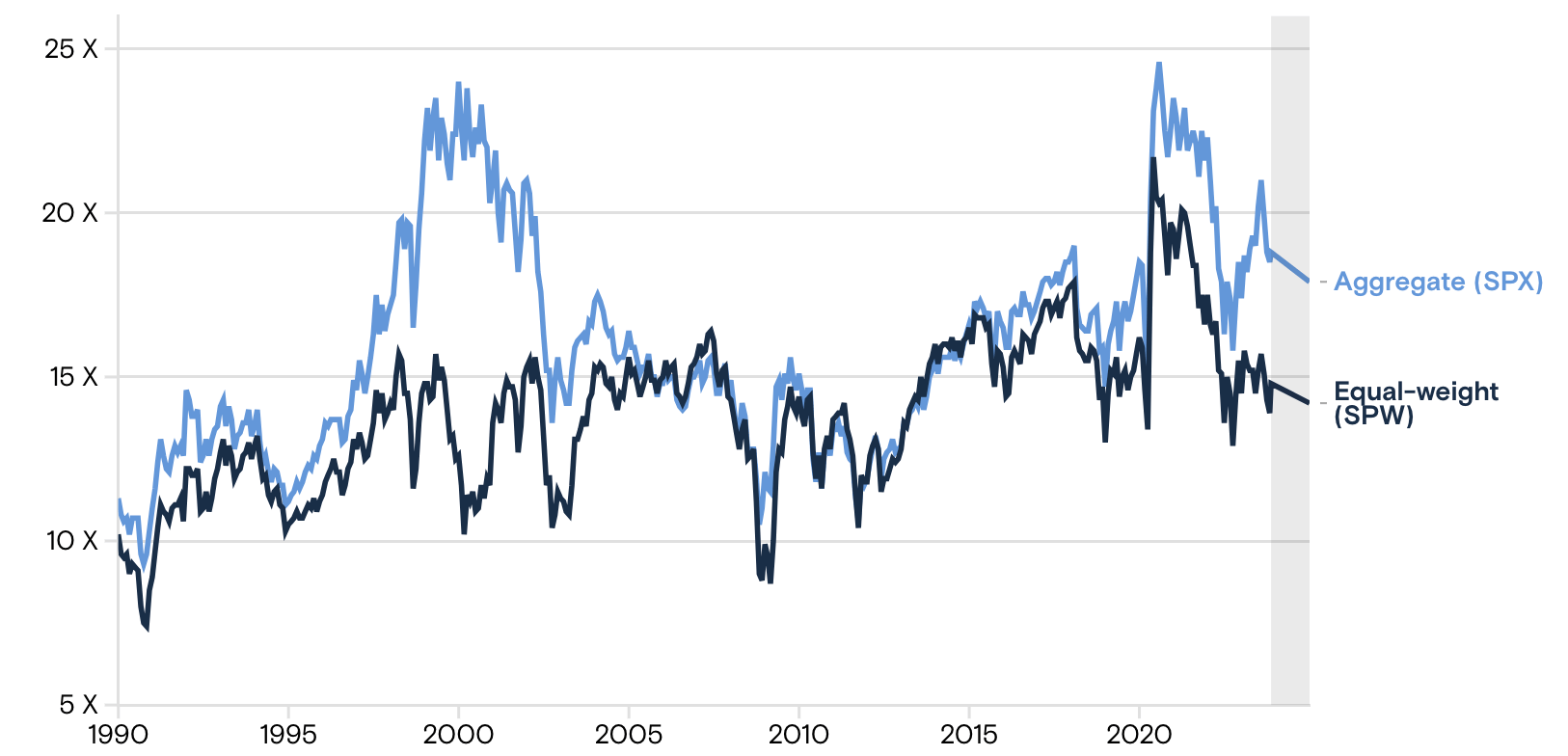

GS: Aggregate stock multiples are high

Kostin points out that the S&P 500’s price-to-earnings ratio trades in the 87th percentile since 1976. And while the Federal Reserve has likely finished hiking rates during this cycle, GS economists expect it’s unlikely the central bank will cut rates until the last quarter of 2024.

By comparison GS notes, the multiple for the S&P 500 aggregate index is higher than for the equal-weight index.

