Wait – is China fine? Middle Kingdom CUTS RATES to combat economic slowdown

Pic: Jennifer A. Smith/Moment via Getty Images

- China issues a surprise rate cut as economic woes linked to Covid and property developers mount

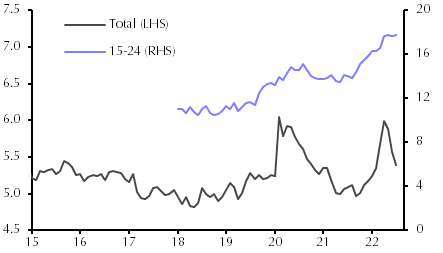

- One in five young Chinese workers are now unemployed

- Iron ore futures fell yesterday after the data dump, with steel production dropping 6.4% YoY in July

We all know the joke about digging a hole so deep it leads to China.

But right now the Chinese economy, fuelled for years by mountains of debt and an unwavering commitment to property and infrastructure development is digging its own hole from the other side.

While the rest of the world is lifting rates to put the kibosh on runaway inflation, China has just played the shock move of cutting rates for the first time since January.

The People’s Bank, as its called, has cut the 7-day reverse repo rate from 2.1% to 2% with another 10 basis point cut in its medium-term lending facility from 2.85 to 2.75%.

What does all that say?

It shows the Chinese Communist Party is getting pretty concerned about its economic data and property market, coming after China’s credit growth numbers for July (RMB679n or around $142bn) came in around RMB450bn below Bloomberg estimates.

Capital Economics senior China economist Julian Evans-Pritchard said mortgage boycotts, where fed-up Chinese homeowners waiting for indebted property developers to hurry up and finish their god-damn apartments have withheld repayments, have prevented demand for credit from growing.

“It may continue to disappoint in the near-term given that sentiment among homebuyers is likely to stay weak and government borrowing is on course to slow,” he said.

Yesterday’s activity data was just as concerning.

Geez, that’s a big miss

Our resident China expert Christian Edwards is away right now, but did advise us through the magic of the interwebs that “China is fine”.

But coming after months of on-again, off-again local lockdowns to contain China’s Covid outbreaks, yesterday’s activity and spending numbers for July read like something out of Xi Jinping’s nightmares.

Retail sales were a particularly big miss. Bloomberg consensus had them rising by 5% year on year after a 3.1% growth rate in June. Not to be, they came in at a wimpy 2.7% growth rate in July, contracting in real terms.

Industrial production and fixed asset investment growth rates also fell, from 3.9% and 6.1% in June to 3.8% and 5.7% respectively, with private sector industrial growth (down from 3% to 1.5%) severely lagging state-owned enterprises (up from 3.1% to 5.4%).

Property investment shrank by 6.4% year to date, down further from a 5.4% year to date decline over the first half of the year.

Most worrying perhaps is the youth unemployment rate (19.9%). Almost one in five young Chinese workers aged 16-24 is out of a job.

“Although the overall urban unemployment rate declined to 5.4% in July, it may indicate a shrinking labour force rather than an improvement in job prospects,” ANZ analysts led by Greater China chief economist Raymond Yeung said.

“A record c.11 million of fresh graduates this year has significantly increased job-hunting pressures. On the other hand, many migrant workers may have left cities for their home towns and some people may have quit active job searching.”

Will the rate cuts help?

“It’s not clear that this will be enough to revive the rebound in credit growth, however,” Evans-Pritchard says.

“The current weakness in loan demand is partly structural, reflecting a loss of confidence in the housing market and the uncertainty caused by recurrent disruptions from China’s zero-COVID strategy.

“These are drags that can’t be easily solved by monetary policy. But today’s rate cuts signal that the PBOC hasn’t resigned itself to staying on the sidelines and we think further easing measures are likely over the coming months.”

Steel output puts iron ore on notice

China’s latest steel production numbers are in for July, and for iron ore miners they don’t look awfully pretty.

It is well known that steelmakers had been losing hatfuls of coin in June, as moves to halt steel mill production and begin maintenance campaigns took hold.

In July, crude steel output fell 6.4% year on year to 81.43Mt, with crude steel output down by the same percentage year to date to 609.28Mt.

No matter how you cut it, that’s a soft July #steel output number from #China . So July output was -6.4%yy; -6%ytd vs 2021 and -4%3myy. Yes, steel prodn is up 6.6%ytd vs 5yr avge, but it fell below that avge in July and has been below 5yr avge in each of last 4 10 day periods. pic.twitter.com/LDsbQyOVMQ

— Robert Rennie (@Robert__Rennie) August 15, 2022

The news set of an afternoon funk for iron ore futures. Singapore 62% Fe swaps for September dropped 2.01% to US$108.15 as of 4.30pm AEST yesterday.

Dalian iron ore accelerated losses after the National Bureau of Statistics data dump, which included a host of other somewhat concerning figures, with the most traded January contract down 3.1%.

Mill margins have improved somewhat, partly because they’re paying less for inputs like iron ore and coking coal, a function in itself of weaker demand.

According to MySteel rebar producers operated blast furnace mills in July at a loss of US$12.8/t (86RMB).

That’s still a loss though, reflecting the massive slowdown in demand felt by Chinese steelmakers amid a dive in the country’s property market, responsible for between 30-40% of downstream demand.

Iron ore giant BHP (ASX:BHP) reports its full year results this morning, where it could dial back its dividend payout ratio in response to weaker economic conditions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.