Van Eck says it’s a new gold game amid market madness; MQG says price focus now on all-time high

Picture: Getty Images

- Van Eck Australia says risk that Fed won’t be able to bring inflation back to target has increased post-SVB fall

- MQG says above Friday’s US$1,989/oz high, “focus would naturally turn to $2,000/oz and the all-time nominal high of $2,075.47/oz”

- MQG prefers NST and RRL for organic growth outlook, while BGL and DEG remain ‘our key exploration and development picks’

Van Eck: Gold’s shiny new three-point ball game

Van Eck’s investment team says it’s an entirely new ball game in the gold sphere, as the precious metal regains its lustre while new market uncertainty foils confidence…

- Worries about contagion risk from the recent collapse of Silicon Valley Bank and First Republic, as well as the near collapse of Credit Suisse, has pushed investors into gold and gold equities again.

- Gold mining companies surged early last week as gold traded around a one-year high, bucking the trend in wider Australian markets.

- Gold’s safe haven appeal is firmly back in force, as investors flock to the yellow metal pushing gold prices up.

MQG: An almost perfect crisis for gold

Next door the investment bank Macquarie Group says that the failure of SVB and all these subsequent fears around financial strength have raised the risk that:

“The Fed is unable or unwilling to sustainably bring inflation back within its target band. This has caused the range of economic and market outcomes being thrown wide open with uncertainty.”

“The failure of Silicon Valley Bank (SVB) and subsequent concerns about broader financial stability have raised the risk that Fed is unable or reluctant to sustainably bring inflation back to target. This has resulted in the range of economic and market outcomes being wide open with uncertainty.”

The Fed Funds futures market has swung from March 8 pricing of a 5.5-5.75% September rate high and one 25bp cut by the 31 January 2024 FOMC, to currently showing a March high of 4.75-5% and 100bps of cuts by next January.

The Fed indicates that rate cuts are not in scope until 2024, contrary to what markets believe as a result of the SVB fallout. Our view is gold would be a beneficiary if the Federal Reserve (Fed) paused interest rate increases in response to problems in the banking system.

“…the longer uncertainty rolls on, with neither market fears being wholly calmed nor a full-blown systematic crisis unfolding, the higher gold prices could be able to trade. Above Friday’s $1,989/oz high, Macquarie Commodity Strategy team believes the technical focus would naturally turn to $2,000/oz and the all-time nominal high of $2,075.47/oz.”

According to Van Eck Australia, gold prices have also been boosted from the big drop in US government bond yields and a decline in the US dollar (as measured by the DXY Index)… and lower bond yields reduce the opportunity cost of holding a metal that pays no income.

A weaker dollar lifts the price of commodities that are denominated in the US currency.

Chart 3: Gold prices have also been boosted by weakness in the US dollar (DXY)

Source: Bloomberg, to end of February 2023

Van Eck: Investing in gold miners

Gold miners stand to benefit from the current instability as their balance sheets remain strong and they typically rise more than the gold price in an upswing.

If inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could create a favourable environment for gold miners.

As gold equities have been underperforming the gold price over the past few years, gold equities remain historically cheap relative to the price of bullion.

Top picks

Macquarie’s current top Australian mining company picks include Northern Star Resources and Regis Resources.

The investment bank put an Outperform rating on both with target prices of $14.20 and $3.00 respectively on the stocks, a 29% and 68% increase from the company’s share prices as at 22 March 2023.

Gold miners tend to outperform gold bullion when the gold price rises, and underperform when the gold price falls. This has been true this month, with VanEck’s Gold Miners ETF (GDX) returning 14.04% so far in March, compared to the 8.46% rise of the LBMA PM Gold Price.1 (All returns as at 20 March 2023, source LBMA, Morningstar.)

Key risks to earnings and valuation

Movements in gold prices for over covered gold stocks present the key risk to our base case earnings forecasts and valuation, both to the upside and downside. Variances in operating costs and capital expenditure budgets can also impact our earnings and valuation.