Aggregate Vs. equal-weight S&P 500 P/E

Shaded area shows GS forecast

Bank of America’s Savita Subramanian recently called for a year-end target of 5,000, as did RBC’s Lori Calvasina.

Goldman Sachs’ David Kostin expects the S&P 500 will chop around and finally end next year at 4,700.

On the same theme, BMO Capital Markets says any Wall Street rally would be broad-based next year amid a more compelling, “normal for longer” trend.

A Monday note from BMO chief investment strategist Brian Belski includes a BMO Capital Market S&P 500 base case scenario for 2024 at 5,100pts so BMO sees a circa 11.5% bump from Friday’s close.

That’d be a slowdown in market growth on calendar 2023, which he believes will be difficult to repeat based on historical bull market trends. The recent gains for the benchmark US index recently took traders beyond BMO’s previously forecast 2023 base range of 4,550.

After a technical analysis of recent historical bull market trends, Belski says there are gains to made, but of a calmer, more evenly distributed nature.

“We believe US stocks will attain another year of positive returns in 2024, albeit while demonstrating more sanguine, broadly distributed, and fundamentally defined performance relative to the last decade or so. In other words, normal and typical.”

In the face of uncertainty, Belski remains broadly bullish on equities and Wall Street in general.

“I still believe that the US stock market is the best equity asset in the world…You don’t have to own everything, just be very selective.”

GS says Mega Tech ‘may not be worth the risk’

GS analysts expect the S&P 500 index gains to be concentrated in second half of 2024.

“Resilient economic growth in the beginning of the year will force the market to push back its current pricing that Fed cuts will begin in the second quarter,” Kostin writes.

“US election uncertainty will suppress risk appetite. Later in the year, the first Fed cut and resolution of election uncertainty will lift US equity prices.”

