Value Investing: Van Eck, Justin Bieber and why the 3 Little Pigs Theory is bringing home the bacon

Via Getty

It seems 2022 isn’t done with your head yet. Value investing, that old chestnut, is being rolled out and polished up as we speak.

The Mr Reliable of Pre-Raphaelite trading is back from a land without crypto, NFTs or even Bieber.

Just. Can you imagine something before Beiber?

Anyway, as year-end nears, cleverer people than Christian are sensing that a line somewhere has been crossed: enough indicators within the torrent of inflationary-whispering data we’ve been laden with have somehow been stoking a sudden group affection for all things retro.

And voila, inexpensive equities have suddenly put together a string of outperforming months.

According to Van Eck’s Cameron McCormack, the MSCI World Value Index spiked 10.3% in October beating its headline growth counterpart around the head and body, ending the month 5% ahead.

And it ain’t just de rigueur.

Last month, the S&P Small Cap 600 Value Index rose over 15%.

In early November, Savita Subramanian, Bank of America Securities’ lead on US equities and quant strategy, wrote to clients that growth is in the middle of a “perfect storm of higher rates + weakening fundamentals”.

“We continue to prefer value over growth… value factors have also historically benefitted from year-end seasonality.”

Terrific. What the hell is value investing anyway?

“A road map for investing that I have now been following for 57 years.”

That’ll be Warren E. Buffett’s Foreword for the current edition of ‘Security Analysis’ the epic first published in 1934 by Columbia University academic brains trust Benjamin Graham and David Dodd. Yes, they literally wrote the book on value investing.

The theory in its bones is sound and the process not overly complex – VI uses indicators such as dividend yields and low price-to-book (P/B), or price-to-earnings (P/E) ratios to identify companies where the business potential is not reflected in the share price. As the foreword implies, it’s the preferred approach of Berkshire Hathaway’s noted founder, among many others.

By way of contrast, growth investing is a stock-buying strategy that looks for companies that are expected to grow at an above-average rate compared to their industry or the broader market.

Over the past decade – around Bieber, I guess – there was a large shift to growth investing as advances in technology and culture accelerated, including Bieber and the desperate need for him to grow up, as well as the advent of new technologies such as the cloud, mobile platforms and software as a service.

“After a lost decade,” Cameron McCormack says, “the tables have turned back to value.”

Comeback Kings

Speaking to CNBC, head of US equity strategy for RBC, Lori Calvasina reckons on Wall Street, small caps and large cap value stocks are the “best places to be” right now – especially when the US dollar is mad-strong and these stocks have less international exposure.

Why value is back with a vengeance

Speaking to CCE, Cameron said that during times of inflation, companies with solid earnings can boost profit margins by raising prices.

“And value companies, which tend to be more mature, have earnings and margins to improve.”

Cameron, who leads investment performance analytics for Van Eck and heads up trade execution for equity and fixed income ETFs, said it’s a whole lot harder for non-profitable companies to increase prices.

“So, in the current environment a sound investment approach could be to seek out established, profitable companies.”

Three little pigs investing

In the past, value companies have outperformed when inflation and interest rates increase, as they tend to be less sensitive to changes in macro-economic conditions. For example, value outperformed in the high inflation, rising rate environment of the late ’70s and ’80s.

“It’s like the three little pigs, growth stocks are easy to build – like the straw house and the other one – the pre-fab, pink batts house – also no good. Then it’s hard work, but that last house, the ugly brick one, that’s a keeper.”

Cameron: 2x reasons value is back in vogue:

Lower ‘duration’

Cameron says value stocks generally have lower ‘duration’ versus growth stocks.

“Duration is typically used in finance to describe the relationship between yields and prices in fixed income assets such as bonds or the time it takes to break even on an investment. It can be used to describe how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows, for example.

“Duration can also be applied to equities by considering a company’s cash-flow. Long duration companies realise a higher proportion of their cash flows far into the future. Many technology companies, that are not yet profitable, for example, would be long duration.”

He says many growth stocks experience negative cash-flow, ploughing money back into the business to grow it, with the hope it will turn a profit in the future. While, on t’other hand value companies, which are generally well established, pay a higher portion back to shareholders. Their valuations are more tied to current and near term expected earnings.

This lessens duration risk.

“So, when stubborn inflation persists, central banks increase policy rates, as we are seeing now and this is adversely impacting the present value of future earnings therefore it is desirable to hold companies where valuations are tied to the near-term earnings. Value companies generally provide this.”

Diversification

“Advanced value strategies also tend to result in more sector diversification than a growth strategy.”

“This is because growth strategies generally lean towards a handful of sectors, which have recently experienced earnings growth. This can result in sector and company concentration.

“For example, the MSCI World Growth Index is currently heavily weighted towards prominent American Information Technology companies. Seven of the top 10 holdings by weight are Information Technology companies. While Apple, Microsoft, Alphabet and Amazon alone make up over 25% of the entire index,” he says.

“By way of contrast, advanced value strategies such as MSCI’s Enhanced Value methodology target ‘cheap’ companies by comparing valuations of companies in the same sector. This results in proportionate sector exposure. Exposure to cyclicals such as energy and utilities have also been a tailwind for performance.

“As macroeconomic conditions have deteriorated, value will likely be better positioned than growth to withstand downturns.”

Cameron’s three international value picks:

MetLife Inc

A number of international value companies have performed relatively well in 2022. Take insurers for example, which have a captive market and pricing power. Metlife is up by 21% for the year to date. We expect insurers could continue to perform for the foreseeable future.