Macquarie: ASX gold producers, stock-specific catalysts and risks:

• Newcrest Mining (ASX:NCM): Changes in operating conditions, such as increased rainfall for the open pits or seismic activity underground can impact the production outlook for NCM’s key operations at Cadia, Lihir, Telfer/Havieron, Fruta del Norte and Red Chris. Growth at Brucejack and the release of various studies, including Red Chris block cave and Havieron Stage 1, are key.

• Northern Star Resources (ASX:NST): Per our outlook, KCGM represents the largest single segment of our asset NAV for NST, and we believe operational improvements and underground additions will be material for NST. KCGM’s mill expansion could also alter our long-term outlook.

• Evolution Mining (ASX:EVN): Red Lake’s performance remains important for our long-term outlook along with the upcoming study for Ernest Henry.

• De Grey Mining (ASX:DEG): Delivering on the overall inventory growth presents the key risk to our base case. Other key risks to our assumptions include grade, gold price, AUD/USD exchange rate, mining costs and our LOM capital assumptions.

• Regis Resources (ASX:RRL): Government approvals of the McPhillamys Project in NSW remains key to RRL’s longer-term outlook and an important catalyst near-term.

• St Barbara (ASX:SBM): We are restricted on SBM.

• Silverlake Resources (ASX:SLR): We expect continued production growth at Deflector to drive improved cash flows into FY23 and FY24 while SLR’s performance at Sugar Zone remains important.

• Ramelius Resources (ASX:RMS): The release of various studies, which present potential changes to our base case, will be important catalysts for RMS over the near-term.

• Gold Road Resources (ASX:GOR): Delivering on Gruyere’s processing projects and optimisations to expand mill capacity to ~10Mtpa is key to our outlook for GOR.

• Perseus Mining (ASX:PRU): PRU’s study work at Meyas Sand (previously Block 14) is key to PRU’s longer-term outlook.

• Resolute Mining (ASX:RSG): The upcoming studies for Syama North present will prove important for the mine’s longer-term outlook.

• Westgold Resources (WGX): The plant expansion study at Cue, Big Bell’s continued +1Mtpa output and growth of the Bluebird mine remain important to our outlook for WGX.

• West African Resources (WAF): The volumes and grade from the underground remains important for our near-term production assumptions. Our longer-term outlook relies on resource to reserve conversion as well as a successful development of Kiaka.

• Capricorn Metals (CMM): Study work at Mt Gibson has potential to drive adjustments to our notional development scenario for the asset.

• Bellevue Gold (BGL): Timing of BGL’s process plant construction remain important as does the development of the underground mine. Toll treating of early ores before the commencement of processing at Bellevue presents the potential for early cash flows and upside to our base case.

• Dacian Gold (DCN): The strategy to re-start operation at Mt Morgans is the key catalyst for DCN following the expiration of Genesis Minerals’ (GMD AU, Not Rated) offer period with GMD now holding +80% of DCN shares.

Van Eck: Investing in gold bullion

Meanwhile, holdings of bullion-backed exchange-traded funds posted their biggest weekly advance in more than a year earlier this month amid the unfolding bank crisis.

The gold price started bottoming in late September 2022, when the US dollar (as measured by the DXY Index) peaked. Now could be a compelling time to invest in physical gold as US dollar prices have recently hit another peak.