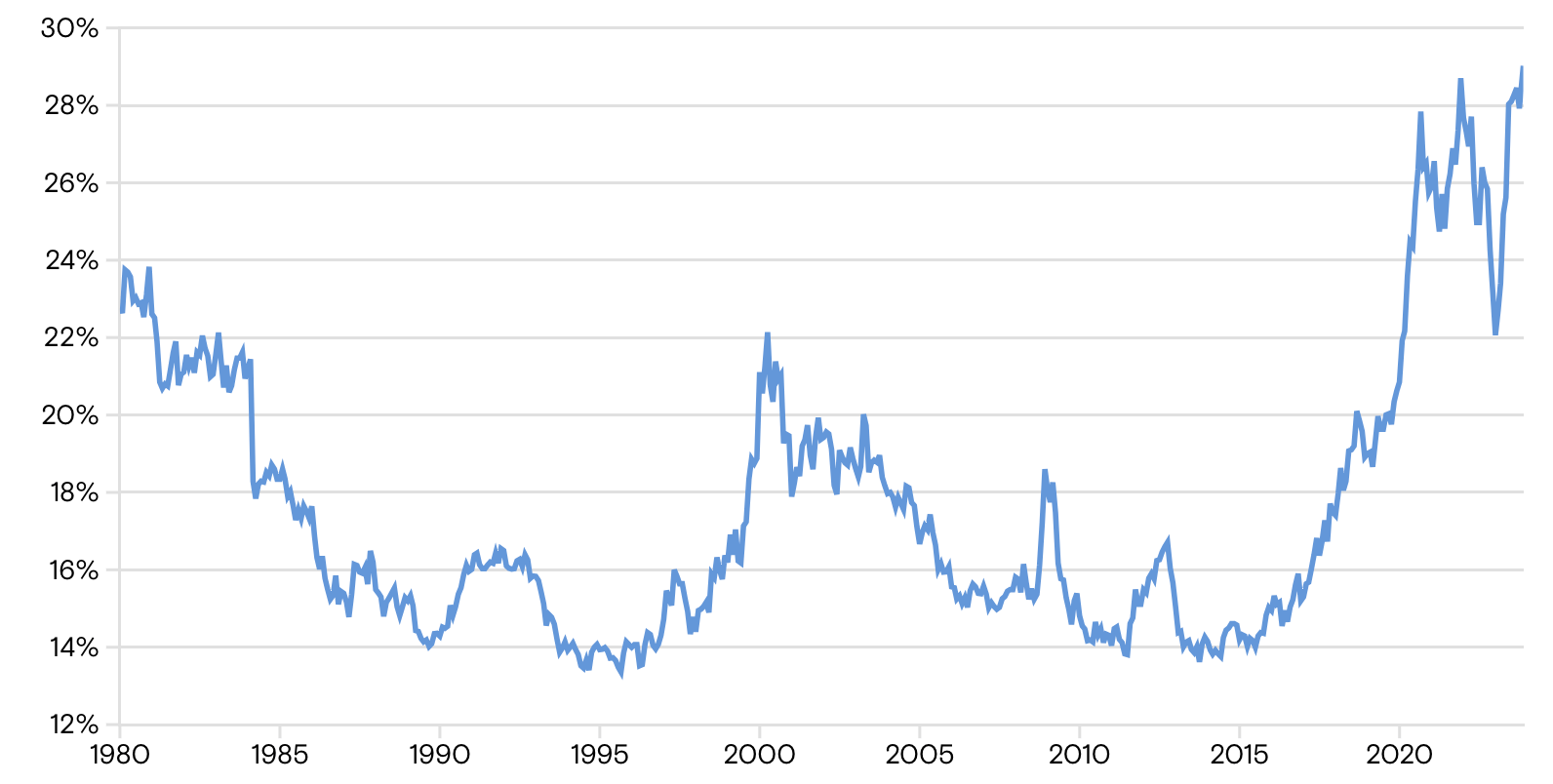

The massive outperformance of a handful of mega-cap tech stocks has been a defining feature of the equity market in 2023.

Kostin points out that the risk-reward for mega-cap tech stocks isn’t especially attractive given expectations are already elevated.

Part of Goldman’s concern here is that hedge fund ownership of the great ones is higher than usual, “and there’s potential for an ‘inflection’ for AI enthusiasm among stock investors”.

Kostin says this could be a risk to the mega-cap family.

“Generative artificial intelligence could potentially drive higher-than-expected growth in company earnings, but in most cases AI is expected to have limited impact on profitability next year.”

Goldman predicts the so called Magnificent 7 will collectively outperform the remainder of the index in 2024, but not like we’ve just seen.

“You’ll get slightly better returns from the seven leading stocks, but not nearly the dramatic difference that you’ve had this year,” Kostin said at a media roundtable event two weeks ago.

Mag’ 7 market cap share of S&P500 at all-time high: GS

Jim Caron, CIO Portfolio Solutions at Morgan Stanley Investment Management, says the narrative for 2024 is shaping up to be a year with easing financial conditions, namely lower bond yields and rising equities.

“Analysts are predicting that, firstly, inflation is likely to keep falling, secondly the Fed, ECB and other central banks are priced to cut interest rates and finally, global equities may return in the 5-7% area as a soft-landing/no-recession call for next year is becoming more mainstream.

“If all of this turns out to be true, then volatility will fall, carry and income strategies will perform well, as will stocks and bonds. Perhaps it’s time for broad financial asset markets to uniformly perform well and make a comeback?

In his latest poddy, Caron says:

“Well – as LL Cool J once said – ‘Don’t call it a comeback.’”

“So as we look for returns in 2024, it won’t come easy in 2024. The path may be very volatile and filled with surprises along the way. This means we are likely to see both great buying and selling opportunities and this may provide chances to perform better than what 2024 may actually deliver.”

Caron also says he’s still optimistic on the outcome for returns in the year ahead.

“Investors should establish a baseline view and actively manage a multi-asset portfolio around that view.”

Caron’s call for ’24

-

I think it’s very likely that we see a soft landing, which to me includes the possibility of a mild recession.

-

If interest rates have peaked, then owning stable cash flows will be more highly valued.

-

The starting yield in bonds is much more attractive and provides a greater cushion than a year ago.

-

The earnings trough that people are worried about is likely behind us.

-

We also likely saw two consecutive quarters of negative earnings growth in H12023 and now we are likely set on a path towards positive earnings growth in the US

-

Investors should start with a well-balanced portfolio and actively manage the risks and opportunities

“We have fat tails ahead of us, both up and down, and should play them against the middle for a modestly positive return in 2024,” Caron adds.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.