Glencore PLC

Global miner Glencore’s share price has rocketed up a massive 51% this year. The company has shown its ability to profit from volatile commodity prices, and its trading arm gives it a competitive advantage. The company’s portfolio is also well diversified with exposure to in-demand metals like nickel, cobalt and copper.

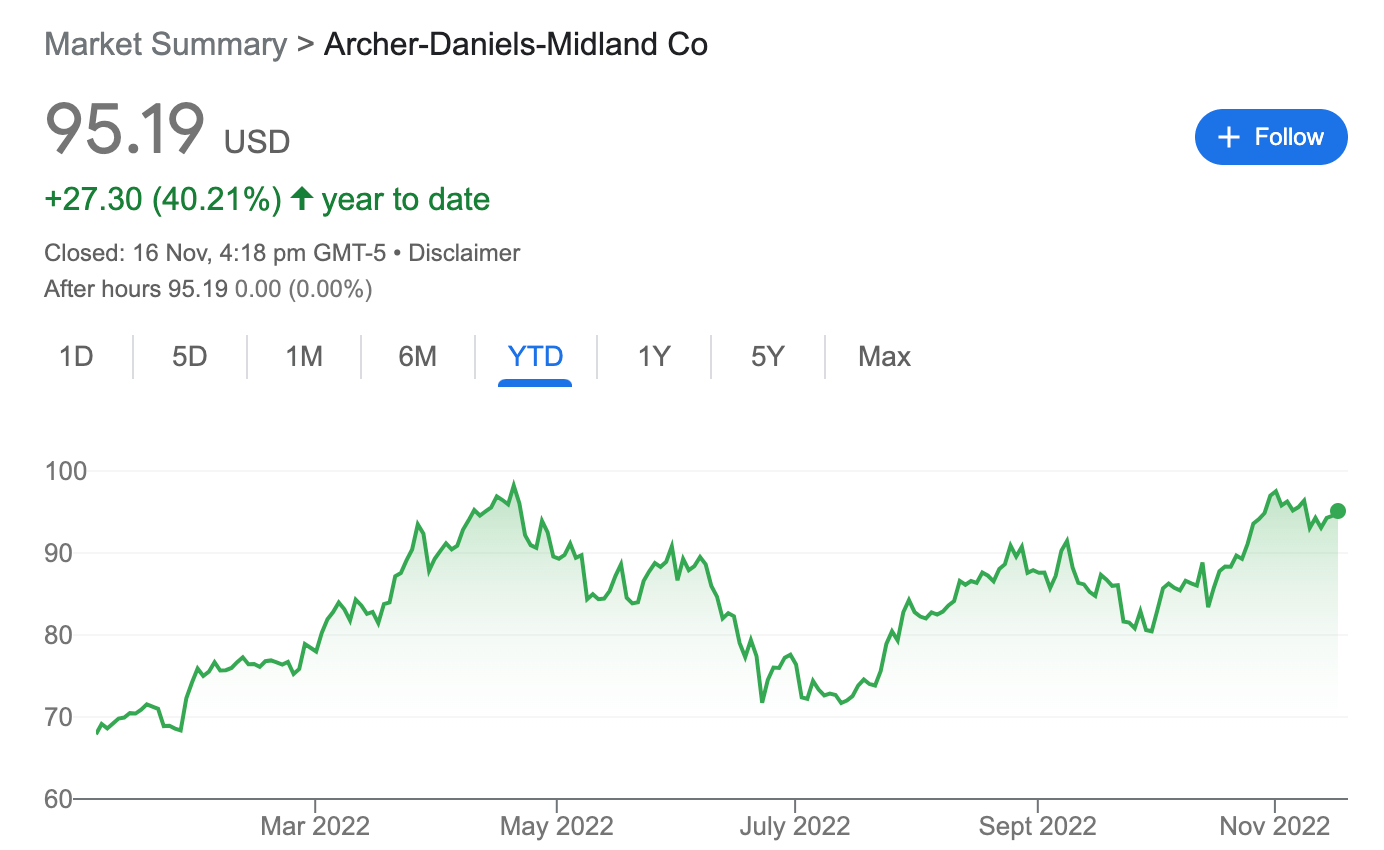

Archer Daniels Midland Co

Meanwhile, food processing company Archer Daniels is up 43% year to date. According to Yahoo Finance: “The company’s recent operating results have benefited (unfortunately) from the war in Ukraine as grain prices and agricultural markets globally experienced strong price increases. ADM is positioned well to benefit from the volatility due to its stable North American agricultural base.”

That’s pretty much all you’ll want for Christmas.

There’s only one way to invest in value stocks

Value investing demands a lot of committed research, Cameron warns.

“You’ll need to go through the financials of numerous companies in order to find a true value gem. For those who don’t fancy doing the heavy lifting, there are a range of ETFs that invest in good value companies.

Investors seeking to tap the current ‘value’ trends may wish to consider the VanEck MSCI International Value ETF (VLUE) which tracks the MSCI World ex Australia Enhanced Value Top 250 Select Index (VLUE Index).

Valuing risk: She’ll be Peaches

It’s not all plain sailing in VLUE-land Cameron says.

But worth it.

VLUE outperformed the MSCI World ex Australia Index by 6.50% for the 12 months ending 31 October 2022.

Morningstar says the VLUE returned 9.23% in October, while the MSCI World ex Australia Index returned 7.8%.

An excess return of 142bps as the value factor came storming back. Though we always caution, past performance cannot be relied upon for future performance.

Unsurprisingly, Vaneck’s VLUE ETF has exposure to all three of Cameron’s three international value picks.

Thanks Cam.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.