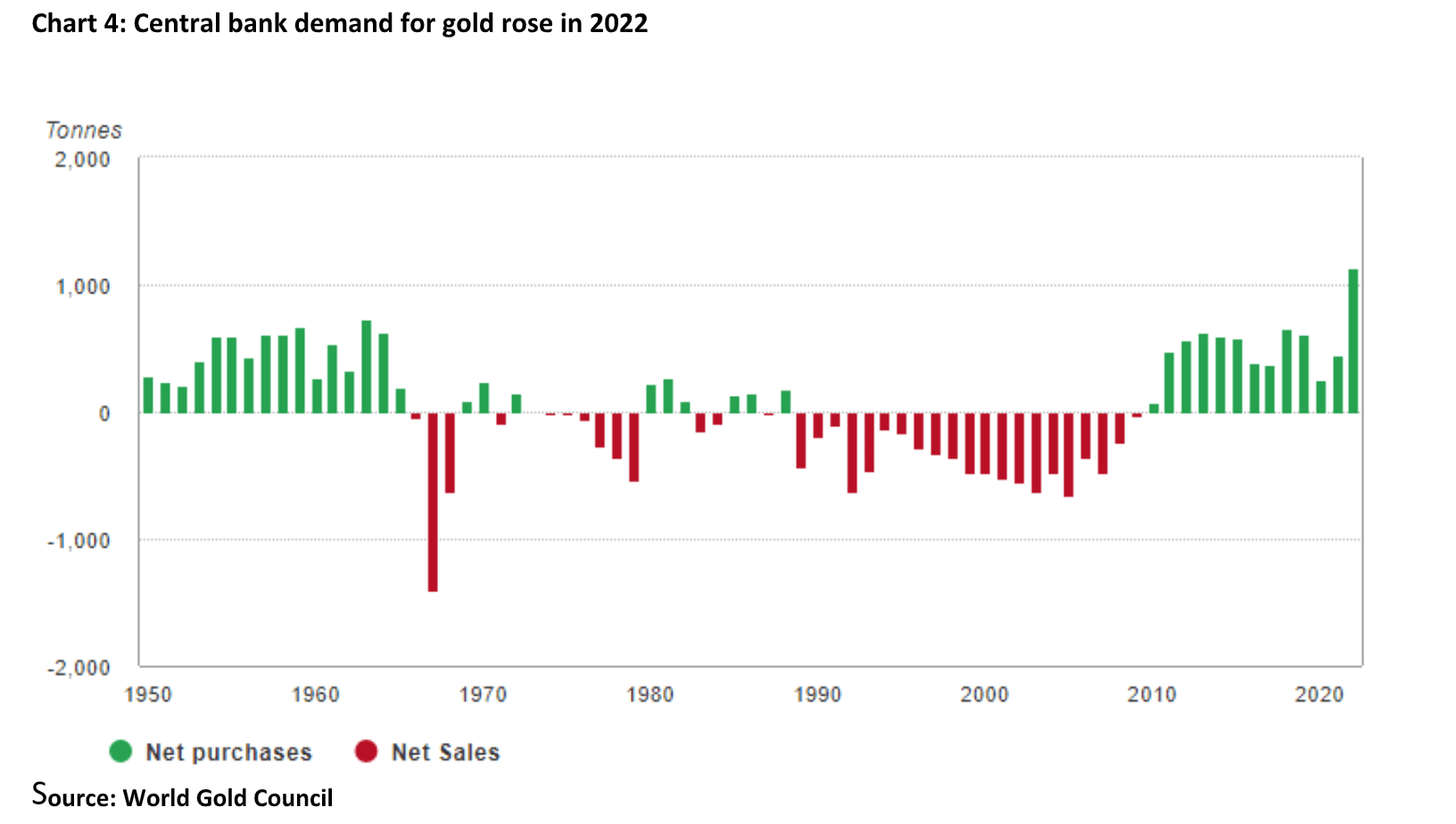

The World Gold Council recently said, though not without risks, a good case for gold remains in place for 2023 driven by: elevated geopolitical risk; a developed market economic slowdown; a peak in interest rates, and risks to equity valuations. In addition, continued central bank buying can’t be ruled out.

Central bank buying in 2022 was the highest on record…

ETFs are an efficient way for investors to access gold investing

VanEck’s track record of gold investing goes back more than 50 years – gold equites and bullion across ETFs and active funds.

So here’s a few ETFs for your portfolio considerations:

NUGG – accessing physical gold, that ‘delivers’

GDX – investing in a diversified portfolio of gold mining companies

Van Eck: Remember your key risks

An investment in NUGG or GDX carries investment risk. These risks vary depending on the fund and may include gold pricing risk, currency risk, custody risk, Australian sourced gold bullion risk, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. This is general advice only and does not take into account any person’s financial objectives, situation or needs.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.